Fuel Dispenser Market Size, Share, Trends and Forecast by Fuel Type, Dispenser System, Flow Meter, and Region, 2025-2033

Fuel Dispenser Market Size and Share:

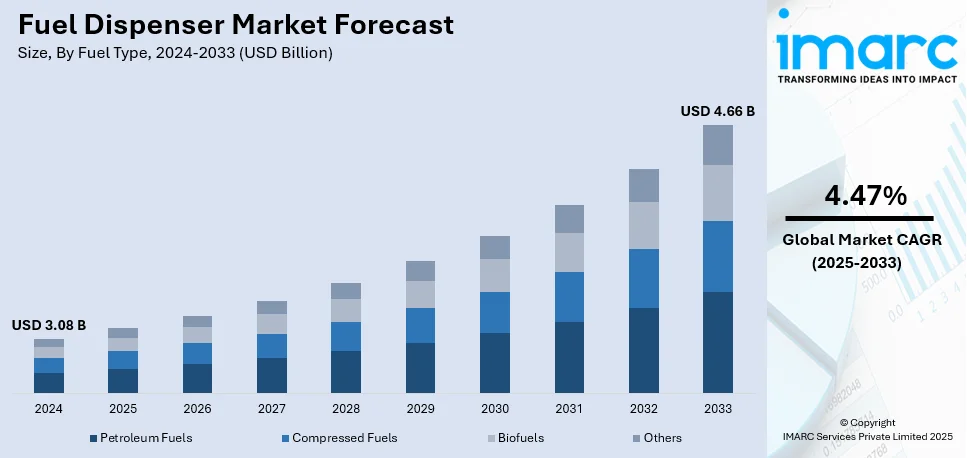

The global fuel dispenser market size was valued at USD 3.08 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.66 Billion by 2033, exhibiting a CAGR of 4.47% from 2025-2033. Asia Pacific currently dominates the market, holding the largest market share in 2024. There are various factors that are boosting the fuel dispenser market share, which include the rising vehicle production on account of rapid urbanization and changing lifestyle of individuals, integration of digital systems and focus on automation, and thriving e-commerce and logistics sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.08 Billion |

|

Market Forecast in 2033

|

USD 4.66 Billion |

| Market Growth Rate (2025-2033) | 4.47% |

The growth of the global fuel dispenser market is primarily driven by increasing vehicle ownership, rising fuel consumption, and expanding transportation networks worldwide. Rapid urbanization and industrialization in emerging economies have further spurred demand for fuel dispensing systems to meet the growing energy requirements. Technological innovations, including the adoption of IoT, contactless payment technologies, and advanced metering systems, are driving improvements in operational performance and customer ease, fueling market growth. Furthermore, the growing focus on alternative fuels such as compressed natural gas (CNG), hydrogen, and electric vehicle (EV) charging stations is stimulating the creation of multifunctional fuel dispensers. Government initiatives promoting infrastructure development and the modernization of fuel stations are also playing a significant role in propelling the fuel dispenser market demand.

Several key factors are driving the growth of the fuel dispenser market in the USA. Despite a slight decline in gasoline demand down 0.8% year-over-year due to more efficient vehicles, the rise of electric vehicles (EVs), and persistent work-from-home trends, retailers have adapted by increasing fuel prices, leading to higher retail margins averaging 39 cents per gallon, up from 24 cents in 2019. This approach has been effective in mitigating inflationary challenges, including rising labor and food expenses. Moreover, convenience store chains like Murphy USA and Casey's General Stores are expanding their operations, with Murphy USA expected to operate 1,903 stores by 2027, up from 1,759 in 2024. These expansions necessitate the installation of new fuel dispensers, thereby driving market growth. Additionally, the integration of digital technologies and automation in fuel dispensing systems enhances operational efficiency and customer experience, further propelling the market.

