Gardening Equipment Market Size, Share, Trends and Forecast by Product, End Use, and Region, 2025-2033

Gardening Equipment Market Size and Share:

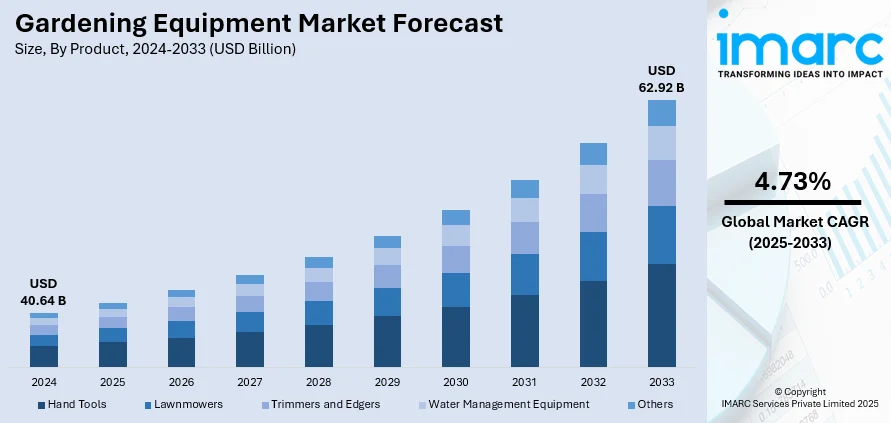

The global gardening equipment market size was valued at USD 40.64 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 62.92 Billion by 2033, exhibiting a CAGR of 4.73% from 2025-2033. North America currently dominates the market, holding a market share of 35% in 2024. The dominance of the market is attributed to high individual spending power, strong demand for advanced tools, and a well-established distribution network. Favorable climatic conditions, widespread adoption of modern landscaping practices, and continuous product innovations further contribute to the expansion of the gardening equipment market share in North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 40.64 Billion |

|

Market Forecast in 2033

|

USD 62.92 Billion |

| Market Growth Rate 2025-2033 | 4.73% |

The growing consciousness about environmental protection is driving the need for sustainable equipment. Individuals are using tools aimed at enhancing energy efficiency, lowering emissions, and promoting sustainable practices. This change corresponds with wider eco-friendly living trends, encouraging families and workers to favor creative gardening options that merge efficiency with ecological accountability. Apart from this, key players are introducing smart, automated, and easy-to-use gardening tools to satisfy changing user demands. Advancements in design and functionality facilitate user-friendliness, minimize manual labor, and increase accuracy. These innovations enhance the accessibility and attractiveness of gardening, promoting its use in both residential and commercial settings.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by the rapid adoption of smart and eco-friendly gardening equipment. Advanced features, automation, and connected technologies are reducing manual effort, improving efficiency, and aligning with sustainability trends, encouraging widespread usage across residential and commercial segments. Besides this, the swift expansion of e-commerce platforms in the USA is improving access to gardening tools by offering a wide range of products, competitive rates, and convenient delivery to homes. Digital platforms enhance informed buying choices via comparisons and reviews, bolstering buyer trust. In line with this growth, the Census Bureau announced that US retail e-commerce sales hit $304.2 billion in the second quarter of 2025, highlighting the crucial importance of online platforms in driving the market demand.

Gardening Equipment Market Trends:

Rising Home Gardening and Lifestyle Trends

Urban residents, in particular, are turning to gardening as a leisure activity and a way to improve their living environment. This shift is supported by a growing awareness about wellness, stress relief, and sustainable living. People are investing in equipment ranging from small hand tools to powered machinery, aiming to maintain home gardens, lawns, and indoor plants efficiently. The trend is further supported by demographic shifts, such as younger households taking up gardening for aesthetic and environmental reasons, and older populations seeking it as a recreational pursuit. According to the World Health Organization (WHO), by 2030, one in six people globally will be aged 60 years or over, and by 2050, that figure will double to 2.1 billion. This lifestyle orientation not only drives the demand but also encourages product diversification, as manufacturers cater to varied preferences with ergonomic, user-friendly, and aesthetically appealing equipment.

Expansion of E-Commerce and Retail Distribution

The rising number of online and offline retail channels is a crucial factor impelling the market growth by broadening user access. E-commerce platforms, in particular, are transforming purchasing behavior by enabling individuals to compare features, access a wider product range, and benefit from competitive pricing. According to IMARC Group, the global e-commerce market reached USD 26.8 Trillion in 2024 and is expected to grow to USD 214.5 Trillion by 2033, reflecting a CAGR of 25.83% during 2025–2033. This rapid growth reinforces the role of digital platforms in driving sales of gardening tools and machinery, particularly for niche and premium brands that rely on online visibility to reach wider audiences. Apart from this, supermarkets, hypermarkets, and specialty stores continue to strengthen their offerings with seasonal promotions and bundled deals. Enhanced logistics and home delivery networks are further lowering barriers to purchasing heavy equipment, encouraging both impulse and replacement purchases.

