GCC Diabetes Care Devices Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Country, 2025-2033

GCC Diabetes Care Devices Market Size and Share:

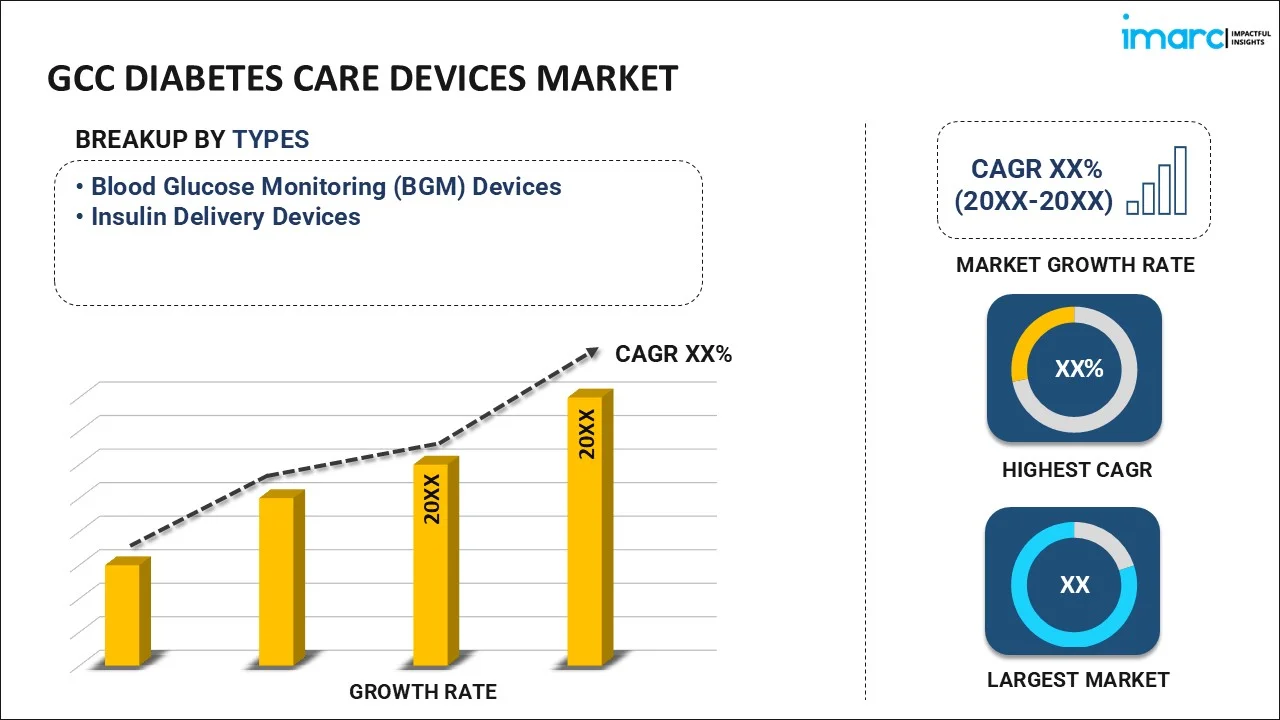

The GCC diabetes care devices market size was valued at USD 787.52 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1614.05 Million by 2033, exhibiting a CAGR of 7.70% from 2025-2033. The market is primarily driven by the rising lifestyle-related disorders, significant advancements in diagnostic tools, proactive health policies, a growing demand for modernized treatment options, public awareness campaigns, preventive care emphasis, the integration of high technology, and a growing trend toward seamless, patient-centric solutions in diabetes management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 787.52 Million |

| Market Forecast in 2033 | USD 1614.05 Million |

| Market Growth Rate (2025-2033) | 7.70% |

The market in GCC is mainly driven by the augmenting demand for innovative measures and management solutions for diabetes management. This can be attributed to the increasing prevalence of diabetes in the region, which is caused by inactive lifestyles, unhealthy food patterns, and genetic predisposition. For example, on September 1, 2024, Kuwait's Dasman Diabetes Institute announced innovative measures to combat diabetes complications through advanced research in immunology and metabolism. Dr. Fawaz Al-Zaid pointed out the efforts taken to identify the relation between immunodeficiency and type 2 diabetes as well as the psychological impact on type 1 diabetes treatment. These efforts for discovering new treatment options are strengthening diabetic-related research worldwide and are increasing collaborations. Furthermore, the aging population is mostly more vulnerable to complications from diseases are using these devices more frequently, contributing to the overall market growth.

