GCC Adult Diaper Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Country, 2026-2034

GCC Adult Diaper Market Summary:

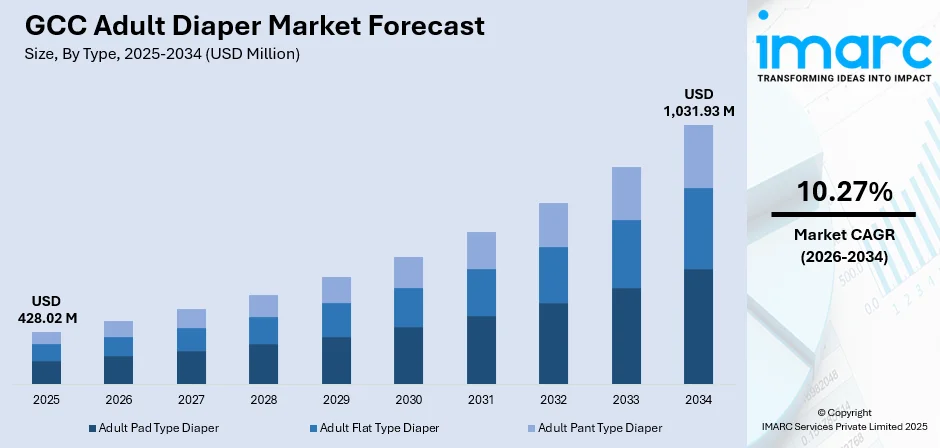

The GCC adult diaper market size was valued at USD 428.02 Million in 2025 and is projected to reach USD 1,031.93 Million by 2034, growing at a compound annual growth rate of 10.27% from 2026-2034.

The GCC adult diaper market is experiencing robust expansion, driven by demographic shifts, particularly the rapidly aging population across member states. Increasing life expectancy, enhanced healthcare infrastructure, and growing awareness regarding incontinence management are fueling the demand for high-quality absorbent products. The region's emphasis on personal hygiene, supported by rising disposable incomes and expanding retail networks, continues to strengthen the GCC adult diaper market share.

Key Takeaways and Insights:

-

By Type: Adult pad type diaper dominates the market with a share of 51.78% in 2025, owing to its cost-effectiveness, discreet design, and superior comfort features. These products offer versatile sizing options and advanced absorbency technology that appeals to consumers seeking reliable incontinence management solutions.

-

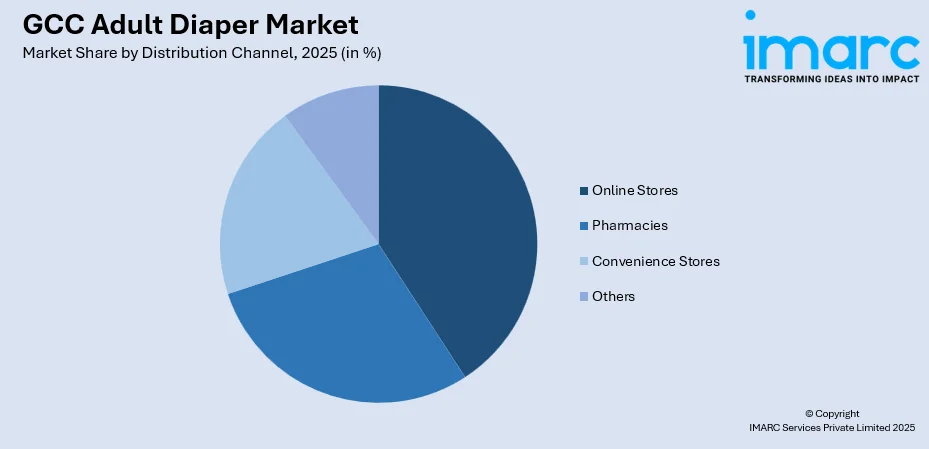

By Distribution Channel: Online stores lead the market with a share of 40.07% in 2025. This dominance is driven by consumer preference for discreet purchasing, convenient home delivery, wider product selection, and competitive pricing offered by digital retail platforms across the region.

-

By Country: Saudi Arabia comprises the largest market with 33% share in 2025, driven by its substantial population base, advanced healthcare infrastructure, higher disposable incomes enabling premium product adoption, and government initiatives supporting elderly care services.

