GCC Modular Construction Market Report by Type (Permanent, Relocatable), Module Type (Four Sided, Open Sided, Partially Open Sided, Mixed Modules and Floor Cassettes, Modules Supported by a Primary Structure, and Others), Material (Steel, Concrete, Wood, Plastic, and Others), End Use (Residential, Commercial, Education, Retail, Hospitality, Healthcare, and Others), and Country 2025-2033

Market Overview:

GCC modular construction market size reached USD 2.0 Billion in 2024. Looking forward, the market is projected to reach USD 3.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.7% during 2025-2033. The rising need for buildings that can withstand extreme weather conditions and offer enhanced durability, along with the growing focus of key industry players on reducing project timelines, is primarily augmenting the market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.0 Billion |

|

Market Forecast in 2033

|

USD 3.3 Billion |

| Market Growth Rate 2025-2033 | 5.7% |

Modular construction is an approach wherein a building or structure is assembled away from the construction site, employing identical materials and following the same standards as traditional on-site construction but within a controlled factory setting. This method includes the creation of individual elements referred to as modules, which are then brought to the site for assembly, culminating in the finished structure. The modules are produced with meticulous precision and efficiency, guaranteeing uniform quality and compliance with distinct design criteria. This method is distinguished by its design flexibility, the controlled manufacturing environment, the prospect of heightened sustainability, etc.

GCC Modular Construction Market Trends:

Growing investments in infrastructure projects

Government spending on infrastructure projects is rising, which is creating the need for quick, scalable, and affordable building solutions. With government organizations in nations like Saudi Arabia, the UAE, and Qatar initiating extensive projects in areas, such as housing, healthcare, education, and transportation, modular construction presents a faster option than conventional building techniques. As per the IMARC Group, the Saudi Arabia transportation infrastructure construction market was valued at USD 9.9 Billion in 2024. Modular methods help reduce on-site labor, construction timelines, and material waste, aligning with sustainability goals. Moreover, government-backed projects offer contractors financial security and predictable demand, encouraging wider adoption of modular techniques. The ability to standardize components and scale up production ensures timely delivery of public infrastructure, reinforcing the role of modular construction in national development strategies across the GCC region.

Heightened demand for temporary structures

Rising demand for temporary structures is creating the need for flexible, quickly deployable, and cost-efficient building solutions across the GCC region. With frequent large-scale events, such as exhibitions, trade shows, religious gatherings, and sporting events, countries like the UAE and Saudi Arabia require short-term facilities, including housing, offices, and sanitation units. As per industry reports, in 2024, Dubai World Trade Centre (DWTC) organized 378 exhibitions and events, representing a 26% increase compared to 2023. Modular construction provides an ideal solution due to its ease of transport, rapid installation, and reusability. The oil and gas sector also relies on modular units for on-site offices and worker accommodation. The growing preferences for adaptable structures that can be assembled, dismantled, and relocated with minimal disruption continue to strengthen the role of modular construction in the GCC region.

Rising tourism activities

Increasing tourism activities are fueling the market growth in the GCC region. In 2024, Qatar welcomed 5 Million international visitors, reflecting a 25% rise compared 2023, based on the latest figures from Qatar Tourism. Countries like the UAE, Saudi Arabia, and Qatar are actively promoting tourism through heritage sites and leisure projects, which demand the rapid development of hotels, resorts, and visitor facilities. Modular construction enables quick assembly and installation, helping developers meet tight deadlines without compromising on quality. The method also supports sustainable building practices, which align with many of the region’s modern tourism goals. With the continuous encouragement to boost international arrivals and enhance hospitality offerings, the demand for modular construction solutions in tourism-related infrastructure continues to grow across the GCC region.

GCC Modular Construction Market Growth Drivers:

Innovations in technology

Technological advancements are improving design precision, construction efficiency, and overall project scalability. Innovations like building information modeling (BIM), 3D printing, and automation in manufacturing allow faster and more accurate module production, reducing human error and construction waste. Smart technologies also support better energy management and integration of sustainable features within modular units, which aligns with the GCC’s increasing focus on green building practices. Additionally, advanced logistics and tracking systems streamline transportation and assembly processes, ensuring timely delivery and installation for large-scale projects. These technologies make modular construction more appealing for developers looking for cost-effective and future-ready building solutions. As urban development and infrastructure projects are expanding across the GCC region, tech-enabled modular construction is becoming a preferred choice for meeting the growing housing, commercial, and institutional demands efficiently.

