GCC Coconut Water Market Size, Share, Trends and Forecast by Type, Flavor, Form, Packaging, Distribution Channel, and Country, 2026-2034

GCC Coconut Water Market Summary:

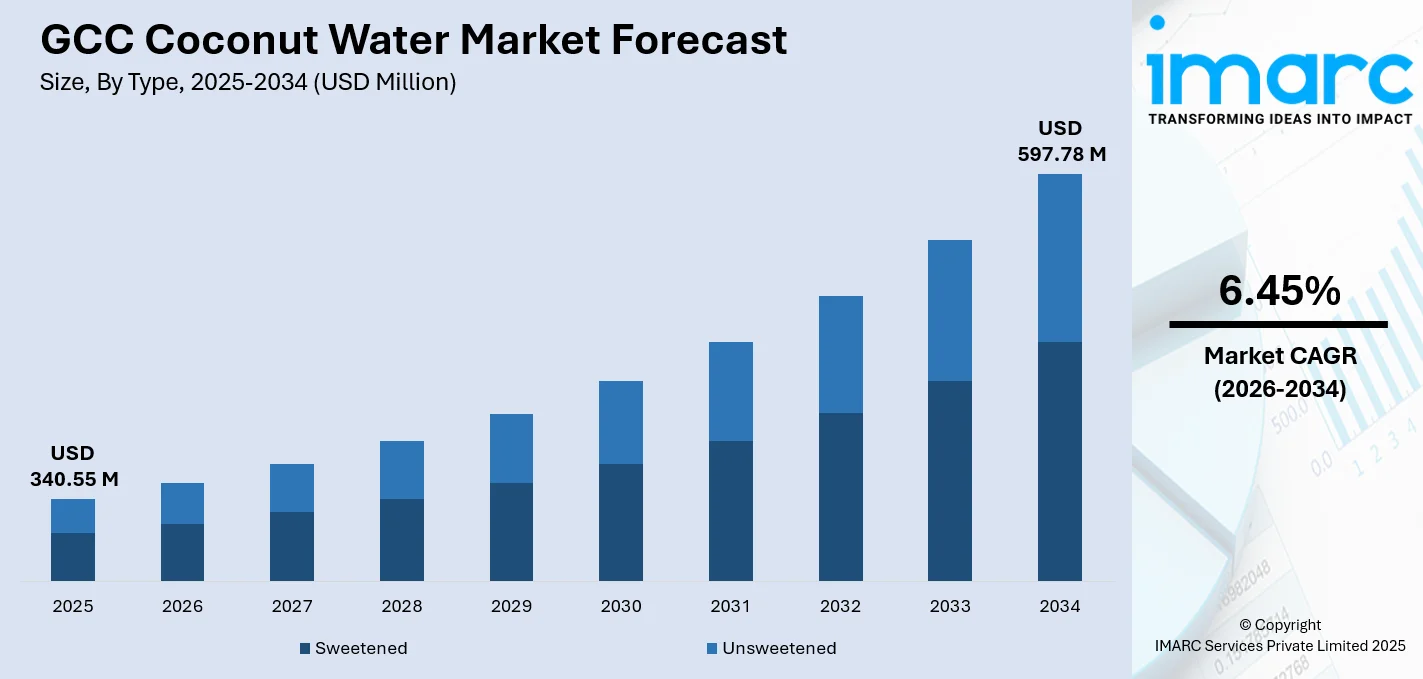

The GCC coconut water market size was valued at USD 340.55 Million in 2025 and is projected to reach USD 597.78 Million by 2034, growing at a compound annual growth rate of 6.45% from 2026-2034.

The market for coconut water in Gulf Cooperation Council is growing strongly due to a notable shift in customer preferences towards functional beverages and natural drinks. Demand is being stimulated because of a growing health and hygiene awareness among people and rising awareness about the health benefits of coconut water. Product accessibility is being fueled because of a growing fitness culture among Gulf countries. In addition, government initiatives promoting healthier living, especially under the Saudi Vision 2030 initiative, are accelerating the adoption of natural drinks and a reduction in sugar intake. As a result, coconut water is proving to be a preferred beverage among health and hygiene-minded people looking for a substitute for carbonated drinks and sugary drinks, and this will boost the market share of coconut water in country members of Gulf Cooperation Council.

Key Takeaways and Insights:

-

By Type: Unsweetened dominates the market with a share of 82% in 2025, driven by growing consumer preference for natural, sugar-free hydration options that align with health-conscious lifestyles and dietary requirements across the GCC region.

