GCC Dark Chocolate Market Report by Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Non-grocery Retailers, and Others), and Country 2026-2034

GCC Dark Chocolate Market Summary:

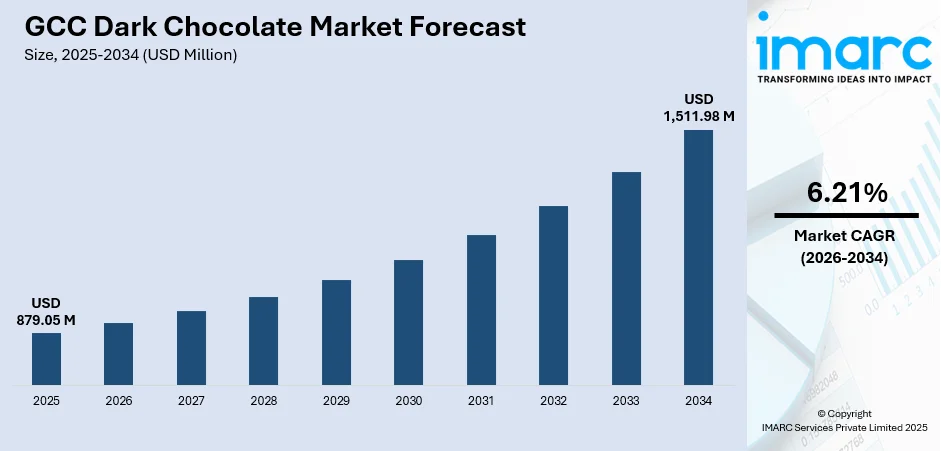

The GCC dark chocolate market size was valued at USD 879.05 Million in 2025 and is projected to reach USD 1,511.98 Million by 2034, growing at a compound annual growth rate of 6.21% from 2026-2034.

The GCC dark chocolate market is experiencing robust expansion, driven by rising health consciousness among consumers who recognize dark chocolate's antioxidant properties and cardiovascular benefits. Increasing disposable incomes across the region, particularly among young and affluent populations, are fueling the demand for premium and artisanal chocolate products. The cultural significance of chocolate gifting during festivals, such as Ramadan, Eid, and weddings, continues to strengthen consumption patterns. Additionally, the expansion of modern retail infrastructure, including hypermarkets and e-commerce platforms, is enhancing product accessibility.

Key Takeaways and Insights:

-

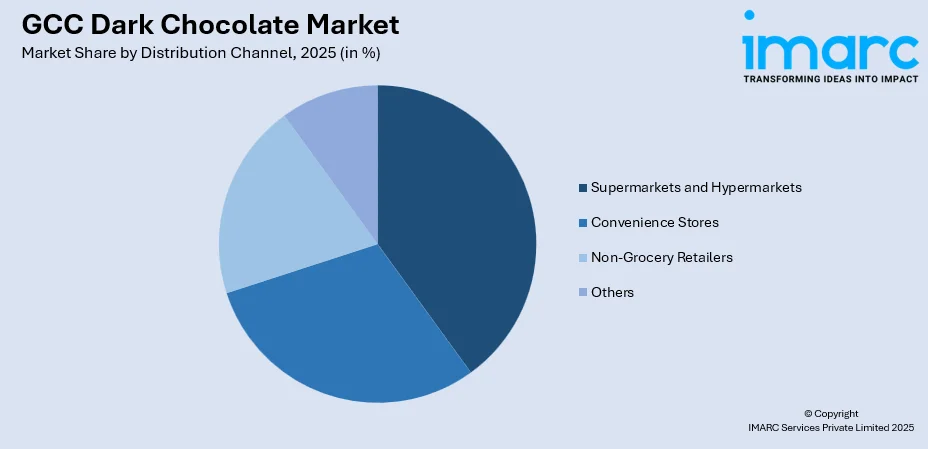

By Distribution Channel: Supermarkets and hypermarkets dominate the market with a share of 39.85% in 2025, owing to their extensive product assortments, competitive pricing strategies, and strategically placed impulse-purchase items. The presence of major retail chains offering diverse premium chocolate brands enhances consumer accessibility and purchase convenience.