Logistical improvements

Logistical improvements are positively influencing the market in the GCC region. Enhanced infrastructure, such as upgraded ports, roads, and warehousing facilities, allows the faster and safer movement of modular components across the region. Efficient logistics systems also enable better coordination between manufacturers, suppliers, and construction sites, ensuring that prefabricated units arrive on time and in optimal condition. This reliability increases the appeal of modular construction among developers looking to meet tight project deadlines. Additionally, improved supply chain management and tracking technologies help minimize waste and optimize resource utilization. Cross-border trade efficiencies and the rise of regional manufacturing hubs are further supporting the timely and cost-effective delivery of modular units. Overall, these logistical advancements are making modular construction a more practical and scalable solution for large-scale projects in the GCC region.

Increasing adoption of sustainability goals

Modular construction supports sustainability by reducing material waste, minimizing on-site pollution, and enhancing energy efficiency through precise factory-controlled processes. These methods contribute to lower carbon footprints and more resource-conscious construction cycles. With the increasing need to adopt green building standards and certifications, modular solutions offer a streamlined way to meet environmental benchmarks. Additionally, reusable and recyclable materials used in modular components support circular economy objectives. In fast-developing urban areas like Riyadh and Dubai, where environmental impact is a growing concern, modular construction helps developers balance rapid infrastructure development with long-term sustainability goals. This alignment with environmental policies and international standards is strengthening modular construction's position in the GCC’s evolving real estate and infrastructure sectors.

GCC Modular Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on type, module type, material, and end use.

Type Insights:

To get more information on this market, Request Sample

- Permanent

- Relocatable

The report has provided a detailed breakup and analysis of the market based on the type. This includes permanent and relocatable.

Module Type Insights:

- Four Sided

- Open Sided

- Partially Open Sided

- Mixed Modules and Floor Cassettes

- Modules Supported by a Primary Structure

- Others

A detailed breakup and analysis of the market based on the module type have also been provided in the report. This includes four sided, open sided, partially open sided, mixed modules and floor cassettes, modules supported by a primary structure, and others.

Material Insights:

- Steel

- Concrete

- Wood

- Plastic

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes steel, concrete, wood, plastic, and others.

End Use Insights:

- Residential

- Commercial

- Education

- Retail

- Hospitality

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, education, retail, hospitality, healthcare, and others.