-

By Flavor: Flavoured leads the market with a share of 58% in 2025, reflecting strong consumer appetite for innovative taste experiences that combine hydration benefits with enhanced palatability and variety.

-

By Form: Coconut water exhibits a clear dominance with 92% share in 2025, owing to its ready-to-drink convenience, immediate consumption appeal, and natural electrolyte content preferred by fitness enthusiasts.

-

By Packaging: Carton represents the biggest segment with a market share of 52.24% in 2025, benefiting from superior shelf stability, cost efficiency, and established supply chain infrastructure enabling regional distribution.

-

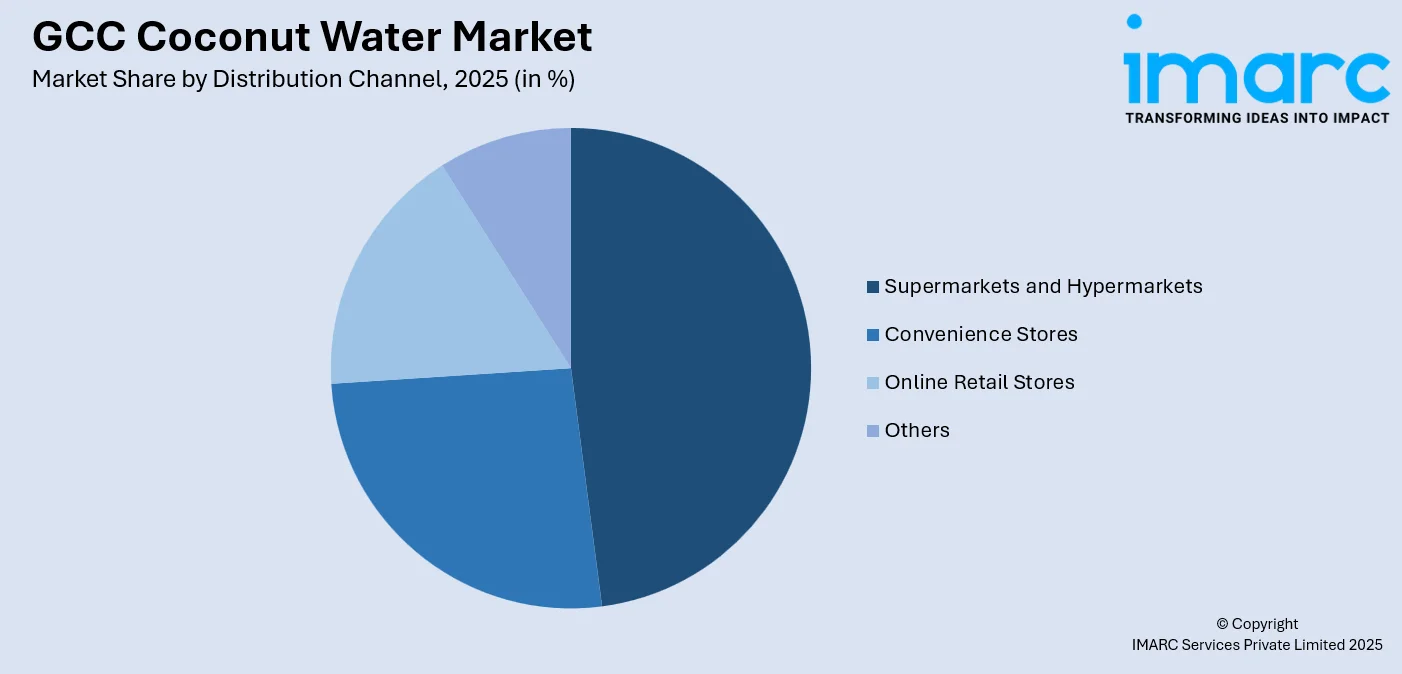

By Distribution channel: Supermarkets and hypermarkets dominate the market with a share of 47.87% in 2025, attributed to widespread product availability, competitive pricing, and frequent promotional offerings that enhance consumer accessibility.

-

By Country: Saudi Arabia is the largest country with 41% share in 2025, driven by the Kingdom's large population, rising health awareness, and government wellness initiatives promoting natural beverage consumption.

-

Key Players: Key players drive the GCC coconut water market by expanding product portfolios, introducing innovative flavors, and strengthening distribution networks. Their investments in marketing, premium positioning, and partnerships with retail chains boost awareness and accelerate adoption.

