GCC Construction Market Size, Share, Trends and Forecast by Sector, and Country, 2026-2034

GCC Construction Market Summary

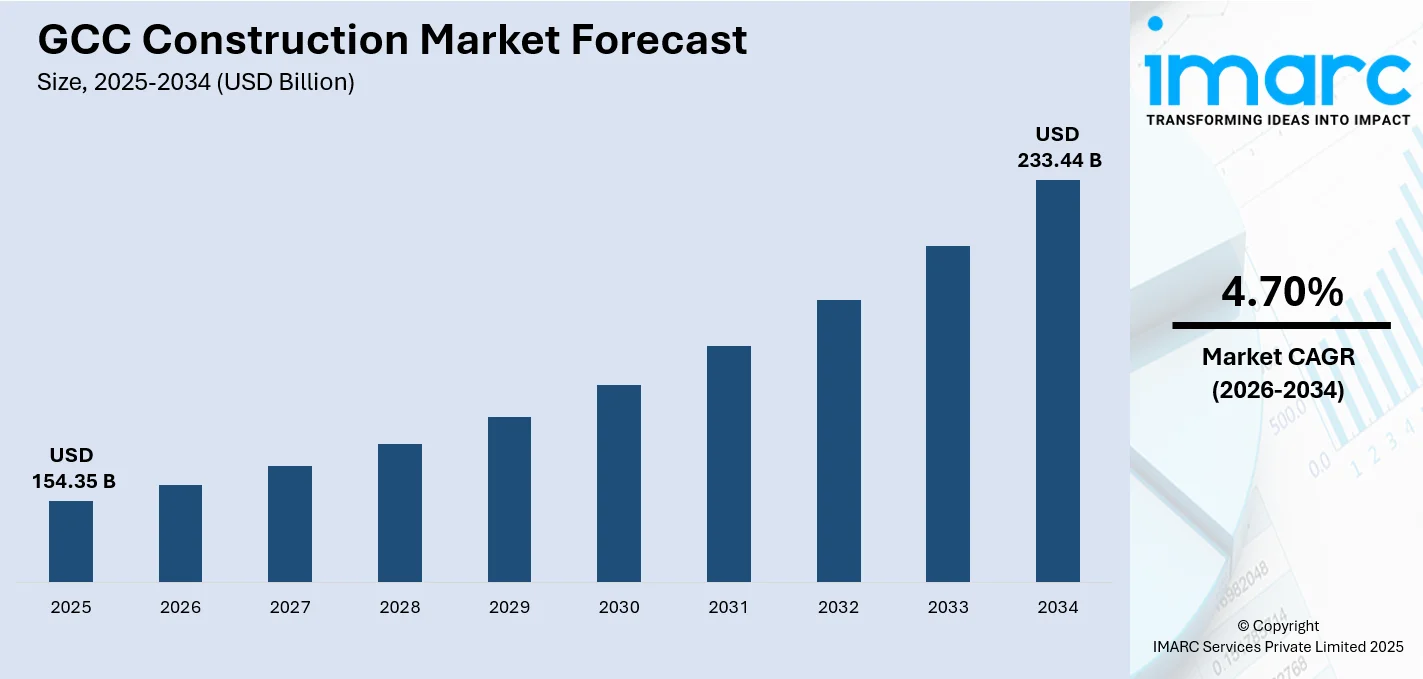

The GCC construction market size was valued at USD 154.35 Billion in 2025 and is projected to reach USD 233.44 Billion by 2034, growing at a compound annual growth rate of 4.70% from 2026-2034.

The GCC construction market represents a dynamic and transformative sector driven by ambitious urbanization initiatives, economic diversification strategies, and large-scale infrastructure modernization programs across the region. As Gulf nations continue their transition away from hydrocarbon dependency, construction activities have become central to national development visions, encompassing residential communities, commercial districts, industrial zones, transportation networks, and renewable energy installations that collectively reshape the regional built environment.

Key Takeaways and Insights:

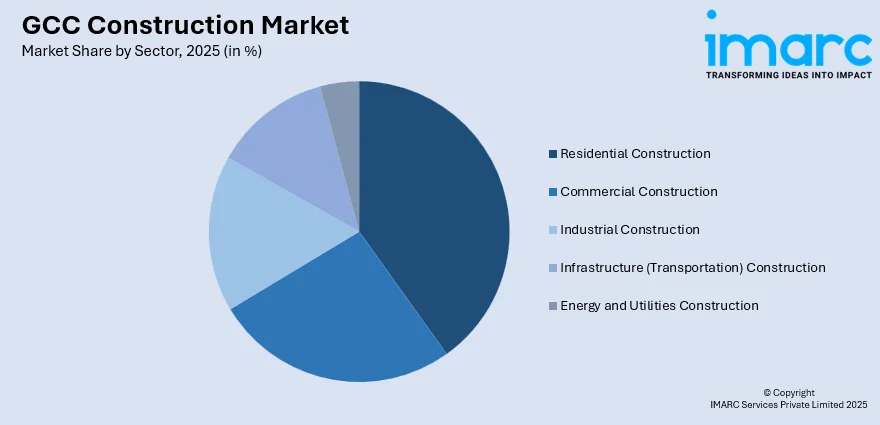

- By Sector: Residential construction dominates the market with a share 38.18 of in 2025, driven by population growth, government housing initiatives, and expanding middle-class demographics requiring modern living spaces across Gulf metropolitan areas