-

Key Players: Key players drive the GCC adult diaper market by expanding product portfolios, improving comfort and absorbency technologies, and strengthening distribution networks. Their investments in marketing, affordability, and partnerships with healthcare providers boost awareness and accelerate adoption.

To get more information on this market Request Sample

The GCC adult diaper market shows a positive growth outlook, supported by demographic, healthcare, and lifestyle trends across the region. A steadily aging population, longer life expectancy, and rising prevalence of age-related conditions, such as incontinence and mobility limitations, are increasing baseline demand. In 2024, the population of males aged 65 and older in Saudi Arabia was documented at 574,235 individuals, according to the World Bank's compilation of development indicators. Growing awareness about personal hygiene and dignity is reducing social stigma, encouraging higher adoption among elderly and caregivers. Healthcare infrastructure expansion, including hospitals, home healthcare services, and elderly care facilities, further supports consumption. Urbanization and busy family structures are boosting demand for convenient care solutions. Product innovations, including breathable materials, odor control, and discreet designs, enhance user comfort and acceptance. Expanding modern retail, pharmacies, and e-commerce platforms improve product accessibility across GCC countries. Government focus on healthcare modernization and preventive care also contributes to sustained demand, positioning the GCC adult diaper market for steady long-term growth and increasing institutional procurement by public healthcare providers regionally.

GCC Adult Diaper Market Trends:

Sustainable and Eco-Friendly Product Innovation

Environmental consciousness is reshaping product development strategies within the GCC adult diaper market, as manufacturers increasingly prioritize sustainable materials. Companies are investing in research to develop biodegradable diapers using plant-based and compostable materials that minimize environmental impact while maintaining performance standards. This trend aligns with broader regional sustainability goals and appeals to younger, educated consumers in urban centers who prioritize eco-friendly purchasing decisions when selecting incontinence management products.

Digital Retail Transformation and E-Commerce Growth

The rapid expansion of digital retail channels is fundamentally transforming purchasing patterns for adult incontinence products across the GCC region. As per IMARC Group, the GCC e-commerce market size reached USD 507.2 Billion in 2024. E-commerce platforms offer consumers privacy-preserving purchasing experiences with discreet packaging and home delivery options that overcome traditional stigma barriers. Subscription-based models are gaining traction, providing automatic deliveries with loyalty benefits and flexible plans that appeal to price-conscious consumers and busy caregivers managing ongoing incontinence care needs.

Expansion of Healthcare Infrastructure and Home Care Services

Rapid development of hospitals, clinics, rehabilitation centers, and home healthcare services across GCC countries is driving institutional demand for adult diapers. Saudi Arabia is set to launch five new hospitals by 2025, increasing bed capacity by 963 in key provinces as part of a larger SR260 Billion (USD 69.3 Billion) budget earmarked for health and social development. Increasing preference for home-based elderly care further boosts consumption, as caregivers require reliable hygiene solutions for daily patient management. Government investments in healthcare modernization and long-term care facilities are expanding procurement volumes. These trends collectively strengthen demand from both public healthcare systems and private homecare providers across the region.

Market Outlook 2026-2034:

The GCC adult diaper market is poised for substantial growth throughout the forecast period as demographic pressures and healthcare advancements converge to drive sustained demand expansion. The market generated a revenue of USD 428.02 Million in 2025 and is projected to reach a revenue of USD 1,031.93 Million by 2034, growing at a compound annual growth rate of 10.27% from 2026-2034. Government initiatives focusing on elderly care infrastructure, expanding healthcare insurance coverage, and growing private sector investment in senior care facilities are expected to accelerate market penetration across member states. Rising social acceptance of incontinence products, coupled with product innovations enhancing comfort, discretion, and absorbency, will further support long-term market growth across both institutional and retail segments.

GCC Adult Diaper Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Adult Pad Type Diaper |

51.78% |

|

Distribution Channel |

Online Stores |

40.07% |

|

Country |

Saudi Arabia |

33% |

Type Insights:

- Adult Pad Type Diaper

- Adult Flat Type Diaper

- Adult Pant Type Diaper

Adult pad type diaper dominates with a market share of 51.78% of the total GCC adult diaper market in 2025.

