GCC Cigarette Lighter Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, and Country, 2026-2034

GCC Cigarette Lighter Market Summary:

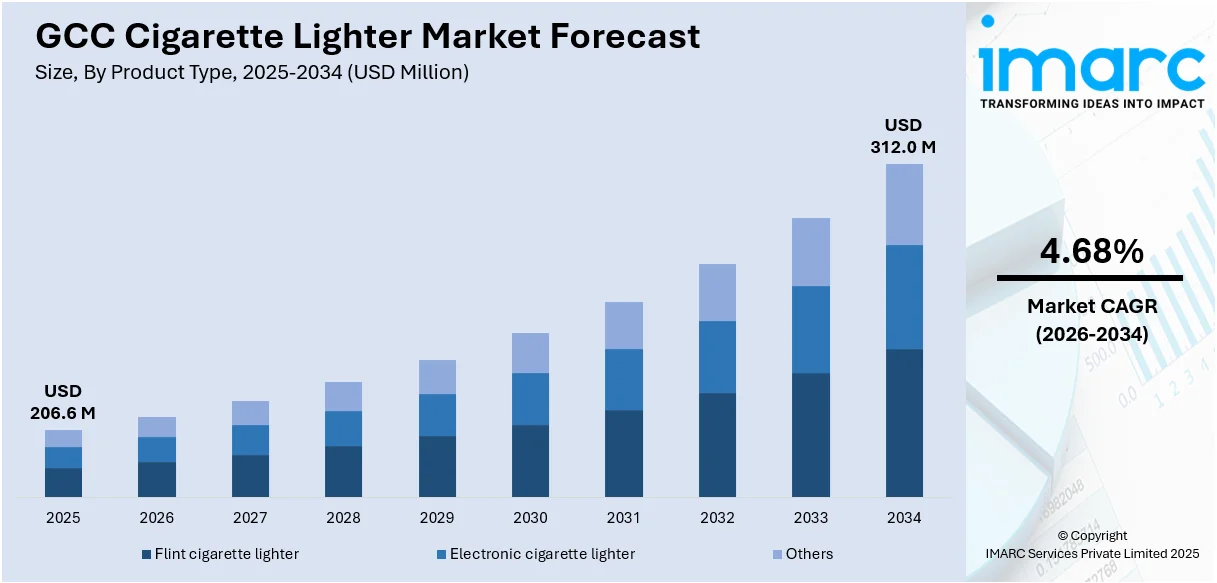

The GCC cigarette lighter market size was valued at USD 206.59 Million in 2025 and is projected to reach USD 312 Million by 2034, growing at a compound annual growth rate of 4.68% from 2026-2034.

The GCC cigarette lighter market is driven by the growing smoking population, rising demand for portable and affordable ignition devices, and expanding retail distribution networks across the region. Increasing urbanization, a significant expatriate population, and the cultural prevalence of smoking in social settings continue to sustain demand. Product innovations, including windproof and refillable designs, further support the GCC cigarette lighter market share.

Key Takeaways and Insights:

- By Product Type: Flint cigarette lighter dominates the market with a share of 52.07% in 2025, owing to its reliable spark-based ignition mechanism, widespread consumer familiarity, and cost-effective manufacturing. The consistent flame output and simple operation make flint lighters preferred among regular smokers.

- By Material Type: Plastic leads the market with a share of 60.03% in 2025. This dominance is driven by the affordability and lightweight nature of plastic lighters, making them ideal for mass production and frequent replacement by consumers across diverse income segments.

