GCC Building and Construction Tapes Market Report by Product (Double-Sided Tapes, Masking Tapes, Duct Tapes, and Others), Material Type (Polyvinyl Chloride, Polyethylene Terephthalate, Polypropylene, Polyethylene, Foil, Paper, Foam), Application (Doors, Flooring, Roofing, Walls and Ceilings, Windows, and Others), End User (Commercial, Residential, Industrial), and Country 2026-2034

Market Overview:

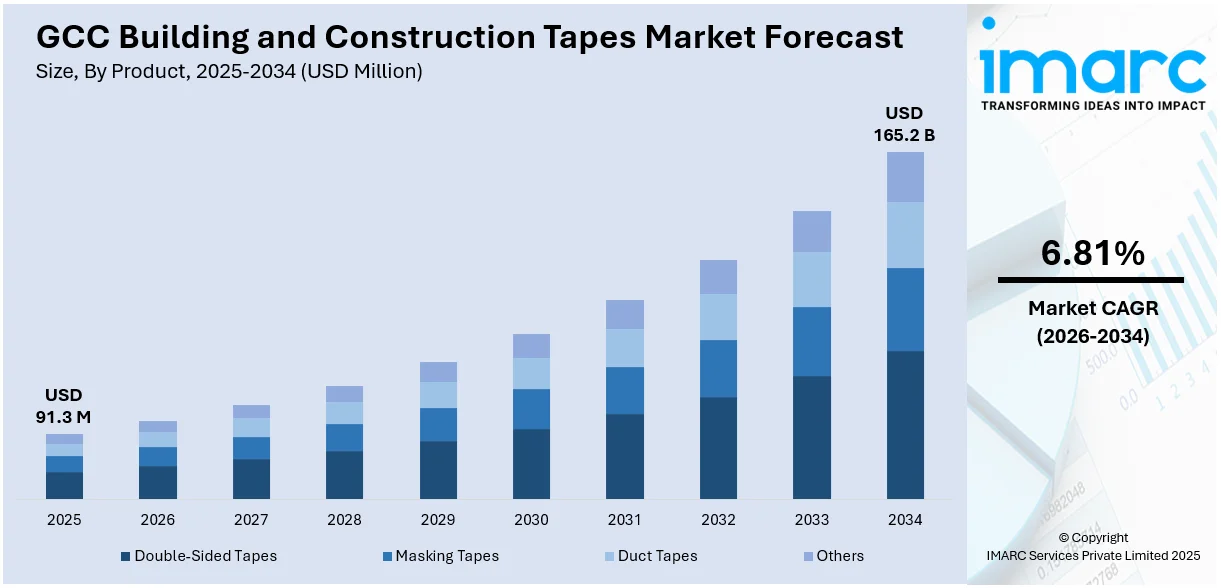

GCC building and construction tapes market size reached USD 91.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 165.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.81% during 2026-2034. The continuous innovation in tape manufacturing technologies, such as the development of tapes with enhanced adhesion properties, weather resistance, and durability, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 91.3 Million |

| Market Forecast in 2034 | USD 165.2 Million |

| Market Growth Rate (2026-2034) | 6.81% |

Building and construction tapes are essential tools in the construction industry, designed to provide accurate measurements, secure joints, and ensure precise alignment during various construction projects. These tapes come in a variety of types, including measuring tapes, adhesive tapes, and barrier tapes. Measuring tapes are crucial for obtaining precise dimensions, ensuring uniformity in structures. Adhesive tapes play a role in securing materials and creating temporary bonds, while barrier tapes are used for safety and demarcation purposes. Construction tapes are often durable, weather-resistant, and feature clear markings for easy readability. They contribute to the efficiency and accuracy of construction tasks, helping builders and contractors achieve high-quality results. The versatility of these tapes makes them indispensable in a wide range of applications, from framing and concrete work to finishing touches. Ultimately, building and construction tapes play a fundamental role in promoting precision and safety throughout the construction process.

To get more information on this market Request Sample

GCC Building and Construction Tapes Market Trends:

The building and construction tapes market in GCC is experiencing robust growth, driven by several key factors. Firstly, the surge in regional construction activities is a major catalyst, propelling the demand for tapes that provide reliable adhesion and durability. As urbanization continues at an unprecedented pace, construction projects, ranging from residential buildings to commercial infrastructure, fuel the need for high-performance tapes. Additionally, stringent regulatory standards and a growing emphasis on safety in the construction industry act as significant drivers for the market. Builders and contractors are increasingly recognizing the importance of using tapes that meet compliance requirements and enhance workplace safety. This awareness is fostering the adoption of specialized construction tapes designed to withstand challenging environmental conditions. Moreover, technological advancements in tape manufacturing processes have led to the development of innovative products with enhanced features. Improved weather resistance, stronger bonding capabilities, and eco-friendly options are attracting construction professionals, further contributing to market growth. Furthermore, the increasing trend towards sustainable and energy-efficient construction practices is influencing the choice of tapes used in building projects. Tapes that contribute to better insulation and energy conservation are gaining prominence, aligning with the industry's commitment to environmental responsibility. In conclusion, the building and construction tapes market in GCC is on an upward trajectory, propelled by a confluence of factors that underscore the industry's evolving needs and priorities.