Technological Advancements in Equipment Design

Producers are concentrating on incorporating battery-operated engines, lightweight substances, and sound-dampening technologies to provide enhanced convenience and efficiency. Cordless tools featuring robust lithium-ion batteries are gradually taking the place of gasoline-powered versions, favored for their environment-friendly performance and user-friendly operation. The use of smart gardening tools, such as app-linked irrigation systems and robotic lawn mowers, emphasizes the increasing influence of automation and digital technology in the industry. A prominent instance is Aldi’s introduction in 2025 of a robotic lawnmower, equipped with Bluetooth operation and a 20V battery, able to mow lawns as large as 400m². These innovations attract time-conscious individuals looking for low-maintenance options that also comply with energy efficiency and sustainability regulations. These advancements in technology not only improve equipment efficiency but also promote product enhancements, driving the demand within both residential and commercial sectors.

Gardening Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gardening equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and end use.

Analysis by Product:

- Hand Tools

- Weeder

- Cape Cod Weeder

- Paving Weeder

- Fishtail Weeder

- Hoe

- Shears and Snips

- Others

- Weeder

- Lawnmowers

- Trimmers and Edgers

- Water Management Equipment

- Others

Lawnmowers account for the biggest market share, holding a share of 36.8%, attributed to their crucial function in lawn care and upkeep, bolstered by steady residential and commercial demand. Their popularity is driven by the importance placed on well-groomed outdoor spaces and the need for efficient tools that deliver precision and convenience. Technological advancements are making lawnmowers more powerful, user-friendly, and eco-friendly, further increasing their adoption across various user segments. The presence of various designs and features enables users to choose models that align closely with their requirements, improving overall client satisfaction. Rising urbanization and housing developments with dedicated lawns and green areas contribute significantly to the consistent use of lawnmowers. Moreover, robust after-sales assistance, longevity, and ongoing innovation enhance their market position. The growing preference for time-saving and effective gardening tools is driving the demand for lawnmowers.

Analysis by End Use:

- Residential

- Commercial/Government

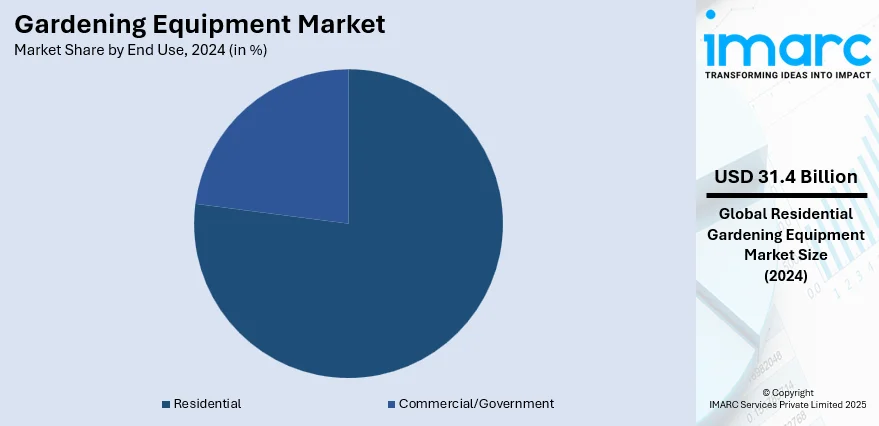

Residential represents the largest segment with a share of 77.2%, owing to rising preferences for well-maintained outdoor spaces, increasing household expenditure on landscaping, and a growing awareness about environmental sustainability. Homeowners place significant importance on enhancing the aesthetic appeal and functionality of their gardens, driving the demand for advanced and efficient equipment. The trend of homeownership, coupled with lifestyle improvements, fosters consistent investment in gardening activities, ranging from lawn maintenance to decorative landscaping. A shift toward healthier and nature-oriented living encourages households to engage more actively in gardening as a recreational and wellness activity. The availability of user-friendly, durable, and technologically enhanced products further increases adoption in residential settings. Moreover, the rising demand is supported by the growing urban and suburban housing developments where private gardens, lawns, and outdoor areas are integral features.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market with a share of 35% because of its advanced technology integration and a cultural emphasis on landscaping and outdoor upkeep. The area benefits from a strong individual buying power, increasing the adoption of high-end and advanced devices aimed at enhanced efficiency and convenience. A robust retail infrastructure, combined with extensive access to online platforms, guarantees smooth availability of a wide variety of products. Moreover, supportive government programs promoting sustainability and eco-friendly practices enhance are strengthening the market growth. The existence of top manufacturers alongside ongoing investment in research activities promotes steady innovation and product progression. In line with these factors, in 2025, Honda Canada launched its new battery-powered lawn mowers (HRN-BV, HRX-BV, HRX-BE, HRC-BE), bringing advanced garden care solutions to the North American market. Designed for both residential and commercial use, these walk-behind mowers combine lithium-ion battery power with Honda’s proven cutting technology. The launch supports Honda’s electrification and sustainability goals.

