Friction Stir Welding Equipment Market Size, Share, Trends and Forecast by Equipment Type, End-Use Industry, and Region, 2025-2033

Friction Stir Welding Equipment Market Size and Share:

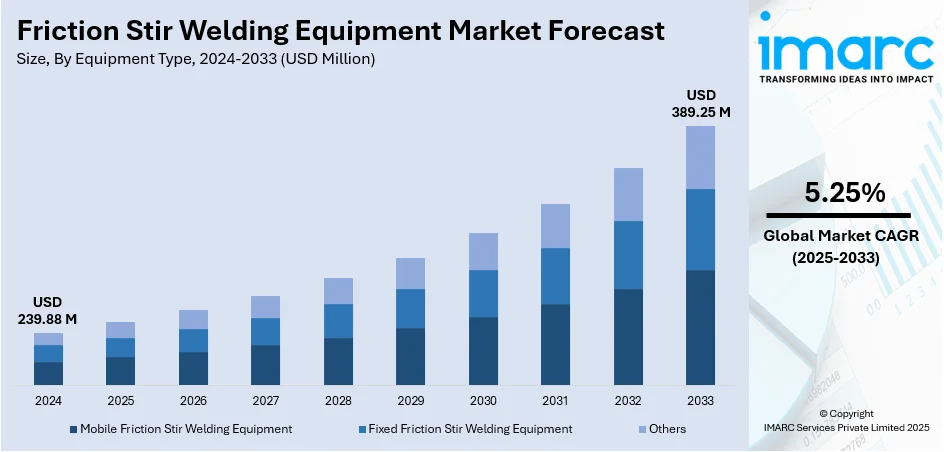

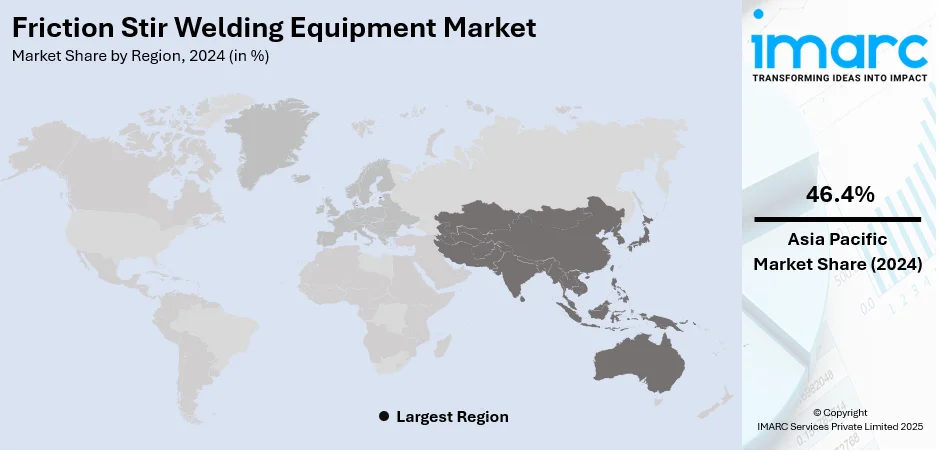

The global friction stir welding equipment market size was valued at USD 239.88 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 389.25 Million by 2033, exhibiting a CAGR of 5.25% during 2025-2033. Asia Pacific dominated the market, holding a significant market share of 46.4% in 2024. Rising demand for lightweight materials in automotive and aerospace, FSW's ability to create high-quality welds, and its eco-friendly, energy-efficient nature are some of the factors contributing to the friction stir welding equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 239.88 Million |

|

Market Forecast in 2033

|

USD 389.25 Million |

| Market Growth Rate (2025-2033) | 5.25% |

The market is driven by several key factors. A primary driver is the escalating demand for lightweight, high-strength materials, particularly in the automotive and aerospace sectors. These industries are under pressure to enhance fuel efficiency and reduce carbon emissions, which lightweight components effectively address. FSW is uniquely suited for joining challenging materials like aluminum alloys, magnesium, and copper, which are critical for this purpose. Furthermore, the market benefits from FSW's inherent advantages over traditional welding techniques. It is an eco-friendly and energy-efficient solid-state process, producing high-quality, low-distortion, and defect-free welds. The increasing adoption of FSW in electric vehicle (EV) battery pack manufacturing and shipbuilding also contributes to its friction stir welding equipment market growth, as these applications require reliable, high-integrity joints in complex structures.

