France Seeds Market Size, Share, Trends and Forecast by Type, Seed Type, Traits, Availability, Seed Treatment, and Region, 2025-2033

France Seeds Market Overview:

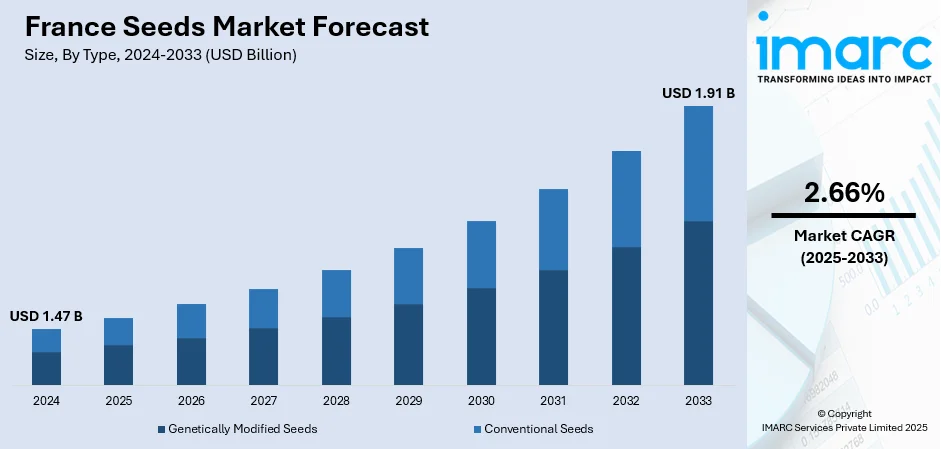

The France seeds market size reached USD 1.47 Billion in 2024. The market is projected to reach USD 1.91 Billion by 2033, exhibiting a growth rate (CAGR) of 2.66% during 2025-2033. The market is evolving with rising demand for quality and sustainable seed varieties guided by environmentally conscious farming practices. Key trends involve increasing adoption of organic and treated seeds, advancements in seed traits such as disease resistance, and diversification across crop types. Regional distinctions reflect local crop suitability and regulatory frameworks. Availability channels are broadening through both direct supply and distributor networks, supported by research institutions and seed treatment innovations. Continued focus on innovation and sustainability is expected to strengthen the France seeds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.47 Billion |

| Market Forecast in 2033 | USD 1.91 Billion |

| Market Growth Rate 2025-2033 | 2.66% |

France Seeds Market Trends:

Innovation in Seed Certification and Quality Control

In June 2024 France’s seed certification agency SOC confirmed that more than 450 new plant varieties were officially certified during that year, reinforcing the nation’s expertise in varietal purity and germination standards. The French system emphasizes rigorous lab testing and field inspections to guarantee varietal identity and seed health, overseen by SOC under SEMAE’s guidance. Seed growers, interprofessional bodies, and public authorities coordinate closely, ensuring certified seeds meet strict quality protocols before entering the market. This framework supports traceability, enhances farmer confidence, and underpins international competitiveness. In daily practice, farmers receive certified seeds with documented purity and germination metrics, giving them reliable planting inputs. As demand for clean, high‑integrity seed material grows, certification standards evolve with technological tools and expanded testing methods. Overall, this systematic oversight is essential to France’s reputation as a top seed exporter helping maintain trust among domestic and foreign users alike. France seeds market growth is increasingly driven by the credibility and consistency built through this robust certification infrastructure.

To get more information on this market, Request Sample

Expansion of Seed Multiplication Area

In 2024 France accounted for approximately 338,940 ha of approved field seed production area across cereals, oilseeds and pulses, retaining its position as Europe’s largest seed producer. This surface underpins the nation’s scale advantage and reinforces genetic diversity and volume capacity for both domestic and export needs. A broad network of roughly seventeen thousand seed‑multiplying farmers, supported by advanced breeding protocols and quality control systems, ensures production consistency. Seed volume across major crops like maize, wheat and forage is optimized via certification-linked contracts between growers and authorities. The scale of this infrastructure supports flexible responses to weather variability and enables preservation of varietal lines suited to different growing zones. As acreage remains high, supply reliability increases, reinforcing France’s leadership in supplying certified seed throughout Europe and globally. With such volume capacity aligned with quality systems, farmers and downstream users gain stable access to diverse seed options. This structural strength plays a key role in France seeds market trends by reinforcing both scale and reliability as core attributes of national supply.

Strategic Mobilisation of Biodiversity and Resilience Traits

In May 2025 experts reported that more than 120 ancient or locally adapted varieties are being reintroduced into national breeding programs to enhance resilience against climate-related stressors such as moisture variation and soil salinity. This initiative aligns with the Seeds and Plants plan for Sustainable Agriculture launched by the Ministry of Agriculture, which emphasises varietal diversity, eco‑friendly breeding and participatory selection methods. Farmers and local researchers participate in trials to adapt heritage traits into modern cultivars. The plan also promotes varieties suited to organic or mixed‑species cropping systems, enabling more resilient crop covers and reducing reliance on synthetic inputs. This biodiversity-led approach diversifies the seed base by blending traditional and newly developed lines, fostering ecological balance and longer‑term food system stability. As these adapted varieties reach certified distribution channels, farmers are gaining access to improved seed options grounded in local genetics. This integrative strategy ensures France seeds market trends reflect both innovation and tradition, supporting sustainable diversity in the seed system and driving aggregate growth.