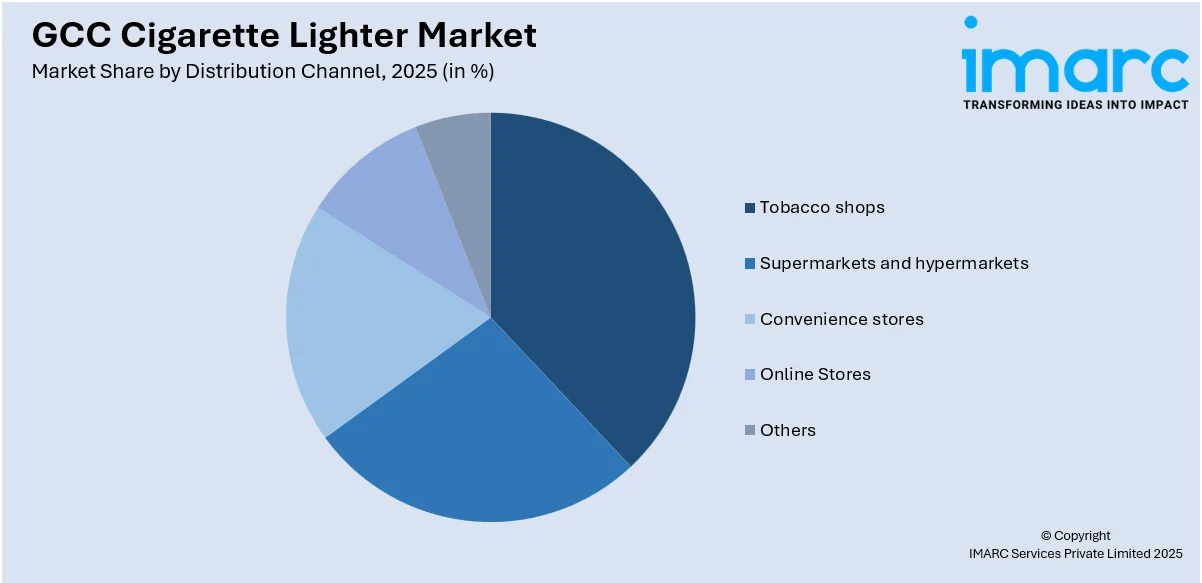

- By Distribution Channel: Tobacco shops comprise the largest segment with a market share of 35.06% in 2025, reflecting the established purchasing behavior of smokers who buy lighters alongside tobacco products. These specialized outlets offer diverse product assortments and expert guidance on premium options.

- By Country: Saudi Arabia represents the largest country with 38% share in 2025, driven by the Kingdom's substantial smoking population, rising disposable incomes, and the expanding retail infrastructure supporting tobacco-related accessory sales throughout metropolitan areas.

- Key Players: Key players drive the GCC cigarette lighter market through innovative product designs, strategic retail partnerships, and competitive pricing. Their focus on expanding distribution networks, enhancing product safety features, and introducing customized lighter variants strengthens brand presence and accelerates market penetration across consumer segments.

To get more information on this market Request Sample

The GCC cigarette lighter market continues to demonstrate resilient growth, supported by the region's stable consumer base and ongoing retail modernization across member nations. Manufacturers are increasingly focusing on product differentiation through enhanced durability, ergonomic designs, and aesthetic customization to appeal to lifestyle-oriented buyers. The growing interest in multi-purpose utility lighters is broadening applications beyond smoking, contributing to new demand pockets across household, automotive, and outdoor-use segments. Convenience-led purchases remain a key factor shaping industry performance, driven by widespread retail penetration and duty-free availability at regional airports. In Saudi Arabia, the prevalence of adult smoking was noted to be 16.6% in 2024, showing a rise from 15.6% in 2020 and a considerable increase from 12.7% in 2019, which directly correlates with sustained demand for cigarette lighters. Rising tourism flows, particularly in the UAE and Qatar, combined with the presence of a diverse expatriate population with varying smoking habits, continue to reinforce consumption patterns, ensuring steady market expansion throughout the forecast period.

GCC Cigarette Lighter Market Trends:

Rising Demand for Windproof and Refillable Lighters

Consumer preferences are shifting towards windproof and refillable cigarette lighters across the GCC region. Outdoor smoking areas, particularly in cafes and recreational venues, have increased the need for reliable flame sources that perform under variable weather conditions. Refillable variants are gaining traction among environmentally aware consumers who value long-term use and reduced plastic waste, prompting manufacturers to expand their portfolios with premium rechargeable options that combine durability with cost-efficiency.

