GCC Natural Mineral Water Market Report by Size (Less Than 1 Litre, 1 to 2 Litre, More Than 2 Litre), Distribution Channel (On-Trade, Supermarkets and Hypermarkets, Convenience Stores, and Others), and Country 2025-2033

Market Overview:

GCC natural mineral water market size reached USD 1.1 Billion in 2024. The market is projected to reach USD 2.5 Billion by 2033, exhibiting a growth rate (CAGR) of 8.4% during 2025-2033. The growing focus of individuals on adopting sustainable packaging and environmentally conscious practices and the emerging trends towards healthier and eco-friendly choices represent some of the key factors driving the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Market Growth Rate (2025-2033) | 8.4% |

Natural mineral water is a pristine and pure form of water sourced directly from underground reservoirs or aquifers, characterized by its inherent mineral content that is obtained through natural processes. Unlike regular tap water, it undergoes minimal human intervention and is free from contaminants, pollutants, and artificial additives. It typically contains a unique combination of minerals such as calcium, magnesium, potassium, and trace elements, contributing to its distinct taste and potential health benefits. Recognized for its refreshing and clean taste, it is often revered for its association with natural springs and the untouched environments from which it originates, making this form of water a preferred choice for those seeking a wholesome and untainted drinking experience.

GCC Natural Mineral Water Market Trends:

Growing health consciousness

Rising health consciousness is fueling the market growth in the GCC region. People are seeking pure and chemical-free drinking options to support a healthy lifestyle, especially as the awareness about the negative effects of sugary and carbonated beverages is increasing. Natural mineral water, with its trace minerals and clean source origins, is viewed as a superior choice for daily hydration. With rising rates of lifestyle-related illnesses like obesity and diabetes, individuals are turning towards simple and natural fluids that promote internal balance. A study by the World Obesity Federation indicated that by 2035, 6.5 Million adults in the UAE will be affected by overweight or obesity, including over 4.5 Million men. The trend is further supported by fitness culture and health campaigns across the region. As a result, the demand for natural mineral water continues to increase among individuals looking for healthier refreshment options aligned with long-term wellness goals.

Rising tourism activities

Increasing tourism activities are positively influencing the market in the GCC region. As per the information provided by Dubai’s Department of Economy and Tourism (DET), during the first half of 2025, Dubai attracted 9.88 Million international tourists, reflecting a 6% rise compared to H1 2024. Tourists, particularly from countries with strict health and safety standards, prefer trusted water sources during travel. Natural mineral water is perceived as a premium, reliable option for hydration in unfamiliar climates, especially given the region’s intense heat. Hotels, resorts, and tour operators regularly stock natural mineral water for guest convenience and health assurance. Luxury tourism also aligns with the consumption of high-quality products, making mineral-rich water a desirable offering. Furthermore, tourism-led events and festivals increase short-term demand, especially in peak seasons. With the expansion of tourism infrastructure across the GCC region, including hospitality and retail outlets, the availability of natural mineral water is growing.

Increasing brand endorsements and marketing

With increasing competition, companies are turning to celebrity endorsements, sports sponsorships, and lifestyle influencers to build strong brand identities across the GCC region. These promotional strategies associate mineral water with health, fitness, and luxury, making it more appealing to people across varied demographics. Visual campaigns often highlight purity, origin, and mineral content, tapping into wellness and environmental trends. Online advertising, especially on social media platforms, is further amplifying reach, particularly among younger audiences. As per the IMARC Group, the Saudi Arabia online advertising market was valued at USD 1.22 Billion in 2024. Limited-edition packaging, collaborations with athletes, and presence at major events are also enhancing brand prestige. These efforts are not only differentiating products from competitors but also creating emotional connections with users, encouraging repeat purchases.

