GCC Acetonitrile Market Size, Share, Trends and Forecast by End Use, and Country, 2025-2033

GCC Acetonitrile Market Size and Share:

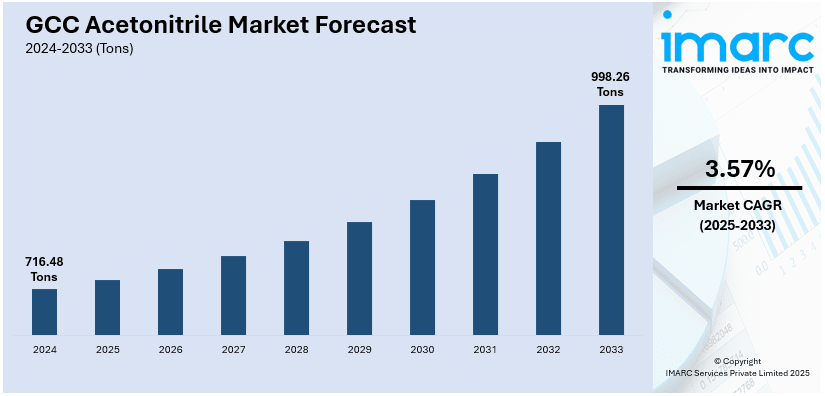

The GCC acetonitrile market size was valued at 716.48 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 998.26 Tons by 2033, exhibiting a CAGR of 3.57% from 2025-2033. The market is driven by the growing utilization in the pharmaceutical industry in the synthesis of various chemicals, and the rising oil and gas explorations, where acetonitrile is produced as a by-product in the manufacture of acrylonitrile.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

716.48 Tons |

|

Market Forecast in 2033

|

998.26 Tons |

| Market Growth Rate (2025-2033) | 3.57% |

Acetonitrile is a vital solvent in the preparation of electrolytes for lithium-ion (Li-ion) batteries. These batteries are employed for storing energy in electric vehicles (EVs), renewable energy systems, and portable electronics. The high dielectric constant and chemical stability of acetonitrile make it an excellent solvent to facilitate ion transport within batteries. Thus, ensuring efficient energy storage and discharge of energy. The GCC lead the global shift to clean energy through investments in renewable energy projects and adoption of electric vehicles (EVs). These developments create an increased demand for advanced battery technologies, catalyzing the demand for high-purity acetonitrile.

The demand for acetonitrile is expanding due to its essential role in analytical techniques like high-performance liquid chromatography (HPLC). Acetonitrile is a preferred solvent in these methods for detecting contamination and impurities in food and beverages. Its solubility in water makes it indispensable for achieving accurate and reliable testing results. With growing food safety regulations in the GCC, there is an increase in the requirement for advanced testing protocols. Regulatory agencies and manufacturers are focusing on quality control to ensure global compliance, facilitating expanding demand. The region's well-established chemical supply chains and strategic trade position support the availability of acetonitrile for testing purposes.

GCC Acetonitrile Market Trends:

Growing use in the pharmaceutical industry

According to the data published on the website of the IMARC Group, the UAE pharmaceutical market size reached USD 4.15 Billion in 2024. Acetonitrile is a versatile solvent, utilized in the synthesis of active pharmaceutical ingredients (API’s) and other chemical intermediates. It finds application in the production of APIs in the pharmaceutical industry due to stability and solubility in various compounds. The region’s booming pharmaceutical sector, driven by growth in demand from the healthcare sector and increasing government initiatives, is driving the demand for acetonitrile. As pharmaceutical companies are prioritizing strict quality standards and regulatory compliance, the demand for high-purity acetonitrile is expanding. The need for acetonitrile is further facilitated by the growing production of generic drugs in the GCC. Supportive trade policies and improved chemical supply chains in the GCC facilitate the availability of acetonitrile for pharmaceutical applications.

Rising chemical synthesis activities

Acetonitrile is widely applied in the production of agrochemicals and specialty chemicals, which are essential in various industries. Its high polarity and low boiling point, make it an ideal choice for reactions requiring precise control and efficient separation. The heightened innovations and diversification efforts in the petrochemical sector are fueling the growth of chemical synthesis activities. Government agencies are promoting the production of specialty chemicals at local level and reduce reliance on imports. This is driving the demand for acetonitrile, which remains a prime input in the processing of specialty chemicals. According to the GCC acetonitrile market analysis, the strategic position of the GCC as an international hub for chemical exports accelerates the production of high-value chemicals. The IMARC Group’s report predicted that the GCC specialty chemicals market will exhibit a growth rate (CAGR) of 4.40% during 2024-2032.

Increasing oil and gas exploration

The GCC region is a major oil and gas producer with its strong petrochemical industry. Acetonitrile is produced as a by-product in the manufacture of acrylonitrile, which is a key petrochemical product. As the GCC continues to expand exploration and production activities increases the output of acrylonitrile and, consequently, acetonitrile. This byproduct relationship assures a stable and cost-effective supply of acetonitrile. Technological advancement and investment in refining and processing capacities further influences the supply acetonitrile. The integration of petrochemical complexes in the region also improves the efficiency of acetonitrile extraction. This linkage between exploration and chemical production is propelling the growth of the GCC acetonitrile market growth. According to the IMARC Group’s report, the UAE oil and gas market will exhibit a growth rate (CAGR) of 6.30% during 2025-2033.

GCC Acetonitrile Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC acetonitrile market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on end use.

