GCC Modular Kitchen Market Report by Product Type (Floor Cabinet Type, Wall Cabinet Type, Tall Storage Type), Design (L-Shape, U-Shape, Parallel, Straight, Island, Peninsula), Material Used (Lacquer Wood, High Pressure Laminates, Wood Veneers, Melamine, Metal, and Others), Distribution Channel (Online, Offline), and Region 2025-2033

Market Overview:

The GCC modular kitchen market size reached USD 1,676.0 Million in 2024. The market is projected to reach USD 2,148.0 Million by 2033, exhibiting a growth rate (CAGR) of 2.70% during 2025-2033. The market is witnessing continuous expansion, supported by robust construction activities and ongoing urban development. The recovery of oil prices is enhancing investor confidence and spending capacity. Additionally, rising population in nations like Saudi Arabia and the UAE is catalyzing the demand for modern space-efficient kitchen solutions in both new and renovated homes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,676.0 Million |

|

Market Forecast in 2033

|

USD 2,148.0 Million |

| Market Growth Rate 2025-2033 | 2.70% |

A modular kitchen is a term used for a kitchen furniture layout that consists of modules of cabinets made up of various materials that hold accessories inside and can facilitate the efficient utilization of spaces in a kitchen. The growth in the market is currently catalysed by factors such as the recovery in oil prices, strong growth in the housing sector and rising urban population.

GCC Modular Kitchen Market Trends:

Increasing investments in residential construction

The growing expenditure on residential construction across the GCC region is driving the demand for modular kitchens. Rapid urbanization, government housing schemes, and private sector real estate initiatives are creating a surge in new home developments. With people seeking modern, efficient, and aesthetically pleasing kitchen solutions, modular kitchens are becoming a preferred choice in newly built residential units. Developers are also offering fully-fitted kitchen solutions as part of property offerings to attract buyers, further accelerating modular kitchen installations. The increase in high-end and mid-range housing segments, particularly in urban hubs like Dubai, Riyadh, and Doha, is reflecting a shift towards contemporary living spaces. Modular kitchens are valued for their space optimization, easy customization, and sleek designs. As residential construction projects are expanding, modular kitchen adoption continues to grow steadily across the region. As per the IMARC Group, the GCC residential construction market is set to attain USD 54,790.4 Million by 2033, showing a growth rate (CAGR) of 4.56% during 2025-2033.

Rising influence of Western interior trends

Western interior design trends are heavily influencing user preferences in the GCC region, contributing to a rising demand for modular kitchens. Open-plan layouts, minimalistic aesthetics, and high-functionality designs seen in Western homes are becoming desirable features in urban GCC households. Modular kitchens offer clean lines, ergonomic layouts, and customizable storage solutions that fit this evolving style. International architects and designers working in luxury housing projects also bring Western design elements into local homes. Increasing exposure to worldwide designs through travel, international media, and rising social media impact is shaping lifestyle aspirations. As per the Datareportal, in January 2025, the UAE had 11.3 Million social media user accounts. Digital platforms showcase modular kitchen setups, inspiring homeowners to adopt similar styles.

Growing demand from hospitality industry

The thriving hospitality industry in the GCC region, marked by luxury hotels, serviced apartments, and vacation homes, is significantly contributing to the growth of the market. With tourism activities increasing in countries like Saudi Arabia, hospitality brands are investing in premium kitchen setups to enhance guest experience and operational efficiency. As per the data provided by the Saudi Ministry of Tourism, the nation experienced 30 Million international visitors in 2024, setting a new record for the country. Modular kitchens offer scalable, hygienic, and space-efficient solutions that align with international standards and hospitality aesthetics. Serviced apartments and extended-stay accommodations particularly benefit from compact and customizable modular kitchen units, allowing guests to enjoy homelike comfort. Moreover, the growing focus on wellness and personalized guest services has increased the inclusion of kitchenettes in hotel suites.

GCC Modular Kitchen Market Growth Drivers:

Technological advancements in kitchen appliances

Technological innovations in kitchen appliances are propelling the market growth in the GCC region. Smart appliances, energy-efficient systems, and space-saving devices are driving the integration of modern kitchen setups into both residential and commercial spaces. Modular kitchens are ideally suited to incorporate these advanced appliances seamlessly, offering homeowners a cohesive and high-tech cooking environment. Voice-controlled systems, built-in coffee makers, smart refrigerators, and touchscreen-enabled ovens are becoming popular. As user preferences are shifting towards smart living, modular kitchen systems that support connectivity, automation, and efficient use of space are becoming essential. Developers and homeowners alike are employing these advancements to enhance convenience, hygiene, and energy savings. The compatibility of modular kitchen structures with evolving technology makes them a logical choice for future-ready homes in tech-savvy urban centers like Dubai and Riyadh.