In addition to this, the implementation of favorable government policies to upgrade healthcare infrastructure and increase awareness of diabetes care are driving the use of new devices. For instance, on November 15, 2024, Qatar unveiled two significant health initiatives at the world innovation summit for health (WISH) to tackle lifestyle diseases, including diabetes, obesity, and cardiovascular diseases. The CARDIO4Cities program and the National action plan for obesity, diabetes, and modifiable risk factors aim to lower non-communicable disease mortality by 36% through 2030, along with Qatar's National Vision 2030. The approaches that focus on prevention, patient-centered care, and increasing individual capacity to make rational health choices are supported through 58 targeted projects. Apart from this, inflating disposable income levels and increased healthcare expenditure by individuals encouraging the use of premium diabetes care products are fueling the market. Moreover, an enhanced focus on research and development (R&D) activities by global and regional players in introducing user-friendly and minimally invasive devices is promoting innovation and thus creating a dynamic market landscape.

GCC Diabetes Care Devices Market Trends:

Increasing Adoption of Digital Health Solutions

The diabetes care devices market in GCC is increasingly shifting toward digital health integration. Products like continuous glucose monitors (CGMs) and insulin pumps are available with connectivity options, where patients can share data in real-time with their healthcare providers. This aligns with the increased focus on personalized care, where patients can track their glucose levels, get actionable insights, and customize their treatment plans. As per an industry report published on October 23, 2024, healthcare providers, employers, and payers are increasingly prioritizing digital health solutions, targeting diabetes and mental health. More than 75% of digital health buyers have increased spending on these tools in the past two years, driven by consumer demand, improved health outcomes, and cost-saving potential. Employers intend to increase digital health investments to meet clinical needs and improve patient care. Telemedicine adoption in the region also supports remote monitoring, thereby reducing the need for frequent hospital visits. These advancements enhance patient engagement, compliance, and outcomes in diabetes management across the GCC.

Focus on Non-Invasive Monitoring Technologies

The increased focus on non-invasive monitoring technologies raises the demand for GCC diabetes care devices since patients and healthcare professionals are requiring these products. An article published by Jeban Chandir Moses et al. on December 2023 highlights new development trends of non-invasive BG monitoring technologies that have positive outcomes in the diabetes care process. Considering the prevalence of diabetes in 463 million adults worldwide in 2019, this paper highlights new, non-invasive methodologies such as salivary, dermal, and breath glucose sensors. All these new sensors have clinical correlations promising clinical correlations with conventional BG measurements. It also emphasizes that the development of future personalized monitoring solutions is necessary for tackling diabetes effectively in an ever-increasing burden of disease. Innovations in wearable devices, such as glucose sensors that operate without finger pricking, are being developed to improve user comfort and convenience.

Integration of Artificial Intelligence in Diabetes Management

Artificial Intelligence (AI) is becoming the new trend in GCC diabetes care devices, especially with the ability to bring predictive analytics and personalized plans for treatment. The most advanced devices, such as continuous glucose monitors and insulin pumps, are now equipped with AI algorithms that analyze patient data to predict glucose fluctuations. This technology aids in patients managing their conditions proactively and reducing the chances of severe complications. Besides this, AI is utilized to assist healthcare professionals in the diagnosis and optimization of treatment plans to provide actionable insights. For instance, a research paper published by Seweryn Ziajor et al. on April 11, 2024, states that AI is increasingly being used in diagnosing diabetes and its complications and has significantly improved detection rates in cases such as diabetic retinopathy with more than 90% accuracy in some cases. AI-based solutions have greatly simplified the detection of diabetic retinopathy, neuropathy, and nephropathy, thereby increasing the effectiveness of early intervention and customized treatment. The paper underlines the fact that healthcare providers can enhance the precision of diagnoses, predict disease progression, and use targeted interventions better through AI algorithms.

GCC Diabetes Care Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC diabetes care devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, distribution channel, and end user.

