GCC Construction Repaint Market Size, Share, Trends and Forecast by Resin Type, Formulation, Application, and Country, 2026-2034

GCC Construction Repaint Market Summary:

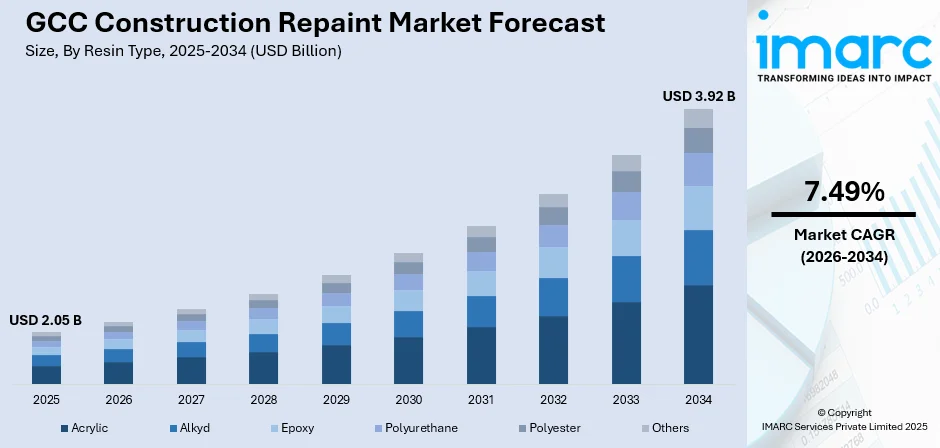

The GCC construction repaint market size was valued at USD 2.05 Billion in 2025 and is projected to reach USD 3.92 Billion by 2034, growing at a compound annual growth rate of 7.49% from 2026-2034.

The GCC construction repaint market is experiencing robust growth driven by unprecedented infrastructure development and urban transformation initiatives across the region. Vision 2030 programs in Saudi Arabia and the UAE's 2040 Urban Master Plan are fueling demand for high-performance coatings that enhance building aesthetics and provide protection against extreme desert conditions. The market is also benefiting from increasing environmental awareness, leading to a shift toward sustainable, low-VOC formulations that meet evolving regulatory requirements across the Gulf region.

Key Takeaways and Insights:

- By Resin Type: Acrylic dominates the market with a share of 43% in 2025, owing to its superior weather resistance, UV protection, and cost-effectiveness for both interior and exterior applications in the region's harsh climate conditions.

- By Formulation: Water-borne leads the market with a share of 65% in 2025, driven by increasing environmental regulations, quick drying properties, low odor characteristics, and minimal VOC emissions that align with green building standards across GCC nations.

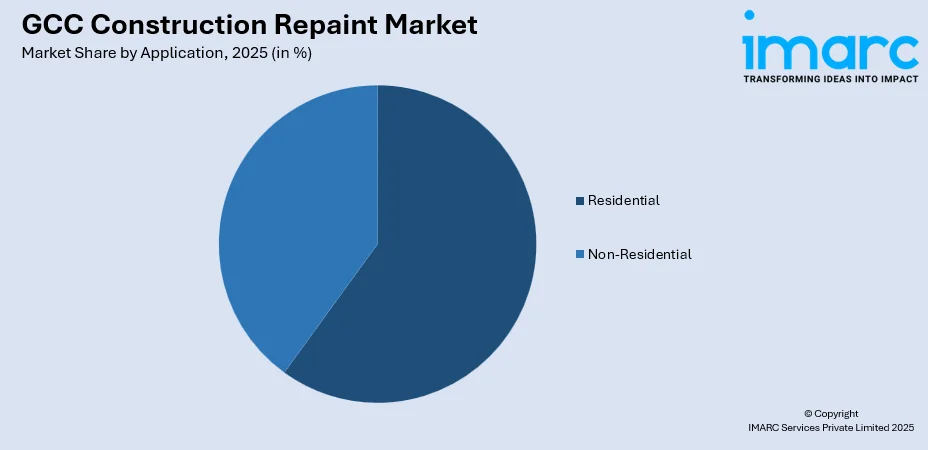

- By Application: Residential represents the largest segment with a market share of 57% in 2025, fueled by rapid urbanization, young demographics, mortgage reforms, and government-backed housing initiatives across Saudi Arabia, UAE, and other GCC countries.

- Key Players: The GCC construction repaint market features a moderately consolidated competitive landscape with major multinational corporations competing alongside strong regional manufacturers. Key players are actively expanding production capacities and introducing innovative eco-friendly product lines.