Key Growth Drivers of GCC Natural Mineral Water Market:

Broadening of retail outlets

The expansion of retail channels is fueling the market growth in the GCC region. With the broadening of supermarkets, hypermarkets, and convenience stores, people can easily find a variety of mineral water options during their regular shopping routines. Organized retail chains offer attractive shelf placements, promotional discounts, and multi-pack offerings that make natural mineral water more affordable and visible. In addition, the rise of e-commerce and home delivery platforms provides convenient purchasing options, especially for health-conscious households. Retail expansion also allows new and international brands to enter the market, offering individuals more choice in terms of taste, source, and packaging. As shopping habits are shifting towards modern retail formats, natural mineral water benefits from enhanced exposure and impulse buying. This widespread availability ensures that people can maintain consistent access to healthier hydration options, supporting the market growth.

Innovations in products

Product diversification is accelerating the growth of the market in the GCC region. Brands are introducing flavored variants, sparkling water options, and functional waters enriched with minerals, vitamins, and electrolytes. This innovation attracts people looking for variety while still maintaining a healthy beverage choice. Flavored mineral water appeals to those trying to reduce sugary drink intake without sacrificing taste, while sparkling options are gaining popularity for social and dining occasions. Smaller pack sizes cater to on-the-go lifestyles, while bulk formats suit households and workplaces. Some brands are also promoting environment friendly packaging to meet the growing sustainability concerns. With more options available, individuals are more likely to include natural mineral water in different aspects of daily life, including hydration, refreshment, and fitness, making product variety a key driver of the market expansion in the region.

Increasing number of sports events

With the GCC region hosting more international and regional tournaments in football, tennis, athletics, and motorsports, the consumption of mineral-rich water is rising sharply. Athletes require reliable, mineral-balanced hydration to support performance and recovery, while organizers and sponsors often provide natural mineral water as part of their health and safety protocols. Spectators and participants attending these large-scale events, especially in outdoor venues, prefer clean, refreshing options in the intense heat. Additionally, sports partnerships and event branding help promote mineral water as part of a healthy and active lifestyle. Featuring prominently in media coverage, sponsorship banners, and athlete endorsements, natural mineral water is gaining visibility and user trust. As sporting activities and fitness culture are growing across the region, they are reinforcing the association between hydration and performance by catalyzing the demand for natural mineral water.

GCC Natural Mineral Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on size and distribution channel.

Size Insights:

To get more information on this market, Request Sample

- Less Than 1 Litre

- 1 to 2 Litre

- More Than 2 Litre

The report has provided a detailed breakup and analysis of the market based on the size. This includes less than 1 litre, 1 to 2 litre, and more than 2 litre.

Distribution Channel Insights:

- On-Trade

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade, supermarkets and hypermarkets, convenience stores, and others.

