GCC Construction Flooring Chemical Market Size, Share, Trends and Forecast by Product, Type, Application, and Country, 2026-2034

GCC Construction Flooring Chemical Market Summary:

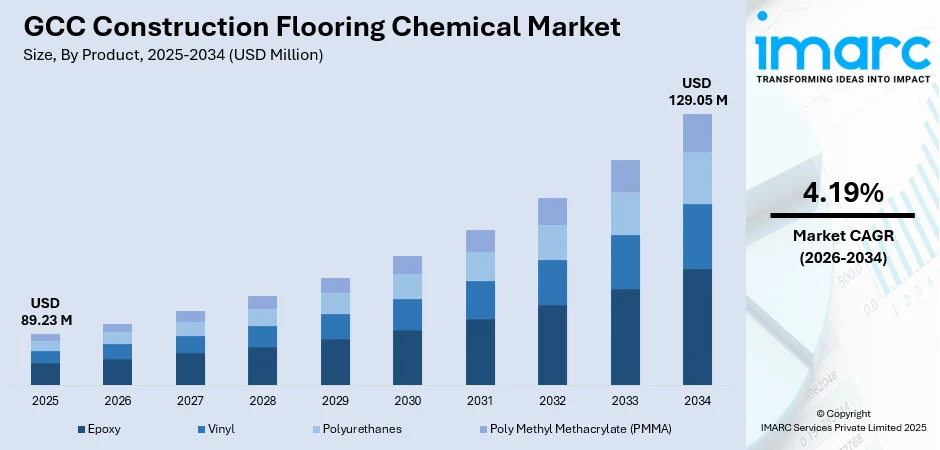

The GCC construction flooring chemical market size was valued at USD 89.23 Million in 2025 and is projected to reach USD 129.05 Million by 2034, growing at a compound annual growth rate of 4.19% during the 2026-2034.

The GCC construction flooring chemical market is experiencing strong momentum driven by large-scale infrastructure development and urban modernization programs across the region. The ongoing construction boom, particularly in Saudi Arabia and the UAE, continues to fuel demand for high-performance flooring solutions. Growing emphasis on sustainable construction practices and green building certifications is accelerating the adoption of eco-friendly flooring chemicals. Technological advancements in flooring formulations, coupled with rising commercial and industrial sector expansion, are reshaping the regional landscape and strengthening the GCC construction flooring chemical market share.

Key Takeaways and Insights:

- By Product: Epoxy leads the market with approximately 38% share in 2025, driven by its superior mechanical strength, chemical resistance, and widespread application in industrial and commercial flooring across the GCC region.

- By Type: Resilient flooring dominates the market with 35% share in 2025, owing to its durability, ease of maintenance, and growing preference in high-traffic commercial and institutional environments.

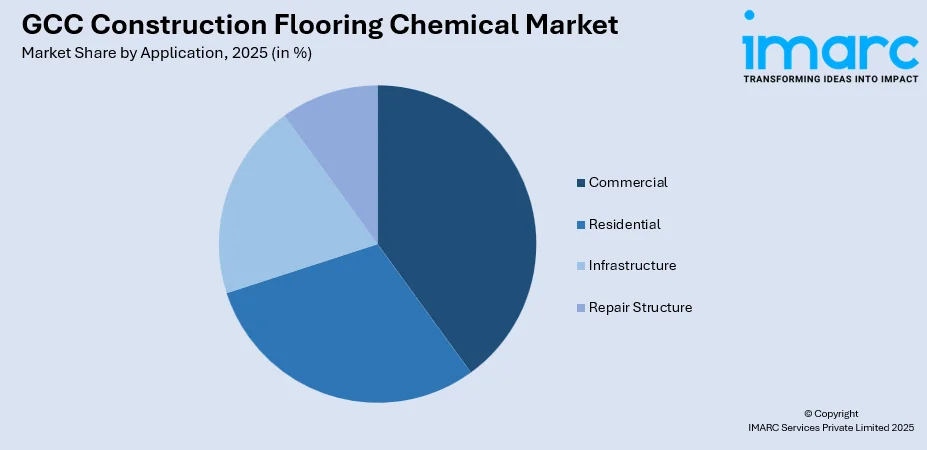

- By Application: Commercial sector leads the largest share at 40% in 2025, reflecting the rapid expansion of retail centers, hospitality establishments, healthcare facilities, and corporate offices throughout the GCC.