To get more information on this market Request Sample

The GCC coconut water market is developing as governments, businesses, and individuals adopt healthier hydration options in response to growing lifestyle-related health concerns. Refreshing drinks are naturally in demand because of the hot heat in the region, while growing urbanization coupled with rising disposable incomes enables premium product purchases. Health consciousness is accelerating the transition from sugary carbonated drinks to their natural alternatives, such as coconut water, as customers become increasingly interested in healthy ingredients in food and beverages and closely watch their meals to control body weight. Easy access to widely available products is ensured by the developing retail infrastructure with significant supermarket and hypermarket chains across the GCC. Market penetration is strengthened by growing e-commerce platforms and digital marketing tactics aimed at catching the attention of younger consumers, placing the GCC in a position to become a developing hub for high-end functional beverages.

GCC Coconut Water Market Trends:

Rising Demand for Functional and Natural Hydration Beverages

The market for coconut water in the Gulf Cooperation Council is undergoing a dramatic shift as consumers choose natural hydration options over those with artificial sweeteners. This change is especially noticeable among health-conscious professionals and fitness enthusiasts who are aware of the natural electrolyte profile of coconut water, which includes potassium, magnesium, and sodium. The market for functional beverages is still growing as customers look for beverages that provide more than just hydration. Younger generations have a particularly strong preference for natural beverages that complement active lifestyles and wellness practices, which will continue the expansion of the GCC coconut water market over the course of the forecast period.

Expansion of Flavored and Premium Coconut Water Varieties

Since businesses recognize the importance of variability in taste as a significant factor in the differentiation of retail competition, R&D in the field of flavor creation has emerged as a significant trend that redefines the GCC Coconut Waters market. Tropical fruits such as pineapple, mango, and passion fruits are being blended with valuable compounds by various businesses to craft a combination of complex tastes, unlike the usual mix of fruits. The use of clean labels, certifications by the USDA as organic, and environmentally responsible procurement practices are featured in the premium labeling strategies, which also target consumers who feel the need to protect the environment.

Digital Commerce and Modern Retail Channel Proliferation

The rapid expansion of modern retail formats and e-commerce platforms is transforming coconut water distribution across the GCC region. Supermarkets, hypermarkets, and convenience stores are increasingly dedicating shelf space to coconut water products due to rising consumer demand, while online grocery platforms enhance accessibility for consumers throughout urban and suburban areas. Digital marketing strategies leveraging social media promotions effectively target health-conscious consumers, particularly younger demographics. The convenience of online shopping, accelerated by shifting consumer behaviors, continues driving beverage sales through digital channels and strengthening omnichannel market presence.

Market Outlook 2026-2034:

The GCC coconut water market is positioned for sustained expansion throughout the forecast period, driven by converging macroeconomic trends, demographic shifts, and evolving consumer preferences that collectively support long-term category growth. Health and wellness trends show no signs of moderating, with younger generations demonstrating particularly strong affinity for natural, functional beverages aligning with active lifestyles and nutritional awareness. The market generated a revenue of USD 340.55 Million in 2025 and is projected to reach a revenue of USD 597.78 Million by 2034, growing at a compound annual growth rate of 6.45% from 2026-2034. The increasing penetration of premium and organic coconut water products, combined with expanding distribution networks and growing hospitality sector demand, will continue propelling market advancement. Government initiatives promoting public health and reduced sugar consumption across GCC nations provide additional impetus for natural beverage adoption.

GCC Coconut Water Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Unsweetened | 82% |

| Flavor | Flavoured | 58% |

| Form | Coconut Water | 92% |

| Packaging | Carton | 52.24% |

| Distribution Channel | Supermarkets and Hypermarkets | 47.87% |

| Country | Saudi Arabia | 41% |

Type Insights:

- Sweetened

- Unsweetened

Unsweetened dominates with a market share of 82% of the total GCC coconut water market in 2025.

Unsweetened coconut water has emerged as the preferred choice among GCC consumers who increasingly prioritize natural hydration solutions without added sugars. This segment's dominance reflects growing health consciousness across the region, with consumers actively seeking beverages that offer nutritional benefits while aligning with dietary preferences including low-sugar and ketogenic lifestyles. The authentic taste profile of unsweetened variants appeals to purists seeking unadulterated coconut water experiences, positioning this segment as a staple among fitness enthusiasts and wellness-focused individuals.