Fuel Dispenser Market Trends:

Integration of Advanced Technologies

Technological advancements such automation, digital system integration, and the creation of more dependable and efficient dispensers are driving the market expansion. Touch screens, contactless payments, and real time data tracking are examples of advanced technologies that help in increasing operational efficiency and user experience. Fuel dispensers with touch screen interfaces offer a simple and easy-to-use interface, which make it simple to navigate through a variety of alternatives such as loyalty plans, promotional offers, and fuel type selection. Additionally, the rising adoption of contactless payment systems such as near-field communication (NFC) and mobile payment apps as they allow for quick and secure transactions is contributing to the fuel dispenser market growth. The global near field communication (NFC) market size reached USD 25.4 Billion in 2024. This feature is beneficial in enhancing user convenience and reducing wait times. Furthermore, companies are launching apps that offer improved individual satisfaction. For instance, Smith Oil launched a mobile application on August 23, 2023, which enables individuals to pay for fuel at the pump using an ACH debit with a few clicks on their smartphone and instantly obtain a discount through price rollback at the pump. This revolutionary new app powered by Liquid Barcodes C-StorePay is integrated seamlessly with their current point of sale (POS) system and uses the trusted Stripe payment system. Individuals simply drive into any of Smith Oil’s fueling stations and link their bank account on their first visit in easy steps.

Increasing Vehicle Production

People are increasingly purchasing vehicles, especially in emerging markets due to their inflating income levels, which is catalyzing the fuel dispenser demand. Rapid urbanization in developing countries is also contributing to an increase in vehicle numbers. As cities are expanding and more people are migrating to urban areas, the need for efficient transportation and fueling infrastructure is intensifying. In addition, companies are expanding their networks into rural areas for catering to the growing vehicle population. The establishment of new fuel stations in these areas necessitates the installation of fuel dispensers, which is contributing to the market growth. S&P Global states that new vehicle sales around the world are projected to reach 88.3 Million in 2024.

Thriving E-Commerce and Logistics Sectors

The rapid growth of the e-commerce sector is leading to a surge in delivery and transportation services. Online shopping platforms require efficient and reliable logistics to ensure the timely delivery of goods to individuals. This necessitates a dependable fuel infrastructure to support the increased movement of delivery vehicles and represent fuel dispenser market drivers, among others. Companies involved in logistics require a constant and reliable fuel supply to operate their fleets efficiently. The demand for fuel dispensers at fuel stations serving logistics companies is directly impacted by this growth. In addition, e-commerce businesses and logistics suppliers are also growing their delivery fleets to fulfill the growing demand from individuals for prompt and dependable delivery services. Fuel dispensers are becoming more and more necessary to guarantee that these cars can refuel effectively and quickly. Additionally, fuel dispensers are essential to this supply chain because they allow delivery vehicles to conveniently recharge. According to reports, the e-commerce market is anticipated to total over USD 7.9 Trillion by 2027.

Fuel Dispenser Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global fuel dispenser market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fuel type, dispenser system, and flow meter.

Analysis by Fuel Type:

- Petroleum Fuels

- Compressed Fuels

- Biofuels

- Others

Petroleum fuels stands as the largest component in 2024, holding around 34.8% of the market. Since most vehicles on the road now operate on petroleum-based fuels like gasoline and diesel, petroleum fuels are in high demand. The infrastructure for petroleum fuel distribution is well-established and extensive, with numerous fuel stations worldwide equipped to dispense gasoline and diesel. This existing network supports the dominance of petroleum fuels in the market. Petroleum fuels offer a high energy density that assists in providing efficient and powerful performance for internal combustion engines (ICEs). This characteristic makes them a preferred choice for many vehicle owners and contributes to various business opportunities in the fuel dispenser market for market players.

