GCC Building Automation and Control System Market Size, Share, Trends and Forecast by Product Type, Technology, End User, and Country, 2026-2034

GCC Building Automation and Control System Market Summary:

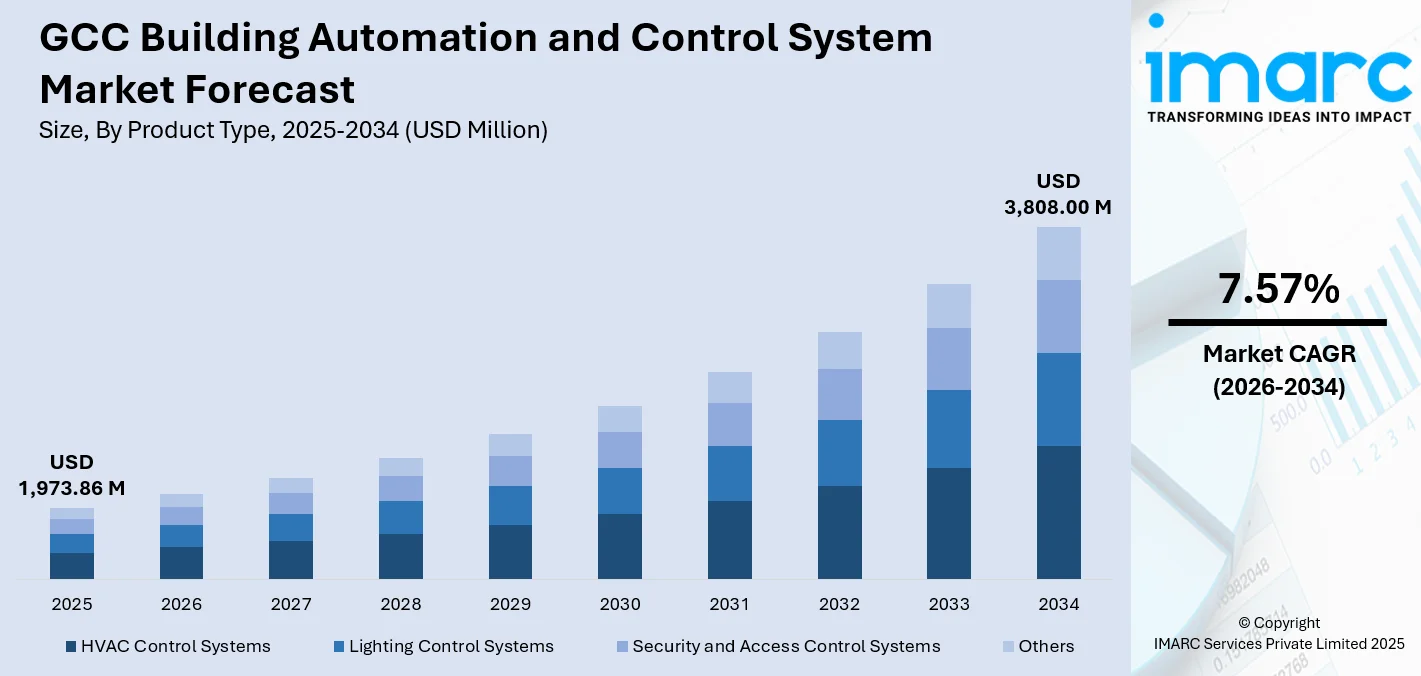

The GCC building automation and control system market size was valued at USD 1,973.86 Million in 2025 and is projected to reach USD 3,808.00 Million by 2034, growing at a compound annual growth rate of 7.57% from 2026-2034.

The GCC building automation and control system market is experiencing significant momentum, as regional governments prioritize smart infrastructure development and sustainable urban planning. Accelerating construction activities across the commercial, industrial, and residential sectors are driving adoption of integrated building management solutions. Rising energy costs and environmental consciousness are compelling property developers to implement intelligent control technologies that optimize operational efficiency. Advancements in Internet of Things (IoT)-enabled devices, artificial intelligence (AI) integration, and cloud-based platforms are transforming how buildings are monitored and managed.

Key Takeaways and Insights:

-

By Product Type: HVAC control systems dominate the market with a share of 43% in 2025, owing to the critical need for climate management in extreme temperature conditions prevalent across the GCC region. Advanced temperature regulation solutions are essential for maintaining occupant comfort and operational efficiency in commercial and residential buildings.

-

By Technology: Wired leads the market with a share of 58% in 2025. This dominance is driven by superior reliability and data transmission stability required for large-scale commercial and industrial facilities where consistent system performance is paramount for critical building operations.