Growth in renovation and remodeling activities

The surge in home renovation and remodeling across the GCC region is fueling the market growth. As property owners look to upgrade outdated interiors, kitchens are a top priority for modernization. Modular kitchens, with their customizable layouts, aesthetic appeal, and functional design, offer an ideal solution for revamping older homes and apartments. Rising disposable incomes, changing lifestyle preferences, and an emphasis on modern living standards are encouraging homeowners to invest in kitchen upgrades. Additionally, many GCC residents, particularly in urban areas, are opting for more efficient use of space, making modular kitchen systems an attractive alternative. The availability of varied materials, colors, and styles allows personalization that complements the existing decor while improving usability. This trend is further supported by renovation-focused government schemes and the active participation of interior design firms, reinforcing the market's upward momentum.

Expansion of retail outlets

The expansion of retail channels is improving accessibility and visibility of kitchen solutions across the GCC region. Large-format home improvement stores, malls, and design showrooms are showcasing modular kitchen models, making it easier for people to explore and purchase entire setups. Organized retailers also offer end-to-end services, including design consultation, customization, installation, and after-sales support, which enhances customer convenience and confidence. As user preferences are evolving, the exposure to diverse kitchen designs, materials, and appliances in retail environments is impacting purchasing decisions. These outlets also frequently collaborate with international brands, introducing global trends to local markets. Organized retail growth in cities, such as Dubai, Abu Dhabi, and Jeddah, ensures wider reach and better service infrastructure, contributing to the increasing adoption of modular kitchens in both urban and suburban regions of the GCC region.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the GCC modular kitchen market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on product type, design, material used and distribution channel.

Breakup by Product Type:

To get more information on this market, Request Sample

- Floor Cabinet Type

- Wall Cabinet Type

- Tall Storage Type

On the basis of product type, the GCC modular kitchen market has been segmented as floor cabinet, wall cabinet and tall storage. Currently, the floor cabinet type accounts for the majority of the market share.

Breakup by Design:

- L-Shape

- U-Shape

- Parallel

- Straight

- Island

- Peninsula

On the basis of design/layout type, the GCC modular kitchen market has been segmented as L-shape, U-shape, parallel, straight, island and peninsula.

Breakup by Material Used:

- Lacquer Wood

- High Pressure Laminates

- Wood Veneers

- Melamine

- Metal

- Others (Glass, Acrylic, etc.)

Based on the type of material used, the GCC modular kitchen market has been divided as lacquer wood, high pressure laminates, wood veneers, melamine and metals.

Breakup by Distribution Channel:

- Online

- Offline

Based on the distribution channel, the GCC modular kitchen market has been divided into online and offline. Currently, the offline distribution channel accounts for the majority of the market share.