-

By Country: Saudi Arabia leads the market with a share of 44% in 2025, driven by increasing health consciousness, expanding middle-class and affluent population, and the rising influence of Western lifestyle trends. The Kingdom's strong gifting culture during religious celebrations further bolsters demand.

-

Key Players: Key players are shaping the GCC dark chocolate market through product reformulation, premium packaging innovations, and digital marketing strategies. Their investments in local manufacturing, sustainability initiatives, and partnerships with healthcare providers boost awareness and accelerate adoption across diverse consumer segments. Some of the key players operating in the market include Al-Seedawi Sweets Factories Co, Bateel International LLC, Chocoladefabriken Lindt & Sprüngli AG, Food Services Company, La Chocolaterie Galler, Ferrero Group, Mars Inc., Mondelez International Inc., Nestle Middle East, Patchi SAL, and The Hershey Company.

To get more information on this market Request Sample

The GCC dark chocolate market demonstrates strong potential, fueled by evolving consumer preferences towards healthier indulgences with lower sugar content and higher cocoa concentrations. The region's young demographic exhibits growing interest in premium and functional food products. Rising urbanization across Saudi Arabia, the United Arab Emirates, and other Gulf nations has expanded the consumer base seeking sophisticated chocolate experiences. In September 2024, Nestlé signed an agreement with MODON to establish its first food manufacturing plant in Saudi Arabia with an initial investment of SAR 270 Million, reflecting strong investor confidence in the regional confectionery sector. The premiumization trend is reshaping product portfolios, as manufacturers introduce organic, vegan, and artisanal dark chocolate variants. E-commerce platforms are expanding product accessibility, enabling consumers to explore diverse international and specialty brands beyond traditional retail channels.

GCC Dark Chocolate Market Trends:

Rising Premiumization and Artisanal Chocolate Demand

Consumers across the GCC region are increasingly gravitating towards premium, artisanal, and handcrafted dark chocolate products that offer superior ingredients, unique flavor profiles, and sophisticated packaging. This premiumization trend reflects evolving taste preferences among the affluent population seeking gourmet experiences rather than mass-market confectionery. Local chocolatiers are blending traditional Middle Eastern ingredients, including dates, Arabic coffee, and cardamom, with premium cocoa to create distinctive regional flavors that appeal to both domestic consumers and tourists seeking authentic culinary experiences.

Growing Health Consciousness and Functional Food Preferences

Health and wellness conscious consumers are driving significant demand for dark chocolate varieties with higher cocoa content, recognizing their rich antioxidant properties and potential cardiovascular benefits. As per IMARC Group, the GCC health and wellness market size reached USD 72.2 Billion in 2024. The shift toward wellness-oriented consumption patterns is encouraging manufacturers to reformulate products with reduced sugar content and natural ingredients. Government initiatives promoting healthier lifestyles, including sugar taxes and mandatory nutrition labeling, are further accelerating consumer preference for dark chocolate over traditional milk-based varieties as a mindful indulgence option.

Digital Retail Expansion and E-Commerce Growth

The GCC region's rapidly expanding digital retail ecosystem is transforming how consumers discover and purchase dark chocolate products. As per ITA, in 2024, the number of Saudi internet users engaging in e-commerce (buying and selling) was predicted to hit 33.6 Million, marking a 42% rise since 2019. E-commerce platforms are unlocking access to niche, luxury, and imported dark chocolate brands that were previously unavailable through traditional retail channels. Online ordering has become a default shopping mode for premium confectionery, offering convenience, personalized recommendations, and doorstep delivery services that cater to modern consumer expectations and busy urban lifestyles.

Market Outlook 2026-2034:

The GCC dark chocolate market outlook remains optimistic, as the convergence of health awareness, premiumization, and digital retail expansion continues to drive sustained growth. The market generated a revenue of USD 879.05 Million in 2025 and is projected to reach a revenue of USD 1,511.98 Million by 2034, growing at a compound annual growth rate of 6.21% from 2026-2034. Product innovations, ethical sourcing practices, and targeted marketing strategies will position manufacturers to capitalize on emerging opportunities across the region's diverse consumer segments.