Analysis by Type:

- Blood Glucose Monitoring (BGM) Devices

- Self-Monitoring Devices

- Continuous Glucose Monitoring Devices

- Insulin Delivery Devices

- Pumps

- Pens

- Syringes

- Jet Injectors

Insulin delivery devices lead the market in 2024, with a share of 55.6%. Insulin delivery devices are a critical component of the market. With the increased prevalence of diabetes, such devices are essential tools to maintain optimal levels of blood glucose, minimizing complications, and improving quality of life. These devices include pens, pumps, and syringes, which are used on patient needs and preferences. The popularity of insulin pens and pumps is rising because they are accurate, easy to use, and portable, thus appealing to consumers seeking easy solutions. The government's push for advanced healthcare technologies and increasing awareness about self-management of diabetes is further propelling demand for these devices.

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Diabetes Clinics/ Centers

- Online Pharmacies

- Others

Hospital pharmacies dominate the market in 2024, holding a share of 57.2%. Hospital pharmacies are an important distribution channel in the market, as they provide patients with accessible, reliable, and quality products. These pharmacies are essential places to supply the different diabetes care devices that range from glucometers to insulin delivery systems, as well as continuous glucose monitors. They are usually the first point of contact for the acquisition of these devices following a diagnosis or during subsequent visits. Hospital pharmacies have a trustworthy reputation, as they offer products recommended by specialists, which boosts patient confidence. As hospitals remain central to healthcare delivery in the GCC, their pharmacies significantly influence the availability and adoption of advanced diabetes care solutions, reinforcing their importance in the overall market structure.

Analysis by End User:

- Hospitals

- Home Care

- Diagnostic Centers

- Ambulatory Surgery Centers

Hospitals lead the market in 2024, accounting for a share of around 44.5%. Hospitals are the most critical end-user segment in the GCC diabetes care devices market, as they play a pivotal role in diagnosing, treating, and managing diabetes. These institutions are often the first point of contact for patients, which provide patients with complete care that includes the use of advanced diabetes care devices like insulin delivery systems, glucometers, and continuous glucose monitors. Hospitals tend to be the launch and deployment sites for cutting-edge technology due to the device manufacturer's collaborations with healthcare providers. Hospitals also provide training programs for the health workers and patients, thereby assuring the correct usage of the devices for the best results in the management of diabetes.