Key Regional Takeaways:

United States Gardening Equipment Market Analysis

In North America, the market portion held by the United States was 84.60%, attributed to the increasing adoption of eco-friendly landscaping methods, as both homeowners and local governments look for responsible solutions. Furthermore, the growing preference for drought-tolerant and indigenous plants is driving the need for specialized equipment suited for low-maintenance gardening. The rising number of senior gardeners is also contributing to the market growth, as it enhances the need for ergonomic, easy-to-use tools. Additionally, ongoing improvements in lightweight lithium-ion battery technology are extending operation durations and increasing the use of cordless garden equipment. The growth of urban farming and community gardens is catalyzing the demand for portable, multifunctional tools. In 2022, the USDA allocated USD 14.2 Million through 52 grants to promote urban agriculture, enhance local food systems, sustainability, and empower communities. The financial support assists agricultural projects, food security programs, and access to nutritious food, particularly in neglected communities. Moreover, sensor-driven smart irrigation systems are becoming increasingly popular in the water conservation market.

Europe Gardening Equipment Market Analysis

The European market for gardening tools is growing because of the rising trend of urban gardening and community gardens, especially in densely populated areas. An increasing number of people are opting for organic products and sustainable living, which is encouraging the use of environment-friendly gardening practices. Additionally, government-supported green infrastructure initiatives, such as rooftop agriculture and vertical gardens, are propelling the market growth in urban locations. Accordingly, France’s Climate and Resilience Act, which took effect in July 2023, required green or solar roofs on commercial, industrial, and office buildings larger than 500–1,000 m², mandating a minimum of 30% coverage for enhancing biodiversity, insulation, and urban sustainability. Moreover, the swift incorporation of intelligent sensors and app-driven systems in irrigation and lawn care, which enhances user efficiency and oversight, is catalyzing the gardening equipment market demand. The growing popularity of gardening as a wellness-oriented leisure pursuit is further driving equipment sales. In addition to this, the area's stringent emissions and noise standards, encouraging the adoption of cleaner, quieter equipment, are generating profitable market prospects.

Asia Pacific Gardening Equipment Market Analysis

The Asia Pacific market is primarily driven by the rise of urbanization in developing economies, leading to an increase in the demand for residential landscaping and home gardening equipment. Moreover, government programs that encourage green infrastructure and sustainable urban planning, along with backing investments in horticultural growth from both public and private sectors, are offering a favorable gardening equipment market outlook. In addition, the expansion of e-commerce platforms is improving product availability, especially in semi-urban and rural regions where conventional retail is still restricted. The market is also benefiting from ongoing innovations in battery-operated and robotic gardening equipment, which attract eco-conscious individuals. Furthermore, the increase in community gardening and urban farming initiatives is motivating younger, environmentally conscious groups to engage actively in the gardening movement. In November 2024, Amazon and ICLEI South Asia established 75 urban food gardens in schools throughout four Indian cities to enhance child nutrition, encourage sustainability, and bolster climate resilience via Amazon's USD 1 Million Right Now Climate Fund initiative.

Latin America Gardening Equipment Market Analysis

The gardening equipment market in Latin America is growing owing to the increase in the middle-class population, leading to greater expenditures on home enhancement and outdoor appeal. Furthermore, the growing focus of individuals on sustainability is encouraging the use of eco-friendly and energy-saving gardening tools throughout the region. The rising popularity of agritourism and locally sourced food is motivating people to purchase personal gardening equipment for small-scale farming. Additionally, state-supported urban greening initiatives and public area renewal projects are encouraging infrastructure investments, thus contributing to the gardening equipment market growth. Brazil’s Green Resilient Model Cities Program aids 50 cities with technical support to carry out climate mitigation and adaptation initiatives, such as restoring urban green spaces and electrifying bus fleets, utilizing AI tools and multi-level governance for sustainable growth.

Middle East and Africa Gardening Equipment Market Analysis

Government initiatives aimed at expanding urban green areas and encouraging sustainable landscaping practices significantly influencing the market in the Middle East and Africa. Consequently, Dubai's Green Spine initiative seeks to convert the E311 corridor into a 64 km eco-friendly urban park encompassing more than a million trees, urban agriculture, renewable energy solutions, and intelligent infrastructure, ultimately improving livability, connectivity, and environmental sustainability. Furthermore, strong investments in residential and commercial property developments, propelled by local growth initiatives, are driving the need for sophisticated gardening tools. Moreover, the growing use of water-saving irrigation methods, motivated by worries over severe water shortages, is influencing gardening habits. Additionally, increasing individual awareness regarding home gardening and its environmental advantages is encouraging higher market involvement throughout the area.

