GCC Demolition Robot Market Size, Share, Trends and Forecast by Product Type, Sales Type, Application, and Country, 2026-2034

GCC Demolition Robot Market Summary:

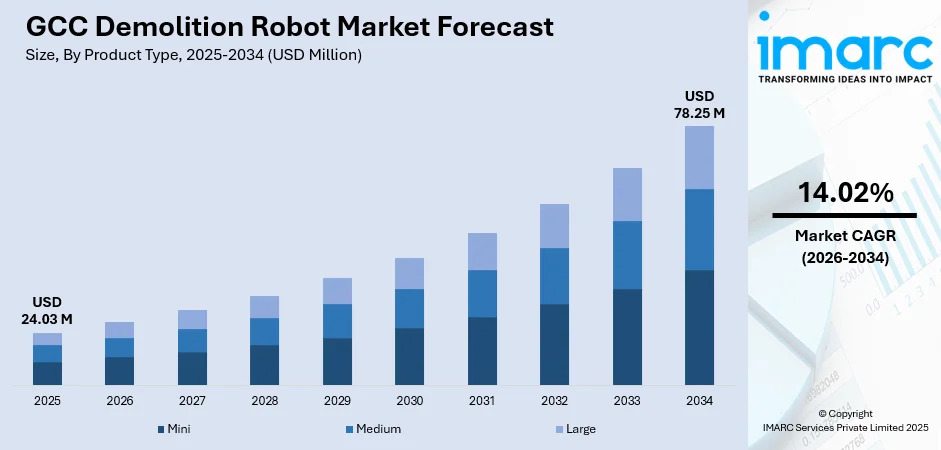

The GCC demolition robot market size was valued at USD 24.03 Million in 2025 and is projected to reach USD 78.25 Million by 2034, growing at a compound annual growth rate of 14.02% from 2026-2034.

The GCC demolition robot market is experiencing remarkable expansion driven by rapid urbanization, massive infrastructure development initiatives, and government-led economic diversification programs across the region. Growing emphasis on workplace safety regulations, labor shortages in the construction sector, and increasing adoption of automation technologies are propelling market growth. The integration of remote-controlled robotic systems enables safer demolition operations in hazardous environments while improving operational efficiency and reducing project timelines across GCC demolition robot market share.

Key Takeaways and Insights:

- By Product Type: Medium demolition robots dominate the market with a share of 45% in 2025, driven by their versatile applications across construction and renovation projects, optimal power-to-weight ratio, and ability to operate efficiently in confined urban spaces common throughout GCC metropolitan areas.

- By Sales Type: New equipment leads the market with a share of 65% in 2025, as construction companies prioritize acquiring latest-generation demolition robots equipped with advanced SmartPower technology, enhanced safety features, and improved operational capabilities to meet demanding project specifications.

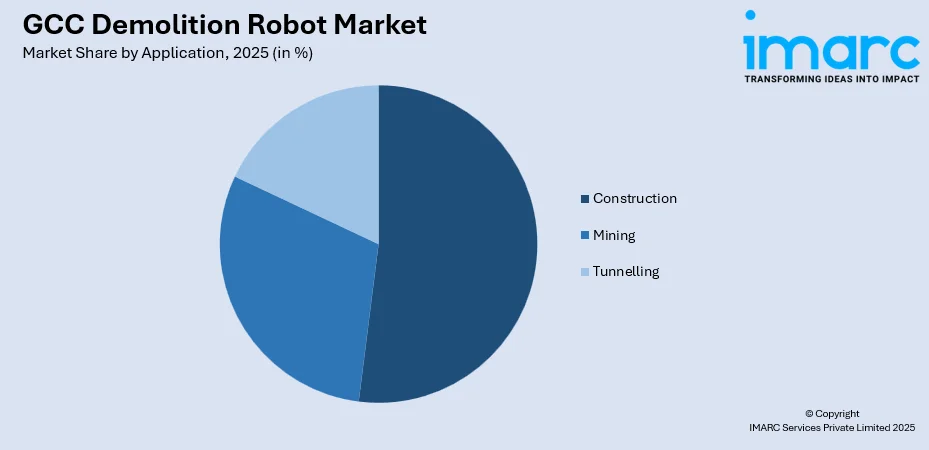

- By Application: Construction represents the largest segment with a market share of 52% in 2025, owing to extensive urban renewal programs, mega-project developments, and growing requirements for precision demolition in densely populated areas across GCC nations.