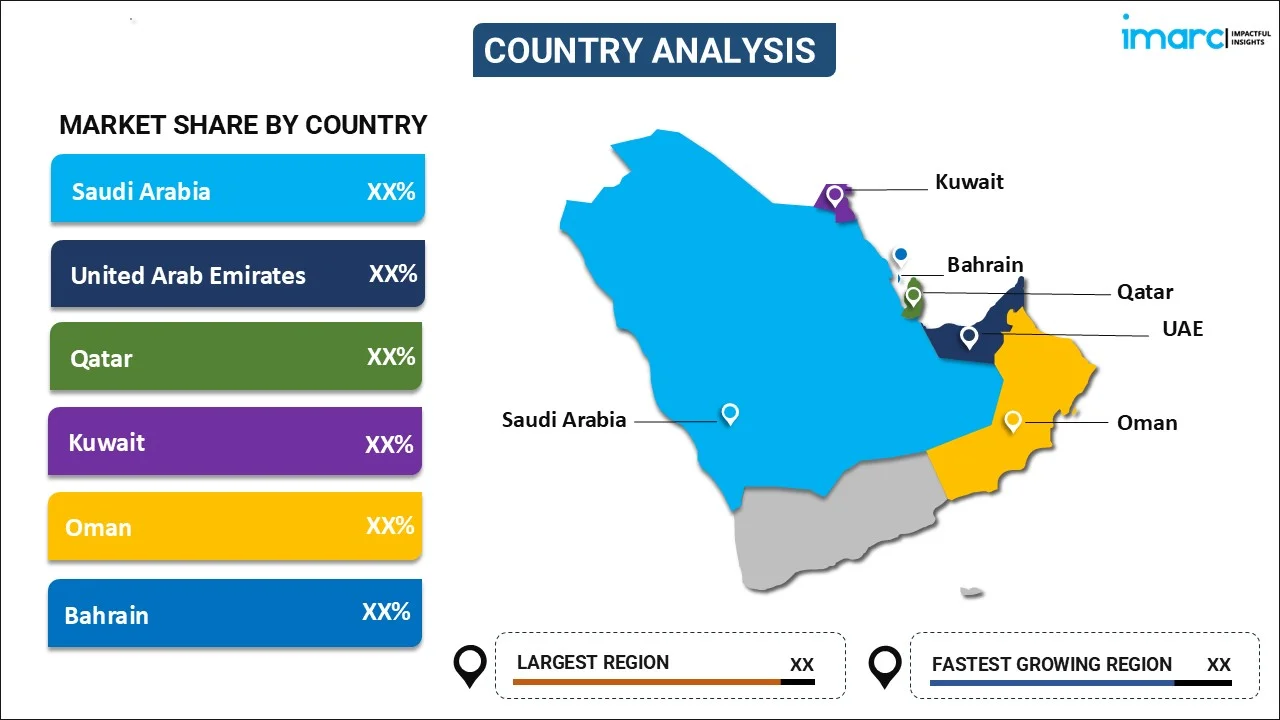

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Al Ain Food & Beverages PJSC (Agthia Group PJSC)

- Alrawdatain Water Bottling Company

- Danone S.A.

- Masafi LLC

- MYNA Water Bahrain

- Nestlé S.A.

- Rayyan Mineral Water Company

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

GCC Natural Mineral Water Market News:

- July 2025: Knuckles Spring Water, manufactured by Cargills (Ceylon) PLC of Sri Lanka, was launched in the Bahraini market with assistance from the Sri Lankan Embassy in Bahrain. Obtained from the pristine Knuckles Mountain range, the spring water was captured at the source to preserve its natural mineral content and clarity. It was to be offered in both glass and PET bottles via the well-known Al Jazira Supermarket chain.

- March 2025: Italian Food Masters, the foremost distributor of high-quality food and beverage (F&B) items in the UAE, declared the official distribution of ‘Lurisia Premium Natural Mineral Water’ sourced from the Italian Alps. Offered in Still and Sparkling, Lurisia was the perfect selection for upscale dining establishments, specialty coffee shops, gourmet stores, and discerning individual clients in the UAE. It was famous for its remarkable purity, subtle mineral composition, and smooth flavor.

GCC Natural Mineral Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sizes Covered | Less Than 1 Litre, 1 to 2 Litre, More Than 2 Litre |

| Distribution Channels Covered | On-Trade, Supermarkets and Hypermarkets, Convenience Stores, Others |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Companies Covered | Al Ain Food & Beverages PJSC (Agthia Group PJSC), Alrawdatain Water Bottling Company, Danone S.A., Masafi LLC, MYNA Water Bahrain, Nestlé S.A., Rayyan Mineral Water Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC natural mineral water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC natural mineral water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC natural mineral water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The natural mineral water market in GCC was valued at USD 1.1 Billion in 2024.

The natural mineral water market in GCC is projected to exhibit a CAGR of 8.4% during 2025-2033, reaching a value of USD 2.5 Billion by 2033.

GCC natural mineral water market is fuelled by growing health consciousness, expanding demand for pure and clean drinking water, and increasing inclination towards natural products. Reticent freshwater resources within the region also promote dependence on packaged mineral water. Urbanization, tourism development, and increasing disposable incomes drive enhanced consumption. Strong distribution channels, brand expansion, and product developments such as green packaging are also supporting the steady growth of the market.

Some of the major players in the GCC natural mineral water market include Al Ain Food & Beverages PJSC (Agthia Group PJSC), Alrawdatain Water Bottling Company, Danone S.A., Masafi LLC, MYNA Water Bahrain, Nestlé S.A., Rayyan Mineral Water Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)