Growing Penetration of E-Commerce Distribution Channels

Online retail platforms are emerging as significant distribution channels for cigarette lighters in the GCC market. Digital shopping offers consumers convenient access to diverse product selections, transparent pricing comparisons, and doorstep delivery services. The expanding gifting culture around designer and collectible lighters is particularly driving e-commerce adoption, with platforms enabling easy discovery of premium brands and limited-edition products that may not be readily available in traditional brick-and-mortar stores. As per IMARC Group, the GCC e-commerce market is set to attain USD 2,081.1 Billion by 2034, exhibiting a growth rate (CAGR) of 15.15% during 2026-2034.

Increasing Focus on Product Customization and Design Innovations

Manufacturers are increasingly investing in product customization to capture consumer interest in the GCC cigarette lighter market. Personalization options, including engraving, unique color schemes, and branded designs, are becoming popular, particularly among younger demographics seeking lighters that reflect individual style preferences. This trend extends to premium designer lighters that function as lifestyle accessories, driving premiumization across the market and enabling higher profit margins for retailers in Saudi Arabia.

Market Outlook 2026-2034:

The GCC cigarette lighter market outlook remains positive, underpinned by favorable demographic trends, retail channel expansion, and sustained tobacco consumption patterns across member states. The market generated a revenue of USD 206.59 Million in 2025 and is projected to reach a revenue of USD 312 Million by 2034, growing at a compound annual growth rate of 4.68% from 2026-2034. The influx of tourists and expatriates with diverse smoking habits will continue to support demand growth. Manufacturers are expected to enhance their focus on safety features, including child-resistant mechanisms and flame control technologies, aligning with evolving regulatory expectations. The premiumization trend, coupled with rising disposable incomes in key markets such as Saudi Arabia and the UAE, is anticipated to drive consumption of designer and luxury lighter variants.

GCC Cigarette Lighter Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Flint Cigarette Lighter | 52.07% |

| Material Type | Plastic | 60.03% |

| Distribution Channel | Tobacco Shops | 35.06% |

| Country | Saudi Arabia | 38% |

Product Type Insights:

- Flint Cigarette Lighter

- Electronic Cigarette Lighter

- Others

Flint cigarette lighter dominates with a market share of 52.07% of the total GCC cigarette lighter market in 2025.

Flint cigarette lighter maintains its leading position in the GCC market owing to its proven reliability and simple mechanical operation that consumers trust. It offers long shelf life and minimal maintenance requirements for users. The spark-wheel ignition mechanism provides consistent flame production without requiring batteries or charging infrastructure, making these lighters particularly suitable for everyday use. Their dependable performance in hot and dusty climatic conditions further strengthens demand across the GCC region.

Consumer preference for flint lighters in the GCC region is reinforced by established purchasing habits and the broad availability of these products across retail channels. Tobacco shops, convenience stores, and supermarkets maintain extensive inventories of flint lighters, ensuring consistent accessibility for impulse purchases. The low unit cost enables frequent replacement, aligning with the disposable consumption patterns prevalent among smokers. Manufacturers continue to enhance flint lighter designs with improved ergonomics and decorative options while maintaining the traditional ignition mechanism that consumers favor.

Material Type Insights:

- Metal

- Plastic

- Others

Plastic leads with a share of 60.03% of the total GCC cigarette lighter market in 2025.

Plastic dominates the GCC market primarily due to its exceptional affordability and lightweight construction that facilitates mass production and cost-effective distribution. The material's versatility enables manufacturers to produce lighters in diverse colors, shapes, and designs that appeal to varying consumer preferences across different demographic segments. Its resistance to minor impacts and everyday handling further supports widespread consumer acceptance. Ease of branding and customization on plastic surfaces also attracts manufacturers and retailers.