The preference for unsweetened coconut water is particularly pronounced among urban professionals and athletes who recognize its natural electrolyte content for hydration and recovery. Clean-label positioning emphasizing minimal processing and absence of artificial additives resonates with consumers demanding ingredient transparency. The growing tendency among GCC consumers to actively monitor their diets and manage weight is driving demand for sugar-free beverage alternatives. Premium pricing justified by perceived purity and health benefits enables market penetration across upscale retail channels and health food stores.

Flavor Insights:

- Plain

- Flavoured

Flavoured leads with a share of 58% of the total GCC coconut water market in 2025.

Flavoured coconut water variants have captured consumer imagination across the GCC region by offering diverse taste experiences that combine natural hydration benefits with enhanced palatability. Manufacturers are introducing sophisticated flavor profiles incorporating tropical fruits such as pineapple, mango, and passion fruit, alongside innovative combinations featuring functional ingredients. This product diversification strategy enables brands to attract broader consumer demographics while differentiating themselves in competitive retail environments where shelf space commands premium positioning. The ability to cater to varying taste preferences while maintaining the inherent health benefits of coconut water strengthens this segment's market appeal.

The segment's growth trajectory reflects consumer appetite for experiential beverages that transcend traditional hydration purposes. Flavoured variants particularly appeal to younger consumers and families seeking healthier alternatives to sugary drinks while maintaining taste appeal. The beverage's growing mainstream acceptance in sports, wellness, and hospitality contexts further reinforces demand. In February 2024, Inter Miami CF signed the first official sports partnership incorporating coconut water with 100 Coconuts, highlighting the beverage's mainstream acceptance in sports and wellness contexts. Flavoured variants particularly appeal to younger consumers and families seeking healthier alternatives to sugary drinks while maintaining taste appeal. Strategic marketing positioning these products as premium refreshments suitable for various consumption occasions continues strengthening segment performance.

Form Insights:

- Coconut Water

- Coconut Water Powder

Coconut water exhibits a clear dominance with a 92% share of the total GCC coconut water market in 2025.

Ready-to-drink coconut water maintains overwhelming market dominance due to its immediate consumption convenience and natural electrolyte profile that appeals to health-conscious consumers seeking instant hydration solutions. The liquid format preserves the authentic taste and nutritional integrity of fresh coconut water, offering consumers a pure beverage experience without preparation requirements. This segment particularly resonates with fitness enthusiasts who value portable hydration options for post-workout recovery and gym consumption. The ready-to-drink format aligns perfectly with modern on-the-go lifestyles prevalent across urbanized GCC populations.

The popularity of ready-to-drink coconut water extends across multiple consumption occasions, from athletic activities to casual refreshment and hospitality settings. Hotels, restaurants, and wellness centers increasingly feature coconut water on their menus, recognizing its appeal among health-oriented guests. Consumer demand for functional and plant-based beverages continues driving category growth as coconut water becomes a preferred alternative to artificial energy drinks and sugary soft beverages across diverse demographic segments. The segment's versatility as both a standalone refreshment and a mixer in smoothies and cocktails further broadens its consumption appeal throughout the region.

Packaging Insights:

- Carton

- Bottles

- Others

Carton represents the leading segment with a 52.24% share of the total GCC coconut water market in 2025.

Carton dominates the GCC coconut water market due to its superior effectiveness in preserving product quality and extending shelf life without requiring preservatives or refrigeration. Tetra Pak and similar aseptic packaging solutions protect contents from light and air exposure, maintaining natural flavor and nutritional value throughout distribution. The lightweight and cost-efficient nature of carton packaging enables effective transportation and storage, reducing operational costs while ensuring product freshness across extensive retail networks. The multi-layered construction incorporating paperboard, polyethylene, and aluminum provides robust barriers against environmental factors that could compromise product integrity.

Sustainability considerations increasingly influence packaging preferences among environmentally conscious consumers. Cartons constructed primarily from renewable paperboard materials sourced from responsibly managed forests align with growing demand for eco-friendly packaging alternatives. The recyclable nature of carton components appeals to consumers prioritizing environmental responsibility in their purchasing decisions. Aseptic carton technology enables extended product shelf life and global distribution efficiency, making this format particularly suitable for the GCC region's import-dependent coconut water supply chain where products travel considerable distances from tropical production centers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Supermarkets and hypermarkets dominate with a share of 47.87% of the total GCC coconut water market in 2025.