To get more information on this market Request Sample

The construction repaint market across GCC countries is undergoing significant transformation, closely tied to the massive infrastructure development across the region. From towering skyscrapers in Dubai to vast developments in Saudi Arabia under Vision 2030, paints and coatings are essential for enhancing structural durability while adding aesthetic appeal. The region's distinctive climate and cultural values are driving innovation, with manufacturers developing specialized formulations that provide protection against extreme temperatures, UV radiation, sandstorm damage, and high humidity conditions prevalent across the Gulf.

GCC Construction Repaint Market Trends:

Accelerating Shift Toward Sustainable and Low-VOC Coating Solutions

The GCC construction repaint market is witnessing a pronounced shift toward environmentally sustainable products as regional governments implement stricter environmental regulations. Jazeera Paints declared that their interior line now satisfies Ultra-Low VOC requirements to enhance indoor air quality in medical facilities and educational institutions. This regulatory push, combined with growing consumer awareness about indoor air quality, is transforming product formulations across the market.

Integration of Smart and Functional Coating Technologies

Technological innovation is reshaping the GCC construction repaint landscape with the introduction of smart and functional coatings offering enhanced performance characteristics. Manufacturers are developing anti-microbial coatings, solar-reflective roof membranes that reduce heat absorption, and self-cleaning paint technologies particularly suited for the dusty Gulf environment. These innovations provide both aesthetic appeal and functional benefits, boosting overall demand.

Expansion of Local Manufacturing and Localization Initiatives

GCC governments are actively promoting local manufacturing through various industrial programs. Saudi Aramco's In-Kingdom Total Value Add (IKTVA) program to retain 70% of Aramco's procurement spend in-Kingdom, rewarding suppliers that establish resin synthesis, pigment dispersion, and manufacturing facilities within Saudi Arabia. In August 2024, Qemtex Chemical Holding introduced a new powder coatings plant in the UAE, located in the Umm Al Quwain Free Trade Zone, with capacity to produce 5,000 tons annually expanding to 10,000 tons. This localization trend is creating regional centers of excellence while reducing import dependence.

Market Outlook 2026-2034:

The GCC construction repaint market outlook remains highly positive, underpinned by massive mega-project investments across the region. Saudi Arabia's Vision 2030 pipeline includes numerous large-scale projects driving unprecedented demand for architectural coatings, while the UAE's construction market continues to expand with thousands of active developments spanning residential, commercial, and infrastructure sectors. The residential segment maintains its position as the largest application category, continuing to propel repaint demand as developers incorporate smart-home systems and green building certifications to meet evolving consumer preferences and regulatory requirements. The market generated a revenue of USD 2.05 Billion in 2025 and is projected to reach a revenue of USD 3.92 Billion by 2034, growing at a compound annual growth rate of 7.49% from 2026-2034.

GCC Construction Repaint Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Resin Type | Acrylic | 43% |

| Formulation | Water-borne | 65% |

| Application | Residential | 57% |

Resin Type Insights:

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Polyester

- Others

The acrylic dominates with a market share of 43% of the total GCC construction repaint market in 2025.

Acrylic resins have emerged as the preferred choice for construction repaint applications across the GCC region due to their exceptional balance of performance characteristics and cost-effectiveness. These thermoplastic resins offer superior hydrolysis resistance, outstanding weather resistance, excellent gloss retention, and remarkable color stability—making them ideal for exterior applications exposed to the harsh Gulf climate. The segment benefits from its compatibility with water-borne formulations, aligning with environmental regulations and sustainability trends sweeping across the region.

The growing preference for acrylic-based construction repaint products is further reinforced by their versatility across both residential and commercial applications. Manufacturers are continuously innovating to enhance acrylic formulations with features like improved sandstorm resistance and enhanced UV protection specifically designed for desert environments. Additionally, the expanding infrastructure projects across the region, including Abu Dhabi's infrastructure partnership projects and Oman's facility developments, are driving demand for acrylic resin-based architectural paintings and coatings.

Formulation Insights:

- Solvent-borne

- Water-borne

- Others

The water-borne leads with a share of 65% of the total GCC construction repaint market in 2025.

Water-borne coatings have established clear dominance in the GCC construction repaint market, driven by their environmental compliance, superior application properties, and alignment with regional sustainability initiatives. These formulations continue to gain market share across the region as specifiers pivot toward zero-to-low-odor work sites. Water-borne coatings offer quick drying rates, low odor, enhanced durability, high block resistance, and minimal VOC emissions—characteristics that make them particularly suitable for decorative paint applications in residential and commercial buildings. Large-scale housing programs across the GCC exemplify the rising residential projects driving greater adoption of water-borne coatings.

