GCC Carmine Market Report by Form (Powder, Liquid, Crystal), Application (Dairy and Frozen Products, Food and Beverages, Cosmetics, Bakery and Confectionery, Meat Products), End-User (Food Processing Companies, Beverage Industry, Catering Industry, Cosmetics and Pharmaceutical Industry), and Country 2026-2034

Market Overview:

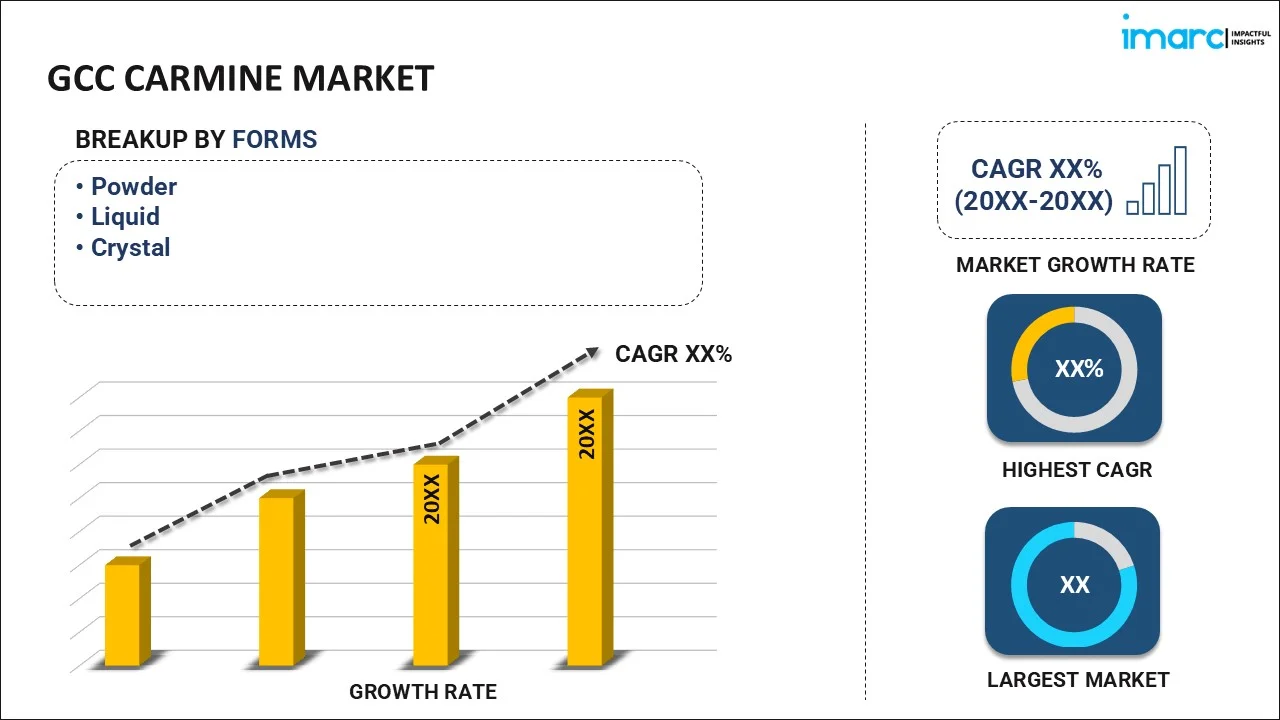

The GCC carmine market size reached USD 1.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2.0 Million by 2034, exhibiting a growth rate (CAGR) of 5.90% during 2026-2034. The increasing product utilization to add richness and depth to fabrics, a significant rise in the popularity of beauty and personal care products and the growing demand for natural and safe food additives represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Million |

| Market Forecast in 2034 | USD 2.0 Million |

| Market Growth Rate (2026-2034) | 5.90% |

Access the full market insights report Request Sample

Carmine, also known as cochineal extract, E120, or natural red 4, is a vivid crimson pigment derived from the cochineal insect, a small, parasitic bug. The insect produces carminic acid as a defense mechanism, which is extracted to create carmine dye. Its extraction process involves drying and crushing the insects to obtain carminic acid, which is then treated to produce the distinctive red dye. Carmine is utilized across multiple industries due to its stability and natural origins. It has a rich and intense red color, making it a sought-after pigment in industries, such as textiles, cosmetics, and food. In the textile industry, carmine is used to dye fabrics and create vivid red hues in clothing, upholstery, and carpets. It has excellent color-fastness properties, allowing it to withstand washing and fading. There has been a growing demand for natural and plant-based alternatives to carmine, driven by consumer preferences for vegan and cruelty-free products. This has encouraged leading companies to explore alternative sources of red pigments, such as beetroot and certain berries, to meet the evolving needs of the market.

GCC Carmine Market Trends:

One of the key drivers is the emerging textile industry in the GCC. The region has witnessed strong growth in textile manufacturing and exports, with a particular emphasis on luxury and high-end fashion. Carmine's vibrant red color is generally used to add richness and depth to fabrics, making them visually appealing. The increasing demand for high-quality textiles has boosted the demand for carmine as a dye. The cosmetics industry in the GCC is another major driver of carmine consumption. The region has experienced a significant rise in the popularity of beauty and personal care products. Carmine's intense red shade is widely used in cosmetics, particularly in lipsticks, blushes, and eye makeup, as it provides a striking and long-lasting color. The growing consumer base and increasing disposable income have fueled the demand for cosmetics, thereby driving the demand for carmine in the GCC. Furthermore, the GCC countries have a strong food processing industry, which has contributed to the uptake of carmine as a natural food coloring agent. Carmine is widely used to enhance the color of various food products, including beverages, dairy products, confectioneries, and processed meats. As consumers are becoming more conscious about the ingredients used in their food, the demand for natural and safe food additives, including carmine has witnessed a rise.