Supermarkets and hypermarkets maintain distribution dominance across the GCC coconut water market due to widespread availability and convenience offered to consumers seeking diverse product selections under one roof. Major retail chains provide extensive coconut water offerings, enabling consumers to compare brands, variants, and pricing efficiently. Competitive pricing strategies and frequent promotional campaigns enhance consumer appeal, while strategic store locations across urban centers ensure accessibility for the region's diverse population. The organized retail environment creates favorable conditions for product discovery and impulse purchases among health-conscious shoppers.

Modern retail infrastructure development across the GCC continues strengthening this channel's market position. Supermarkets and hypermarkets account for the dominant share of total consumer spending in the grocery retail sector, reflecting established consumer preferences for organized retail formats. Leading retail chains operate extensive store networks spanning all GCC nations, ensuring comprehensive geographic coverage. These retail giants increasingly dedicate shelf space to health and wellness beverages, providing coconut water brands with crucial visibility and consumer access points. Enhanced in-store merchandising and dedicated health beverage sections further support product awareness and trial among mainstream consumers.

Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Saudi Arabia holds the largest share with 41% of the total GCC coconut water market in 2025.

Saudi Arabia's market leadership reflects the Kingdom's substantial population base, rising health consciousness, and government commitment to promoting healthier lifestyles under the Vision 2030 framework. The Quality of Life Programme specifically aims to significantly increase physical activity participation rates, creating favorable conditions for functional beverage adoption. Increasing disposable incomes and urbanization enable consumers to invest in premium health products, while expanding retail infrastructure ensures widespread product accessibility across major cities including Riyadh, Jeddah, and Dammam.

The Kingdom's youthful demographic profile drives demand for trendy, healthy, and convenient beverage options. Government campaigns encouraging reduced sugar consumption further support coconut water's positioning as a healthier alternative to traditional sodas and juices. The Saudi Food and Drug Authority's regulatory framework ensures product safety and quality standards, enhancing consumer confidence. With the Saudi Arabia health and wellness market valued at USD 38,747.7 Million in 2025 and projected to reach USD 85,661.6 Million by 2034, the broader wellness ecosystem provides substantial growth opportunities for coconut water brands targeting health-conscious consumers.

Market Dynamics:

Growth Drivers:

Why is the GCC Coconut Water Market Growing?

Rising Health Consciousness and Wellness Trends

The GCC coconut water market is experiencing robust growth driven by escalating health consciousness among the region's population, who increasingly recognize the adverse effects of sugary beverages and carbonated drinks on overall well-being. Consumers are actively seeking healthier alternatives that provide natural hydration without artificial additives, positioning coconut water as a preferred choice due to its inherent electrolyte content and low-calorie profile. The region's demographic composition, characterized by a significant young and health-aware population, demonstrates particularly strong affinity for functional beverages aligning with active lifestyles and fitness routines. This wellness orientation is further reinforced by rising awareness of lifestyle-related health conditions, motivating dietary modifications that favor natural and nutrient-rich beverage options. GCC nations witness elevated obesity rates that prompt consumers to actively seek healthier alternatives. A growing proportion of consumers across the region actively look for healthy ingredients in food and beverages, while many report following diets to manage their weight. This health consciousness fundamentally reshapes beverage consumption patterns, creating sustained demand for coconut water as a guilt-free hydration solution.

Government Initiatives Promoting Healthy Lifestyles

Government-led wellness initiatives across GCC nations provide substantial impetus for natural beverage adoption, creating policy environments that encourage reduced sugar consumption and healthier dietary choices. Saudi Arabia's Vision 2030 framework, with its emphasis on improving public health outcomes, directly supports market expansion through various programs promoting physical activity and nutritional awareness. The Quality of Life Programme specifically targets increasing sports participation rates, indirectly boosting demand for functional hydration beverages among active consumers. Similar national development agendas across the UAE, Qatar, and other Gulf states prioritize healthcare infrastructure and wellness tourism, generating spillover benefits for the health beverage sector. Government campaigns discouraging carbonated drink consumption and promoting natural alternatives create favorable market conditions for coconut water positioning. The rapid expansion of health and fitness clubs across the Kingdom reflects substantial investment in wellness infrastructure that supports functional beverage demand. These coordinated policy efforts fundamentally transform consumer behavior patterns and create durable growth foundations for natural hydration products.