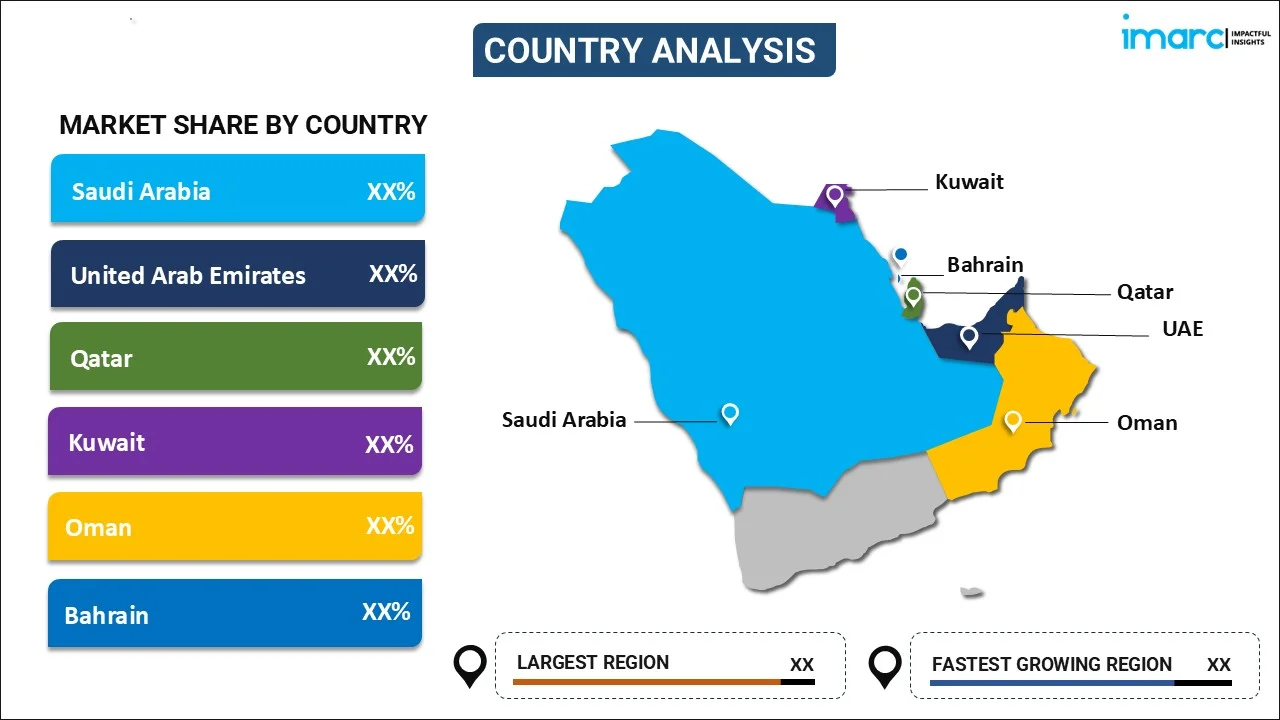

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

In 2024, Saudi Arabia holds the largest market share. Saudi Arabia is the market leader in the GCC diabetes care devices market, with a large population and high prevalence of diabetes. The country is responsible for a significant share of the regional demand due to increasing awareness of diabetes management and government initiatives aimed at improving healthcare infrastructure. Advanced medical facilities and an increasing adoption of advanced technologies, including continuous glucose monitoring systems and insulin pumps, further contribute to market growth in the region. Also, strategic partnerships with international manufacturers ensure the availability of high-quality devices. For instance, on October 21, 2024, Novo Nordisk and Lifera declared they would localize more than 50% of Saudi Arabia's insulin production by 2027. This initiative aims to transfer technology, develop a skilled local biopharmaceutical workforce, and position Saudi Arabia as the first Gulf Cooperation Council country to produce biologic innovator insulin. The partnership supports Saudi Arabia's Vision 2030 by diversifying the economy and enhancing healthcare resilience. Saudi Arabia, through its focus on public health campaigns and diabetes education, is shaping the dynamics of the GCC market and driving growth.

Key Regional Takeaways:

Kingdom of Saudi Arabia Diabetes (KSA) Care Devices Market Analysis

The Kingdom of Saudi Arabia dominated the GCC diabetes care devices market in 2024, as it experienced an increasing prevalence of diabetes and growing healthcare investments. Advanced monitoring and management solutions have witnessed a high demand due to rising diabetes prevalence. The government's Vision 2030 aims for progressive changes to health infrastructure and patients accepting emerging technologies in medicine. The International Trade Administration published an article on January 1, 2024, revealing that nearly 18% of the population suffers from diabetes, and more than 40% suffer from the negative effects of obesity. This article stated that the expenditure of Saudi Arabia would increase towards the prevention and treatment of type 2 diabetes and lifestyle disorders. Additionally, it stated that between 25% and 35% of Saudi Arabia's overall healthcare spending was allocated to diabetes, obesity, and cardiovascular disorders in 2021. As Saudi Arabia increasingly focuses on preventative care screenings to effectively manage chronic diseases, the number of primary healthcare center visits per capita is expected to double.

United Arab Emirates (UAE) Diabetes Care Devices Market Analysis

Increasing numbers of diabetic patients in the UAE, along with awareness regarding early diagnosis and efficient management, are promoting the usage of diabetes care equipment. The National Diabetes Control Program implemented by the government aims to control prevalence, spread awareness, and prevent through country-wide screening and education. The market in UAE is further bolstered by the country's investment in digital health solutions and smart healthcare technologies, aligning with its vision of becoming a global leader in innovative healthcare systems. According to a market report on January 12, 204, UAE completed its 100-Day Diabetes Prevention Campaign, which exceeded 140%. The program, targeting an early detection test for 5,000 residents, outperformed the targets as the country had to conduct tests on 12,877 citizens. It was possible due to the collaboration among agencies, private institutions, and local government units that all aimed at lowering the incidence of diabetes in the country, now placed at 11.8%.