- Key Players: The GCC construction flooring chemical market is characterized by a competitive environment where both regional and international players emphasize innovation, eco-friendly formulations, and strategic collaborations. Companies are leveraging these approaches to strengthen their market position and take advantage of increasing infrastructure development and construction activities across the region.

To get more information on this market Request Sample

The GCC construction flooring chemical market is advancing as governments, developers, and industries embrace modern flooring solutions that combine durability with aesthetic appeal. The region's mega-projects are driving substantial demand for specialized flooring systems capable of withstanding extreme climatic conditions while meeting stringent performance standards. In March 2025, BASF and Sika jointly launched Baxxodur EC 151, a new epoxy hardener specifically designed for flooring applications in production plants, storage halls, and parking decks, featuring up to 90 percent less volatile organic compound emissions compared to conventional hardeners. This development exemplifies the industry's commitment to sustainable innovation and high-performance flooring solutions.

GCC Construction Flooring Chemical Market Trends:

Adoption of Low-VOC and Sustainable Flooring Chemicals

The move toward environmentally responsible flooring solutions is driving growth in the GCC construction flooring chemical market. For instance, in February 2025, Messara Living has revealed an exclusive collaboration with Kiwi to launch their innovative hybrid-resilient flooring in the Middle East. This inaugural partnership brings a cutting-edge, environmentally friendly flooring solution to the GCC region, combining sustainability with advanced performance features. Manufacturers are creating low-VOC adhesives, coatings, and sealants that comply with green building standards and support improved indoor air quality. These eco-friendly products are gaining strong adoption as developers aim for certifications such as LEED and Estidama. Companies like BASF and Sika have introduced advanced epoxy hardeners designed to significantly reduce volatile organic compound emissions compared to conventional alternatives.

Rapid-Curing Systems for Fast-Track Construction

The demand for rapid-curing flooring systems is rising as construction schedules become increasingly tight. Poly methyl methacrylate and hybrid methyl methacrylate-urethane systems that cure quickly at ambient temperatures are gaining popularity. These fast-curing solutions minimize project downtime and allow facilities to be reoccupied sooner. They are especially favored for emergency repairs and applications in colder climates, where timely installation and quick functionality are critical for maintaining operational continuity.

Integration of Smart and High-Performance Flooring Technologies

Advanced flooring technologies featuring antimicrobial coatings, anti-slip properties, and electrostatic discharge protection are transforming commercial and industrial applications. For instance, Smart building integration is driving demand for flooring systems compatible with digital management platforms. In line with this, the GCC smart cities market size reached USD 16.67 Billion in 2024. The market is projected to reach USD 68.05 Billion by 2033, exhibiting a growth rate (CAGR) of 15.1% during 2025-2033. Moreover, these high-performance solutions address specific operational requirements in healthcare facilities, pharmaceutical plants, electronics manufacturing, and food processing establishments across the GCC region.

Market Outlook 2026-2034:

The GCC construction flooring chemical market is positioned for sustained expansion as regional economies diversify and infrastructure investments accelerate. The market is driven by mega-projects, commercial sector growth, and rising demand for sustainable flooring solutions. Technological innovations in rapid-curing systems, low-emission formulations, and high-performance coatings will reshape market dynamics. The emphasis on green building practices and smart city development will continue to drive the adoption of advanced flooring chemicals across residential, commercial, and infrastructure applications. The market generated a revenue of USD 89.23 Million in 2025 and is projected to reach a revenue of USD 129.05 Million by 2034, growing at a compound annual growth rate of 4.19% from 2026-2034.

