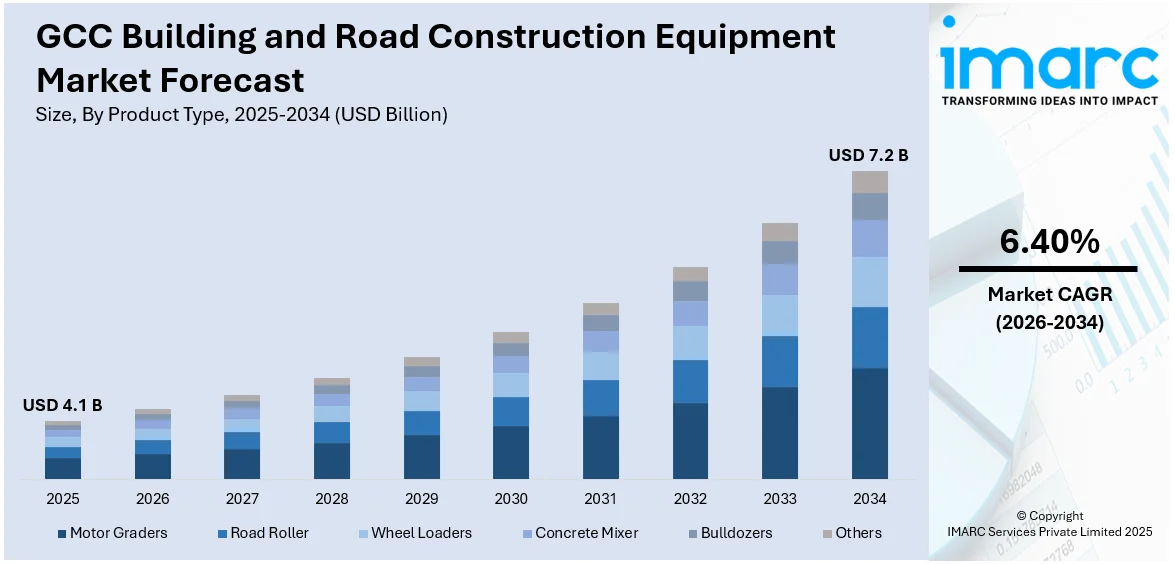

GCC Building and Road Construction Equipment Market Report by Product Type (Motor Graders, Road Roller, Wheel Loaders, Concrete Mixer, Bulldozers, and Others), Application Type (Building Construction, Road Construction), Equipment Type (Earthmoving Equipment, Material-Handling Equipment, Heavy Construction Vehicles, and Others), and Country 2026-2034

Market Overview:

GCC building and road construction equipment market size reached USD 4.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.2 Billion by 2034, exhibiting a growth rate (CAGR) of 6.40% during 2026-2034. The increasing innovations in construction equipment technology, including automation, telematics, and IoT (Internet of Things), which can enhance efficiency, safety, and productivity on construction sites, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.1 Billion |

| Market Forecast in 2034 | USD 7.2 Billion |

| Market Growth Rate (2026-2034) | 6.40% |

Building and road construction equipment encompasses a wide array of machinery designed to facilitate the construction of structures and infrastructure. These essential tools are crucial for executing various construction tasks efficiently. Common examples include excavators, bulldozers, cranes, concrete mixers, and road pavers. Excavators are utilized for digging and earthmoving, while bulldozers assist in leveling and shaping terrain. Cranes are pivotal for lifting heavy materials, and concrete mixers ensure the proper blending of construction materials. Road pavers play a crucial role in laying asphalt or concrete for roads. The advancements in technology have led to the development of sophisticated equipment, enhancing precision, safety, and speed in construction projects. The selection and deployment of appropriate machinery depend on the specific requirements and scope of the construction project, contributing to the overall progress and success of the construction industry.

To get more information on this market Request Sample

GCC Building and Road Construction Equipment Market Trends:

The building and road construction equipment market in GCC is experiencing robust growth, primarily driven by increasing urbanization and infrastructure development. Moreover, the rising demand for modern and sustainable construction practices has spurred investments in advanced equipment. To meet these evolving needs, construction companies are embracing innovative technologies, fueling the market's expansion. Furthermore, government initiatives and substantial investments in infrastructure projects play a pivotal role in propelling the building and road construction equipment market forward. Policymakers regionally recognize the importance of robust infrastructure in fostering economic growth, creating a conducive environment for market growth. Additionally, the surge in population in urban areas has intensified the need for efficient transportation networks and urban facilities, further boosting the demand for construction equipment. The market is also influenced by the growing emphasis on safety and efficiency in construction operations. Technological advancements, such as the integration of telematics and IoT solutions, enhance equipment performance and facilitate real-time monitoring, addressing concerns related to project timelines and worker safety. These technological innovations act as key enablers for market expansion, fostering a positive outlook for the building and road construction equipment industry in the foreseeable future.

