France Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

France Steel Tubes Market Overview:

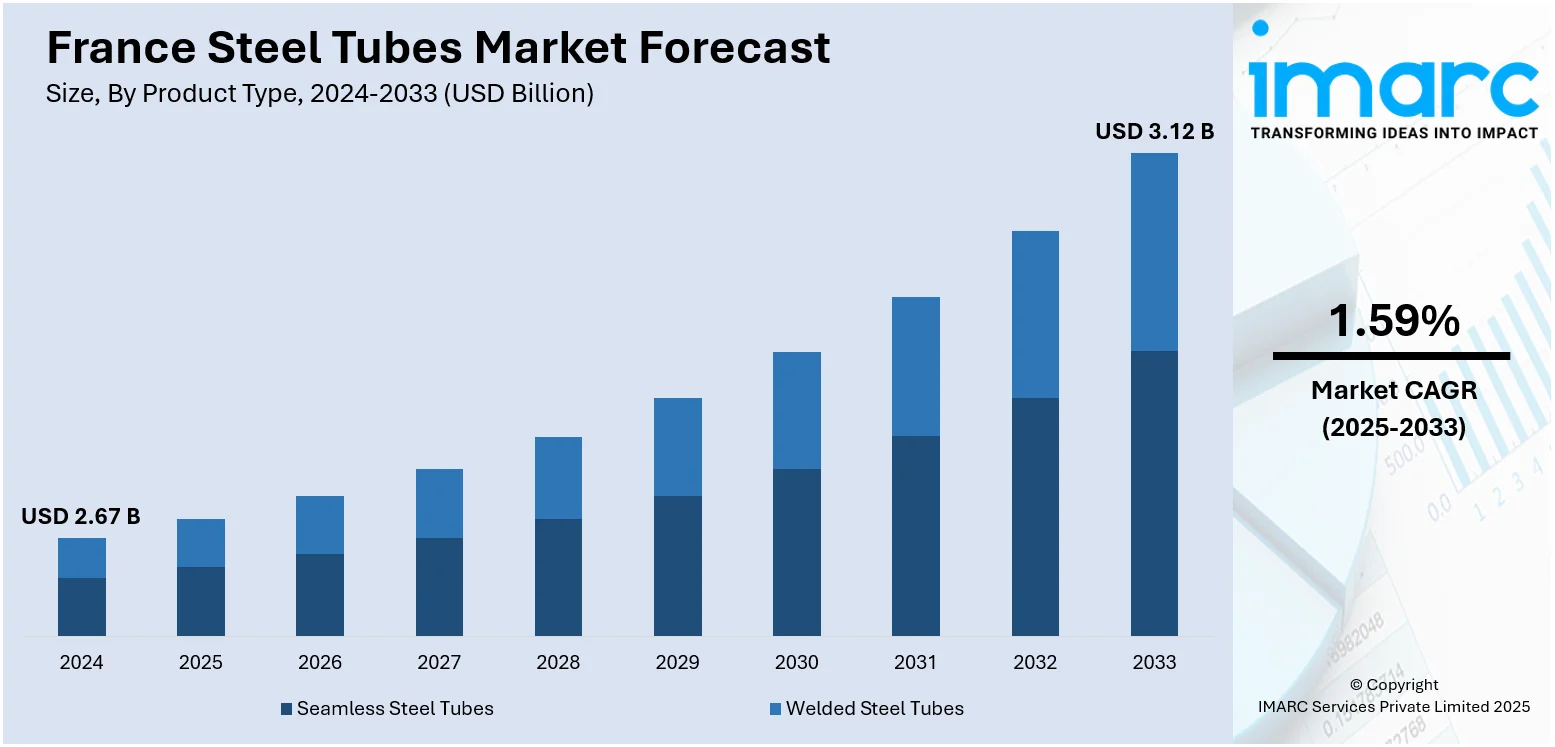

The France steel tubes market size reached USD 2.67 Billion in 2024. The market is projected to reach USD 3.12 Billion by 2033, exhibiting a growth rate (CAGR) of 1.59% during 2025-2033. The market is progressing steadily, driven by demand across sectors such as construction, automotive, energy, and industrial manufacturing. Market players are emphasizing advanced product development, sustainability, and supply chain optimization to meet evolving application needs. Innovations in seamless and welded tube technologies are also contributing to improved efficiency and quality. Regional and global trade dynamics, alongside policy support for green infrastructure, are shaping market strategies. These factors continue to influence the competitive landscape of the France steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.67 Billion |