GCC Construction Flooring Chemical Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Epoxy | 38% |

| Type | Resilient | 35% |

| Application | Commercial | 40% |

Product Insights:

- Epoxy

- Vinyl

- Polyurethanes

- Poly Methyl Methacrylate (PMMA)

Epoxy dominates the GCC construction flooring chemical market with approximately 38% share in 2025.

Epoxy-based flooring solutions hold a leading position in the GCC construction flooring chemical market due to their superior durability, chemical resistance, and long service life. These systems are highly favored in commercial, industrial, and infrastructure projects where floors must withstand heavy foot traffic, machinery, and exposure to harsh chemicals. Contractors and developers prefer epoxy coatings for their ability to provide seamless, easy-to-clean surfaces that enhance safety and operational efficiency, making them a reliable choice for high-performance flooring applications.

The dominance of epoxy is further reinforced by its versatility and adaptability to different substrate types and environmental conditions. Epoxy systems can be customized with additives for anti-slip, antimicrobial, or aesthetic enhancements, meeting specific project requirements in sectors such as healthcare, manufacturing, hospitality, and retail. Additionally, rapid-curing epoxy formulations reduce project downtime and accelerate facility reoccupation, making them highly attractive for large-scale commercial and industrial projects across the GCC region.

Type Insights:

- Soft Covering

- Resilient

- Non-resilient

- Others

Resilient flooring leads the GCC construction flooring chemical market with the largest share at 35%, establishing its position as the leading type category in 2025.

Resilient flooring holds the largest segment in the market, commanding a substantial share due to its durability, versatility, and cost-effectiveness. This category of flooring encompasses materials such as vinyl, linoleum, and rubber, which offer durability under heavy foot traffic while preserving visual appeal. Its low maintenance requirements, strong resistance to wear, and adaptability to various commercial and industrial settings make it a favored option for offices, retail outlets, healthcare centers, and educational institutions.

The popularity of resilient flooring is further reinforced by its adaptability to design trends and functional requirements. It offers customizable finishes, patterns, and colors, enabling architects and designers to achieve both practical and aesthetic objectives. Additionally, resilient flooring can be paired with advanced coatings, anti-slip treatments, and antimicrobial finishes, enhancing safety and hygiene in high-traffic areas. Its durability and minimal upkeep requirements make it a cost-effective and environmentally friendly choice suitable for diverse applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Infrastructure

- Repair Structure

Commercial sector dominates the GCC construction flooring chemical market with the highest revenue share at 40%, reflecting robust expansion in 2025.

The commercial sector dominates the GCC construction flooring chemical market, capturing the largest revenue share due to rapid urbanization and the expansion of retail, office, hospitality, and institutional projects. Developers and contractors increasingly demand high-performance flooring solutions that combine durability, aesthetic appeal, and safety features such as anti-slip and chemical resistance. The sector’s growth is also driven by stringent regulatory standards, including fire safety and hygiene requirements, which necessitate the use of advanced adhesives, coatings, and sealants for commercial applications.

In addition, the commercial segment benefits from the integration of smart building technologies and sustainable construction practices. Flooring solutions that support rapid curing, low emissions, and long-term maintenance efficiency are particularly valued in high-traffic commercial environments. The focus on operational efficiency, occupant safety, and compliance with green building certifications such as LEED and Estidama continues to propel demand, making the commercial sector a key driver of revenue and innovation in the GCC flooring chemicals market.

Regional Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

In Saudi Arabia, the flooring chemical market is driven by large-scale infrastructure projects, industrial development, and government-backed initiatives such as Vision 2030. Demand is rising for high-performance coatings, adhesives, and sealants that provide durability, chemical resistance, and aesthetic appeal. The push for sustainable construction and green building practices also encourages the adoption of low-VOC and eco-friendly flooring solutions in commercial, residential, and industrial applications.

