GCC Generic Injectables Market Report by Container Type (Vials, Prefilled Syringes, Ampoules, Premix, and Others), Therapeutic Area (Oncology, Anaesthesia, Anti-infectives, Cardiovascular, Parenteral Nutrition, and Others), Distribution Channel (Hospitals, Clinics, Retail Pharmacy Stores), and Region 2025-2033

Market Overview:

The GCC generic injectables market size reached USD 761.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,893.0 Million by 2033, exhibiting a growth rate (CAGR) of 10.7% during 2025-2033. The growing investment by pharmaceutical companies in marketing innovative drugs, less approval time, and domestic manufacturing in the GCC region represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 761.0 Million |

|

Market Forecast in 2033

|

USD 1,893.0 Million |

| Market Growth Rate 2025-2033 | 10.7% |

Rising Prevalence of Chronic Diseases Impelling Market Growth

The growing population and rising occurrence of chronic diseases and non-communicable diseases (NCDs) currently represent one of the primary factors driving the sales of generic injectables in the GCC region. With the growing geriatric population in the region, the deaths and disabilities caused due to NCDs are rising. High-valued patented injectables add more cost, whereas generic injectables do the same job at a lower price, thereby making them affordable to maximum patients.

Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is fragmented with a number of global and regional players operating in the industry. The volume of new entrants is moderate in the GCC generic injectables industry as the high market growth and low product differentiation and switching costs, attract new entrants to enter the market. However, high capital investment prevents new entrants from foraying into the industry.

What are Generic Injectables?

Generic injectables are pharmaceutical drugs which are equivalent to brand-name injectables with respect to dosage, strength, route of administration, quality, performance, and intended use. These injectables are made available in the market after the patent expiration of branded injectables. They undergo complex manufacturing processes, but cheaper and shorter research and development (R&D) cycles as compared to branded injectables. Generic injectables are less expensive than branded injectables and, thereby contribute to significant savings for patients and healthcare providers. They are widely used in the treatment of various chronic diseases, such as cancer, diabetes, cardiovascular diseases, respiratory diseases, rheumatoid arthritis, osteoarthritis, and osteoporosis.

COVID-19 Impact:

The rapid spread of COVID-19 in the GCC countries has adversely impacted various businesses across the region. In order to slow down the spread, governing agencies in the region have taken various measures, including the closing of borders, suspension of air traffic, and imposition of a comprehensive quarantine. The rapid spread of the virus has negatively impacted both the supply and demand across the region. Supply chain disruptions, reduced availability of raw materials, factory shutdowns, and trade bans are some of the major factors that have impacted the supply. The outbreak of COVID-19 has also impacted supply chains in the GCC pharmaceutical industry. This was true not only for finished products but also for raw materials. The countries in the GCC region were facing interruptions in the supply of generic drugs as the majority of the generic drug demand in the region were fulfilled by imports. Logistics services were the primary reason for this disruption. As a consequence of this, countries in the region, especially Saudi Arabia and UAE, were fostering the localization and encouraging local production of generic drugs to reduce the impact of any disruptions. This, in turn, is expected to provide a positive impetus to the GCC generic injectables sector.

GCC Generic Injectables Market Trends:

At present, the rising demand for generic injectables on account of the high affordability, as they do not require extensive research and testing and saves both money and time, represents one of the key factors supporting the growth of the market in the GCC region. Besides this, generic injectables require lower capital investment compared to patented injectables, as key manufacturers do not invest in drug discovery and various clinical trials since it is previously verified for the patented injectable, which is impelling the growth of the market in the region. In addition, the growing demand for generic injectables due to less approval time is offering a favorable market outlook in the GCC region. Moreover, the increasing investment by pharmaceutical companies in marketing innovative drugs, as they need to educate both physicians and authorities on the efficacy and safety profile of new drugs, is strengthening the growth of the market. Apart from this, governing agencies in the GCC region are encouraging domestic manufacturing of generic injectables, which is offering lucrative growth opportunities to industry investors. Additionally, the growing prevalence of acute and chronic disease cases due to the rising emigrant population in the region is positively influencing the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the GCC generic injectables market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on container type, therapeutic area and distribution channel.

Container Type Insights:

- Vials

- Prefilled Syringes

- Ampoules

- Premix

- Others

The report has provided a detailed breakup and analysis of the GCC generic injectables market based on the container type. This includes vials, prefilled syringes, ampoules, premix, and others. According to the report, vials represented the largest segment, as they are small glasses or plastic vessels, often used to store medication in several forms, such as liquids, powders, or capsules. In addition, the growing demand for vials due to the lower risk of breakage and contamination is offering a favorable market outlook.

Therapeutic Area Insights:

- Oncology

- Anaesthesia

- Anti-infectives

- Cardiovascular

- Parenteral Nutrition

- Others

A detailed breakup and analysis of the GCC generic injectables market based on the therapeutic area has also been provided in the report. This includes oncology, anaesthesia, anti-infectives, cardiovascular, parenteral nutrition, and others. According to the report, oncology accounted for the largest market share due to the rising prevalence of cancer in the region. Moreover, various government and non-government organizations are promoting the manufacturing of generic oncology injectables to provide treatment to the maximum number of people at affordable rates.

Distribution Channel Insights:

- Hospitals

- Clinics

- Retail Pharmacy Stores

A detailed breakup and analysis of the GCC generic injectables market based on the distribution channel has also been provided in the report. This includes hospitals, clinics, and retail pharmacy stores. According to the report, hospitals accounted for the largest market share, as injectables cannot be traded without prescription from a certified practitioner due to stringent regulations in the GCC countries. Moreover, the rapid increase in non-communicable diseases (NCDs) has prompted investments in specialized hospitals and clinics with advanced technologies and improved capabilities.

