GCC Bottled Water Market Report by Product Type (Still Bottled Water, Carbonated Bottled Water, Flavored Bottled Water, Mineral Bottled Water), Distribution Channel (Supermarkets/Hypermarkets, Retailers, Stores, On-Trade, and Others), and Region 2025-2033

GCC Bottled Water Market Outlook 2025-2033:

The GCC bottled water market size reached USD 25.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.2% during 2025-2033. The harsh climatic conditions in the region, escalating concerns about tap water quality, and the increasing health consciousness and awareness among consumers regarding the health hazards associated with consuming carbonated drinks represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.7 Billion |

| Market Forecast in 2033 | USD 48.0 Billion |

| Market Growth Rate 2025-2033 | 7.2% |

The Rising Awareness About the Convenience and Hygiene of Bottled Water Augmenting the Market Growth

The bottled water market in the GCC has been experiencing continuous growth. Product convenience and hygiene currently represent one of the primary drivers resulting in the increasing sales of bottled water. Bottled water is incredibly convenient for transportation, carrying, and storage, especially in areas where drinkable water is scarce or unavailable altogether. This represents one of the major benefits of bottled water, as it can be easily purchased, making it a reliable source of hydration on the go.

Moreover, bottled water undergoes special treatments, such as distillation and ozonation, to ensure that the water is free from impurities. It is rigorously tested for various chemicals and bacteria, resulting in a lower risk of being contaminated with disease-causing germs compared to tap water. This ensures the safety and quality of bottled water. In addition to its safety, bottled water also offers a distinct taste and more consistent quality. The filtration and treatment processes used in bottling water can result in a crisper and cleaner taste compared to tap water, which may contain minerals or other flavor-altering substances.

Competitive analysis such as market structure, market growth, new entrants, competitive dashboard, and product differentiation has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is concentrated with several small and large players operating in the industry due to low capital investments. The volume of new entrants is high in the bottled water industry due to the easy access to distribution networks and the minimization of threats due to product differentiation.

What is Bottled Water?

Bottled water is purified or natural water packaged in plastic or glass containers for commercial sale. It may be sourced from springs, wells, or municipal supplies and undergoes treatment to remove impurities before bottling. It is typically produced through special treatments, such as distillation and ozonation, which enhances its quality and purity. This process involves purifying water to remove impurities and contaminants, resulting in a product that is considered safe and clean for consumption. One of the main advantages of bottled water is its consistent quality and taste, as compared to tap water which can vary in taste and quality depending on the source and treatment process. Bottled water is often preferred for its convenience, especially in regions with hot and dry climatic conditions like the GCC countries. It is readily available in various sizes and formats, making it easy to carry and consume on the go. Furthermore, it offers consumers a wide range of choices, including different brands, flavors, and variations in pH and sodium levels.

COVID-19 Impact:

The outbreak of the COVID-19 pandemic has posed a severe risk to the growth of the beverage industry as countries and companies continue to grapple with unprecedented challenges. Manufacturers and retailers are facing issues with production being halted, which has resulted in depleted stockpiles that are difficult to replenish. However, the easy availability of pure potable water has become even more imperative during a global pandemic like COVID-19, as adequate daily intake of pure water is critical in maintaining healthy immunity levels.

States and cities have taken proactive measures to ensure continued access to clean water for drinking and handwashing during the COVID-19 pandemic. Bottled water companies in the GCC are increasing their bottling capacity, acquiring extra packaging and materials, working closely with retailers to determine demand, and hiring additional drivers and bottling plant workers to keep pace with the ever-increasing demand for bottled water.

However, there have been some shortages in the availability of raw materials for manufacturing bottled water due to restrictions on personnel transportation and travel. One of the most significant shifts resulting from the COVID-19 outbreak is that more consumers are trying out online grocery purchasing, and it is expected that many consumers will continue to use this method in the future. As a result, there has been a massive uptick in online grocery purchases of clean and mineral-rich naturally alkaline water as consumers prioritize the convenience and safety of having bottled water delivered to their doorsteps.

GCC Bottled Water Market Trends:

In the GCC countries, the bottled water market has witnessed significant growth due to the harsh climatic conditions, along with concerns about tap water quality. The increasing health consciousness and awareness among consumers regarding the health hazards associated with consuming carbonated drinks is acting as another growth-inducing factor. Additionally, the expanding expatriate community and the growing number of tourists and pilgrims have contributed to the increase in sales of bottled water, further driving the market growth. In line with this, key international companies are forming alliances with regional firms to expand their consumer base. They are also introducing user-friendly packaging and adopting aggressive marketing techniques, which, in turn, is creating a positive outlook for the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the GCC bottled water market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Still Bottled Water

- Carbonated Bottled Water

- Flavored Bottled Water

- Mineral Bottled Water

A detailed breakup and analysis of the GCC bottled water market based on the product type has also been provided in the report. This includes still bottled water, carbonated bottled water, flavored bottled water, and mineral bottled water. According to the report, still bottled water segment accounted for the largest market share due to the shifting consumer preference toward bottled water over tap water. Moreover, the inflating consumer expenditure power and surging tourism are influencing the market growth.

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Retailers

- Stores

- On-Trade

- Others

A detailed breakup and analysis of the GCC bottled water market based on the packaging has also been provided in the report. This includes supermarkets/hypermarkets, retailers, stores, on-trade, and others. According to the report, supermarkets/hypermarkets accounted for the largest market share due to the wide availability of different brands. Besides this, the convenience of choosing the product and availability of massive storage space are other growth-inducing factors.