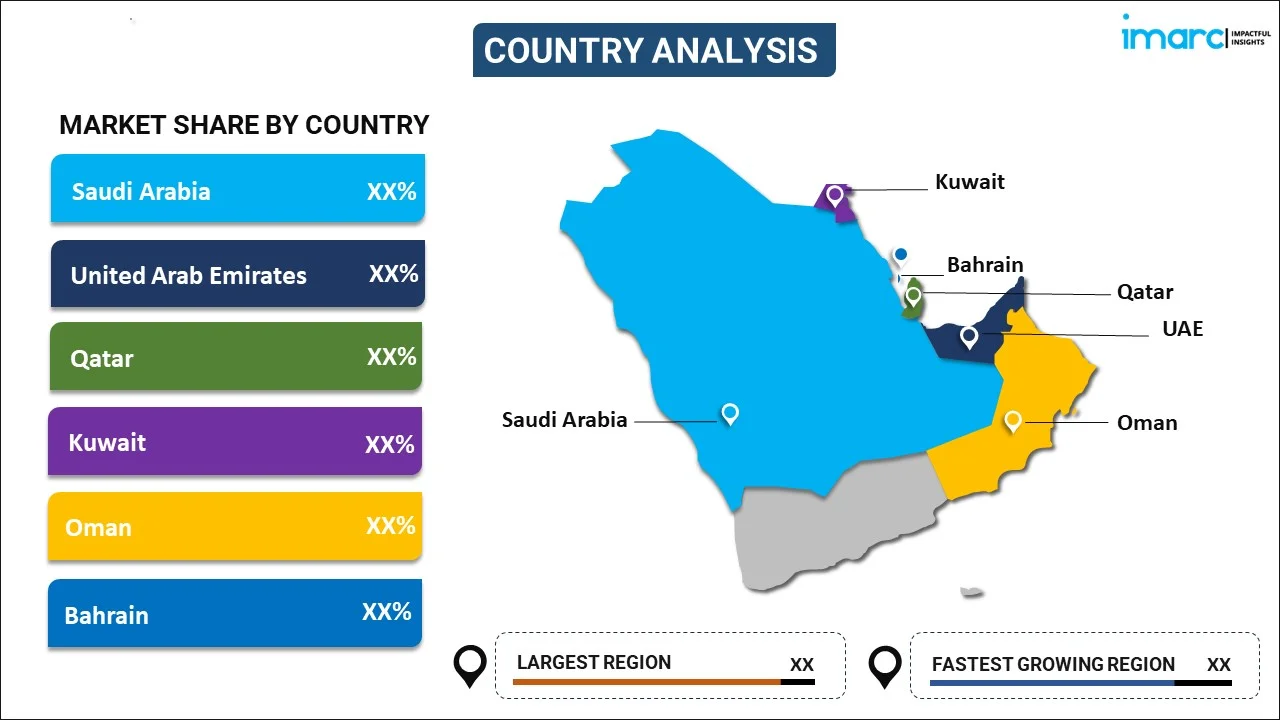

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Modular Construction Market News:

- May 2025: CIMC Modular Building Systems (MBS), a worldwide frontrunner in modular construction, entered into a significant agreement to deliver the Earth Riyadh Hotel in Saudi Arabia. This achievement emphasized CIMC MBS's dedication to promoting sustainable construction methods. The firm was set to offer a comprehensive range of services, such as module design, offsite production, and on-site assembly. The innovative modular building technology was anticipated to reduce the construction duration by more than 50% relative to conventional techniques, while greatly improving resource and energy efficiency.

- April 2025: Tamimi PEB established a new benchmark for modular building in Saudi Arabia, supported by BOPAS accreditation. The firm introduced its new five-year strategy to enhance its capabilities and encompass modular mid- and high-rise buildings, along with the offsite production of kitchen and bathroom pods. The implementation of semi-automated manufacturing systems was expected to result in a 35% boost in productivity, in line with the company’s overarching objectives of industrializing construction and aiding Saudi Arabia’s Vision 2030.

- March 2025: China Harbour Engineering Company (CHEC) started work at its modular construction facility for the Sedra residential project, which was executed by Roshn, in Riyadh, Saudi Arabia. Covering 200,000sqm, the factory was set to provide prefabricated parts for Sedra’s entirely modular villas and establish the industrial groundwork for upcoming prefabricated construction projects in Saudi Arabia.

- January 2025: DuBox, the prominent firm in modular construction, unveiled Productization, its newest solution providing clients across the UAE with ready-made turnkey offerings. Productization aimed to transform the modular construction sector by bringing a heightened degree of standardization and efficiency to the industry. The updated approach guaranteed assurance in quality, scalability, speed, and sustainability, completing projects on time and to the utmost standards.

- January 2025: Arco Turnkey Solutions purchased Laing O’Rourke Joinery to broaden operations in the UAE. The initiative sought to enhance production capability, facilitating premium projects and modular building throughout the GCC region.

- October 2024: Azizi Developments allocated USD 272 Million for modular construction factories in Abu Dhabi's economic zone. The firm planned to establish 12 cutting-edge factories in Abu Dhabi’s KEZAD.

GCC Modular Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Permanent, Relocatable |

| Module Types Covered | Four Sided, Open Sided, Partially Open Sided, Mixed Modules and Floor Cassettes, Modules Supported by a Primary Structure, Others |

| Materials Covered | Steel, Concrete, Wood, Plastic, Others |

| End Uses Covered | Residential, Commercial, Education, Retail, Hospitality, Healthcare, Others |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC modular construction market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC modular construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC modular construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The modular construction market in GCC was valued at USD 2.0 Billion in 2024.

The GCC modular construction market is projected to exhibit a CAGR of 5.7% during 2025-2033, reaching a value of USD 3.3 Billion by 2033.

The GCC modular construction market is driven by rapid urbanization, rising demand for affordable and sustainable housing, and the need for faster project completion. Government infrastructure initiatives, labor cost optimization, technological advancements in prefabrication, and growing adoption of eco-friendly, energy-efficient building solutions further accelerate market growth across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)