| Market Forecast in 2033 | USD 3.12 Billion |

| Market Growth Rate 2025-2033 | 1.59% |

France Steel Tubes Market Trends:

Stable Industrial Production Supports Supply

In March 2025, France’s steel production showed a clear recovery in 2024, rebounding from previous declines, according to the French Ministry of Economy and Finance’s industry report. This upswing in steel output is crucial for the steel tubes market, as it ensures greater availability of the raw materials required to produce steel tubes for key sectors like construction, automotive, and energy. A steady supply of steel allows fabricators to operate with fewer disruptions, minimizing delays and reducing price volatility. This stability supports investments in production capacity and modernization efforts. As infrastructure and industrial projects gain momentum, consistent steel supply acts as a solid foundation for meeting growing demand in steel tube manufacturing. Buyers and project planners benefit from improved reliability in sourcing, enabling more accurate procurement and scheduling. Together, these conditions point to a favorable outlook for the France steel tubes market growth, which is anchored by renewed industrial activity and a more reliable supply chain.

To get more information on this market, Request Sample

Expanding Export Opportunities Boost Market Reach

In October 2024, sources highlighted that France increased shipments of seamless steel tubes and hollow profiles to key international markets, notably the United States. This growing export volume reflects rising global demand and France’s strengthening position as a reliable steel tube supplier. Expanding export markets help diversify revenue beyond domestic consumption, supporting manufacturers’ decisions to invest in enhanced capacity and improved production technologies. Buyers abroad prioritize consistent quality and timely delivery, particularly in critical sectors like construction, automotive, and energy infrastructure. This dependable supply strengthens France’s reputation and opens doors to new international partnerships. Additionally, stable external demand encourages improvements in logistics and supply chain resilience, helping manufacturers mitigate risks associated with global market fluctuations. With this broader geographic reach, French steel tube producers gain greater market stability and growth potential. Overall, these factors highlight how France steel tubes market trends are increasingly driven by expanding exports and enhanced global connectivity, laying a strong foundation for the industry’s future.

Diversified Demand Drives Adaptation and Resilience

In March 2025, news coverage from the French Finance Ministry and related industry communications underscored that steel remains essential for Europe’s clean and digital transition serving sectors from construction to transportation even amid cost pressures and global supply imbalances. That broader industrial importance drives a quiet yet meaningful push for adaptable, reliable tube supply ranging from structural tube applications to specialized industrial profiles. It’s not just about volume it’s about responsiveness and alignment with evolving end-user needs. Engineers, specifiers, and planners expect supply shifts to be flexible and timely. That requires manufacturers to stay attentive and agile, adjusting the batching and specifications to match demand. That kind of adaptability builds confidence: buyers feel supported, and industry continues to invest in tube formats that align with future infrastructure needs. Ultimately, this dynamic strengthens the foundation for France steel tubes market, as resilience and versatility become the stock in trade of a maturing, forward-looking supply base.

France Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

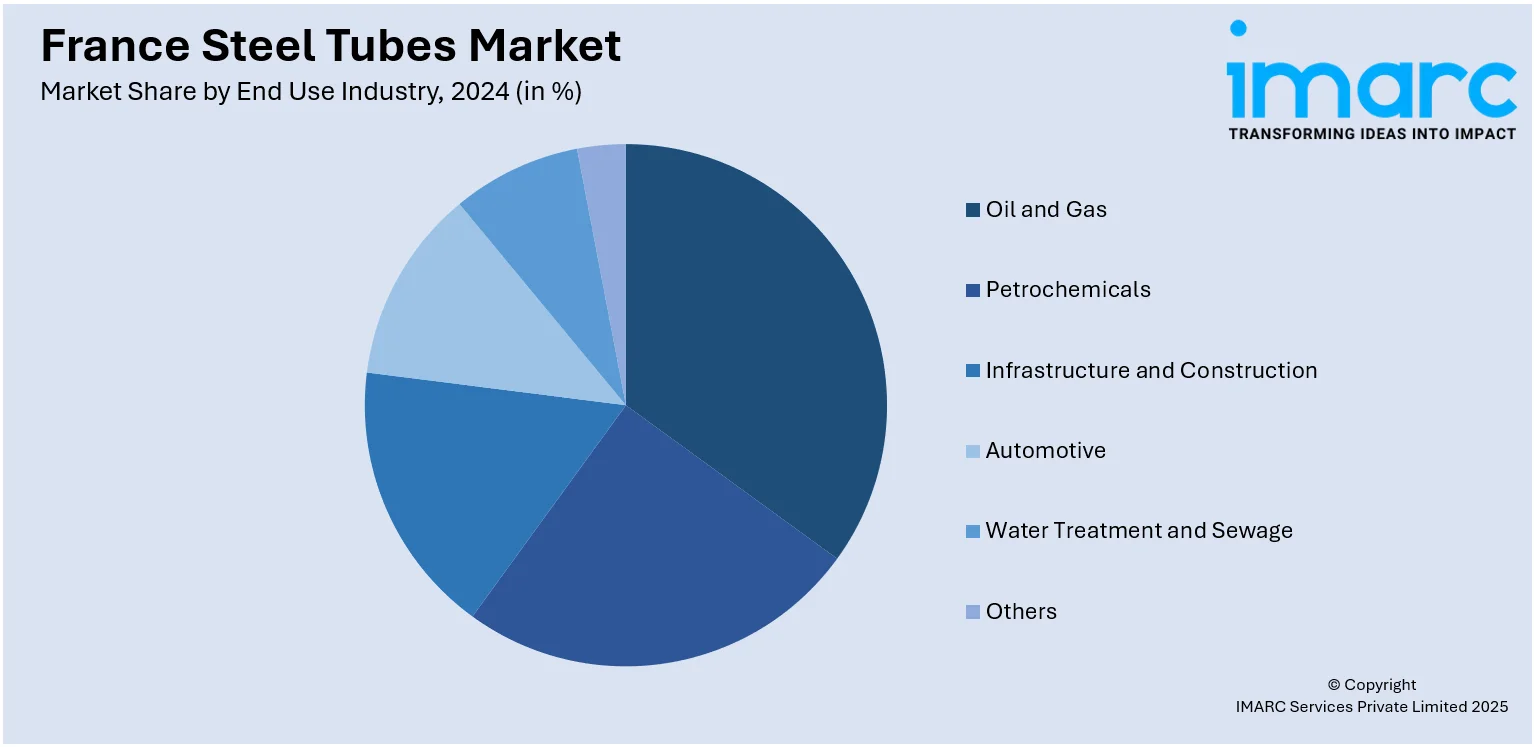

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Steel Tubes Market News:

- March 2024: Vallourec, a leading French manufacturer of steel pipes and tubes, has welcomed significant industrial backing as ArcelorMittal takes a strategic minority stake in the company. The investment reinforces Vallourec’s position in the premium tubular market, especially in energy and industrial sectors while bolstering its low‑carbon manufacturing capabilities. With strong operations spanning Europe, the US, and Brazil, this partnership aligns both firms around shared goals of sustainable expansion, value‑added product development, and reinforcing France’s tubular solutions industry.

France Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the France steel tubes market on the basis of product type?

- What is the breakup of the France steel tubes market on the basis of material type?

- What is the breakup of the France steel tubes market on the basis of end use industry?

- What is the breakup of the France steel tubes market on the basis of region?

- What are the various stages in the value chain of the France steel tubes market?

- What are the key driving factors and challenges in the France steel tubes market?

- What is the structure of the France steel tubes market and who are the key players?

- What is the degree of competition in the France steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)