Competitive Landscape:

The competitive landscape of the market is characterized by increasing competition due to rising diabetes prevalence, technological advancements, and healthcare investments. Key players in the market are shifting their focus to innovative solutions, such as continuous glucose monitoring systems, insulin delivery devices, and smart health technologies, to cater to the needs of this region for effective management of diabetes. Also, strategic collaborations and partnerships between manufacturers are enhancing the market outlook. For instance, Medtronic and Abbott’s strategic partnership announced on August 7, 2024 unites two leading healthcare innovators to facilitate diabetes management. This collaboration uses the combination of Abbott's FreeStyle Libre sensors and Medtronic's smart insulin delivery systems, and aims to reduce the burden on patients, enhance global access to continuous glucose monitoring (CGM) and automated insulin delivery solutions, and improve care for patients with type 1 and type 2 diabetes. Regulatory support with the increasing awareness of the consumer is also intensifying competition while promoting innovation and market expansion across the GCC region.

The report provides a comprehensive analysis of the competitive landscape in the GCC diabetes care devices market with detailed profiles of all major companies, including:

- Dexcom Inc.

- Insulet Corporation

- Medtronic PLC

- Novo Nordisk A/S

- Ascensia Diabetes Care

- Bionime Corporation

- Becton, Dickinson and Company

- Abbott Diabetes Care

- Eli Lilly

- Sanofi

Latest News and Developments:

- November 28, 2024: PureHealth announced the launch of a diabetes care module within its AI-enabled health app, Pura, which has already achieved over 140,000 downloads. This module simplifies diabetes management by integrating real-time glucose tracking, personalized meal plans, and seamless connectivity with continuous glucose monitoring devices. Integrated with PureHealth’s hospital and clinic network, the app offers tools for managing appointments, teleconsultations, and medicine delivery, aiming to revolutionize healthcare accessibility in the UAE.

GCC Diabetes Care Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Diabetes Clinics/Centers, Online Pharmacies, Others |

| End Users Covered | Hospitals, Home Care, Diagnostic Centers, Ambulatory Surgery Centers |

| Countries Covered | Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain |

| Companies Covered | Dexcom Inc., Insulet Corporation, Medtronic PLC, Novo Nordisk A/S, Ascensia Diabetes Care, Bionime Corporation, Becton, Dickinson and Company, Abbott Diabetes Care, Eli Lilly, Sanofi, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC diabetes care devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC diabetes care devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC diabetes care devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Diabetes care devices are specialized tools designed to monitor, manage, and treat diabetes effectively. These include blood glucose meters, insulin pumps, continuous glucose monitors (CGMs), and insulin pens. They are essential for maintaining glucose levels, improving patient outcomes, and enabling personalized diabetes management in healthcare settings and daily life.

The GCC diabetes care devices market was valued at USD 787.52 Million in 2024.

IMARC estimates the GCC diabetes care devices market to exhibit a CAGR of 7.70% during 2025-2033.

The key factors driving the GCC diabetes care devices market include rising diabetes prevalence, increasing health awareness, government initiatives for diabetes management, advancements in technology, and growing demand for user-friendly, portable devices to support effective self-management of the condition in the region.

Insulin delivery devices represented the largest segment by type, driven by rising diabetes prevalence, advanced technology adoption, ease of use, government healthcare initiatives, and increasing patient awareness.

Hospital pharmacies lead the market by distribution channel due to their integration with healthcare systems, access to specialist-recommended devices, immediate availability, quality assurance, and government-backed healthcare infrastructure advancements.

Hospitals are the leading segment by end user, driven by their comprehensive diabetes management services, adoption of advanced technologies, specialized care, high patient footfall, and government support for healthcare modernization and innovation.

On a regional level, the market has been classified into Saudia Arabia, UAE, Qatar, Kuwait, Oman, Bahrain, wherein Saudi Arabia currently dominates the GCC diabetes care devices market.

Some of the major players in the GCC diabetes care devices market include Dexcom Inc., Insulet Corporation, Medtronic PLC, Novo Nordisk A/S, Ascensia Diabetes Care, Bionime Corporation, Becton, Dickinson and Company, Abbott Diabetes Care, Eli Lilly, and Sanofi, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)