To get more information on this market, Request Sample

In the United States, a new research initiative is driving progress in large-format additive manufacturing, with emphasis on friction stir welding (FSW) for ground vehicle components. By focusing on large metal part production and partnering with defense collaborators, the effort strengthens supply chain resiliency and accelerates the adoption of FSW in critical defense manufacturing. For instance, in May 2025, the University of Illinois Urbana-Champaign, with USD 8.15 Million in DoD funding, launched a large-format additive manufacturing research center, emphasizing friction stir welding (FSW) for ground vehicle components. In collaboration with RIA-JMTC, the initiative aimed to mature FSW applications for producing large metal parts, supporting defense and supply chain resiliency.

Friction Stir Welding Equipment Market Trends:

Lower Emissions Driving Adoption

Friction stir welding equipment market trends reflect that friction stir welding (FSW) is gaining wider acceptance because it eliminates the need for flux, shielding gas, or filler materials. This process is proving attractive to industries under pressure to cut emissions, as recent studies show it can lower CO₂ output by as much as 50%. Beyond sustainability, the approach reduces operational costs linked to consumables and safety measures, making it appealing for sectors like automotive, aerospace, shipbuilding, and rail. With manufacturers moving toward greener production methods, demand for equipment that supports FSW is expected to rise steadily. Companies exploring lightweight materials and energy-efficient manufacturing are increasingly investing in this solid-state joining technique, which also delivers high-quality welds with fewer defects compared to conventional processes. Notably, friction stir welding (FSW) does not require flux, protective gas, or filler metal, significantly reducing CO₂ emissions by up to 50%, according to a recent report.

Advancements in Transonic FSW for Aerospace

A recent analysis points to the advantages of transonic friction stir welding (FSW) in aerospace applications. By incorporating a reduced leading-edge sweep angle at the 50% chord line, this approach generates less compressive flow (CF). The result is greater stability during the weld process, minimizing irregularities, improving overall consistency, and shaping the friction stir welding equipment market outlook. These refinements are particularly valuable in high-precision aerospace manufacturing, where uniformity and defect-free joints are critical for safety and performance. The improvement in weld quality also strengthens the case for FSW as a preferred joining method in the production of advanced airframes and components, reinforcing its role in supporting lightweight design strategies and stringent industry standards. An industrial report also highlights that transonic FSW, due to its reduced leading edge sweep angle for the same 50% chord line angle, presents less compressive flow (CF), which enhances weld quality and consistency, especially in high-precision aerospace applications.

Growing Demand for FSW in Aerospace and Defense

The aerospace and defense sector is experiencing steady expansion, creating stronger demand for advanced manufacturing technologies. As per the friction stir welding equipment market forecast, friction stir welding (FSW) is expected to become increasingly important within this environment, as it supports the need for lightweight structures, improved weld quality, and greater production efficiency. Transonic FSW, with its ability to deliver higher consistency and reduce structural stresses, is particularly suited for aerospace applications where precision and reliability are paramount. As companies focus on lowering emissions and meeting rigorous performance standards, the role of FSW equipment is set to become more prominent, reinforcing its position as a preferred joining method across both commercial and defense programs. As such, the UK aerospace and defense market size was valued at USD 28.7 Billion in 2024 and expected to reach USD 58.3 Billion by 2033, exhibiting a CAGR of 8.21% from 2025-2033.