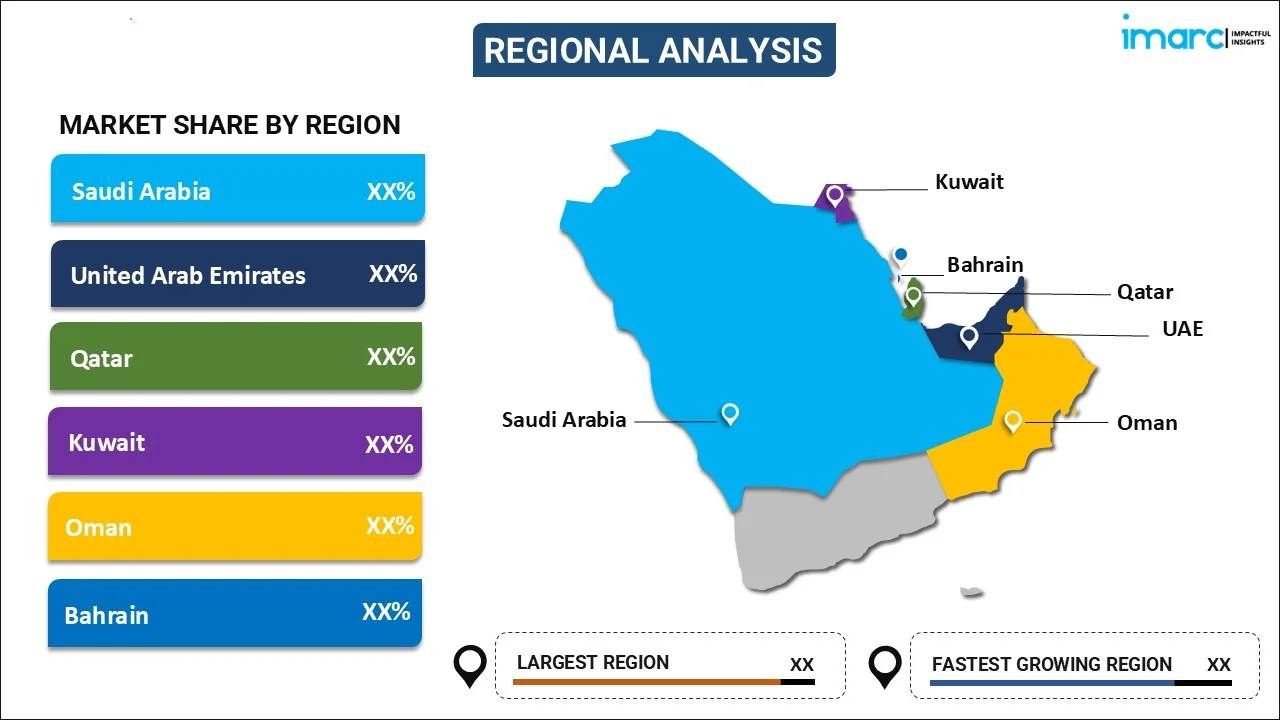

Regional Insights:

- Saudi Arabia

- United Arab Emirates

- Oman

- Qatar

- Kuwait

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Oman, Qatar, Kuwait, and Bahrain. According to the report, Saudi Arabia was the largest market for bottled water. Some of the factors driving the Saudi Arabia bottled water market included its inflating consumer expenditure power. This is further bolstered by rapid technological advancements, increasing health awareness of the health hazards associated with consuming carbonated drink, and the rapidly expanding retail sector.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global paper cups market. Some of the companies covered in the report include:

- Al Ain Water

- Al Jomaih Bottling Plants

- Al Kawther Water Treatment W.L.L.

- Alsafi Drinking Water Purification LLC

- Hana Food Industries Company

- Masafi Park

- Oasis Water Company SAOC (The Zubair Corporation)

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Billion Litres |

| Segment Coverage | Product Type, Distribution Channel, Country |

| Countries Covered | Saudi Arabia, United Arab Emirates, Oman, Qatar, Kuwait, Bahrain |

| Companies Covered | Al Ain Water, Al Jomaih Bottling Plants, Al Kawther Water Treatment W.L.L., Alsafi Drinking Water Purification LLC, Hana Food Industries Company, Masafi Park and Oasis Water Company SAOC (The Zubair Corporation) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC bottled water market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC bottled water market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC bottled water market was valued at USD 25.7 Billion in 2024.

We expect the GCC bottled water market to exhibit a CAGR of 7.2% during 2025-2033.

The growing consumer awareness towards the need for safe drinking water, along with rapid increase in the number of tourists and pilgrims in the region, is currently driving the GCC bottled water market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the region resulting in temporary shutdown of numerous manufacturing units for bottled water.

Based on the product type, the GCC bottled water market has been segmented into still, carbonated, flavored, and mineral. Currently, still water holds the majority of the total market share.

Based on the distribution channel, the GCC bottled water market can be divided into supermarkets/hypermarkets, retailers, stores, on-trade, and others. Among these, supermarkets/hypermarkets currently account for the largest market share.

On a regional level, the market has been classified into Saudi Arabia, United Arab Emirates, Oman, Qatar, Kuwait, and Bahrain, where Saudi Arabia currently dominates the GCC market.

Some of the major players in the GCC bottled water market include Al Ain Water, Al Jomaih Bottling Plants, Al Kawther Water Treatment W.L.L., Alsafi Drinking Water Purification LLC, Hana Food Industries Company, Masafi Park, Oasis Water Company SAOC (The Zubair Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)