- Key Players: The GCC demolition robot market exhibits moderate competitive intensity characterized by the presence of established international manufacturers competing alongside regional distributors. Leading participants are focusing on technological innovation, strategic partnerships with local contractors, and expansion of after-sales service networks to strengthen market positioning throughout the region.

To get more information on this market Request Sample

The GCC demolition robot market is witnessing transformative growth as governments and private developers increasingly recognize the substantial benefits of robotic automation in construction and demolition activities. The region's ambitious infrastructure agenda, exemplified by Saudi Arabia's NEOM development consuming significant global steel supply, has catalyzed demand for sophisticated demolition equipment. The deployment of remote-controlled demolition robots enables contractors to execute complex demolition tasks in extreme heat conditions prevalent across GCC construction sites while maintaining productivity levels and ensuring compliance with increasingly stringent workplace safety regulations mandated by regional authorities.

GCC Demolition Robot Market Trends:

Integration of Advanced SmartPower Technology in Demolition Equipment

The GCC demolition robot market is witnessing accelerated adoption of next-generation SmartPower technology that maximizes hydraulic power output from compact motor configurations. This technological advancement enables demolition robots to deliver substantially increased hitting force while maintaining smaller footprints essential for urban construction environments. Leading equipment manufacturers have introduced SmartPower+ systems featuring enhanced durability with shock, temperature, and vibration resistance alongside significantly reduced cable connections for improved reliability. The new control systems incorporate two-way communication capabilities and visual status indicators that allow operators to maintain focus on demolition tasks while monitoring machine performance in real-time.

Rising Emphasis on Construction Site Safety and Worker Protection

Stringent occupational health and safety regulations across GCC nations are driving substantial demand for remote-controlled demolition equipment that eliminates worker exposure to hazardous environments. GCC authorities are increasingly deploying artificial intelligence and Internet of Things systems to monitor workplace safety through connected cameras and sensors, with the regional market for construction safety automation forecast to expand significantly through the next decade. These regulatory developments are compelling construction companies to invest in robotic demolition solutions that enhance safety while maintaining operational productivity.

Government Investment in Construction Automation and Robotics Programs

GCC governments are implementing comprehensive robotics and automation programs to modernize construction practices and address persistent labor challenges. The Dubai Robotics and Automation Program aims to deploy substantial numbers of robots across various sectors including construction over the coming decade, with objectives to increase the robotics sector's contribution to Dubai's economy. Building Information Modeling has been mandated across Dubai starting from January 2024, signaling government commitment to digital transformation in construction. These initiatives are creating favorable conditions for demolition robot adoption as construction firms align their equipment investments with broader national technology advancement strategies.

Market Outlook 2026-2034:

The GCC demolition robot market is positioned for sustained expansion throughout the forecast period, underpinned by accelerating infrastructure investments, technology modernization initiatives, and evolving regulatory frameworks promoting construction automation. The region's construction sector transformation, driven by mega-projects across Saudi Arabia, UAE, and Qatar, will continue generating strong demand for advanced demolition equipment. Growing contractor familiarity with robotic systems, expanding after-sales service networks, and continuous improvements in equipment capabilities will support broader market penetration across project categories. The market generated a revenue of USD 24.03 Million in 2025 and is projected to reach a revenue of USD 78.25 Million by 2034, growing at a compound annual growth rate of 14.02% from 2026-2034.

GCC Demolition Robot Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Medium | 45% |

| Sales Type | New Equipment | 65% |

| Application | Construction | 52% |

Product Type Insights:

- Mini

- Medium

- Large

The medium demolition robot segment dominates with a market share of 45% of the total GCC demolition robot market in 2025.

Medium-sized demolition robots have emerged as the preferred choice across GCC construction projects due to their exceptional balance of power output, operational flexibility, and manageable dimensions. These machines typically deliver hydraulic capabilities sufficient to handle demanding demolition tasks while maintaining compact footprints that enable navigation through standard building entrances and confined workspace environments prevalent in urban renovation projects. The segment benefits from substantial technological advancements with leading manufacturers introducing enhanced power management systems that maximize performance from efficient motor configurations.

The medium demolition robot category addresses critical market requirements for versatile equipment capable of operating across diverse application scenarios within single project environments. Construction contractors increasingly favor these machines for their ability to perform multiple demolition functions using interchangeable attachments including breakers, crushers, grapples, and drum cutters without requiring additional equipment mobilization. The segment's growth trajectory is further supported by expanding rental market availability that enables smaller contractors to access advanced demolition technology without substantial capital investments. Regional distributors report strong demand for medium-class robots from renovation specialists working on commercial building upgrades and residential complex modernization projects where space constraints and precision requirements align with medium robot capabilities.