The adult pad type diaper segment maintains commanding market leadership attributed to its exceptional versatility and user-friendly design characteristics. These products offer customizable fit options that accommodate varying levels of incontinence while maintaining discretion under regular clothing. The lightweight construction and targeted absorption zones provide effective moisture management without the bulkiness associated with full-coverage alternatives, making them preferred choices for active elderly individuals.

Cost-effectiveness represents a significant driver for pad type diaper adoption across the GCC region, particularly among price-conscious consumers managing ongoing incontinence care needs. The segment benefits from widespread availability across pharmacy chains, supermarkets, and online platforms, ensuring convenient access throughout urban and suburban areas. Additionally, ease of disposal and compatibility with existing undergarments enhance user convenience and hygiene compliance. Continuous product innovations in absorbent materials and odor-control technologies further strengthen consumer preference and repeat purchases.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies

- Convenience Stores

- Online Stores

- Others

Online stores lead with a share of 40.07% of the total GCC adult diaper market in 2025.

The online retail channel has emerged as the dominant distribution platform for adult diapers across the GCC region, driven by consumer preference for privacy-preserving purchasing experiences. Digital platforms offer discreet packaging and doorstep delivery services that effectively address stigma-related purchasing barriers traditionally associated with incontinence products.

E-commerce platforms provide consumers with comprehensive product information, customer reviews, and price comparison capabilities that enhance purchasing decisions. Subscription-based delivery models have gained significant traction, offering automatic replenishment services with loyalty rewards and flexible scheduling options. High smartphone penetration rates and robust digital infrastructure across GCC countries continue to accelerate consumer migration towards online purchasing channels for adult incontinence products. As per the November 2024 edition of the Ericsson Mobility Report, by the end of 2024, the GCC nations were projected to achieve 47% penetration of 5G subscriptions.

Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia exhibits a clear dominance with a 33% share of the total GCC adult diaper market in 2025.

Saudi Arabia commands the largest market share within the GCC adult diaper landscape, underpinned by its substantial population base and rapidly expanding elderly demographic segment. Healthcare infrastructure investments under Vision 2030 have significantly enhanced elderly care capabilities, with government allocating SAR 260 Billion for health and social development in the 2025 budget.

Rising life expectancy, coupled with increasing prevalence of chronic conditions requiring incontinence management, drives sustained demand growth. Well-established pharmaceutical retail networks and expanding e-commerce infrastructure ensure widespread product accessibility across urban and regional markets. The kingdom's high disposable income levels enable adoption of premium incontinence products featuring advanced technology and superior comfort characteristics. Growing awareness campaigns around elderly health and dignity are further reducing social stigma and encouraging proactive incontinence care adoption across households and care facilities.

Market Dynamics:

Growth Drivers:

Why is the GCC Adult Diaper Market Growing?

Aging Population and Increasing Life Expectancy

Because of improvements in living standards, preventive medicine, and healthcare infrastructure, life expectancy is steadily increasing throughout the GCC region. The need for adult diapers is being directly driven by the rising prevalence of age-related problems, such as chronic illnesses, mobility issues, and urinary incontinence. In the first half of 2025, the elderly population in Kuwait rose by 11.3%, which is an increase of 16,620, compared to 2024. For elderly people to continue living comfortably, independently, and with dignity, they need reliable hygiene products. In order to assist elderly family members at home, families are also taking the initiative to embrace specialized care items. Reliance on practical personal care solutions rather than informal caring alone is further reinforced by urbanization and smaller family arrangements. Consistent use of adult diapers is encouraged by the growing perception that they are necessary medical supplies rather than discretionary extras. Manufacturers have a steady, long-term demand base due to this demographic shift. Adult diaper usage is anticipated to normalize, as the older population steadily grows throughout the GCC region, guaranteeing steady market expansion fueled by structural demographic shift.