-

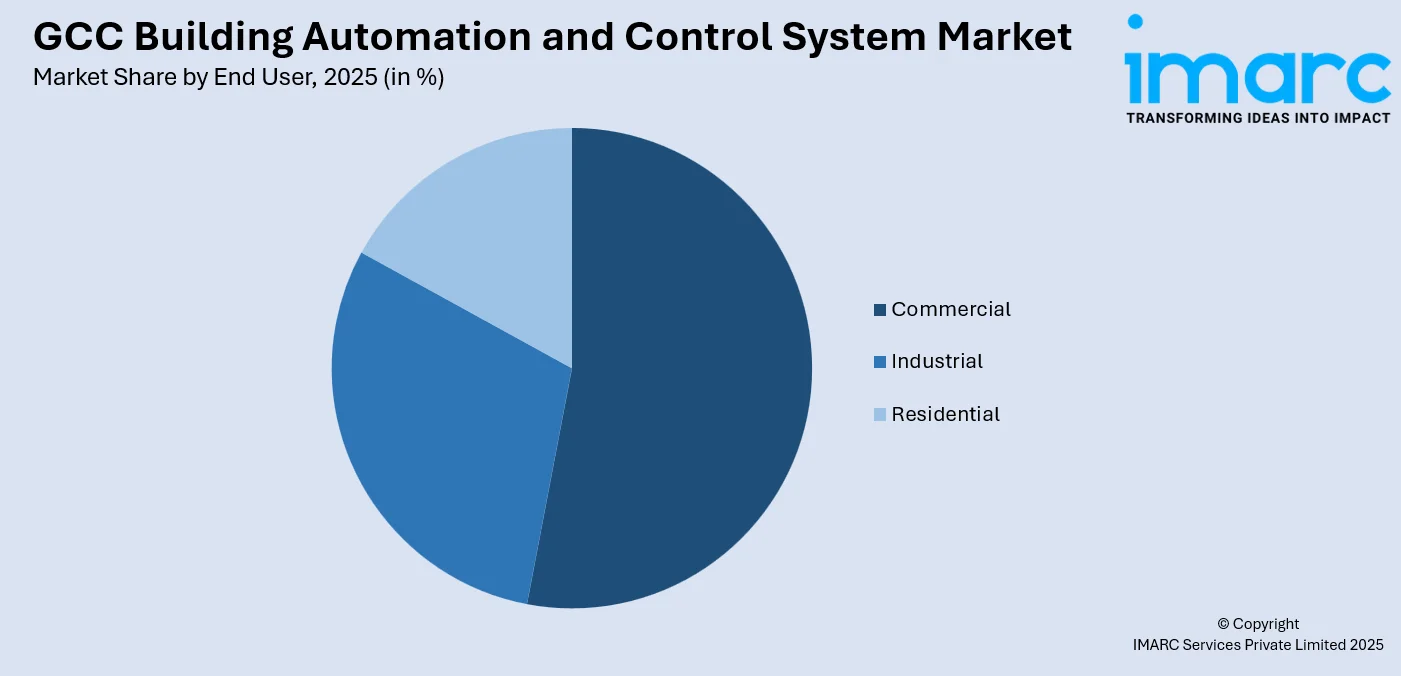

By End User: Commercial comprises the biggest segment with a market share of 53% in 2025, reflecting the substantial investments in office complexes, retail centers, hospitality venues, and healthcare facilities that require sophisticated automation for energy management and occupant comfort.

-

By Country: Saudi Arabia represents the largest country with 44% share in 2025, driven by ambitious mega-projects under Vision 2030, extensive urban development initiatives, and government mandates promoting energy-efficient building practices across the Kingdom.

-

Key Players: Key players drive the GCC building automation and control system market by expanding product portfolios, enhancing IoT integration capabilities, and strengthening regional distribution networks. Their investments in smart building technologies, energy-efficient solutions, and strategic partnerships with local developers accelerate adoption and ensure consistent product availability across diverse construction segments.

To get more information on this market Request Sample

The GCC building automation and control system market is propelled by transformative regional development initiatives and escalating demand for intelligent infrastructure solutions. Governments across the GCC countries are implementing comprehensive smart city programs that mandate energy-efficient building technologies, creating substantial opportunities for automation system providers. The extreme climatic conditions prevalent throughout the region necessitate sophisticated HVAC control systems capable of maintaining optimal indoor environments while minimizing energy consumption. Rapid urbanization and population growth are fueling unprecedented construction activities in commercial, residential, and industrial sectors, all requiring integrated building management capabilities. In June 2024, Honeywell inaugurated its first building automation assembly line in Dhahran, Saudi Arabia, marking significant expansion of localized manufacturing capabilities for fire alarm and building management solutions in the Middle East region.