The regulatory environment across GCC nations increasingly favors water-borne technology, with governmental regulations supportive of low-VOC products due to environmental concerns. Major coating manufacturers have announced plans to expand their water-based product portfolios across GCC markets, reflecting the industry's commitment to eco-friendly solutions. The shift toward sustainability has led to an accelerated conversion from traditional solvent-borne coatings to powder coatings across the region, driven by zero-VOC mandates and growing environmental awareness.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Residential

- Non-Residential

The residential segment holds the largest share with 57% of the total GCC construction repaint market in 2025.

The residential application segment maintains its position as the primary driver of construction repaint demand across the GCC region. This dominance is propelled by young demographics, mortgage reforms, and substantial government housing initiatives. As part of the Sakani program, one of the Vision 2030 initiatives, which intends to increase the homeownership rate among Saudi families to 70% by 2030, 104,492 families moved into their first home. In the UAE, residential real estate transactions have reached record levels. These developments are creating sustained demand for both new construction paints and repaint products.

The GCC residential real estate market continues to expand rapidly, driven by population growth and urbanization across the region. Developers are increasingly bundling smart-home systems and district-cooling links to meet green-code thresholds, which correspondingly drives demand for specialized coating systems. The UAE government's Sheikh Zayed Housing Program and Dubai Tourism Strategy are generating investment in residential construction projects, while Abu Dhabi's Department of Municipalities and Transport continues to approve new residential developments across various areas including Saadiyat Island, Yas Island, and Al Reem Island. Alongside elastomeric exterior paints that repair façade hairline cracks brought on by heat cycling, interior emulsions with formaldehyde-scavenging ingredients that adhere to local indoor-air regulations are becoming more and more popular.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia commands the largest share of the GCC construction repaint market, driven by its dominant position in regional construction activity. Vision 2030's extensive pipeline of mega-projects drives unprecedented demand for architectural coatings, with construction output continuing to expand significantly. The paint and coatings market continues to experience steady growth supported by government initiatives and urbanization.

The United Arab Emirates represent the second-largest market in the region, with the paints and coatings sector experiencing consistent growth. The country's construction market features thousands of active projects across multiple sectors, with major developments including Dubai South, Etihad Rail, and the Palm Jebel Ali revival project driving sustained coating demand.

Qatar's construction sector continues to demonstrate robust performance, building on infrastructure developed for the FIFA World Cup while pursuing major energy expansion projects. Commercial construction maintains a leading position within the market as the country diversifies its development portfolio beyond sporting infrastructure.

Kuwait is expected to be the fastest-growing country in the region's paints and coatings market. Major infrastructure investments awarded by the Public Authority for Housing Welfare and Ministry of Public Works for infrastructure works and Kuwait International Airport Terminal 2 are driving growth. International partnerships support residential development expansion.

Oman's construction sector benefits from PPP frameworks codified in national law, attracting private capital for infrastructure development. The sultanate's investments in infrastructure projects including hotels, resorts, and basic facilities create sustained demand for construction coatings across multiple application segments.

Bahrain's housing initiatives, including the Salman City Expansion program launched by the Housing Ministry, are driving residential construction and corresponding repaint demand. The country's focus on smart applications in housing projects and digital technologies is shaping market development and creating opportunities for innovative coating solutions.

Market Dynamics:

Growth Drivers:

Why is the GCC Construction Repaint Market Growing?

Massive Infrastructure Development and Government Mega-Projects

The GCC construction repaint market is experiencing unprecedented growth driven by massive infrastructure development programs across the region. In April 2025, Diriyah Company has entered into a joint venture agreement valued at $1.4 billion (SAR 5.1 billion) for the development of the Royal Diriyah Opera House in iconic Diriyah, collaborating with El Seif Engineering Contracting Co. Ltd., Midmac Construction Co. Ltd., and China State Construction Engineering Corporation Ltd. (CSCEC), the largest construction firm globally. These developments are creating sustained demand for construction coatings across residential, commercial, and industrial applications. The Kingdom's King Salman International Airport project exemplifies the scale of coating requirements, demanding multi-layer systems able to endure dust abrasion, intense UV radiation, and thermal shock.

Rapid Urbanization and Population Growth Driving Housing Demand

The GCC region is experiencing rapid urbanization with urban populations projected to reach 85% in the future, translating to approximately 2.5 million additional people annually requiring housing and associated infrastructure. Young demographics, mortgage reforms, and favorable property ownership laws for foreign investors are fueling residential construction across all GCC countries. In the UAE, around 243,000 new residential units are expected to be constructed by 2027. This population-driven expansion creates continuous demand for both new construction coatings and maintenance repaint products as buildings age and require periodic renovation to maintain aesthetic appeal and structural protection against the region's harsh environmental conditions.