. - By Country: Saudi Arabia leads the regional market with the largest share of 38% in 2025, reflecting the kingdom's massive urban development programs, megaproject implementations, and comprehensive infrastructure expansion aligned with national transformation objectives.

- Key Players: The GCC construction market features a competitive landscape comprising international construction conglomerates, regional developers, specialized engineering firms, and local contractors competing across multiple project categories, price segments, and technical capabilities while navigating varying regulatory frameworks and procurement mechanisms.

To get more information on this market Request Sample

The construction sector across the Gulf Cooperation Council nations serves as a cornerstone of economic transformation, with governments channeling substantial investments into building modern cities, diversified industrial bases, and world-class infrastructure networks. The market encompasses a broad spectrum of activities ranging from high-rise residential towers and sprawling commercial complexes to advanced transportation systems and renewable energy facilities. This construction boom reflects not merely physical expansion but strategic positioning for post-oil economies, integrating smart city technologies, sustainability principles, and innovative architectural concepts that establish new benchmarks for urban development in arid climates.

GCC Construction Market Trends:

Digital Transformation and Construction Technology Integration

The regional construction sector experiences accelerating adoption of digital technologies including building information modeling, drone surveying, artificial intelligence-powered project management, and Internet of Things sensors for real-time monitoring. These technological integrations enhance project coordination, reduce material waste, improve safety protocols, and enable predictive maintenance capabilities that collectively elevate construction efficiency and quality standards. For instance, in October 2025, Qatar’s Ministry of Municipality launched an AI-Powered Building Permit System under the patronage of Prime Minister and Foreign Minister HE Sheikh Mohammed bin Abdulrahman bin Jassim Al Thani. The pioneering system aims to streamline public services and accelerate the country’s digital transformation, supporting the goals of Qatar National Vision 2030 and the Third National Development Strategy.

Sustainability and Green Building Emphasis

Environmental considerations increasingly influence construction methodologies across Gulf nations, with developers incorporating energy-efficient designs, renewable energy systems, water conservation technologies, and sustainable materials into building specifications. This sustainability focus responds to climate challenges, resource conservation objectives, and international environmental commitments while creating healthier indoor environments and reducing operational costs for building occupants. For instance, in October 2025, the UAE Ministry of Economy and Tourism (MoET), in collaboration with Expo City Dubai, launched the nation’s first Green Innovation District, promoting sustainability and technological advancement. The district marks a milestone in the UAE’s push to diversify its economy, fostering innovation and competitiveness in green technology and circular economy sectors while supporting long-term sustainable growth.

Modular and Prefabricated Construction Expansion

Off-site construction techniques gain prominence throughout the region as developers seek faster project delivery, enhanced quality control, reduced labor requirements, and minimized construction waste. Prefabrication facilities produce standardized building components under controlled conditions, enabling rapid assembly at project sites while maintaining consistent quality standards and reducing weather-related delays common in traditional construction approaches. For instance, in January 2025, DuBox, a leading regional provider of modular construction solutions and part of the AMANA group, has unveiled Productization, its latest offering providing ready-to-use turnkey solutions for clients across the region. Targeting the commercial sector, the company’s new Workbox concept delivers high-quality, scalable, and sustainably constructed office spaces that can be fully installed and operational within seven months, combining speed, efficiency, and modern design to meet growing demand for flexible, prefabricated commercial buildings.

Market Outlook 2026-2034:

The GCC construction market continues to benefit from strong regional development momentum, driven by ongoing megaprojects, infrastructure upgrades, and urban expansion across diverse sectors. Government-led initiatives supporting economic diversification, tourism growth, logistics hubs, and renewable energy projects are fueling steady demand for construction services. These strategic commitments provide clear visibility of a robust project pipeline, ensuring sustained activity in the sector. As a result, construction companies in the region are positioned to capitalize on long-term opportunities arising from both public and private sector developments across the GCC. The market generated revenue of USD 154.35 Billion in 2025 and is projected to reach revenue of USD 233.44 Billion by 2034, growing at a compound annual growth rate of 4.70% from 2026-2034.