GCC Building and Road Construction Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on product type, application type, and equipment type.

Product Type Insights:

- Motor Graders

- Road Roller

- Wheel Loaders

- Concrete Mixer

- Bulldozers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes motor graders, road roller, wheel loaders, concrete mixer, bulldozers, and others.

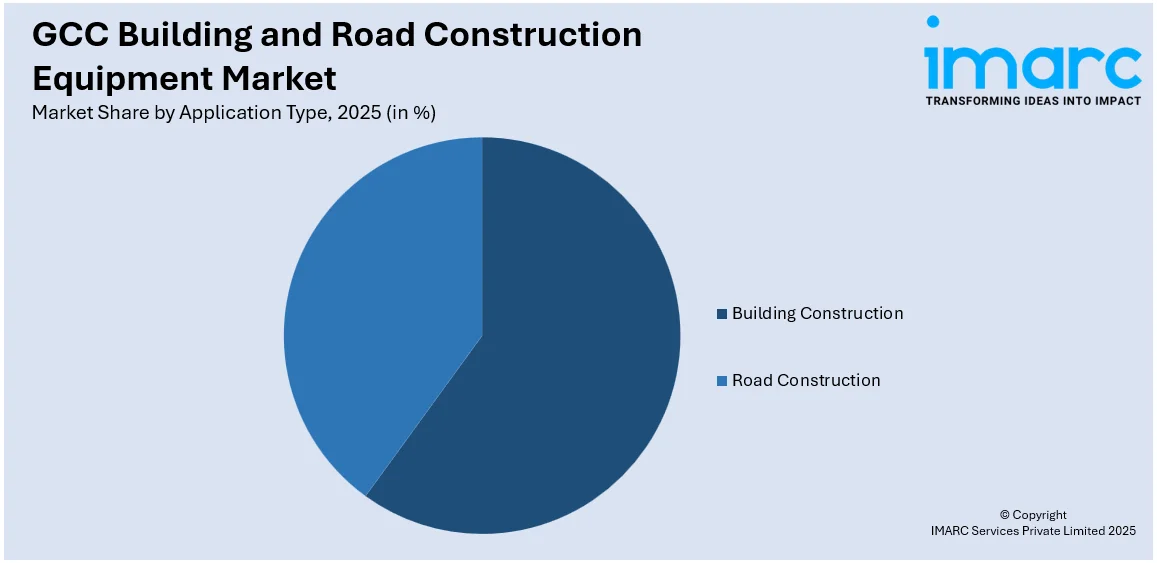

Application Type Insights:

Access the comprehensive market breakdown Request Sample

- Building Construction

- Road Construction

A detailed breakup and analysis of the market based on the application type have also been provided in the report. This includes building construction and road construction.

Equipment Type Insights:

- Earthmoving Equipment

- Material-Handling Equipment

- Heavy Construction Vehicles

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes earthmoving equipment, material-handling equipment, heavy construction vehicles, and others.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Building and Road Construction Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Motor Graders, Road Roller, Wheel Loaders, Concrete Mixer, Bulldozers, Others |

| Application Types Covered | Building Construction, Road Construction |

| Equipment Types Covered | Earthmoving Equipment, Material-Handling Equipment, Heavy Construction Vehicles, Others |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC building and road construction equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the GCC building and road construction equipment market on the basis of product type?

- What is the breakup of the GCC building and road construction equipment market on the basis of application type?

- What is the breakup of the GCC building and road construction equipment market on the basis of equipment type?

- What are the various stages in the value chain of the GCC building and road construction equipment market?

- What are the key driving factors and challenges in the GCC building and road construction equipment?

- What is the structure of the GCC building and road construction equipment market and who are the key players?

- What is the degree of competition in the GCC building and road construction equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC building and road construction equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC building and road construction equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC building and road construction equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)