Expansion of Healthcare Infrastructure and Homecare Services

Adult diaper utilization is mostly driven by the GCC's rapidly expanding healthcare infrastructure. The use of incontinence products in institutions is increased by investments in clinics, hospitals, long-term care homes, and rehabilitation facilities. In September 2024, Amana Healthcare, alongside Bahrain Mumtalakat Holding Company, held a groundbreaking ceremony to signify the commencement of construction for the Amana Healthcare facility in Al Jasra, Bahrain. This milestone marked Amana Healthcare’s arrival in Bahrain and its dedication to providing exceptional health solutions and specialized care for the health and wellness of individuals in the Kingdom. Concurrently, retail and bulk purchases of adult diapers are increasing due to the growing demand for home-based healthcare services. Professional caregivers and home nursing services, which depend on regular usage of hygiene products to efficiently manage patient care, are becoming more popular among families. Adult diaper purchases in both public and private facilities are further supported by government programs aimed at enhancing healthcare quality and accessibility. Rising usage levels are a result of long-term sickness management, disability care, and post-surgical recuperation. Adult diapers are becoming necessary consumables, as healthcare systems prioritize patient comfort and hygiene standards.

Rising Disposable Incomes and Premium Product Adoption

The GCC's high levels of disposable income allow customers to purchase high-end personal care items, such as sophisticated adult diapers. Products with exceptional absorbency, breathability, odor control, and skin-friendly materials are becoming more popular. The trend of employing high-end, branded adult diapers is supported by consumers' willingness to spend for comfort, confidentiality, and quality. Particularly, urban customers look for goods that cater to their dignity and lifestyle standards. Innovative features like ultra-thin designs, ergonomic fits, and dermatologist-tested materials are encouraged by premiumization. By encouraging repeat business, these value-added items increase profit margins and promote brand loyalty. Increasing income levels also enable families to prioritize high-quality long-term care for senior family members instead of choosing less expensive options. This trend positions premium adult diapers as a major contributor to overall market value and long-term profitability, supporting revenue growth beyond volume expansion.

Market Restraints:

What Challenges the GCC Adult Diaper Market is Facing?

Premium Product Pricing and Affordability Constraints

Mass-market adoption of technologically advanced adult diapers is severely hampered by their high cost, especially for middle-class users who need to use them every day for extended periods of time. For many households with continuous incontinence care needs, premium solutions with improved absorbency, odor control, and skin-friendly materials fetch price points that are too high.

Persistent Cultural and Social Stigma

Despite changing attitudes, traditional cultural views around aging and incontinence still restrict market penetration in some demographic groups. Due to social humiliation, some customers are still unwilling to acknowledge incontinence issues or buy related products, which causes underutilization and delayed adoption of remedies that could enhance quality of life.

Uneven Distribution Infrastructure in Remote Regions

Limited retail infrastructure and healthcare facility coverage in remote and rural areas restricts product accessibility for populations outside major urban centers. While e-commerce partially addresses distribution gaps, logistics challenges, and delivery infrastructure limitations in peripheral regions constrain market reach and adoption rates among dispersed elderly populations.

Competitive Landscape:

The GCC adult diaper market exhibits a moderately competitive structure, characterized by the presence of established multinational corporations alongside regional manufacturers offering competitively priced alternatives. Leading international players leverage strong brand recognition, extensive distribution networks, and continuous product innovations to maintain market leadership positions. Companies are investing substantially in research and development (R&D) activities to introduce products, featuring advanced absorbency technology, breathable materials, and sustainable components that address evolving consumer preferences. Strategic partnerships with healthcare institutions and pharmacy chains enhance market penetration while collaborative agreements with e-commerce platforms expand digital reach across the region.

GCC Adult Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Type Covered | Adult Pad Type Diaper, Adult Flat Type Diaper, Adult Pant Type Diaper |

| Distribution Channel Covered | Pharmacies, Convenience Stores, Online Stores, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC adult diaper market size was valued at USD 428.02 Million in 2025.

The GCC adult diaper market is expected to grow at a compound annual growth rate of 10.27% from 2026-2034 to reach USD 1,031.93 Million by 2034.

Adult pad type diaper dominated the market with a share of 51.78%, owing to its cost-effectiveness, discreet design, and versatile sizing options that accommodate varying incontinence levels.

Key factors driving the GCC adult diaper market include rapidly expanding aging population, increased life expectancy, enhanced healthcare infrastructure, growing awareness about incontinence management, and digital retail channel expansion.

Major challenges include premium product pricing limiting affordability, persistent cultural stigma around incontinence products, uneven distribution infrastructure in remote areas, and limited healthcare facility coverage outside major urban centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)