GCC Dark Chocolate Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Distribution Channel |

Supermarkets and Hypermarkets |

39.85% |

|

Country |

Saudi Arabia |

44% |

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Non-Grocery Retailers

- Others

Supermarkets and hypermarkets dominate with a market share of 39.85% of the total GCC dark chocolate market in 2025.

Supermarkets and hypermarkets maintain their dominant position in the GCC dark chocolate distribution landscape by offering extensive product assortments, competitive promotional pricing, and strategically placed impulse-purchase displays at checkouts and end-caps. Major retail chains attract consumers through one-stop shopping convenience, enabling them to purchase premium chocolate brands alongside regular grocery items.

The robust retail infrastructure across the GCC supports extensive dark chocolate distribution through modern trade formats that offer superior merchandising, cold storage capabilities, and promotional support. Hypermarket chains continuously expand their footprint, opening new stores to cater to growing consumer demand across urban and suburban locations. Retailers provide diverse premium chocolate selections, including Lindt, Godiva, Patchi, and Ferrero Rocher, catering to varied consumer preferences for both everyday indulgence and festive gifting occasions that drive seasonal sales spikes.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia leads with a share of 44% of the total GCC dark chocolate market in 2025.

Saudi Arabia commands the largest share of the GCC dark chocolate market, driven by increasing health consciousness among its expanding middle-class and affluent population. The Kingdom's strong gifting culture during religious celebrations, including Ramadan and Eid, significantly boosts chocolate consumption, with premium dark chocolate varieties becoming preferred choices for festive occasions. Saudi Arabia imported approximately 123 Million Kilograms of chocolate in 2024, underscoring robust consumer demand that positions the Kingdom as the region's largest chocolate-consuming nation.

The Saudi chocolate market benefits from a youthful demographic structure, exhibiting strong interest in premium and health-oriented confectionery products. Rising disposable incomes enable consumers to explore diverse chocolate varieties, ranging from mass-market to artisanal brands. Additionally, rapid expansion of modern retail formats and e-commerce platforms is improving access to premium dark chocolate brands nationwide. Growing interest in international flavors and functional chocolates with added health benefits further strengthens Saudi Arabia’s leadership in the GCC dark chocolate market.

Market Dynamics:

Growth Drivers:

Why is the GCC Dark Chocolate Market Growing?

Increasing Disposable Incomes and Premiumization Trends

Sustained economic growth across the GCC region has elevated consumer purchasing power, enabling households to afford premium and indulgent food products, including artisanal dark chocolate. Based on the findings of the 2023 Household Income and Consumption Expenditure Statistics, the average monthly disposable income for households in the Kingdom was SAR 11,839. The young demographic actively seeks distinct flavors, ethical sourcing, and high-quality ingredients that distinguish artisanal chocolates from mass-market alternatives. The premiumization trend is reshaping product portfolios as consumers willingly pay premium prices for superior chocolate experiences, handcrafted creations, and sophisticated packaging that elevates both personal consumption and gifting occasions. This shift is encouraging local chocolatiers and international brands to introduce limited editions and customized offerings tailored to regional tastes. Premium dark chocolate is increasingly perceived as an affordable luxury, reinforcing sustained demand across urban and high-income consumer segments.

Strong Gifting Culture and Festive Consumption

The market for dark chocolate is mostly driven by the GCC's strong gift-giving culture. During religious holidays, family get-togethers, and social events, including Ramadan, Eid, weddings, and business parties, chocolates are frequently traded. Dark chocolate is becoming more popular for these events because it is frequently marketed as a high-end and sophisticated present. Its attraction is increased by luxurious assortments, attractive packaging, and personalized gift boxes. The demand for high-end dark chocolate goods is further elevated by corporate gift-giving practices. Sales peaks during significant festivities are driven by limited-edition holiday collections and seasonal promotions. Dark chocolate enjoys steady demand linked to social and religious calendars since gift-giving customs are still ingrained in GCC society. This cultural predilection boosts market expansion by encouraging firms to innovate around holiday themes and supporting steady consumption quantities.

