GCC Pre-Owned Construction Equipment Market Report by Product (Earthmoving and Roadbuilding Equipment, Material Handling and Cranes, Concrete Equipment, and Others), Application (Excavation, Earthmoving, Transportation, and Others), End User Industry (Construction, Mining, Oil and Gas, Defense, and Others), and Country 2026-2034

Market Overview:

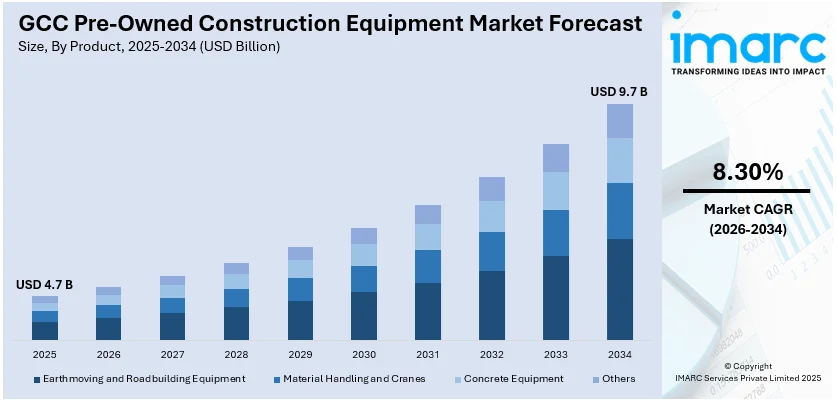

GCC pre-owned construction equipment market size reached USD 4.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.7 Billion by 2034, exhibiting a growth rate (CAGR) of 8.30% during 2026-2034. The inflating need for cost-effective solutions to allow firms to reallocate their resources strategically, ensuring that the budget constraints do not hinder the refurbishment projects, is primarily augmenting the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.7 Billion |

|

Market Forecast in 2034

|

USD 9.7 Billion |

| Market Growth Rate 2026-2034 | 8.30% |

Pre-owned construction equipment refer to machinery and tools that have been previously owned and used in construction activities. These instruments, ranging from excavators and bulldozers to cranes and loaders, have previous operational history before being made available for resale. Despite being used, they are generally well-maintained and thoroughly inspected to ensure they meet safety and performance standards. Purchasing pre-owned equipment presents a cost-effective alternative for construction companies looking to acquire machinery without the high upfront costs associated with brand-new equipment. They offer an opportunity for businesses to access reliable and functional construction equipment that aligns with their budget constraints while still meeting project requirements. The pre-owned construction equipment also provide a sustainable and economical option for companies aiming to enhance their fleet without compromising operational efficiency.

To get more information on this market Request Sample

GCC Pre-Owned Construction Equipment Market Trends:

The GCC pre-owned construction equipment market is experiencing notable shifts driven by key drivers and trends that reflect the region's dynamic construction landscape. A primary driver is the region's focus on cost-effectiveness, with companies seeking reliable machinery at lower costs to enhance their operational efficiency. The market is also witnessing an increased demand as construction firms look for opportunities to optimize their budgets without compromising on the quality and performance of equipment. Besides this, the launch of favorable policies by government bodies for thorough inspections and assessments of pre-owned equipment to assure buyers of their reliability is acting as another significant growth-inducing factor. Additionally, the growing emphasis on sustainability contributes to the popularity of pre-owned equipment, aligning with several efforts to reduce environmental impact through responsible resource use. Apart from this, the increasing number of financing and leasing options that provide businesses with alternatives to outright purchases is also bolstering the market growth across the GCC. The flexibility allows companies to access the equipment they need without a substantial initial investment, fostering a more adaptable approach to fleet management. In conclusion, the elevating focus of industry players on cost-effectiveness, technological integration, and sustainability are expected to fuel the GCC pre-owned construction equipment market over the forecasted period.

GCC Pre-Owned Construction Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country level for 2026-2034. Our report has categorized the market based on product, application, and end user industry.

Product Insights:

- Earthmoving and Roadbuilding Equipment

- Material Handling and Cranes

- Concrete Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes earthmoving and roadbuilding equipment, material handling and cranes, concrete equipment, and others.

Application Insights:

.webp)

Access the comprehensive market breakdown Request Sample

- Excavation

- Earthmoving

- Transportation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes excavation, earthmoving, transportation, and others.

End User Industry Insights:

- Construction

- Mining

- Oil and Gas

- Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes construction, mining, oil and gas, defense, and others.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Pre-Owned Construction Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Earthmoving and Roadbuilding Equipment, Material Handling and Cranes, Concrete Equipment, Others |

| Applications Covered | Excavation, Earthmoving, Transportation, Others |

| End User Industries Covered | Construction, Mining, Oil and Gas, Defense, Others |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC pre-owned construction equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the GCC pre-owned construction equipment market on the basis of product?

- What is the breakup of the GCC pre-owned construction equipment market on the basis of application?

- What is the breakup of the GCC pre-owned construction equipment market on the basis of end user industry?

- What are the various stages in the value chain of the GCC pre-owned construction equipment market?

- What are the key driving factors and challenges in the GCC pre-owned construction equipment?

- What is the structure of the GCC pre-owned construction equipment market and who are the key players?

- What is the degree of competition in the GCC pre-owned construction equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC pre-owned construction equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC pre-owned construction equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC pre-owned construction equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)