France Seeds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, seed type, traits, availability, and seed treatment.

Type Insights:

- Genetically Modified Seeds

- Conventional Seeds

The report has provided a detailed breakup and analysis of the market based on the type. This includes genetically modified seeds and conventional seeds.

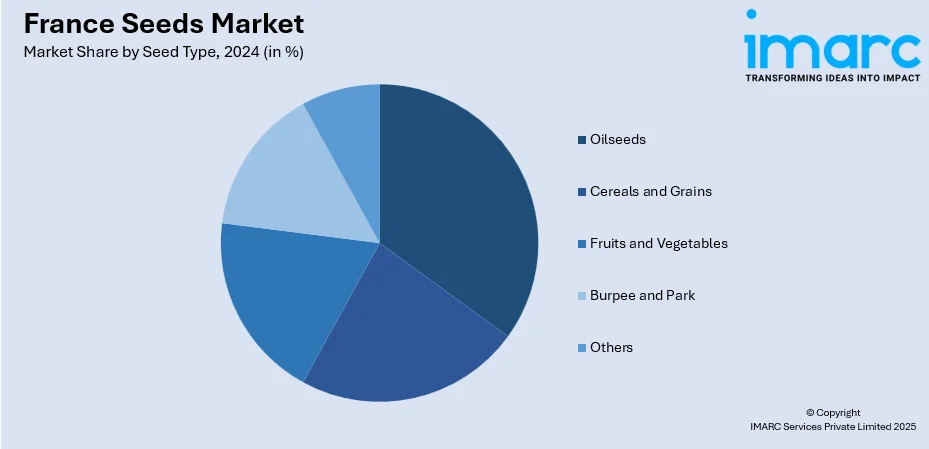

Seed Type Insights:

- Oilseeds

- Soybean

- Sunflower

- Cotton

- Canola/Rapeseed

- Cereals and Grains

- Corn

- Wheat

- Rice

- Sorghum

- Fruits and Vegetables

- Tomatoes

- Lemons

- Brassica

- Pepper

- Lettuce

- Onion

- Carrot

- Burpee and Park

- Others

A detailed breakup and analysis of the market based on the seed type have also been provided in the report. This includes oilseeds (soybean, sunflower, cotton, and canola/rapeseed), cereals and grains (corn, wheat, rice, and sorghum), fruits and vegetables (tomatoes, lemons, brassica, pepper, lettuce, onion, and carrot), burpee and park, and others.

Traits Insights:

- Herbicide-Tolerant (HT)

- Insecticide-Resistant (IR)

- Others

The report has provided a detailed breakup and analysis of the market based on the traits. This includes herbicide-tolerant (HT), insecticide-resistant (IR), and others.

Availability Insights:

- Commercial Seeds

- Saved Seeds

A detailed breakup and analysis of the market based on the availability have also been provided in the report. This includes commercial seeds and saved seeds.

Seed Treatment Insights:

- Treated

- Untreated

The report has provided a detailed breakup and analysis of the market based on the seed treatment. This includes treated and untreated.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Seeds Market News:

- June 2025: France company Vilmorin & Cie, via its subsidiary Limagrain Vegetable Seeds (LVS), is in exclusive talks with Abu Dhabi sovereign investor ADQ. ADQ aims to acquire a minority stake in LVS, consolidating Vilmorin & Cie’s vegetable seed activities including Hazera, HM, CLAUSE and Vilmorin‑Mikado. Headquartered in France, LVS would partner with ADQ’s agri‑tech arm Silal to launch a joint R&D venture in the UAE focused on developing vegetable seeds resilient to desert climates, targeting extreme heat, drought and salinity.

France Seeds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Genetically Modified Seeds, Conventional Seeds |

| Seed Types Covered |

|

| Traits Covered | Herbicide-Tolerant (HT), Insecticide-Resistant (IR), Others |

| Availabilities Covered | Commercial Seeds, Saved Seeds |

| Seed Treatments Covered | Treated, Untreated |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France seeds market performed so far and how will it perform in the coming years?

- What is the breakup of the France seeds market on the basis of type?

- What is the breakup of the France seeds market on the basis of seed type?

- What is the breakup of the France seeds market on the basis of traits?

- What is the breakup of the France seeds market on the basis of availability?

- What is the breakup of the France seeds market on the basis of seed treatment?

- What is the breakup of the France seeds market on the basis of region?

- What are the various stages in the value chain of the France seeds market?

- What are the key driving factors and challenges in the France seeds market?

- What is the structure of the France seeds market and who are the key players?

- What is the degree of competition in the France seeds market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France seeds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France seeds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France seeds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)