The UAE market is fueled by rapid urbanization, luxury commercial projects, and expanding hospitality and retail sectors. Developers increasingly prefer advanced flooring chemicals with properties like rapid curing, anti-slip, and high durability to meet stringent safety and aesthetic standards. Sustainability initiatives, including LEED and Estidama certifications, further drive demand for low-emission and environmentally friendly adhesives, coatings, and sealants across residential, commercial, and infrastructure projects.

Qatar’s construction flooring chemical market benefits from ongoing infrastructure expansion, including stadiums, hotels, and commercial complexes, ahead of international events and urban development plans. The demand for high-performance, fast-curing, and durable flooring systems is increasing, particularly for industrial and large-scale commercial applications. Government regulations promoting environmentally responsible construction and the adoption of low-VOC adhesives and coatings support the market’s growth in both new construction and renovation projects.

In Kuwait, flooring chemical demand is driven by modern commercial developments, luxury residential projects, and infrastructure upgrades. The market favors products that enhance durability, chemical resistance, and ease of maintenance. Sustainability and energy efficiency initiatives encourage adoption of eco-friendly adhesives, coatings, and sealants, while innovations such as rapid-curing systems help reduce project timelines, making advanced flooring chemicals essential for meeting accelerated construction schedules.

Oman’s market growth is supported by ongoing infrastructure projects, including commercial buildings, hotels, and industrial facilities. Demand is rising for high-performance flooring chemicals with anti-slip, moisture-resistant, and durable properties to withstand heavy foot traffic and environmental challenges. The increasing adoption of green building practices and eco-friendly materials, alongside initiatives to improve project efficiency with fast-curing systems, continues to boost the use of advanced flooring chemicals across the country.

In Bahrain, construction flooring chemical demand is driven by urban development, commercial expansion, and the hospitality sector. Developers and contractors seek adhesives, coatings, and sealants that provide long-lasting performance, aesthetic appeal, and safety features such as anti-slip properties. The market is further supported by a focus on sustainable construction, low-emission products, and innovations in rapid-curing and high-performance formulations, ensuring faster project completion and enhanced operational efficiency in residential, commercial, and infrastructure projects.

Market Dynamics:

Growth Drivers:

Why is the GCC Construction Flooring Chemical Market Growing?

Unprecedented Infrastructure Development and Mega-Projects

The GCC region is experiencing an extraordinary construction boom driven by ambitious national visions and diversification strategies. At present, more than 5,000 projects, with a combined value of $5 trillion, are in progress, highlighting Saudi Arabia’s significant strides in transforming its economic and social framework. The Kingdom's construction output is expected to grow at an annual average rate of 5.2 percent from 2025 to 2028. Significant projects, such as NEOM's The Line, the Mukaab development, and the Jeddah Central initiative, are driving exceptional demand for specialized flooring solutions. In Qatar, the Public Works Authority unveiled a QR 81 billion five-year infrastructure plan for 2025-2029, representing the country's largest development program in history. These massive investments are translating into sustained demand for high-performance construction flooring chemicals across industrial, commercial, and residential applications.

Rising Adoption of Green Building Standards and Sustainability Mandates

Environmental sustainability is becoming a cornerstone of construction practices across the GCC, driving demand for eco-friendly flooring chemicals. The UAE has established itself as a global leader with over 600 LEED-registered projects, ranking third worldwide for green building certifications. Abu Dhabi's Estidama Pearl Rating System mandates sustainable standards for all new buildings, while Dubai's Green Building Regulations require compliance with environmental performance benchmarks. The GCC green building materials market size reached USD 10.6 Billion in 2024. Looking forward, the market is expected to reach USD 28.8 Billion by 2033, exhibiting a growth rate (CAGR) of 10.7% during 2025-2033. These regulatory frameworks are accelerating adoption of low-VOC adhesives, sustainable coatings, and environmentally responsible flooring solutions that meet stringent indoor air quality standards.