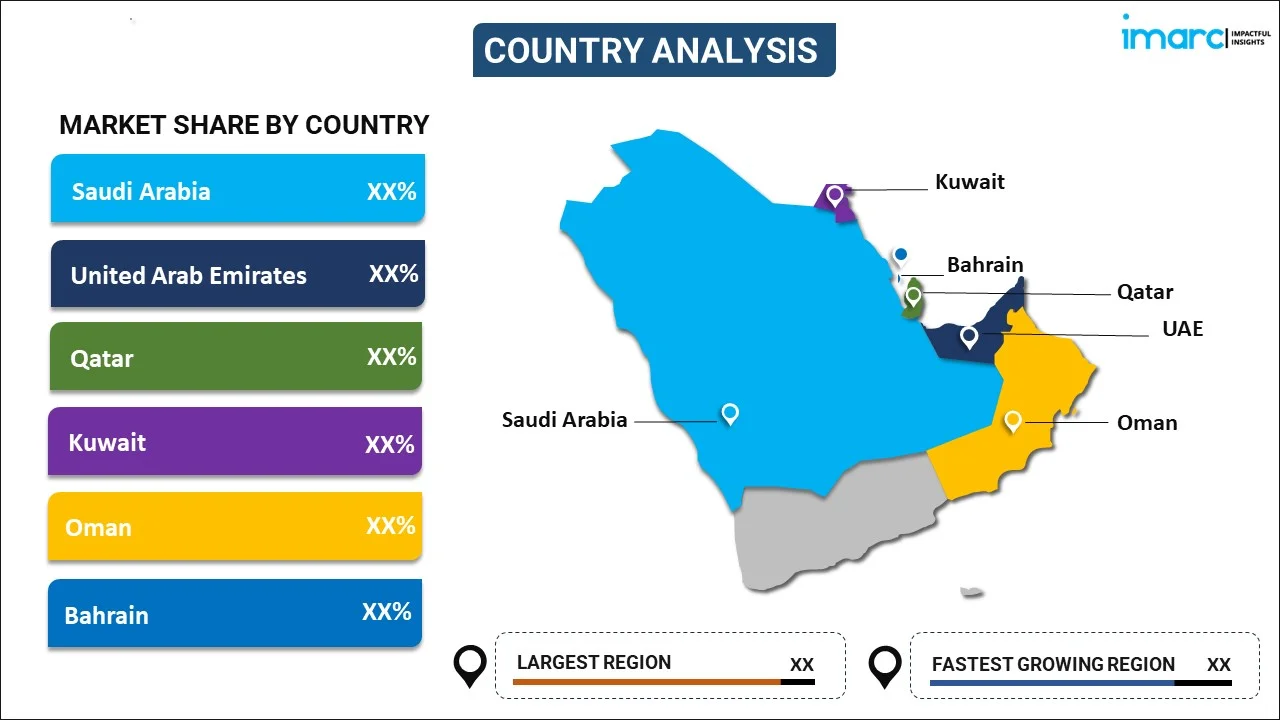

Regional Insights:

- Saudi Arabia

- UAE

- Kuwait

- Qatar

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, UAE, Kuwait, Qatar, Oman, and Bahrain. According to the report, Saudi Arabia was the largest market for GCC generic injectables. Some of the factors driving the Saudi Arabia generic injectables market included the growing domestic generic injectable manufacturing base, rising prevalence of chronic diseases, and new product launches. In addition, the increasing healthcare expenditure, along with favorable government initiatives, is offering lucrative growth opportunities to industry investors. Moreover, the transition of public hospitals to an increasingly privatized and comprehensive healthcare system in Saudi Arabia is catalyzing the demand for generic injectables.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the GCC generic injectables market.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Container Type, Therapeutic Area, Distribution Channel, Country |

| Countries Covered | Saudi Arabia, UAE, Kuwait, Qatar, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC generic injectables market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC generic injectables market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC generic injectables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC generic injectables market was valued at USD 761.0 Million in 2024.

We expect the GCC generic injectables market to exhibit a CAGR of 10.7% during 2025-2033.

The rising prevalence of various chronic diseases, such as cancer, diabetes, osteoporosis, rheumatoid arthritis, etc., along with the increasing adoption of generic injectables, as they are cost-effective and offer enhanced patient outcomes, is primarily driving the GCC generic injectables market.

The sudden outbreak of the COVID-19 pandemic has led to the growing demand for generic injectables across several GCC nations, owing to the introduction of self-injection devices to reduce the risk of the coronavirus infection upon hospital visits or interaction with healthcare professionals.

Based on the container type, the GCC generic injectables market can be segmented into vials, prefilled syringes, ampoules, premix, and others. Currently, vials hold the majority of the total market share.

Based on the therapeutic area, the GCC generic injectables market has been divided into oncology, anesthesia, anti-infectives, cardiovascular, parenteral nutrition, and others. Among these, oncology currently exhibits a clear dominance in the market.

Based on the distribution channel, the GCC generic injectables market can be segregated into hospitals, clinics, and retail pharmacy stores. Currently, hospitals account for the largest market share.

On a regional level, the market has been classified into Saudi Arabia, UAE, Kuwait, Qatar, Oman, and Bahrain, where Saudi Arabia currently dominates the GCC generic injectables market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)