Expanding Modern Retail and E-Commerce Infrastructure

The proliferation of modern retail formats and digital commerce platforms significantly enhances coconut water accessibility across the GCC region, enabling brands to reach diverse consumer segments through multiple distribution channels. Supermarkets, hypermarkets, and specialty health stores increasingly dedicate shelf space to functional beverages as consumer demand intensifies, providing crucial visibility for coconut water products. Major retail chains continue expanding their footprints. The e-commerce revolution has accelerated beverage distribution, with online grocery platforms making coconut water accessible to consumers throughout urban and suburban areas. Digital marketing capabilities enable targeted promotional campaigns reaching health-conscious demographics through social media and influencer partnerships. UAE grocery retail sector demonstrates the significance of organized retail. The continued investment in retail infrastructure and digital commerce capabilities ensures coconut water brands can effectively penetrate diverse market segments and geographic locations.

Market Restraints:

What Challenges the GCC Coconut Water Market is Facing?

Premium Pricing and Price Sensitivity

Premium coconut water products command higher price points compared to conventional beverages, creating affordability barriers for price-sensitive consumer segments across the GCC market. The imported nature of coconut water necessitates significant logistics and supply chain costs that translate into retail pricing premiums. While health-conscious consumers with higher disposable incomes willingly pay for natural hydration solutions, broader market penetration remains constrained by cost considerations. Competing beverages including traditional soft drinks and locally produced refreshments offer significantly lower price points that appeal to budget-conscious shoppers.

Supply Chain Dependencies and Import Reliance

The GCC region's complete dependence on imported coconut water products creates supply chain vulnerabilities that impact market stability and pricing consistency. Coconuts are not cultivated domestically within Gulf nations, requiring sourcing from distant production centers including Thailand, Indonesia, the Philippines, and India. This import reliance exposes the market to fluctuations in global commodity prices, transportation costs, and potential supply disruptions. Geopolitical factors, shipping constraints, and production variations in source countries can affect product availability and pricing. The extended supply chain also presents challenges for maintaining product freshness and quality standards.

Competition from Established Traditional Beverages

Traditional beverages including laban, tamarind juice, and various regional refreshments maintain strong cultural significance and consumer loyalty across GCC markets, presenting competitive challenges for coconut water adoption. Established soft drink brands with substantial marketing budgets and distribution networks command significant shelf space and consumer mindshare. Consumer education regarding coconut water's specific health benefits remains incomplete among certain demographic segments unfamiliar with the beverage category. The relatively recent market entry of coconut water in the region means brand awareness and consumption habits are still developing compared to deeply entrenched beverage alternatives.

Competitive Landscape:

The GCC coconut water market exhibits a moderately competitive structure characterized by the presence of established international brands alongside emerging regional players. Market participants compete through product innovation, flavor diversification, premium positioning, and strategic distribution partnerships. Companies are focusing on expanding product portfolios to capture diverse consumer preferences while strengthening retail relationships for enhanced shelf visibility. Investment in marketing campaigns emphasizing natural health benefits and sustainability credentials differentiates brands in competitive retail environments. Strategic collaborations with fitness centers, hospitality establishments, and wellness retailers expand consumption occasions beyond traditional retail channels. The market witnesses continued entry of new players attracted by favorable growth projections, intensifying competition while driving innovation.

Recent Developments:

-

In December 2025, Global Coconut Farmers Company Ltd. launched Coco Neera in Dubai, a 100% natural, non-alcoholic, preservative-free coconut sap drink. The product is tetra-packed without preservatives using an innovative method developed by the Central Plantation Crops Research Institute, targeting health-conscious consumers seeking natural hydration solutions in the GCC market.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Sweetened, Unsweetened |

| Flavors Covered | Plain, Flavoured |

| Forms Covered | Coconut Water, Coconut Water Powder |

| Packagings Covered | Carton, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail Stores, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC coconut water market size was valued at USD 340.55 Million in 2025.

The GCC coconut water market is expected to grow at a compound annual growth rate of 6.45% from 2026-2034 to reach USD 597.78 Million by 2034.

Unsweetened dominated the market with a share of 82%, driven by growing consumer preference for natural, sugar-free hydration options that align with health-conscious lifestyles and dietary requirements across the GCC region.

Key factors driving the GCC coconut water market include rising health consciousness, government wellness initiatives under Vision 2030, expanding modern retail infrastructure, growing fitness culture, and increasing consumer shift from sugary carbonated beverages to natural hydration alternatives.

Major challenges include premium pricing compared to conventional beverages, complete dependence on imports creating supply chain vulnerabilities, competition from established traditional and carbonated beverages, limited consumer awareness in certain demographic segments, and fluctuations in global commodity prices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)