France Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2025-2033

France Watch Market Overview:

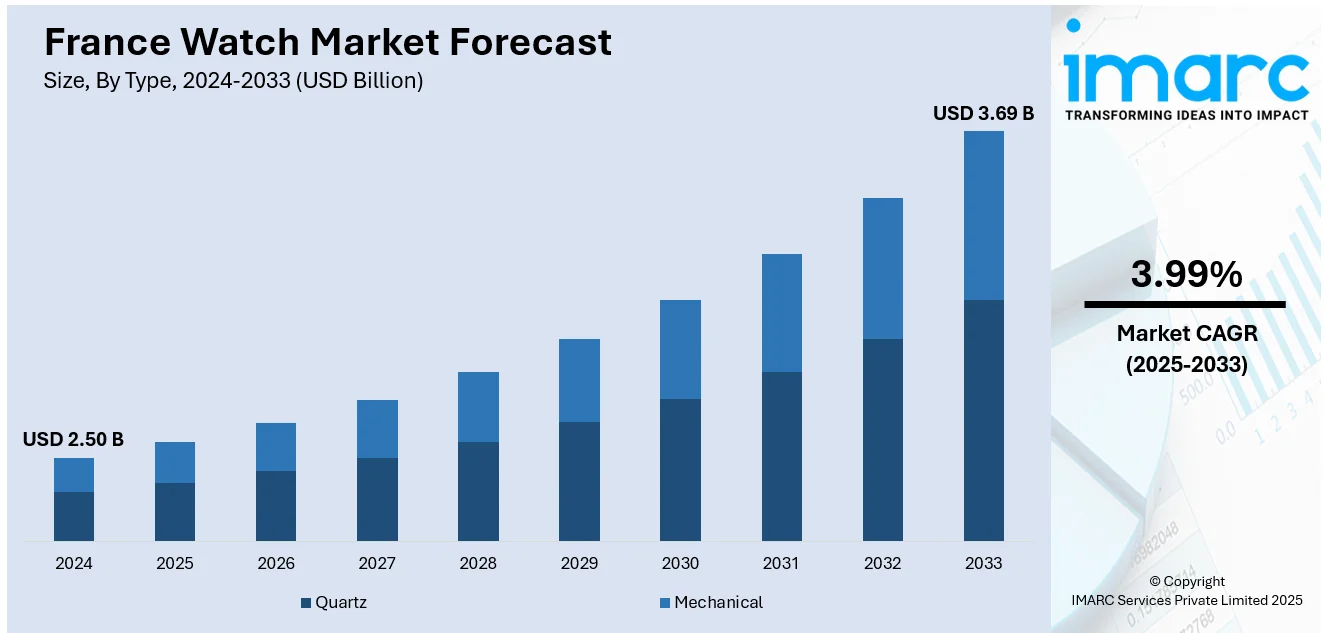

The France watch market size reached USD 2.50 Billion in 2024. The market is projected to reach USD 3.69 Billion by 2033, exhibiting a growth rate (CAGR) of 3.99% during 2025-2033. The market is driven by a blend of heritage craftsmanship, rising demand for luxury timepieces, and growing interest in smartwatches among younger consumers. Tourism-driven purchases and a strong retail presence in cities like Paris also support market growth. Additionally, sustainability and personalization trends are shaping buyer preferences. These evolving dynamics are key to expanding France's presence in the global watch industry and increasing France watch market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.50 Billion |

| Market Forecast in 2033 | USD 3.69 Billion |

| Market Growth Rate 2025-2033 | 3.99% |

France Watch Market Trends:

Flagship Retail Enhances Brand Prestige

France’s luxury watch industry is adopting experiential retail by developing flagship boutique spaces that move beyond standard selling points. These elevated locations incorporate private lounges, interactive horology exhibitions, and customization areas to create environments that immerse buyers in craftsmanship and brand heritage narratives. In March 2025, sources highlighted how this experiential pivot is shaping luxury categories in France by encouraging deeper consumer immersion in premium spaces. Visitors aren’t just making transactions they’re forging emotional connections with artisanal legacies and values. In doing so, brands establish distinct value propositions that attract discerning local and international buyers alike. These immersive environments also serve as cultural symbols, reinforcing France’s reputation as a hub for refined artistry. This evolution marks a significant step in aligning retail innovation with evolving consumer behaviors, where in-store environments must reflect identity and status as much as the products themselves. These flagship retail formats are now fundamental to driving France watch market growth by enhancing prestige, personalization, and customer lifetime value.

To get more information on this market, Request Sample

E-Commerce Integration Expands the Market

Digital platforms are fundamentally transforming how French consumers access and engage with the watch market, especially among digitally savvy and remote buyers. In April 2025, trade activity updates reflected noticeable growth in cross-border e-commerce, particularly in luxury accessories, signaling increased demand for digital retail infrastructure. Watch brands in France are adapting by optimizing websites with high-resolution imagery, augmented reality (AR) try-ons, and regional delivery options. These advancements improve the overall user journey while making high-end watches more accessible. Integration between online and physical retail is becoming essential as consumers seek convenience without compromising exclusivity. Whether browsing limited collections or using live virtual assistance, today’s shoppers expect a seamless blend of touchpoints. By aligning omnichannel experiences with evolving consumer preferences, retailers are tapping into new audience segments and reshaping retail logistics. This transformation signals a definitive shift in France watch market trends, where online platforms not only enable purchases but also serve as essential storytelling tools. Digital adaptation is no longer optional it’s central to reaching and retaining today’s evolving customer base.