Growing Environmental Awareness and Sustainability Regulations

Increasing environmental consciousness coupled with stricter governmental regulations is reshaping the GCC construction repaint market toward sustainable product solutions. The UAE's goal of achieving 40% emission reduction by 2030 and Saudi Arabia's Environmental Law (Royal Decree M/165) effective January 2025 are accelerating the shift to low-VOC and water-borne coating technologies. Dubai Green Building Regulations and Abu Dhabi's Estidama Pearl Rating System encourage the use of eco-friendly paints, creating market opportunities for manufacturers developing innovative sustainable formulations. This regulatory push, combined with consumer preference for healthier indoor environments, is driving substantial product innovation and market transformation across the region.

Market Restraints:

What Challenges the GCC Construction Repaint Market is Facing?

Raw Material Price Volatility and Supply Chain Disruptions

The GCC construction repaint market faces challenges from fluctuating raw material prices, particularly for petroleum-derived components essential in solvent-based formulations. As major oil and gas producers, GCC countries are susceptible to crude oil price volatility that directly impacts manufacturing costs. Supply chain disruptions and geopolitical tensions continue to affect material availability and pricing stability, challenging manufacturers' ability to maintain consistent product pricing and margins.

Higher Costs of Eco-Friendly Formulations

The transition toward sustainable, low-VOC, and water-borne coating technologies presents cost challenges for both manufacturers and end-users. Eco-friendly formulations typically carry higher initial costs compared to conventional paints, potentially limiting adoption in price-sensitive market segments. While the long-term benefits in terms of health, environmental sustainability, and regulatory compliance are recognized, the higher upfront investment remains a barrier for some construction projects, particularly in residential segments focused on affordability.

Skilled Labor Shortages and Application Challenges

The scarcity of skilled labor combined with elevated labor costs can slow down project timelines and increase overall application costs across the GCC construction repaint market. Advanced coating technologies require specialized application techniques and trained professionals to achieve optimal performance. The industry faces challenges in maintaining consistent quality standards across the diverse range of construction projects, from luxury residential developments to large-scale infrastructure, particularly given the region's extreme climate conditions.

Competitive Landscape:

The GCC construction repaint market features a highly consolidated competitive landscape with major multinational corporations competing alongside established regional manufacturers. Companies are actively investing in research and development to deliver eco-friendly products and advanced formulations meeting evolving regulatory standards. The company operates major production facilities in Dubai and Qatar capable of producing twenty million liters of water-based paint annually. Regional manufacturers leverage strong brand recognition, extensive dealer networks, and Arabic label familiarity to maintain competitive positions, while international players pursue localization strategies through joint ventures and technology partnerships to strengthen their market presence across the GCC.

Recent Developments:

- In February 2025, Jazeera Paints announced a deal with NHC (National Housing Company) to offer high-performance, sustainability-certified paints across planned residential and commercial buildings in Saudi Arabia.

- June 2024: Jotun Paints Abu Dhabi unveiled an innovative customer-centric retail concept featuring a New Product Activation Unit highlighting latest product finishes, trending colors, and sample displays for both interior and exterior paint applications.

GCC Construction Repaint Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Acrylic, Alkyd, Epoxy, Polyurethane, Polyester, Others |

| Formulations Covered | Solvent-borne, Water-borne, Others |

| Applications Covered | Residential, Non-Residential |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC construction repaint market size was valued at USD 2.05 Billion in 2025.

The GCC construction repaint market is expected to grow at a compound annual growth rate of 7.49% from 2026-2034 to reach USD 3.92 Billion by 2034.

The acrylic dominated the GCC construction repaint market with a 43% share in 2025, driven by its exceptional weather resistance, UV protection capabilities, and cost-effectiveness for both interior and exterior applications in the region's demanding climate conditions.

Key factors driving the GCC Construction Repaint market include massive infrastructure development under Vision 2030 and similar mega-project initiatives, rapid urbanization and population growth driving residential construction, increasing environmental awareness leading to adoption of sustainable low-VOC coating solutions, and favorable government policies supporting local manufacturing.

Major challenges include raw material price volatility particularly for petroleum-derived components, higher costs associated with eco-friendly low-VOC formulations, skilled labor shortages affecting application quality and project timelines, and supply chain disruptions impacting material availability across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)