Competitive Landscape:

Major stakeholders in the market are emphasizing innovation, strategic partnerships, and product variety to enhance their market positions. They are putting resources into cutting-edge technologies to improve efficiency, longevity, and user-friendliness, while incorporating environment-friendly elements to meet sustainability objectives. Businesses are increasing their international presence through mergers, acquisitions, and collaborations to seize new opportunities in both advanced and emerging markets. Leading companies are focusing on research operations to deliver smart, interconnected solutions that address evolving user needs. For example, in 2024, Philips introduced its Robot Lawn Mower with GardenCare Intelligent Technology, designed to mow in precise parallel lines using GPS, completing tasks 3x faster than random-pattern mowers. It featured smart app control, automatic recharging, and a winter care service for maintenance. Models included the RSL3000/10 and RSL3000/20 in the GardenCare 3000 Series.

The report provides a comprehensive analysis of the competitive landscape in the gardening equipment market with detailed profiles of all major companies, including:

- Ariens Company

- Briggs & Stratton Corporation

- Deere & Company

- Falcon Garden Tools Pvt. Ltd.

- Fiskars Group

- Husqvarna AB

- KUBOTA Corporation

- MTD Products Inc

- Robert Bosch GmbH

- The Honda Motor Company Ltd.

- The Toro Company.

Latest News and Developments:

- June 2025: GrowGeneration acquired Viagrow, a USD 3 Million gardening and hydroponics supplier, to expand into big box retail and the home gardening market. The deal enhances GrowGen’s e-commerce and retail presence, supports private-label growth, and strengthens its position in the consumer-focused controlled environment agriculture (CEA) industry.

- April 2025: De Vroomen Garden Products launched the Miffy Gardening Collection for kids in the U.S. and Canada. Featuring 20 Miffy-themed items like flower bulbs, pot kits, and child-sized tools, the line encourages children to garden while promoting environmental awareness.

- February 2025: Clas Ohlson relaunched its Cocraft LXC battery platform with 20 new affordable, high-quality battery-powered tools and garden machines. Featuring 18V Lithium-Ion batteries and brushless motors, the range ensures compatibility with previous tools. Additional products will be added later in the year, enhancing flexibility for DIY and gardening.

- February 2025: Togo began distributing market gardening tool kits to 5,500 producers, including 2,475 women, across six agricultural regions. Funded by FSRP and GAFSP, the kits include seeds, tools, biopesticides, and pumps to boost productivity and resilience, aiming to improve livelihoods and food self-sufficiency in rural communities.

- September 2024: GARDENA introduced innovative gardening tools for the new season, including smart SILENO robotic lawnmowers without boundary wires, AquaPrecise irrigation, solar-powered AquaBloom L, undercover hose boxes, advanced secateurs, pruning tools, chainsaws, lawnmowers, trimmers, leaf vacuums, and submersible pumps, enhancing convenience and sustainability.

Gardening Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Uses Covered | Residential, Commercial/Government |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ariens Company, Briggs & Stratton Corporation, Deere & Company, Falcon Garden Tools Pvt. Ltd., Fiskars Group, Husqvarna AB, KUBOTA Corporation, MTD Products Inc, Robert Bosch GmbH, The Honda Motor Company Ltd., and The Toro Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gardening equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global gardening equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gardening equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gardening equipment market was valued at USD 40.64 Billion in 2024.

The gardening equipment market is projected to exhibit a CAGR of 4.73% during 2033, reaching a value of USD 62.92 Billion by 2033.

The gardening equipment market is driven by rising interest in home improvement, increasing disposable incomes, and the growing awareness about sustainable living. Technological advancements enhance efficiency and ease of use, attracting both professionals and hobbyists. Expanding urban green spaces and government initiatives for environmental conservation further strengthen the market demand.

North America currently dominates the gardening equipment market, accounting for a share of 35%. The dominance of the region is attributed to high individual spending power, strong demand for advanced tools, and a well-established distribution network. Favorable climatic conditions, widespread adoption of modern landscaping practices, and continuous product innovations further support the region’s leadership and consistent market expansion.

Some of the major players in the gardening equipment market include Ariens Company, Briggs & Stratton Corporation, Deere & Company, Falcon Garden Tools Pvt. Ltd., Fiskars Group, Husqvarna AB, KUBOTA Corporation, MTD Products Inc, Robert Bosch GmbH, The Honda Motor Company Ltd., The Toro Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)