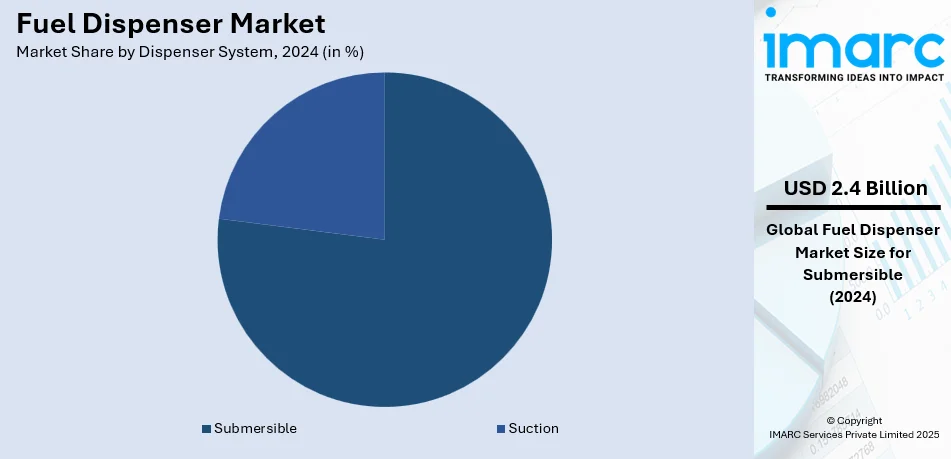

Analysis by Dispenser System:

- Submersible

- Suction

Submersible led the market with around 77.5% of market share in 2024. Submersible fuel dispensers are known for their efficiency in pumping fuel. They are installed inside the fuel storage tanks that allow them to push fuel to the dispensers with greater force and speed as compared to suction systems, resulting in faster fueling times. They require less maintenance than above-ground pumps because these systems are shielded from the elements and normal wear and tear. These systems save space as the pumping mechanism is housed within the fuel tank itself. This is especially helpful in cramped metropolitan locations. Because the gasoline is maintained under pressure and away from any ignition sources, these dispensers also lessen the risk of fire and explosion. This improves overall safety during the fuel dispensing process and leads to a positive fuel dispenser market forecast.

Analysis by Flow Meter:

- Mechanical

- Electronics

In 2024, electronics accounts for the majority of the market. Electronics fuel dispensers provide more accurate fuel measurement and dispensing compared to mechanical systems. This accuracy helps in minimizing fuel loss and ensuring users receive the exact amount of fuel they pay for. Electronic dispensers offer a better user experience through features like touch screens, interactive interfaces, and real time information displays. These features make the fueling process more convenient and efficient for individuals. The incorporation of electronic payment systems is beneficial in simplifying transactions and reducing the need for cash handling.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share. According to the India Brand Equity Foundation (IBEF), the total production of passenger vehicles, including three wheeler (3W), two wheeler (2W), and quadricycles was 2.32 million units in India in January 2024. People are adopting vehicles in the Asia Pacific region due to rapid urbanization. Apart from this, governing agencies in the Asia Pacific region are investing in infrastructure development including transportation and fuel distribution networks. They are also providing several policies and undertaking initiatives that aim to improve fuel accessibility and distribution, positively influencing the fuel dispenser industry overview.

Key Regional Takeaways:

North America Fuel Dispenser Market Analysis

The fuel dispenser market in North America is expanding driven by several important factors. The region's robust automotive sector and high vehicle ownership rates have led to a consistent demand for fuel, necessitating the expansion and modernization of fueling infrastructure. Technological advancements, such as the integration of electronic flow meters, which are more reliable and accurate than mechanical ones, are enhancing operational efficiency and customer experience, further propelling market growth. Additionally, the increasing adoption of alternative fuels, including biofuels and compressed natural gas (CNG), has prompted the development of versatile fuel dispensers to accommodate diverse fuel types, thus creating a positive fuel dispenser market outlook.

United States Fuel Dispenser Market Analysis

The fuel dispenser market in the United States is experiencing consistent growth, largely driven by the country's expanding transportation infrastructure and rising vehicle ownership. According to an article published in Autoinsurance.com, the number of registered vehicles in the U.S. has steadily increased over the past two decades. In 2022, there were nearly 279 Million private and commercial vehicles registered, with total registrations, including publicly owned vehicles, reaching approximately 283 Million. This represents a 47% increase around 90 Million more vehicles since 1990, highlighting the growing demand for fuel across the nation. This surge in vehicle ownership necessitates the expansion and modernization of fueling infrastructure, propelling the demand for advanced fuel dispensers. Technological advancements in fuel dispensers, such as digital interfaces, enhanced security systems, and compatibility with alternative fuels, cater to evolving consumer preferences for convenience and efficiency. Additionally, government initiatives promoting cleaner fuels and energy-efficient solutions, supported by the U.S. Department of Energy, encourage the adoption of modern fuel dispensing systems. Collectively, these factors contribute to the robust expansion of the U.S. fuel dispenser market, aligning with evolving consumer needs and environmental sustainability goals.