Sales Type Insights:

- New Equipment

- Aftermarket

The new equipment segment leads the market with a share of 65% of the total GCC demolition robot market in 2025.

New equipment purchases dominate the GCC demolition robot market as construction companies prioritize acquiring latest-generation machines equipped with cutting-edge technology and comprehensive manufacturer warranties. The significant investment volumes flowing into regional mega-projects have enabled contractors to allocate substantial capital expenditure budgets toward equipment modernization programs. Major construction firms recognize that newest-model demolition robots incorporating advanced features deliver superior operational efficiency, enhanced safety compliance, and reduced maintenance requirements compared to older equipment generations.

The preference for new demolition equipment reflects broader market dynamics including rapid technology evolution, expanding manufacturer financing programs, and contractor requirements for equipment meeting current safety certification standards. Construction companies participating in government-led infrastructure projects face stringent equipment specification requirements that often necessitate deployment of new-generation machines with documented compliance credentials. The aftermarket segment continues growing steadily as fleet operators require replacement parts, attachment upgrades, and maintenance services, though new equipment sales maintain commanding market position driven by project pipeline expansion and equipment fleet modernization programs across GCC contractors.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Mining

- Tunnelling

The construction segment exhibits clear dominance with a 52% share of the total GCC demolition robot market in 2025.

Construction applications represent the primary demand driver for demolition robots across the GCC region as unprecedented infrastructure development programs generate continuous requirements for advanced demolition capabilities. Urban renewal initiatives, commercial building renovation projects, and site preparation activities for new developments collectively create sustained demand for precision demolition equipment capable of operating in populated environments with minimal disruption. The construction sector's adoption of demolition robots has accelerated significantly as contractors recognize productivity advantages including reduced project timelines, improved worker safety, and enhanced demolition precision compared to traditional methods.

The construction application segment benefits from expanding infrastructure investment across all GCC nations with Saudi Arabia's Vision 2030 program generating particularly substantial demand. Mega-developments including NEOM, Qiddiya, and Red Sea tourism destinations require extensive demolition and site preparation activities creating strong equipment demand. Mining and tunnelling applications contribute meaningful market volumes particularly in Saudi Arabia's expanding mineral extraction sector and regional metro rail construction programs. These specialized applications often require dedicated heavy-class demolition robots with enhanced capabilities for underground operations and hard rock demolition tasks.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia Vision 2030 mega-projects like NEOM, Qiddiya, and The Line massively drive demand for demolition robots. The Kingdom dominates the GCC market, prioritizing automation for efficiency and safety across its rapid urbanization efforts.

United Arab Emirates represents the second-largest market benefiting from Dubai's Smart City Initiative, mandatory BIM implementation, and the Dubai Robotics and Automation Program targeting deployment of substantial robot fleets across various sectors including construction through the next decade.

Qatar has been a key market, bolstered by significant infrastructure investments related to past major events. Its focus now shifts to smart city development, maintaining demand for advanced demolition robots for urban renewal and complex projects.

Kuwait's market is developing with government housing initiatives and infrastructure modernization programs including airport terminal construction and residential city developments driving gradual demolition equipment demand growth.

Oman presents emerging opportunities through infrastructure investments projected to reach substantial levels, with the country leading on wage-protection enforcement indirectly pushing mechanical automation uptake in construction activities.

Bahrain's demolition robot market is expanding alongside broader industrial robotics growth, supported by smart city development components embedded in national planning and increasing adoption of automation technologies across construction sector operations.

Market Dynamics:

Growth Drivers:

Why is the GCC Demolition Robot Market Growing?

Unprecedented Infrastructure Investment and Mega-Project Development

The GCC region is experiencing an extraordinary construction boom driven by government-led economic diversification initiatives that are generating massive demand for advanced demolition equipment. Saudi Arabia's Vision 2030 program encompasses mega-developments including NEOM, a futuristic sustainable region spanning over 26,500 square kilometers, alongside Qiddiya entertainment city, Red Sea tourism destinations, and extensive urban expansion projects throughout the kingdom. These developments require substantial demolition and site preparation activities creating sustained equipment demand. The UAE continues advancing ambitious infrastructure programs including Dubai's Urban Master Plan 2040 and Abu Dhabi's economic diversification initiatives. Qatar’s current investment cycle—driven by the North Field LNG expansion and ongoing post-World Cup infrastructure work—creates steady demand for high-productivity construction tools. Contractors working under tight schedules and strict safety rules tend to adopt demolition robots for controlled dismantling tasks, which strengthens the GCC market outlook for these machines.