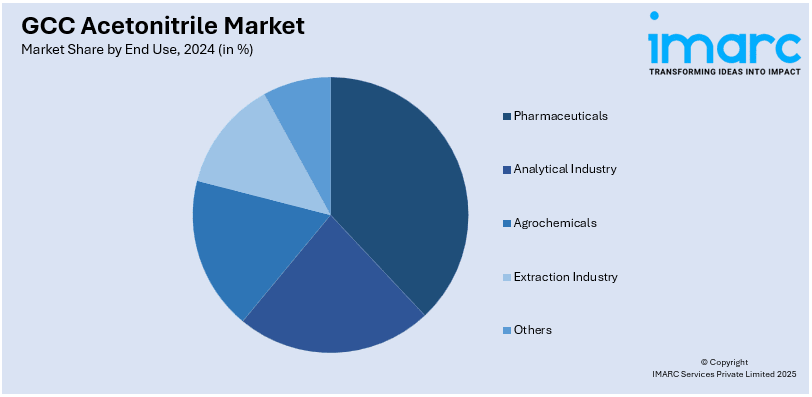

Analysis by End Use:

- Pharmaceuticals

- Analytical Industry

- Agrochemicals

- Extraction Industry

- Others

Pharmaceuticals dominate the GCC acetonitrile market share because of its extensive use as a solvent in drug synthesis and analytical testing. Acetonitrile is employed as a chemical intermediary due to its excellent efficiency in dissolving a range of compounds. It is a key solvent in high-performance liquid chromatography (HPLC), widely utilized in drug quality testing and regulatory compliance. The rising healthcare needs and government initiatives to expand local production further strengthen the market in the GCC region. Strict regulations and rising investment in innovations are catalyzing the demand for high-purity acetonitrile in pharmaceuticals.

Analysis by Country:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia holds the biggest market share due to its strong petrochemical industry and extensive oil and gas operations. Acetonitrile is a byproduct of acrylonitrile production, which is closely tied to Saudi Arabia’s significant petrochemical output. Additionally, the country's developed infrastructure and downstream chemical production are impelling the availability of acetonitrile. The diversified use in pharmaceuticals and specialty chemicals are leading to an increased demand in applications like drug synthesis and laboratory analysis. The region’s initiative to localize pharmaceutical manufacturing and research hubs is influencing the utilization of acetonitrile. For instance, the Minister of Industry and Mineral Resources Bandar Al-Khorayef in 2024 revealed that the ministry planned to identify around 200 medicines whose localization is at prime focus for Saudi Arabia on account of their immense importance in establishing drug security. Major initiatives are taken to localize 42 of these medicines in coordination with governments and private entities.

Competitive Landscape:

Key players in the GCC acetonitrile market are driving the market growth through their expertise in production and distribution. The leading producers ensure steady supply by developing technologies that bring the production process closer to the petrochemical industry. This allows them to easily extract acetonitrile as a by-product of acrylonitrile, thus facilitating market growth. Key companies maintain the quality of products, thus, meeting strict regulations in various industries. They are also investing in innovation to come up with solutions that increase the purity and efficiency of acetonitrile production. Major corporations are expanding distribution networks and collaborating with end-users to provide tailored solutions. Improvements in therapies and launch of new medications, supports the acetonitrile market because of its critical role in drug production and analysis.

The report provides a comprehensive analysis of the competitive landscape in the GCC acetonitrile market with detailed profiles of all major companies.

Latest News and Developments:

- September 2024: INEOS Nitriles launched INVIREO, a bio-based acetonitrile for pharmaceutical production. It will support sustainable production, reducing carbon footprint by 90%.

- April 23, 2024: Ineos Nitriles launched INVIREO ™, the world's first and only bio-based acetonitrile used for pharmaceutical applications like insulin and Covid-19 vaccines. This has been produced from a certified mass balance route that yields a carbon footprint reduction of up to 90 percent compared to the traditional methods of production. As the world's largest producer of acetonitrile, Ineos is operational in Europe, the United States, and Asia.

- May 17, 2024: Qatar Free Zones Authority (QFZ) and Evonik,a global leader in specialty chemicals signed an MoU at the Qatar Economic Forum to explore investment opportunities in Qatar, focusing on sustainable solutions within Evonik's smart materials portfolio. This partnership aims to enhance Qatar’s industrial capabilities with potential investments in Umm Alhoul free zone.

GCC Acetonitrile Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Pharmaceuticals, Analytical Industry, Agrochemicals, Extraction Industry, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, GCC acetonitrile market forecasts, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC acetonitrile market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC acetonitrile industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Acetonitrile is a colorless and flammable liquid with a slightly sweet odor. It is a byproduct of acrylonitrile production, making it an important compound in the petrochemical industry. It is commonly employed in pharmaceuticals, chemical synthesis, and laboratory analyses. It is particularly utilized in high-performance liquid HPLC).

The GCC acetonitrile market was valued at 716.48 Tons in 2024.

IMARC estimates the GCC acetonitrile market to exhibit a CAGR of 3.57% during 2025-2033.

One of the key factors driving the GCC acetonitrile market growth include the rising demand from the pharmaceutical industry. The oil and gas explorations are increasing the availability of acetonitrile as a byproduct of acrylonitrile production. Rising battery manufacturing and the food and beverage testing further stimulates the market growth.

In 2024, pharmaceuticals represent the largest segment by end use, driven by the increasing demand for acetonitrile in the synthesis of high-quality drugs and analytical testing.

On a regional level, the market has been classified into Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain, wherein Saudi Arabia currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)