Europe Fuel Dispenser Market Analysis

The European fuel dispenser market is experiencing significant growth, driven by stringent environmental regulations and the shift toward cleaner fuels. Countries like Germany and France are investing in modern fueling infrastructure to comply with EU directives aimed at reducing carbon emissions. This transition has increased demand for advanced fuel dispensers that support alternative fuels such as compressed natural gas (CNG), liquefied natural gas (LNG), and hydrogen. However, diesel-powered vehicles still dominate the market. According to the European Automobile Manufacturers Association (ACEA), diesel-powered light commercial vehicles make up 91% of the EU fleet. This ongoing dominance highlights the need for diesel-compatible dispensers alongside those for alternative fuels. Manufacturers are responding by developing hybrid dispensers that cater to both traditional and emerging fuel types. Technological advancements, including the integration of Internet of Things (IoT) solutions and automation, are further enhancing operational efficiency and customer experience. Additionally, the expansion of retail fuel outlets, particularly in urban areas, is supporting market growth. These combined factors ensure the European fuel dispenser market evolves in line with changing energy demands.

Asia Pacific Fuel Dispenser Market Analysis

The fuel dispenser market in the Asia-Pacific (APAC) region is experiencing substantial growth, driven by rapid urbanization, increasing industrialization, and the expansion of the automotive sector. In particular, countries like China and India are seeing a surge in transportation activities, fueling the demand for advanced fuel dispensing technologies. Additionally, the region is witnessing growing adoption of clean energy solutions, including dispensers for alternative fuels such as compressed natural gas (CNG) and liquefied petroleum gas (LPG). This trend is supported by an expected expansion in gross national disposable income, which grew by 8.9% in FY24 and 14.5% in FY23, reflecting a higher purchasing power that drives fuel consumption. Furthermore, the demand for modern fueling systems is growing due to rising disposable incomes and a shift toward more automated and efficient dispensing solutions, such as contactless payments. Governments are also introducing stricter environmental regulations, leading to the development of advanced, energy-efficient dispensers that meet safety and sustainability standards, further boosting market growth.

Latin America Fuel Dispenser Market Analysis

The fuel dispenser market in Latin America is seeing growth due to the increasing demand for fuel efficiency and modernized infrastructure. As urbanization reaches around 80% in the region, a trend highlighted in reports, the rising vehicle ownership and road travel are naturally following. This urban expansion creates a need for more efficient and secure fueling solutions to keep pace with the growing number of vehicles on the road. With these developments, the demand for advanced fuel dispensers offering faster fueling and improved security features has escalated, prompting manufacturers to innovate in order to meet the evolving demands of urban transportation.

Middle East and Africa Fuel Dispenser Market Analysis

The fuel dispenser market in the Middle East and Africa is expanding due to rising urbanization and infrastructure development. As cities grow and modernize, the demand for advanced fueling systems intensifies. The region's automotive sector, along with its focus on energy-efficient, environmentally friendly solutions, further drives market growth. With MENA already 64% urbanized, as reported by the World Bank, urban expansion is fueling increased vehicle ownership and road travel. This growth in personal and commercial transportation creates a heightened need for modern fuel dispensers, particularly as retail fuel stations embrace digital technologies to cater to the demands of expanding urban populations.

Competitive Landscape:

The competitive landscape of the global fuel dispenser market is characterized by the presence of numerous key players striving to enhance their market position through innovation, strategic partnerships, and geographic expansion. Major companies dominate the market, offering advanced fuel dispensing technologies, including IoT-enabled systems, contactless payment solutions, and alternative fuel compatibility. Emerging players focus on niche markets and cost-effective solutions to gain traction. Industry consolidation through mergers and acquisitions further intensifies competition, enabling companies to expand product portfolios and access new markets. Additionally, the shift towards sustainable energy solutions, such as electric vehicle (EV) charging and hydrogen fueling infrastructure, has prompted manufacturers to diversify their offerings. Regional players compete by catering to specific local needs, emphasizing affordability and compliance with regulatory standards.