GCC Building Automation and Control System Market Trends:

Integration of AI and Machine Learning (ML) Technologies

The GCC building automation and control system market is witnessing accelerated adoption of AI and ML capabilities that enable predictive analytics and autonomous decision-making. As per the IMARC Group, the GCC AI market size reached USD 5.4 Billion in 2024. AI and ML-based systems analyze historical operational data to anticipate equipment failures, optimize energy consumption patterns, and automatically adjust building parameters based on occupancy patterns and environmental conditions. AI-powered platforms are transforming facility management by enabling proactive maintenance scheduling, reducing unplanned downtime, and enhancing overall building performance.

Expansion of IoT-Enabled Smart Building Ecosystems

IoT integration is revolutionizing building automation across the GCC region by enabling seamless connectivity between diverse building systems and centralized management platforms. IoT sensors deployed throughout facilities continuously monitor environmental parameters, occupancy levels, and equipment performance, transmitting real-time data for comprehensive building intelligence. This interconnected approach facilitates remote monitoring capabilities, automated fault detection, and optimized resource utilization while supporting digital twin technologies that create virtual replicas of physical buildings for simulation and planning purposes, fueling the market growth.

Growing Emphasis on Sustainable Building Certifications

Sustainability requirements are increasingly shaping building automation adoption patterns, as regional governments and developers pursue green building certifications. Building automation systems play a critical role in achieving certification requirements by enabling precise energy monitoring, efficient resource management, and documented environmental performance improvements. The transition towards net-zero carbon buildings is motivating stakeholders to implement sophisticated automation platforms that optimize renewable energy integration, reduce operational carbon footprints, and demonstrate compliance with evolving sustainability standards mandated across regional construction projects.

Market Outlook 2026-2034:

The GCC building automation and control system market outlook remains robust, as regional economies continue to diversify away from hydrocarbon dependence towards technology-driven sectors. Ongoing mega-project developments, including Saudi Arabia's NEOM, Qatar's World Cup infrastructure legacy, and UAE's sustainable city initiatives, are creating sustained demand for advanced building management solutions. The market generated a revenue of USD 1,973.86 Million in 2025 and is projected to reach a revenue of USD 3,808.00 Million by 2034, growing at a compound annual growth rate of 7.57% from 2026-2034. Increasing localization initiatives, expanding manufacturing capabilities, and strengthening technical expertise are enhancing regional market readiness for sophisticated automation deployments. The convergence of smart city programs, energy efficiency mandates, and construction sector growth positions the GCC as an attractive destination for building automation investments throughout the forecast period.

GCC Building Automation and Control System Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

HVAC Control Systems |

43% |

|

Technology |

Wired |

58% |

|

End User |

Commercial |

53% |

|

Country |

Saudi Arabia |

44% |

Product Type Insights:

- HVAC Control Systems

- Lighting Control Systems

- Security and Access Control Systems

- Others

HVAC control systems dominate with a market share of 43% of the total GCC building automation and control system market in 2025.

HVAC control systems represent the cornerstone of building automation across the GCC region, where extreme temperature variations necessitate sophisticated climate management solutions. These systems integrate sensors, controllers, and actuators to regulate heating, ventilation, and air conditioning functions while optimizing energy consumption patterns. The emphasis on occupant comfort in commercial buildings, combined with stringent energy efficiency requirements, drives continuous investments in advanced HVAC automation technologies across the GCC region.

The dominance of HVAC control systems reflects the critical importance of indoor climate management in GCC countries where cooling accounts for substantial portions of building energy consumption. Modern HVAC automation incorporates variable refrigerant flow systems, intelligent zoning capabilities, and predictive maintenance features that enhance operational efficiency while reducing utility costs. Building owners increasingly recognize that sophisticated HVAC controls deliver measurable return on investment through reduced energy expenditure and extended equipment lifespan. The integration of HVAC systems with broader building management platforms enables holistic facility optimization.

Technology Insights:

- Wired

- Wireless

- ZigBee

- Wi-Fi

- Bluetooth

- Others

Wired leads with a share of 58% of the total GCC building automation and control system market in 2025.

Wired building automation technology maintains market leadership across the GCC region due to its proven reliability, superior data transmission capabilities, and minimal signal interference characteristics. Large-scale commercial and industrial facilities prioritize wired infrastructure for mission-critical building systems where consistent performance and cybersecurity considerations are paramount. The established installation expertise, comprehensive technical support networks, and long-term operational stability associated with wired solutions contribute to sustained segment dominance across the GCC region.