Friction Stir Welding Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global friction stir welding equipment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on equipment type and end-use industry

Analysis by Equipment Type:

- Mobile Friction Stir Welding Equipment

- Fixed Friction Stir Welding Equipment

- Others

Fixed friction stir welding equipment stood as the largest equipment type in 2024, holding around 52.7% of the market due to its precision, reliability, and wide adoption in high-volume industrial applications. Unlike portable systems, fixed FSW machines are better suited for mass production, as they offer consistent weld quality, higher operational efficiency, and the ability to handle large and complex workpieces. Automotive, aerospace, shipbuilding, and rail industries are increasingly investing in these machines to join lightweight materials such as aluminum and magnesium, aiming for weight reduction and improved fuel efficiency. Additionally, fixed equipment integrates easily with automation and robotic systems, making it ideal for production lines. This rising demand for durable, efficient, and high-quality welding solutions positions fixed FSW machines as a central factor boosting market expansion.

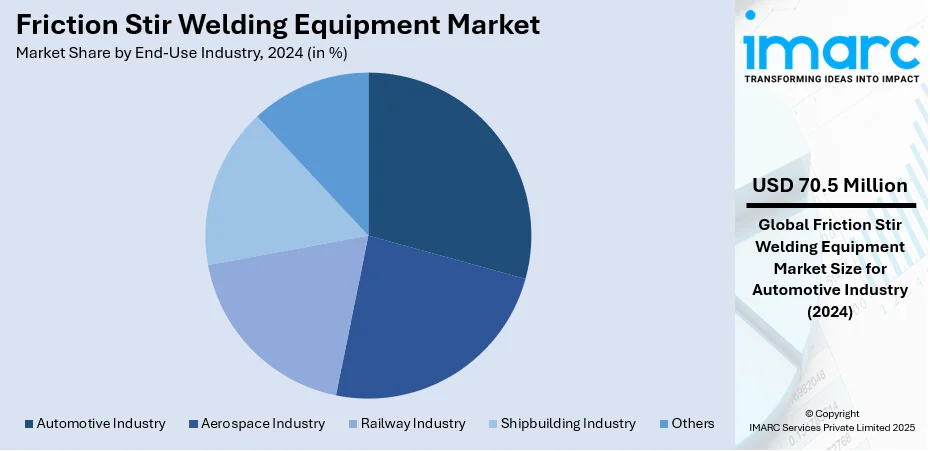

Analysis by End-Use Industry:

- Automotive Industry

- Aerospace Industry

- Railway Industry

- Shipbuilding Industry

- Others

The automotive industry led the market with around 29.4% of market share in 2024, largely because of the industry’s strong push toward lightweighting and fuel efficiency. Automakers are increasingly using aluminum and other lightweight alloys to reduce vehicle weight, improve performance, and meet stringent emission standards. FSW provides a cost-effective and high-strength joining solution for these materials, outperforming conventional welding techniques that often struggle with lightweight metals. The method ensures superior joint quality, minimal defects, and enhanced durability, making it highly suitable for structural and safety-critical automotive components. With the rise of electric vehicles, the demand for efficient joining processes for battery enclosures, chassis, and body parts is also increasing. This steady adoption of FSW in automotive production significantly boosts market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of 46.4% due to several key factors. The region's rapid industrialization and robust growth in key sectors like automotive, aerospace, shipbuilding, and railways are major drivers. FSW is increasingly adopted in these industries, especially for joining lightweight materials like aluminum alloys, which are critical for enhancing fuel efficiency in vehicles and aircraft. Countries such as China and India are leading this growth with massive vehicle production and significant investments in defense and infrastructure projects. The increasing focus on sustainable and energy-efficient manufacturing processes also favors FSW technology, which is a cleaner alternative to traditional welding methods.