GCC Carmine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC carmine market report, along with forecasts at the regional and country level for 2026-2034. Our report has categorized the market based on form, application, and end-user.

Form Insights:

To get detailed segment analysis of this market Request Sample

- Powder

- Liquid

- Crystal

The report has provided a detailed breakup and analysis of the market based on the form. This includes powder, liquid and crystal.

Application Insights:

- Dairy and Frozen Products

- Food and Beverages

- Cosmetics

- Bakery and Confectionery

- Meat Products

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes dairy and frozen products, food and beverages, cosmetics, bakery and confectionery and meat products.

End-User Insights:

- Food Processing Companies

- Beverage Industry

- Catering Industry

- Cosmetics and Pharmaceutical Industry

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes food processing companies, beverage industry, catering industry and cosmetics and pharmaceutical industry.

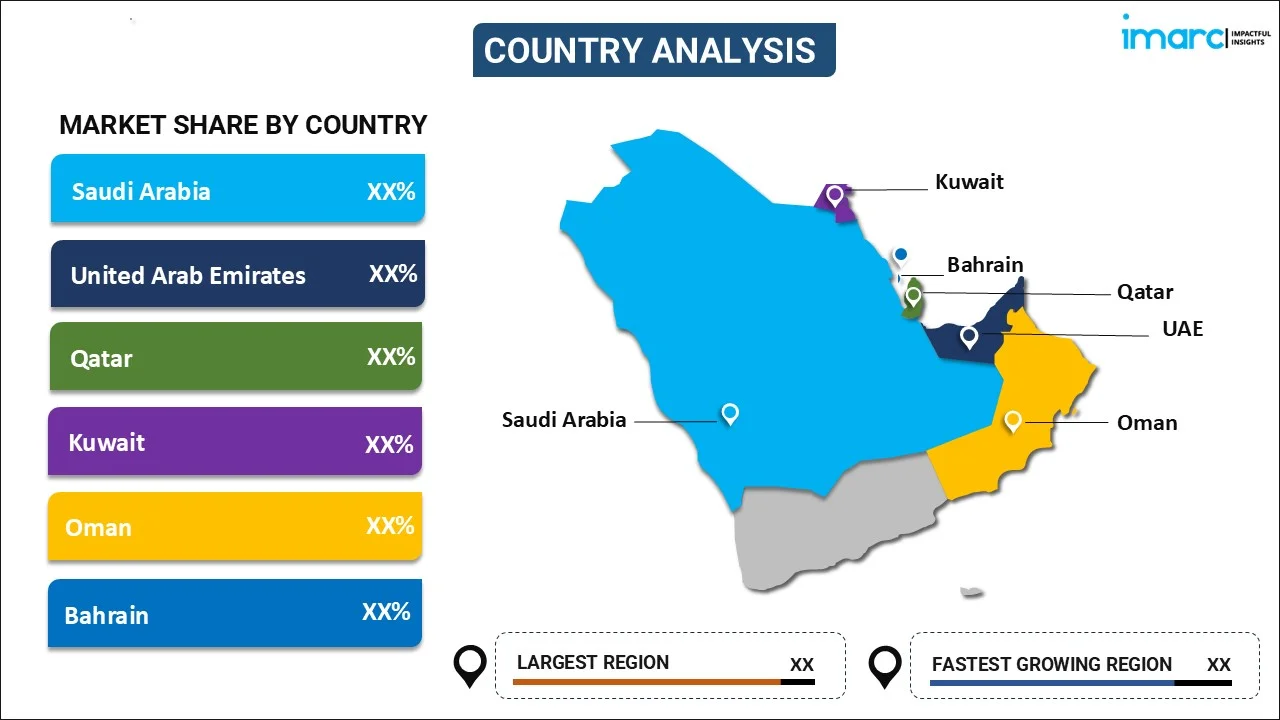

Country Insights:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, UAE, Qatar, Bahrain, Kuwait and Oman.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the GCC carmine market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Carmine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Forms Covered | Powder, Liquid, Crystal |

| Applications Covered | Dairy and Frozen Products, Food and Beverages, Cosmetics, Bakery and Confectionery, Meat Products |

| End-Users Covered | Food Processing Companies, Beverage Industry, Catering Industry, Cosmetics and Pharmaceutical Industry |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email |

Key Questions Answered in This Report:

- How has the GCC carmine market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the GCC carmine market?

- What is the breakup of the GCC carmine market on the basis of form?

- What is the breakup of the GCC carmine market on the basis of application?

- What is the breakup of the GCC carmine market on the basis of end-user?

- What are the various stages in the value chain of the GCC carmine market?

- What are the key driving factors and challenges in the GCC carmine market?

- What is the structure of the GCC carmine market and who are the key players?

- What is the degree of competition in the GCC carmine market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC carmine market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC carmine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC carmine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)