GCC Building and Construction Tapes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product, material type, application, and end user.

Product Insights:

- Double-Sided Tapes

- Masking Tapes

- Duct Tapes

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes double-sided tapes, masking tapes, duct tapes, and others.

Material Type Insights:

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Polypropylene

- Polyethylene

- Foil

- Paper

- Foam

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes polyvinyl chloride, polyethylene terephthalate, polypropylene, polyethylene, foil, paper, and foam.

Application Insights:

- Doors

- Flooring

- Roofing

- Walls and Ceilings

- Windows

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes doors, flooring, roofing, walls and ceilings, windows, and others.

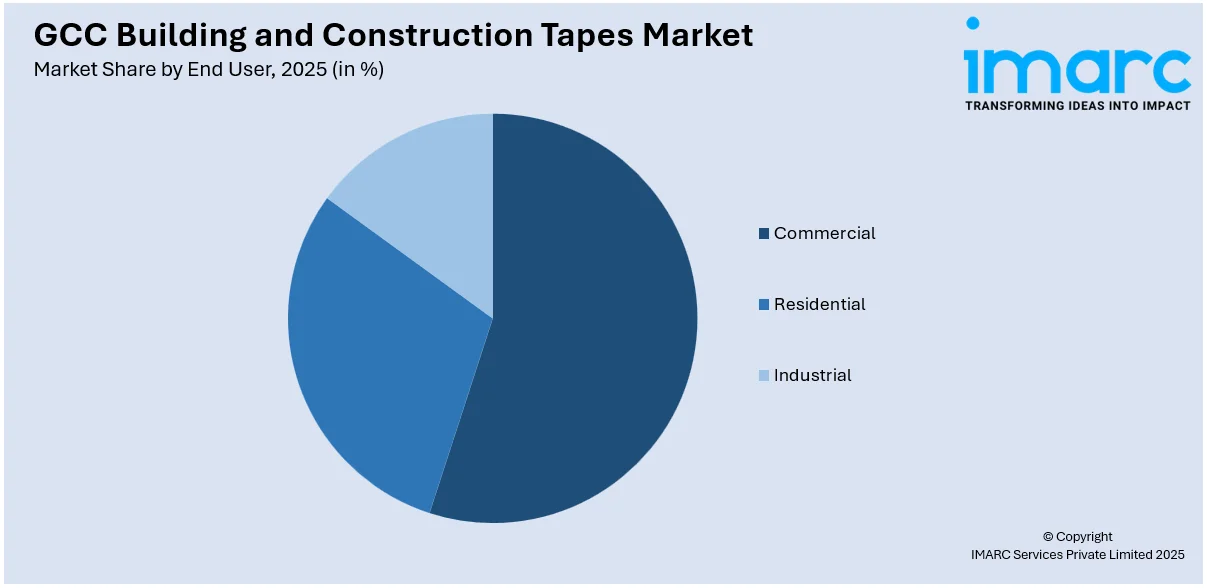

End User Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial, residential, and industrial.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Building and Construction Tapes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Double-Sided Tapes, Masking Tapes, Duct Tapes, Others |

| Material Types Covered | Polyvinyl Chloride, Polyethylene Terephthalate, Polypropylene, Polyethylene, Foil, Paper, Foam |

| Applications Covered | Doors, Flooring, Roofing, Walls and Ceilings, Windows, Others |

| End Users Covered | Commercial, Residential, Industrial |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC building and construction tapes market performed so far and how will it perform in the coming years?

- What is the breakup of the GCC building and construction tapes market on the basis of product?

- What is the breakup of the GCC building and construction tapes market on the basis of material type?

- What is the breakup of the GCC building and construction tapes market on the basis of application?

- What is the breakup of the GCC building and construction tapes market on the basis of end user?

- What are the various stages in the value chain of the GCC building and construction tapes market?

- What are the key driving factors and challenges in the GCC building and construction tapes?

- What is the structure of the GCC building and construction tapes market and who are the key players?

- What is the degree of competition in the GCC building and construction tapes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC building and construction tapes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC building and construction tapes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC building and construction tapes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)