The preference for plastic lighters in the GCC region is driven by the practical advantages these products offer to price-conscious consumers who view lighters as frequently replaced utility items rather than long-term investments. Retailers favor stocking plastic lighters due to their high turnover rates and favorable profit margins on volume sales. The segment continues to benefit from manufacturing efficiencies in Asian production facilities that supply the global market, ensuring competitive pricing that maintains accessibility across all consumer income levels throughout the GCC countries.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Tobacco shops

- Supermarkets and hypermarkets

- Convenience stores

- Online Stores

- Others

Tobacco shops exhibit a clear dominance with a 35.06% share of the total GCC cigarette lighter market in 2025.

Tobacco shops maintain their position as the primary distribution channel for cigarette lighters in the GCC due to the natural purchasing synergy between smoking accessories and tobacco products. These specialized retailers offer comprehensive product assortments ranging from disposable plastic lighters to premium designer variants, catering to diverse consumer preferences within their target demographic. Their extended operating hours and neighborhood locations further enhance convenience and repeat purchasing behavior.

The strength of tobacco shops in the GCC cigarette lighter market stems from their strategic positioning as one-stop destinations for smokers' complete accessory needs. Store operators leverage their specialized expertise to provide personalized recommendations, particularly for refillable and premium lighter categories where consumer education influences purchasing decisions. The consistent footfall from regular tobacco purchasers ensures steady lighter sales, while the ability to display and demonstrate products enhances conversion rates compared to self-service retail formats that lack dedicated product expertise.

Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia represents the leading country with a 38% share of the total GCC cigarette lighter market in 2025.

Saudi Arabia's dominance in the GCC cigarette lighter market is underpinned by its substantial smoking population and the Kingdom's position as the largest economy in the region with significant consumer purchasing power. The country's extensive retail infrastructure, including modern shopping centers, traditional tobacco shops, and convenience stores, ensures widespread product accessibility across urban and suburban areas. As per IMARC Group, the Saudi Arabia retail market size was valued at USD 293.6 Billion in 2025.

The Saudi Arabian market benefits from demographic factors, including a young population with growing disposable incomes and increasing urbanization that concentrates consumers in metropolitan areas where retail access is optimal. Despite regulatory measures, tobacco consumption remains culturally embedded in social settings, sustaining accessory demand. Additionally, strong brand presence and frequent product launches by international and regional manufacturers support steady market growth. Impulse-driven purchasing behavior further reinforce Saudi Arabia’s leading position in the GCC cigarette lighter market.

Market Dynamics:

Growth Drivers:

Why is the GCC Cigarette Lighter Market Growing?

Expanding Smoking Population and Rising Tobacco Consumption

The GCC cigarette lighter market is experiencing sustained growth, driven by the gradually expanding smoking population across member states. Demographic diversity, including significant expatriate communities from regions with higher smoking prevalence, continues to strengthen demand for ignition accessories. The cultural acceptance of smoking in social gatherings and hospitality settings reinforces consumption patterns, particularly among adult male populations. Rising disposable incomes enable consumers to afford tobacco products and related accessories without significant budgetary constraints, supporting consistent sales volumes. The findings from the 2023 Household Income and Consumption Expenditure Statistics indicated that the average monthly disposable income per household in the Kingdom was SAR 11,839. The stress-relief associations with smoking among working professionals dealing with demanding schedules further sustain tobacco consumption and consequently lighter demand throughout the region.

Affordable Product Pricing and Widespread Retail Availability

Affordability is a key driver that underlines market development within the GCC region. A low price per unit allows consumers to buy frequently, as it is easily replaceable and very accessible to a wide consumer base regardless of their income levels. Easy availability through several retail points, such as tobacco shops, convenience stores, supermarkets, hypermarkets, and filling stations, ensures that consumers come across this product while they are performing their routine purchase activities. Impulse buying is high at the checkout counters where lighters are placed next to tobacco products. This pricing accessibility makes trying different designs and brands possible without major financial investments. High purchase frequency supports strong sales volumes despite low individual margins. The combination of affordability and omnichannel presence creates sustained demand momentum across the GCC cigarette lighter market.