The preference for wired automation technology reflects the GCC construction industry's emphasis on building systems that deliver decades of reliable service across demanding operational environments. Wired infrastructure provides inherent advantages in electromagnetic interference resistance, bandwidth capacity, and security hardening that remain essential for critical facilities, including hospitals, data centers, and high-rise commercial towers. Property developers and facility managers recognize that wired system foundations accommodate future technology upgrades while maintaining backward compatibility.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Industrial

- Residential

Commercial exhibits a clear dominance with a 53% share of the total GCC building automation and control system market in 2025.

Commercial represents the primary adoption segment for building automation systems across the GCC, driven by intensive construction activities in office complexes, retail centers, hospitality venues, and healthcare facilities. Data published by the Saudi Arabia Ministry of Commerce indicated that as of October 2023, there were 210,818 commercial entities in the Eastern Province, an increase from 207,606 at the close of June. The economic imperative to reduce operational expenditures while enhancing tenant satisfaction compels commercial property owners to implement sophisticated automation platforms. Large-scale commercial developments increasingly incorporate building management systems as standard infrastructure components rather than optional upgrades.

The commercial segment's dominance reflects the substantial floor space expansion occurring across GCC countries, as regional economies diversify towards service-oriented sectors, including finance, tourism, and healthcare. Modern commercial buildings require integrated automation capabilities spanning HVAC, lighting, security, and access control functions to meet tenant expectations and regulatory requirements. The competitive commercial real estate market drives differentiation through smart building features that attract premium tenants willing to pay higher rents for technologically advanced facilities.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia represents the leading country with a 44% share of the total GCC building automation and control system market in 2025.

Saudi Arabia commands the largest share of the GCC building automation and control system market, propelled by ambitious Vision 2030 development programs and unprecedented infrastructure investments across the Kingdom. Mega-projects, including NEOM, the Red Sea development, and Qiddiya entertainment city, are incorporating advanced building automation as fundamental design requirements. The Saudi government's commitment to economic diversification creates sustained demand for smart building technologies across the commercial, residential, and hospitality sectors.

The Kingdom's market leadership reflects strategic initiatives aimed at promoting localization of building automation manufacturing and technical capabilities. Saudi authorities are implementing energy efficiency regulations and green building standards that mandate automation system installations in new construction projects. The Municipal Affairs and Housing Ministry's housing expansion programs, including plans for nearly 16,000 new residential units in 2025, create additional demand for building automation solutions. Major international automation providers are establishing local assembly facilities and service centers to capture opportunities arising from the Kingdom's construction boom and localization requirements.

Market Dynamics:

Growth Drivers:

Why is the GCC Building Automation and Control System Market Growing?

Accelerated Smart City Development Initiatives

GCC governments are implementing comprehensive smart city programs that fundamentally transform urban infrastructure development and building construction standards. These strategic initiatives mandate integration of intelligent building management systems capable of optimizing energy consumption, enhancing security, and improving occupant experiences across residential, commercial, and public facilities. Saudi Arabia's Vision 2030, UAE's Smart Dubai initiative, and Qatar's National Vision are creating regulatory frameworks that favor automation adoption while allocating substantial public investments towards smart infrastructure development. The convergence of government policy support, dedicated funding mechanisms, and established implementation timelines generates sustained market demand for building automation solutions. Regional authorities recognize that smart building technologies deliver measurable improvements in urban sustainability, resource efficiency, and quality of life metrics aligned with national development objectives. Construction developers increasingly view building automation as essential infrastructure rather than optional amenities when competing for government contracts and attracting international tenants seeking technologically advanced facilities.

Rising Energy Costs and Efficiency Mandates

Escalating energy prices and strengthening efficiency regulations are compelling GCC building owners to adopt automation technologies that deliver measurable operational savings. Building automation systems enable precise monitoring and optimization of HVAC, lighting, and other energy-intensive systems that collectively account for substantial portions of facility operating budgets. Regional governments are implementing progressive utility pricing structures and efficiency standards that create financial incentives for automation investments while penalizing inefficient building operations. The extreme climate conditions prevalent throughout the GCC region amplify energy consumption patterns, making building automation particularly valuable for facilities seeking to minimize cooling costs during extended summer periods. Property developers recognize that green building certifications require demonstrated automation capabilities that enable continuous performance monitoring and documented efficiency improvements. Facility managers increasingly utilize building automation platforms to identify optimization opportunities, implement demand response strategies, and demonstrate compliance with evolving regulatory requirements governing commercial building operations.