Stringent Workplace Safety Regulations and Labor Protection Requirements

GCC governments have implemented increasingly comprehensive occupational health and safety frameworks that are driving substantial demand for remote-controlled demolition equipment eliminating worker exposure to hazardous environments. The UAE enforces mandatory midday work bans during summer months protecting workers from extreme heat conditions prevalent across regional construction sites. Saudi Arabia requires industrial establishments and construction firms with substantial employee counts to appoint technically qualified occupational health and safety officers responsible for hazard prevention. These regulatory developments compel construction companies to invest in robotic demolition solutions that enhance workplace safety while maintaining operational productivity.

Labor Shortage Challenges and Workforce Efficiency Imperatives

Construction sector labor shortages across GCC nations are compelling contractors to adopt automation technologies that reduce workforce requirements while maintaining or improving productivity levels. The regional construction industry faces persistent challenges attracting and retaining skilled workers for physically demanding and hazardous demolition tasks, creating strong incentives for robotic equipment investment. Demolition robots can substantially reduce onsite workforce requirements through offsite prefabrication and automated operations, with some robotic systems delivering productivity gains up to ten times faster than manual labor while achieving significant cost savings compared to traditional methods. The combination of rising labor costs, worker availability constraints, and increasing project complexity is accelerating construction automation adoption throughout the GCC. Contractors recognize that demolition robots enable consistent performance levels regardless of heat conditions or shift changes, addressing critical operational challenges inherent in regional construction environments.

Market Restraints:

What Challenges the GCC Demolition Robot Market is Facing?

High Initial Equipment Investment and Acquisition Costs

The substantial capital investment required to acquire advanced demolition robots presents a significant barrier particularly for smaller and medium-sized contractors operating within budget-constrained project environments. Latest-generation demolition equipment incorporating SmartPower technology and enhanced safety features commands premium pricing that may exceed financial capabilities of regional contractors. Additionally, equipment financing arrangements and rental options remain less developed compared to mature markets, limiting access pathways for emerging construction firms.

Technical Expertise and Operator Training Requirements

Operating advanced demolition robots requires specialized technical knowledge and training that creates workforce development challenges across the GCC construction sector. The regional market faces shortages of skilled operators proficient in robotic equipment operation, maintenance, and troubleshooting procedures. Construction companies must invest in comprehensive training programs to develop internal capabilities while simultaneously managing project execution demands, creating operational complexity that may slow adoption rates.

Supply Chain Dependencies and Equipment Availability Constraints

The GCC demolition robot market relies heavily on international equipment manufacturers and supply chains that may experience disruptions affecting equipment availability and spare parts procurement timelines. Extended lead times for equipment delivery, limited regional inventory holdings, and after-sales service network gaps can impact project planning and equipment utilization rates, presenting challenges for contractors requiring rapid equipment deployment.

Competitive Landscape:

The GCC demolition robot market exhibits moderate competitive intensity characterized by the presence of established international manufacturers alongside regional distributors and equipment dealers. Market participants compete across multiple dimensions including product technology, pricing strategies, after-sales service capabilities, and local market knowledge. Leading international manufacturers maintain competitive advantages through continuous product innovation, comprehensive equipment portfolios spanning multiple weight classes, and established global support networks. Regional distributors leverage local market relationships, customs clearance expertise, and proximity advantages for equipment delivery and service response. The competitive environment is evolving as manufacturers increasingly establish direct presence in major GCC markets while regional players develop specialized capabilities in equipment rental, operator training, and maintenance services.

GCC Demolition Robot Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mini, Medium, Large |

| Sales Types Covered | New Equipment, Aftermarket |

| Applications Covered | Construction, Mining, Tunnelling |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC demolition robot market size was valued at USD 24.03 Million in 2025.

The GCC demolition robot market is expected to grow at a compound annual growth rate of 14.02% from 2026-2034 to reach USD 78.25 Million by 2034.

Medium demolition robots held the largest market share at 45% in 2025, driven by their versatile applications, optimal power-to-weight ratio, and ability to operate efficiently in confined urban spaces common throughout GCC metropolitan construction environments.

Key factors driving the GCC Demolition Robot market include unprecedented infrastructure investment through mega-projects like NEOM and Vision 2030 initiatives, stringent workplace safety regulations mandating use of robotic technologies, persistent labor shortages compelling automation adoption, and technological advancements enhancing equipment capabilities.

Major challenges include high initial equipment investment costs limiting smaller contractor adoption, technical expertise and operator training requirements, supply chain dependencies affecting equipment availability, limited rental market development, and after-sales service network gaps in emerging GCC markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)