Tourism Growth and Expatriate Population Dynamics

The GCC region's robust tourism sector and substantial expatriate workforce significantly contribute to cigarette lighter market growth. Data from the Dubai Department of Economy and Tourism reveals that the city welcomed 17.55 Million overnight visitors from January to November 2025, reflecting a 5 percent rise compared to the same timeframe in 2024. International visitors from diverse geographic backgrounds bring varying smoking habits and accessory preferences, generating consistent demand throughout the year. Major tourism destinations, including Dubai, Abu Dhabi, and Doha, attract millions of visitors annually who purchase lighters for personal use during their stays. The expatriate population, comprising workers from South Asia, Southeast Asia, Europe, and other regions, often exhibits smoking rates reflective of their home countries, sustaining baseline demand beyond the native population. Duty-free shopping opportunities at regional airports capitalize on traveler preferences for purchasing lighters as affordable souvenirs or personal supplies before departure.

Market Restraints:

What Challenges the GCC Cigarette Lighter Market is Facing?

Stringent Anti-Tobacco Regulations and Excise Taxation

GCC governments have introduced strict tobacco control measures that influence smoking behavior and related accessory markets. Higher excise duties on tobacco products increase overall smoking costs, which can reduce discretionary spending on accessories, such as cigarette lighters. Regulations, including public smoking bans, prominent health warnings, and limits on advertising, are designed to discourage tobacco use and shift consumer behavior over time. These policies may gradually lower smoking frequency, leading to softer demand for ignition products.

Rising Health Awareness and Anti-Smoking Campaigns

Increasing public health awareness regarding the harmful effects of tobacco consumption poses challenges to the cigarette lighter market in the GCC region. Government-sponsored anti-smoking campaigns, combined with healthcare provider initiatives, are educating populations about smoking-related diseases, including lung cancer, cardiovascular conditions, and respiratory ailments. This heightened awareness may encourage some consumers to reduce or quit smoking, potentially affecting long-term lighter demand patterns across the region.

Competition from Alternative Nicotine Products

The growing adoption of alternative nicotine delivery systems, including e-cigarettes, heated tobacco products, and nicotine pouches, presents competitive challenges to the traditional cigarette lighter market. These alternative products often do not require external ignition sources, potentially reducing the frequency of lighter purchases among consumers who transition from conventional cigarettes. The legalization and increasing availability of vaping devices in certain GCC markets may accelerate this shift among health-conscious smokers seeking perceived harm-reduction options.

Competitive Landscape:

The GCC cigarette lighter market exhibits a moderately fragmented competitive structure, characterized by the presence of both international manufacturers and regional distributors. Global brands leverage their established reputations, extensive distribution networks, and consistent product quality to maintain market leadership. Manufacturers compete through product differentiation strategies, including enhanced safety features, ergonomic designs, aesthetic customization options, and competitive pricing. Innovations in windproof technology, refillable mechanisms, and premium materials enable players to target specific consumer segments, ranging from budget-conscious buyers to luxury-oriented purchasers. Distribution partnerships with major retail chains, tobacco shops, and duty-free operators strengthen market penetration across the region.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Flint Cigarette Lighter, Electronic Cigarette Lighter, Others |

| Material Types Covered | Metal, Plastic, Others |

| Distribution Channels Covered | Tobacco Shops, Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC cigarette lighter market size was valued at USD 206.59 Million in 2025.

The GCC cigarette lighter market is expected to grow at a compound annual growth rate of 4.68% from 2026-2034 to reach USD 312 Million by 2034.

Flint cigarette lighter dominated the market with a share of 52.07%, driven by its reliable spark-based ignition mechanism, widespread consumer familiarity, and cost-effective production enabling affordable pricing across retail channels.

Key factors driving the GCC cigarette lighter market include expanding smoking population, affordable product pricing, widespread retail availability, growing tourism sector, substantial expatriate communities, and increasing demand for premium designer lighter variants.

Major challenges include stringent anti-tobacco regulations, substantial excise taxation on tobacco products, rising health awareness through government-sponsored campaigns, smoking bans in public spaces, and growing competition from alternative nicotine delivery systems, including e-cigarettes and heated tobacco products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)