Key Regional Takeaways:

United States Friction Stir Welding Equipment Market Analysis

In 2024, the United States accounted for 89.50% of the market share in North America. The United States friction stir welding (FSW) equipment market is experiencing steady growth due to the rising emphasis on lightweight material joining in various high-end manufacturing applications. The integration of automation and Industry 4.0 practices is propelling the adoption of advanced FSW systems, especially in sectors such as transportation and aerospace, where precision and strength are critical. According to CEIC data, the United States Motor Vehicle Production was reported at 10,611,555 units in December 2023. This records an increase from the previous number of 10,052,958 units. Increasing investments in infrastructure modernization and the push toward sustainable construction techniques are also supporting demand. Furthermore, the need for reduced energy consumption and improved weld quality in production environments is driving innovation in process control and equipment customization. The rising application of dissimilar metal joining, particularly lightweight structural components, is further augmenting market prospects. Additionally, government initiatives promoting advanced manufacturing technologies are boosting the deployment of friction stir welding in both industrial and defense-related sectors. This growing interest in high-performance, solid-state joining techniques is positioning FSW equipment as a critical tool in modern fabrication workflows.

Europe Friction Stir Welding Equipment Market Analysis

The Europe friction stir welding equipment market is witnessing notable momentum driven by the region’s shift toward energy-efficient and low-emission manufacturing processes. Increasing utilization of aluminum in renewable energy infrastructure and lightweight mobility solutions is boosting demand for FSW systems. The European Commission has set an ambitious target to reduce net greenhouse gas emissions by at least 55% by 2030, intensifying the demand for clean, low-thermal-impact welding technologies like FSW. Additionally, the region’s focus on enhancing circular economy initiatives is encouraging manufacturers to adopt welding methods that offer minimal material waste and high structural integrity. The adoption of robotic FSW solutions in high-precision manufacturing environments is gaining traction, especially in technologically mature industries. Rising R&D collaborations across universities and industrial hubs are promoting innovation and deployment of next-generation FSW machines. Furthermore, environmental compliance regulations are prompting industries to move toward solid-state welding technologies that limit emissions and improve workplace safety.

Asia Pacific Friction Stir Welding Equipment Market Analysis

The Asia Pacific friction stir welding equipment market is expanding rapidly, supported by the surge in high-volume manufacturing activities and increased investment in precision engineering technologies. According to the India Brand Equity Foundation (IBEF), India's manufacturing sector is poised to reach USD 1 Trillion by FY26, which is expected to significantly contribute to the rising demand for automated, high-throughput FSW equipment. A significant contributor to this growth is the region’s accelerated adoption of electric mobility platforms and high-speed rail networks, which demand advanced joining techniques for lightweight and durable components. Smart sensors and real-time monitoring in welding systems improve process visibility and production outcomes. Automated production lines in consumer electronics and appliances increase demand for compact, high-throughput friction stir welding equipment, making it an attractive option.

Latin America Friction Stir Welding Equipment Market Analysis

In Latin America, the friction stir welding equipment market is gaining traction, fueled by growing adoption of advanced fabrication methods in the region’s industrial base. The shift toward durable and energy-efficient metal joining solutions is fostering the use of FSW systems, particularly in sectors embracing modernization and export-driven manufacturing. According to the Association of Manufacturing Technology, Brazil consumed more than USD 6 Billion of manufacturing technology products in 2024, highlighting the region’s growing appetite for advanced production systems, including friction stir welding. Public-private sector collaboration on skill development programs enhances non-fusion welding techniques. Digital interfaces and automation improve operational consistency and product quality. FSW is seen as a practical alternative to conventional methods.

Middle East and Africa Friction Stir Welding Equipment Market Analysis

The Middle East and Africa friction stir welding equipment market is progressing, driven by increased focus on infrastructure durability and efficient metal fabrication techniques. As industrial sectors diversify, there is rising interest in solid-state joining technologies that can meet stringent strength and performance requirements without compromising material integrity. According to IMARC Group, Saudi Arabia’s metal fabrication market reached USD 682.15 Million in 2024 and is expected to grow to USD 962.54 Million by 2033, at a CAGR of 3.90% from 2025 to 2033, reflecting the region’s growing manufacturing ambitions. The growing demand for thermal control and energy optimization in production settings is encouraging the use of FSW systems with minimal heat-affected zones. Advanced industrial initiatives are integrating digitally controlled FSW equipment in fabrication units, attracting industries seeking reliable, cost-efficient welding solutions for structural complexity and production scalability.