Expansion of Commercial and Industrial Sectors

The rapid growth of commercial establishments and industrial facilities across the GCC is fueling demand for durable and high-performance flooring chemicals. The region is witnessing significant expansion in retail centers, hospitality venues, healthcare facilities, and food and beverage manufacturing plants. The establishment of the Dubai Food Park and similar agro-industrial initiatives are encouraging investment in food manufacturing facilities requiring specialized industrial flooring. Saudi Arabia's construction of data centers, including discussions for a massive SAR 48 billion facility at Oxagon, reflects the diversification of industrial applications requiring advanced flooring solutions. The Ministry of Municipal, Rural Affairs, and Housing's goal of delivering 365,000 new housing units by 2025 further amplifies demand for residential flooring chemicals.

Market Restraints:

What Challenges the GCC Construction Flooring Chemical Market is Facing?

High Initial Investment Costs for Premium Flooring Solutions

The upfront costs associated with advanced flooring chemical systems remain significantly higher than conventional alternatives, limiting adoption among cost-sensitive project developers. Premium epoxy, polyurethane, and specialized coating systems require substantial investment in materials and installation expertise, creating barriers for smaller construction projects and budget-constrained developments.

Supply Chain Vulnerabilities and Import Dependencies

The GCC construction flooring chemical market relies heavily on imported raw materials and finished products, creating supply chain vulnerabilities. Limited local manufacturing capacity exposes the market to global logistics disruptions, currency fluctuations, and extended lead times. These dependencies can impact project timelines and increase overall costs for construction stakeholders.

Skilled Labor Shortages for Specialized Flooring Installation

The installation of advanced flooring systems requires specialized technical expertise that remains in short supply across the GCC region. Proper application of epoxy, polyurethane, and rapid-curing systems demands trained professionals to ensure optimal performance and longevity. The shortage of skilled installers can affect quality outcomes and limit the adoption of sophisticated flooring technologies.

Competitive Landscape:

The GCC construction flooring chemical market features a competitive landscape with global chemical manufacturers and regional players vying for market share. Companies are focusing on product innovation, sustainable formulations, and strategic expansions to strengthen their regional presence. Key strategies include localized manufacturing, partnerships with construction developers, and development of climate-adapted flooring solutions. The market is witnessing increased merger and acquisition activity as major players seek to consolidate their positions and expand product portfolios across the value chain.

Recent Developments:

- February 2024: MAPEI acquired Bitumat, a leading waterproofing systems manufacturer based in Dammam, Saudi Arabia, and completed a new manufacturing plant in Tabuk to serve major projects including NEOM. This expansion strengthens MAPEI's footprint in the Middle East construction chemicals market.

- June 2024: Saint-Gobain agreed to acquire Fosroc, a construction chemicals manufacturer with manufacturing locations in Jeddah and Dammam, Saudi Arabia, as well as Dubai, for approximately EUR 960 million. The acquisition aims to strengthen Saint-Gobain's presence in high-growth Middle East and India markets.

GCC Construction Flooring Chemical Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Epoxy, Vinyl, Polyurethanes, Poly Methyl Methacrylate (PMMA) |

| Types Covered | Soft Covering, Resilient, Non-resilient, Others |

| Applications Covered | Residential, Commercial, Infrastructure, Repair Structure |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC construction flooring chemical market size was valued at USD 89.23 Million in 2025.

The GCC construction flooring chemical market is expected to grow at a compound annual growth rate of 4.19% from 2026-2034 to reach USD 129.05 Million by 2034.

Epoxy, holding the largest revenue share of 38%, remains pivotal for the GCC construction flooring chemical market, offering exceptional mechanical strength, chemical resistance, and versatile application across industrial and commercial flooring.

Key factors driving the GCC construction flooring chemical market include unprecedented infrastructure development under Vision 2030, expanding commercial and industrial sectors, rising adoption of green building standards, and growing demand for sustainable and high-performance flooring solutions.

Major challenges include high upfront costs for premium flooring solutions, supply chain vulnerabilities due to import dependencies, skilled labor shortages for specialized installation, and fluctuating raw material prices affecting manufacturing costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)