The report provides a comprehensive analysis of the competitive landscape in the fuel dispenser market with detailed profiles of all major companies, including:

- Beijing SANKI Petroleum Technology Co. Ltd

- Bennett Pump Company

- Censtar Science & Technology Corp. Ltd

- Dover Corporation

- Fortive Corporation

- Korea EnE Co. Ltd

- Scheidt & Bachmann GmbH

- Tatsuno Corporation

- Tominaga Mfg. Company

- Zhejiang Lanfeng Machine Co. Ltd.

Latest News and Developments:

- September 2024: Bennett has introduced the MaxFlow™ H70 UHF hydrogen fuel dispenser, designed for high-speed refueling of Class 7-9 heavy-duty vehicles. It delivers over 10 kilograms of hydrogen per minute using the SAE J2601/5 protocol and Bennett’s proprietary filling algorithm, ensuring efficient and safe fueling.

- May 2024: SANKI presented UNITI Expo 2024 and announced the release of its AIoT fuel dispenser- Skyline series, and new upgraded prime series fuel dispenser, fuel tank ATG, cloud platform FMS, charging piles, and other products. Skyline series of fuel dispensers with AIoT Built-in Cloud Services attracted the most attention at the exhibition. The dispenser supports multiple connectivity and multiple protocols adapt to any network environment.

- May 2024: Dover Fueling Solutions (DFS), a part of Dover, and a leading global provider of advanced customer-focused technologies, services and solutions in the fuel and convenience retail industries, launched RDM by DFS – a remote diagnostics and management solution that will enable retailers to invest in a truly connected dispenser in the Europe, Middle East, and Africa region. RDM by DFS is an optional module that is available on Wayne Helix® fuel dispensers, which, once activated, will allow retailers to gather enhanced original equipment manufacturer (OEM) data, regardless of pump protocol, and enable remote monitoring and management via DX Monitor®.

- December 2023: Shell launched a new generation of fuel dispensers designed to provide an enhanced user experience. The latest addition to Shell's line of fuel dispensers is equipped with advanced technology that ensures faster, more accurate, and safer fueling. The new fuel dispenser is equipped with an innovative user interface that is intuitive and easy to use.

- May 2022: Gilbarco Veeder-Root Middle East and Africa launched the Latitude™ fuel dispenser, offering customizable and scalable configurations to meet evolving business needs. Designed for efficiency, security, and user convenience, the Latitude™ features a modern design to enhance customer experience and support business growth.

Fuel Dispenser Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Petroleum Fuels, Compressed Fuels, Biofuels, Others |

| Dispenser Systems Covered | Submersible, Suction |

| Flow Meters Covered | Mechanical, Electronics |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Beijing SANKI Petroleum Technology Co. Ltd, Bennett Pump Company, Censtar Science & Technology Corp. Ltd, Dover Corporation, Fortive Corporation, Korea EnE Co. Ltd, Scheidt & Bachmann GmbH, Tatsuno Corporation, Tominaga Mfg. Company, Zhejiang Lanfeng Machine Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the fuel dispenser market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global fuel dispenser market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the fuel dispenser industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fuel dispenser market was valued at USD 3.08 Billion in 2024.

IMARC Group estimates the market to reach USD 4.66 Billion by 2033, exhibiting a CAGR of 4.47% from 2025-2033.

Key factors driving this growth include the rising vehicle production due to rapid urbanization and changing lifestyles, the integration of digital systems and focus on automation, and the thriving e-commerce and logistics sectors.

Asia Pacific currently dominates the fuel dispenser market, accounting for a significant share due to its extensive fuel retail infrastructure, high vehicle ownership rates, and increasing adoption of advanced fueling technologies and alternative fuel dispensers like CNG and EV chargers.

Some of the major players in the fuel dispenser market include Beijing SANKI Petroleum Technology Co. Ltd, Bennett Pump Company, Censtar Science & Technology Corp. Ltd, Dover Corporation, Fortive Corporation, Korea EnE Co. Ltd, Scheidt & Bachmann GmbH, Tatsuno Corporation, Tominaga Mfg. Company, Zhejiang Lanfeng Machine Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)