GCC Construction Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

| Battery Technology | Lead-acid Battery |

48% |

| Application | Automotive |

33% |

Sector Insights:

Access the comprehensive market breakdown Request Sample

- Commercial Construction

- Residential Construction

- Industrial Construction

- Infrastructure (Transportation) Construction

- Energy and Utilities Construction

Residential construction dominates with a market share of 38.18% of the total GCC construction market in 2025.

The residential construction segment maintains commanding market leadership throughout the GCC region, reflecting fundamental demographic pressures, government-led housing programs, and evolving lifestyle preferences among Gulf populations. Rapid urbanization across major metropolitan areas creates continuous demand for diverse housing typologies ranging from affordable apartment complexes to luxury villa communities, with developers responding to varied income segments and cultural preferences. Government initiatives targeting citizen homeownership, particularly in Saudi Arabia and the United Arab Emirates, stimulate substantial residential project launches, while expatriate populations require rental accommodations fueling multi-family development across business districts and suburban zones.

This segment benefits from favorable financing mechanisms, including subsidized mortgages, developer payment plans, and banking sector support that enhance housing affordability and accessibility for target demographics. Architectural trends emphasize community amenities, smart home technologies, energy efficiency, and lifestyle-oriented design features that differentiate residential offerings in competitive urban markets. The ongoing development of new cities, satellite communities, and integrated townships ensures sustained residential construction activity, with master-planned developments incorporating schools, healthcare facilities, retail centers, and recreational spaces that create self-contained urban ecosystems meeting comprehensive resident needs throughout the forecast horizon.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia leads with a 38% share of the total GCC construction market in 2025.

Saudi Arabia dominates regional construction activity through unprecedented scale and scope of development initiatives aligned with national transformation goals and economic diversification strategies. The kingdom's ambitious megaprojects including new urban centers, entertainment destinations, tourism developments, and industrial complexes create extraordinary construction demand across multiple sectors and geographic locations. Government infrastructure investments targeting transportation networks, utilities expansion, educational facilities, and healthcare institutions supplement private sector developments, establishing comprehensive construction pipelines extending throughout the decade ahead.

The kingdom's demographic profile featuring a young, rapidly growing population necessitates substantial housing construction, commercial space development, and public facility expansion to accommodate evolving social and economic requirements. Regional development programs aim to distribute economic activity beyond traditional urban centers, spurring construction across secondary cities and previously underdeveloped areas while creating employment opportunities and improving living standards nationwide. The construction sector serves as a primary mechanism for Vision realization, translating strategic objectives into physical infrastructure, urban landscapes, and economic facilities that collectively position Saudi Arabia as a regional hub for tourism, logistics, manufacturing, and technology sectors throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the GCC Construction Market Growing?

National Vision Programs and Economic Diversification Initiatives

The transformative economic strategies implemented across Gulf nations fundamentally reshape regional construction demand patterns, with governments channeling massive investments into infrastructure, tourism, entertainment, logistics, and manufacturing sectors designed to reduce hydrocarbon dependency and create sustainable revenue streams. These comprehensive development programs encompass new city construction, existing urban area modernization, transportation network expansion, and industrial zone establishment that collectively require unprecedented construction volumes. National visions prioritize quality of life improvements, international competitiveness enhancement, and private sector growth stimulation through enabling infrastructure and attractive business environments. The long-term nature of these strategic initiatives ensures sustained construction activity throughout the forecast horizon, with project pipelines extending beyond immediate planning cycles. Public-private partnership frameworks increasingly finance major developments, combining government strategic direction with private sector efficiency and innovation in project delivery methodologies that accelerate construction timelines and optimize resource allocation. For instance, in October 2025, the Dubai government introduced Law No. 7 of 2025, effective 8 January 2026, establishing a digital, unified framework for regulating all construction and contracting activities, enhancing contractor oversight, transparency, and standards while supporting sustainable growth in the construction sector.

Population Growth and Urbanization Acceleration

The GCC region experiences demographic changes that form the basic construction demand due to natural population growth and migration trends between rural and urban areas. Youthful demographic characteristics of the Gulf countries translate into housing, academic, healthcare, and leisure amenities demand towards the continuous development of residential, business and institutional structures. The aggregation of population in large urban centers creates the need to develop vertically, create mass transportation systems, increase utilities, and develop service infrastructures that can sustain the large population localities without compromising livability conditions. Government policies that promote urbanization, family size, and purchasing of their own homes continue to increase the demand for construction. This shift in lifestyle of the Gulf people towards contemporary comforts, shopping centers, entertainment and recreational centers creates commercial and mixed use development which incorporates residential, office, hotels and lifestyle aspects into master planned communities and renewal of cities.