Competitive Landscape:

The friction stir welding equipment market is seeing steady momentum driven by collaborations, product improvements, and R&D activities. Companies are focusing on new system launches tailored for automotive, aerospace, and EV applications, with lightweight materials being a key driver. Partnerships and agreements between equipment makers and OEMs are becoming more common to expand regional reach and technical capabilities. Governments are supporting the technology through initiatives that encourage advanced manufacturing and sustainable production. Research centers and manufacturers are also investing in developing portable and automated FSW machines to meet demand from the infrastructure and defense sectors. At present, the most common practices shaping the market are strategic partnerships, product launches, and ongoing research and development investments.

The report provides a comprehensive analysis of the competitive landscape in the friction stir welding equipment market with detailed profiles of all major companies, including:

- Bond Technologies, LLC.

- ETA Technology

- FOOKE GmbH

- Grenzebach Group

- Groupe TRA-C industrie

- KUKA AG

- Manufacturing Technology, Inc.

- Norsk Hydro ASA

- PAR Systems

- Stirweld

- Yamazaki Mazak Corporation

Latest News and Developments:

- April 2025: ABB Robotics showcased FSW using its IRB 7720 robot, highlighting the growing integration of advanced welding techniques in industrial automation. The demonstration emphasized ABB's interest in expanding robotic applications in sectors like automotive and aerospace. This aligned with the rising demand for energy-efficient, high-strength welding solutions in modern manufacturing processes.

- February 2025: Honda implemented FSW for the first time globally in mass production at its Anna Engine Plant. The technology was used to join EV battery case halves and attach water jackets, offering high-strength welds with lower energy use. This innovation supported Honda’s sustainability goals and advanced EV battery production capabilities.

- January 2025: Stadler introduced FSW at its Szolnok factory to enhance the production of aluminium double-decker train cars. The energy-efficient process reduced raw material waste and improved weld strength. This investment expanded the factory’s capabilities, aligning with Stadler’s sustainability strategy and boosting its competitive edge in the global railway manufacturing sector.

Friction Stir Welding Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Mobile Friction Stir Welding Equipment, Fixed Friction Stir Welding Equipment, Others |

| End-Use Industries Covered | Automotive Industry, Aerospace Industry, Railway Industry, Shipbuilding Industry, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bond Technologies, LLC., ETA Technology, FOOKE GmbH, Grenzebach Group, Groupe TRA-C industrie, KUKA AG, Manufacturing Technology, Inc., Norsk Hydro ASA, PAR Systems, Stirweld, Yamazaki Mazak Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the friction stir welding equipment market from 2019-2033.

- The friction stir welding equipment market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the friction stir welding equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The friction stir welding equipment market was valued at USD 239.88 Million in 2024.

The friction stir welding equipment market is projected to exhibit a CAGR of 5.25% during 2025-2033, reaching a value of USD 389.25 Million by 2033.

The key factors driving the friction stir welding (FSW) equipment market are the rising demand for lightweight, high-strength materials in the automotive and aerospace industries. This is fueled by the need for fuel efficiency and structural integrity. FSW's ability to create high-quality, defect-free welds in materials like aluminum and magnesium, coupled with its eco-friendly and energy-efficient nature, makes it an attractive alternative to traditional welding methods.

Asia Pacific dominated the friction stir welding equipment market in 2024, accounting for a share of 46.4% due to robust industrialization, rapid growth in automotive, aerospace, and shipbuilding industries, and increasing adoption of advanced manufacturing technologies in countries like China and India.

Some of the major players in the friction stir welding equipment market include Bond Technologies, LLC., ETA Technology, FOOKE GmbH, Grenzebach Group, Groupe TRA-C industrie, KUKA AG, Manufacturing Technology, Inc., Norsk Hydro ASA, PAR Systems, Stirweld, Yamazaki Mazak Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)