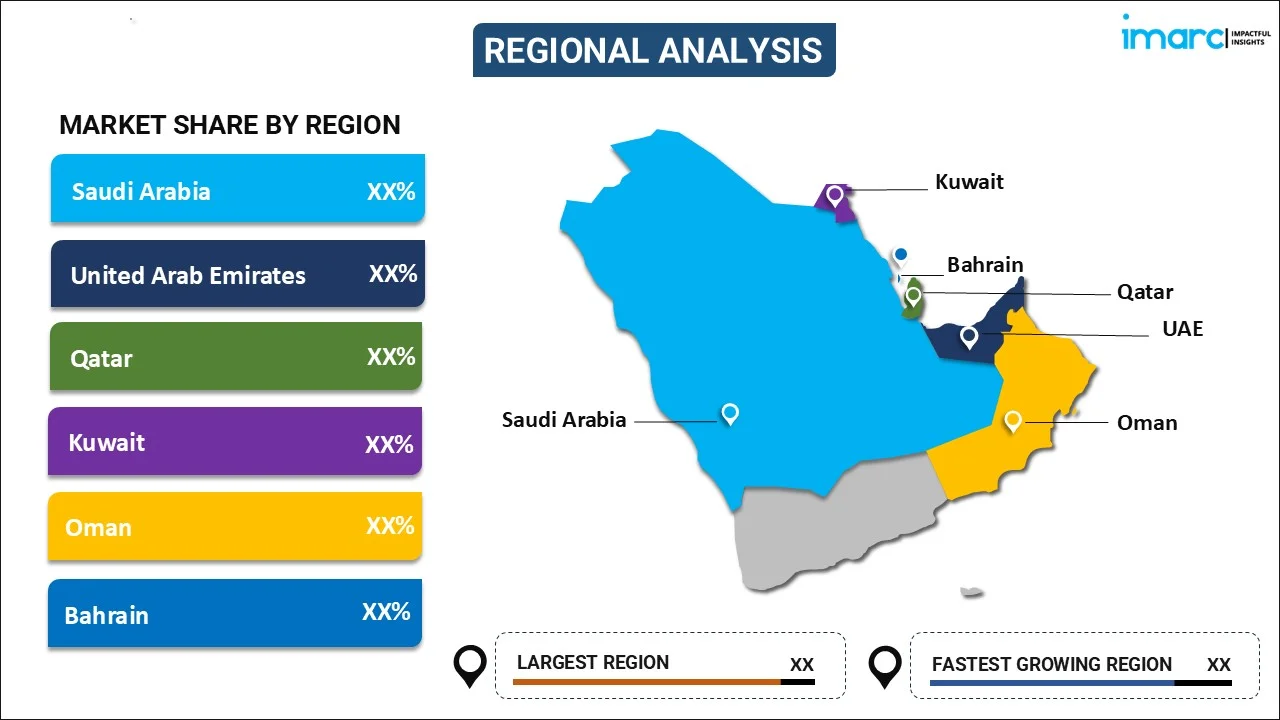

Region Insights:

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Bahrain

- Oman

Region-wise, the market has been divided into Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain and Oman. Amongst these, Saudi Arabia is the biggest market, accounting for the majority of the modular kitchen market in the GCC region.

Competitive Landscape:

The competitive landscape of the GCC modular kitchen market has also been analyzed in this report.

This report provides a deep insight into the GCC modular kitchen market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the GCC modular kitchen market in any manner.

GCC Modular Kitchen Market News:

- April 2025: Tamimi PEB set a new standard for modular construction in Saudi Arabia, backed by BOPAS certification. The company launched its new five-year plan to improve its abilities and include modular mid- and high-rise structures, as well as the offsite manufacturing of kitchen and bathroom units. The introduction of semi-automated manufacturing systems was anticipated to yield a 35% increase in productivity, aligning with the company’s main goals of industrializing construction and supporting Saudi Arabia’s Vision 2030.

- February 2025: Big 5 Construct Saudi, the biggest construction event in Saudi Arabia, was set to be conducted in Riyadh, featuring a remarkable growth in both size and scope. Over 75,000 construction professionals and more than 2,000 exhibitors were anticipated at the Riyadh Front Exhibition & Conference Centre during the first week (15 - 18 Feb 2025) and second week (24 - 27 Feb 2025). The event spanned numerous product sectors, including offsite and modular construction, kitchen and bathroom building envelope, and smart buildings.

- November 2024: Noblessa, the well-known brand recognized for its upscale kitchens, established its presence in Oman by launching a new luxury showroom in Muscat. The showroom provided an insight into the realm of stunning design, innovative technology, and eco-friendly kitchen options. Created for selective homeowners and property developers, it would offer modular kitchens tailored to fulfill the newest criteria in modern design and environmental accountability.

- August 2024: Pizza Express introduced an expandable food truck in Dubia, in partnership with modular design specialists wheelsAHOY. The main characteristic of this mobile eatery was its capacity to enlarge its kitchen area from a typical size to a broader and more accommodating workspace with just the press of a button. With its modular design and cutting-edge technology, the brand could deliver the cherished Pizza Express experience to additional locations within the country while preserving its high quality standards.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product Type, Design, Material Used, Distribution Channel, Country |

| Countries Covered | Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The modular kitchen market in GCC was valued at USD 1,676.0 Million in 2024.

The GCC modular kitchen market is projected to exhibit a CAGR of 2.70% during 2025-2033, reaching a value of USD 2,148.0 Million by 2033.

The GCC modular kitchen market is driven by urbanization, rising disposable incomes, and burgeoning preference for modern, space-efficient home designs. Growing awareness of aesthetics, convenience, and smart kitchen solutions, along with expanding real estate and hospitality sectors, and adoption of advanced materials and technologies, further fuel market growth in the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)