Expansion of Modern Retail and E-commerce Channels

Dark chocolate products are becoming more accessible and visible throughout the GCC region, owing to the growth of contemporary retail and e-commerce platforms. The UAE e-commerce market was valued at USD 125.0 billion in 2024, according to IMARC Group. Numerous domestic and foreign dark chocolate brands are available in supermarkets, hypermarkets, specialty shops, and duty-free stores. Trial and impulse purchases are encouraged via premium shelf positioning and in-store promotions. Customers have access to specialty, artisanal, and imported dark chocolate items that are not usually offered in traditional stores, because of the expansion of e-commerce platforms. Subscription boxes, same-day delivery services, and online gift alternatives increase sales. Modernizing retail helps maintain product quality and manage the cold chain, both of which are crucial for high-end chocolates. As retail infrastructure continues to expand and digital shopping becomes mainstream, distribution efficiency improves, driving sustained growth of the GCC dark chocolate market.

Market Restraints:

What Challenges the GCC Dark Chocolate Market is Facing?

High Cost and Volatility of Raw Materials

The high cost and price volatility of cocoa beans and other premium materials needed to produce high-quality chocolate provide hurdles for the GCC dark chocolate business. Since the GCC does not grow cocoa domestically, the region is totally dependent on imports, leaving producers susceptible to supply chain interruptions, geopolitical unrest, and transportation delays that raise manufacturing costs.

Competition from Milk Chocolate and Alternative Confectionery

Milk chocolate variations continue to dominate consumer tastes throughout the GCC region, posing a serious threat to dark chocolate. The creamy texture and sweeter flavor profile of milk chocolate appeal to a wider range of customers, especially kids and those who enjoy traditional chocolate flavor, which continues to hinder the market penetration of dark chocolate.

Intense Market Competition and Brand Proliferation

The GCC dark chocolate market is marked by fierce competition from both up-and-coming local businesses and well-established international behemoths fighting for consumers' attention. The construction of distribution networks, the necessity for brand uniqueness, and the marketing expenditures required to successfully compete against well-established firms with well-known brands are among the significant obstacles that new market entrants must overcome.

Competitive Landscape:

The GCC dark chocolate market is moderately competitive, with both local specialty brands and multinational confectionery giants vying for customers in both premium and mass-market markets. To improve their market positioning and take advantage of changing consumer tastes, leading companies use digital marketing techniques, high-end packaging, and new product innovations. To set themselves apart from the competition, manufacturers are investing more in sustainable sourcing methods, local production capabilities, and innovative flavors that use local ingredients. Through strategic alliances with retail chains, e-commerce sites, and lodging facilities, businesses may increase their distribution reach and foster consumer loyalty by offering limited-edition seasonal collections and customized gift options.

Some of the key players include:

- Al-Seedawi Sweets Factories Co

- Bateel International LLC

- Chocoladefabriken Lindt & Sprüngli AG

- Food Services Company

- La Chocolaterie Galler

- Ferrero Group

- Mars Inc.

- Mondelez International Inc.

- Nestle Middle East

- Patchi SAL

- The Hershey Company

GCC Dark Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Non-grocery Retailers, Others |

| Countries Covered | United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain |

| Companies Covered | Al-Seedawi Sweets Factories Co, Bateel International LLC, Chocoladefabriken Lindt & Sprüngli AG, Food Services Company, La Chocolaterie Galler, Ferrero Group, Mars Inc., Mondelez International Inc., Nestle Middle East, Patchi SAL, The Hershey Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC dark chocolate market size was valued at USD 879.05 Million in 2025.

The GCC dark chocolate market is expected to grow at a compound annual growth rate of 6.21% from 2026-2034 to reach USD 1,511.98 Million by 2034.

Supermarkets and hypermarkets dominated the market with a share of 39.85%, driven by extensive product assortments, competitive pricing strategies, and the presence of major retail chains offering diverse premium chocolate brands across the region.

Key factors driving the GCC dark chocolate market include rising health consciousness and awareness of antioxidant benefits, increasing disposable incomes enabling premium purchases, cultural gifting traditions during festivals, and expanding modern retail infrastructure, including hypermarkets and e-commerce platforms.

Major challenges include high costs and volatility of imported cocoa and raw materials, intense competition from milk chocolate and alternative confectionery products, supply chain dependencies on cocoa-producing regions, and the need for continuous product innovation to meet evolving consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)