Expansion of Commercial and Hospitality Construction

The GCC region's economic diversification towards tourism, entertainment, hospitality, and services sectors is generating unprecedented commercial construction activities that drive building automation and control system demand. As per IMARC Group, the Saudi Arabia hospitality market size was valued at USD 53.2 Billion in 2025. Hospitality developments across Saudi Arabia and UAE are incorporating sophisticated building management systems to deliver premium guest experiences while maintaining operational efficiency. Major entertainment destinations, including Qiddiya, Dubai theme parks, and Qatar tourism infrastructure, require advanced automation capabilities spanning climate control, lighting, security, and crowd management functions. Commercial office developments targeting multinational corporate tenants must demonstrate smart building credentials to compete effectively in regional real estate markets. Healthcare facility expansion programs across GCC countries mandate building automation for infection control, patient comfort, and regulatory compliance purposes.

Market Restraints:

What Challenges the GCC Building Automation and Control System Market is Facing?

High Initial Implementation Costs

The substantial upfront investment required for comprehensive building automation implementations presents financial barriers for cost-conscious developers and building owners across the GCC region. Advanced automation systems, incorporating integrated HVAC controls, lighting management, security platforms, and centralized building intelligence, require significant capital expenditure alongside ongoing maintenance commitments. Small and medium-sized property developers often struggle to justify automation investments despite long-term operational savings potential.

Shortage of Skilled Technical Personnel

The GCC building automation and control system market faces persistent challenges in recruiting and retaining qualified technical professionals capable of designing, implementing, and maintaining sophisticated building management systems. Rapid market growth has created demand for skilled engineers, programmers, and technicians that exceeds regional workforce availability. The specialized knowledge required for integrating diverse building systems, configuring complex automation protocols, and troubleshooting operational issues remains scarce throughout the region, potentially constraining project execution capabilities.

Integration Complexity with Legacy Systems

Integrating modern building automation technologies with existing infrastructure presents technical challenges that complicate retrofit projects and limit market expansion in established building stock. Legacy building systems often utilize proprietary communication protocols incompatible with contemporary automation platforms, requiring costly middleware solutions or complete system replacements. The fragmented nature of building equipment manufacturers creates interoperability challenges that increase implementation complexity while elevating project risks for building owners considering automation upgrades.

Competitive Landscape:

The GCC building automation and control system market features a competitive landscape, characterized by the presence of established multinational technology providers alongside regional system integrators and emerging local players. Market participants compete through comprehensive solution portfolios, spanning hardware components, software platforms, and professional services, tailored to regional construction requirements. Strategic partnerships between global automation leaders and local distributors enhance market penetration while addressing localization mandates increasingly prevalent across GCC countries. Technology differentiation through IoT integration capabilities, AI features, and cloud-based management platforms influences competitive positioning. Companies are investing in regional assembly facilities, training centers, and service networks to capture opportunities arising from mega-project developments and government smart city initiatives.

Recent Developments:

- In November 2025, Dubai Municipality and Siemens signed a strategic Memorandum of Understanding (MoU) to accelerate AI and smart technology integration across public facilities. The partnership establishes a framework for piloting advanced digital solutions, including predictive maintenance systems, AI-powered building automation, energy optimization, and smart analytics platforms across Dubai's public infrastructure.

- In October 2025, Red Sea International Airport (RSI) announced a multi-year collaboration agreement with Honeywell to deliver advanced building automation systems and services, spanning building management, safety, and security at the Saudi Arabian airport. The partnership supported RSI's mission to provide world-class aviation facilities while creating nearly 50 new regional jobs.

GCC Building Automation and Control System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | HVAC Control Systems, Lighting Control Systems, Security and Access Control Systems, Others |

| Technologies Covered |

|

| End Users Covered | Commercial, Industrial, Residential |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC building automation and control system market size was valued at USD 1,973.86 Million in 2025.

The GCC building automation and control system market is expected to grow at a compound annual growth rate of 7.57% from 2026-2034 to reach USD 3,808.00 Million by 2034.

HVAC control systems dominated the market with a share of 43%, driven by the critical need for climate management solutions in extreme temperature conditions and rising demand for energy-efficient building operations across commercial and residential facilities.

Key factors driving the GCC building automation and control system market include accelerated smart city development initiatives, rising energy costs and efficiency mandates, expansion of commercial and hospitality construction, and increasing government focus on sustainable building practices.

Major challenges include high initial implementation costs, shortage of skilled technical personnel, integration complexity with legacy building systems, cybersecurity concerns for connected building infrastructure, and inconsistent regulatory frameworks across different GCC countries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)