Sustainability Shapes Market Expectations

The growing focus on environmental responsibility is redefining consumer preferences in the French watch industry. Buyers are increasingly drawn to timepieces that combine refined aesthetics with sustainable values, including those crafted from recycled metals or renewable materials. Transparent sourcing, low-emission production processes, and eco-friendly packaging are now key differentiators in a market where quality and conscience coexist. Consumers, particularly in urban areas, are shifting toward brands that demonstrate environmental awareness without compromising traditional watchmaking excellence. Industry coverage shows how French producers are aligning with sustainability goals to appeal to these value-driven audiences. Beyond compliance, the emphasis on circular design supports both brand ethics and long-term consumer trust. As this expectation becomes standard rather than niche, it is influencing material sourcing, production workflows, and even after-sale services. Sustainability is no longer a side offering; it is a strategic pillar shaping how the French watch sector competes and communicates. These values are becoming deeply embedded in how buyers evaluate credibility and taste, contributing actively to France watch market.

France Watch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, price range, distribution channel, and end user.

Type Insights:

- Quartz

- Mechanical

The report has provided a detailed breakup and analysis of the market based on the type. This includes quartz and mechanical.

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range, mid-range, and luxury.

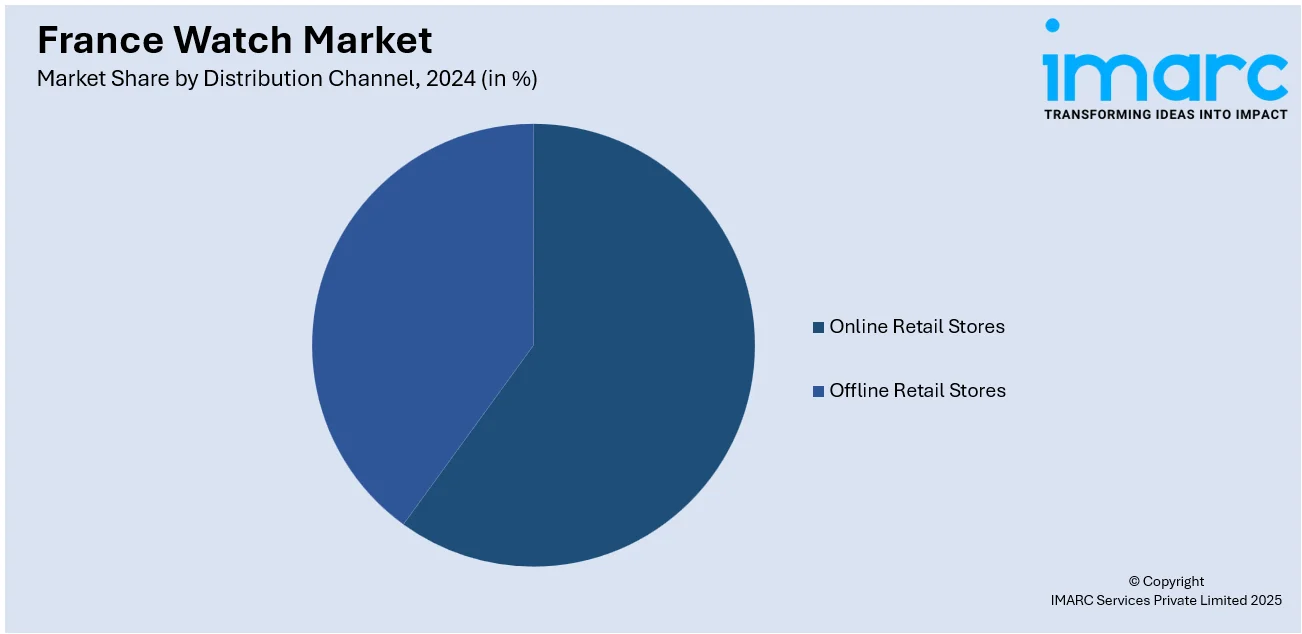

Distribution Channel Insights:

- Online Retail Stores

- Offline Retail Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online retail stores and offline retail stores.

End User Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and unisex.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

France Watch Market News:

- November 2024: French independent watchmaker Awake has introduced The Poppies, a limited-edition variant of its Son Mai Métiers d’Art timepiece, supporting a UK charity for bereaved military children. Inspired by Remembrance Weekend and the iconic red poppy, Awake’s founder Lilian Thibault who has military roots designed the vibrant red lacquer dial using traditional Vietnamese techniques. The 39 mm automatic watch is elegantly paired with a matching strap. With a strong connection to its French heritage and craftsmanship, Awake blends artistry and purpose, advancing its reputation in watchmaking circles.

- November 2024: Bulgari has unveiled a new Octo Finissimo limited edition in collaboration with French conceptual artist Laurent Grasso. Featuring a sleek 40 mm sandblasted titanium case coated in midnight-blue PVD, the timepiece showcases Grasso’s signature iridescent cloud motif on the brass dial via a refined serigraphy technique. The minimalist three-hand display appears to float above the dial, enhancing its ethereal quality. A transparent caseback reveals the ultra-thin automatic BVL 138 movement, signed by Grasso. This release highlights the fusion of French artistic vision and Italian horological mastery.

France Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the France watch market performed so far and how will it perform in the coming years?

- What is the breakup of the France watch market on the basis of type?

- What is the breakup of the France watch market on the basis of price range?

- What is the breakup of the France watch market on the basis of distribution channel?

- What is the breakup of the France watch market on the basis of end user?

- What is the breakup of the France watch market on the basis of the region?

- What are the various stages in the value chain of the France watch market?

- What are the key driving factors and challenges in the France watch market?

- What is the structure of the France watch market and who are the key players?

- What is the degree of competition in the France watch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the France watch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the France watch market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the France watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)