Infrastructure Modernization and Connectivity Enhancement

The push to develop world-class infrastructure across the Gulf drives significant construction investments in transportation, utilities, telecommunications, and public facilities. Governments prioritize airport expansions, seaports, railways, and highways to enhance trade, passenger movement, and regional connectivity, supporting economic diversification. Smart city projects integrate advanced technologies, including fiber optic networks, sensors, command centers, and digital platforms, enabling efficient urban management and optimized resource use. Renewable energy initiatives, such as solar, wind, and green hydrogen projects, alongside transmission networks, require specialized construction capabilities. Investments in water and wastewater infrastructure, including desalination and treatment plants, ensure sufficient supply for growing populations and industrial sectors throughout the forecast period. For instance, in November 2025, Saudi Arabia’s Ministry of Municipalities and Housing introduced a “Real Estate Stimulus” program designed to enhance the sustainability of the sector, attract new investment opportunities, and speed up property development throughout the Kingdom.

Market Restraints:

What Challenges the GCC Construction Market is Facing?

Labor Supply Constraints and Workforce Skill Gaps

Construction labor availability fluctuates with regulatory changes affecting expatriate worker policies, visa restrictions, and localization requirements that impact workforce composition and availability. Specialized skill shortages in advanced construction technologies, project management capabilities, and technical trades create bottlenecks for complex projects requiring sophisticated expertise. Training infrastructure limitations and education system gaps fail to produce sufficient local talent to meet construction sector demand.

Supply Chain Disruptions and Material Cost Volatility

Construction material prices experience significant fluctuations driven by global commodity markets, international trade tensions, and logistics challenges affecting import-dependent Gulf economies. Supply chain vulnerabilities expose projects to delays when critical materials face sourcing difficulties or shipping constraints. Long lead times for specialized equipment and custom materials complicate project scheduling and budget management across large-scale developments.

Regulatory Complexity and Permitting Delays

Evolving building codes, environmental regulations, and safety standards require continuous adaptation by construction firms navigating multiple jurisdictional frameworks across different emirates and kingdoms. Permitting processes sometimes extend project timelines through bureaucratic procedures, documentation requirements, and approval hierarchies that delay construction commencement. Compliance costs increase as regulatory standards become more stringent regarding sustainability, worker welfare, and quality assurance across construction activities.

Competitive Landscape:

The GCC construction market features a layered competitive landscape, including multinational engineering and construction firms with global portfolios, regional developers with expertise in Gulf market dynamics, and local contractors serving specific regions or project types. Mega-projects typically attract international consortia leveraging extensive resources and technical know-how, while smaller residential and commercial developments rely on regional and local players offering cost efficiency and market insight. Companies differentiate through technological capabilities, safety performance, financial strength, track record, and relationships with government and private clients. Joint ventures often combine international expertise with local regulatory knowledge. Rising national ownership, adoption of digital construction, sustainability credentials, and turnkey contracting models are increasingly shaping competition, prioritizing efficiency, environmental performance, and integrated project delivery across the region.

Recent Developments:

- February 2025: Saudi Arabia launched Infra-guaranteed financing and surety bonds to support construction contractors. At the Private Sector Forum in Riyadh, Leyla Abdimomunova of PIF highlighted initiatives to upskill and pre-qualify contractors, strengthening capabilities across the Kingdom’s construction sector.

- November 2024: Tilal Real Estates announced the launch of a new smart city project on Saudi Arabia’s eastern coast, valued at approximately 6 billion SAR ($1.6 billion). Unveiled during the Citiscape event in Riyadh, the multi-purpose “Heart of Khobar” development spans around 268,000 square metres and will feature a mix of residential units, offices, hotels, parks, roads, shopping malls, cinemas, and other entertainment amenities.

GCC Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Commercial Construction, Residential Construction, Industrial Construction, Infrastructure (Transportation) Construction, Energy and Utilities Construction |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC construction market size was valued at USD 154.35 Billion in 2025.

The market is expected to grow at a compound annual growth rate of 4.70% from 2026-2034 to reach USD 233.44 Billion by 2034.

Residential construction dominated the market with a share of 38.18% in 2025, driven by population growth, government housing initiatives, and urban expansion programs creating sustained demand for diverse housing typologies across income segments and demographic groups throughout the region.

Key factors driving the GCC construction market include national economic diversification programs requiring massive infrastructure investments, rapid population growth necessitating residential and public facility construction, urbanization acceleration demanding modern city infrastructure, government megaproject implementations, and strategic positioning as regional hubs for tourism, logistics, and manufacturing sectors.

Major challenges include labor supply constraints affecting workforce availability, specialized skill gaps limiting advanced project capabilities, supply chain disruptions creating material sourcing difficulties, construction cost volatility impacting project budgets, regulatory complexity requiring continuous compliance adaptation, permitting delays extending project timelines, and climate conditions affecting construction scheduling and worker productivity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)