GCC Sports Betting Market Size, Share, Trends and Forecast by Platform, Betting Type, Sports Type, and Country, 2026-2034

GCC Sports Betting Market Summary:

The GCC sports betting market size was valued at USD 3.07 Billion in 2025 and is projected to reach USD 7.16 Billion by 2034, growing at a compound annual growth rate of 9.89% from 2026-2034.

The GCC sports betting market is experiencing substantial growth driven by the convergence of digital transformation, evolving regulatory frameworks, and expanding sports infrastructure across the region. The proliferation of high-speed internet connectivity, widespread smartphone adoption, and a young, tech-savvy population are accelerating the shift toward online betting platforms. Major international sporting events, strategic government investments in sports tourism, and the development of sophisticated digital payment ecosystems are collectively fueling market expansion and reshaping the regional betting landscape.

Key Takeaways and Insights:

- By Platform: Online dominates the market with a share of 63% in 2025, driven by widespread smartphone penetration, enhanced internet infrastructure, and growing consumer preference for convenient, real-time betting experiences.

- By Betting Type: Fixed odds wagering leads the market with a share of 35% in 2025, owing to its simplicity, predictable payout structures, and clear risk-reward calculations that appeal to both novice and experienced bettors.

- By Sports Type: Football represents the largest segment with a market share of 46% in 2025, supported by the sport's massive regional following, year-round competitive calendar, and extensive coverage of international leagues and tournaments.

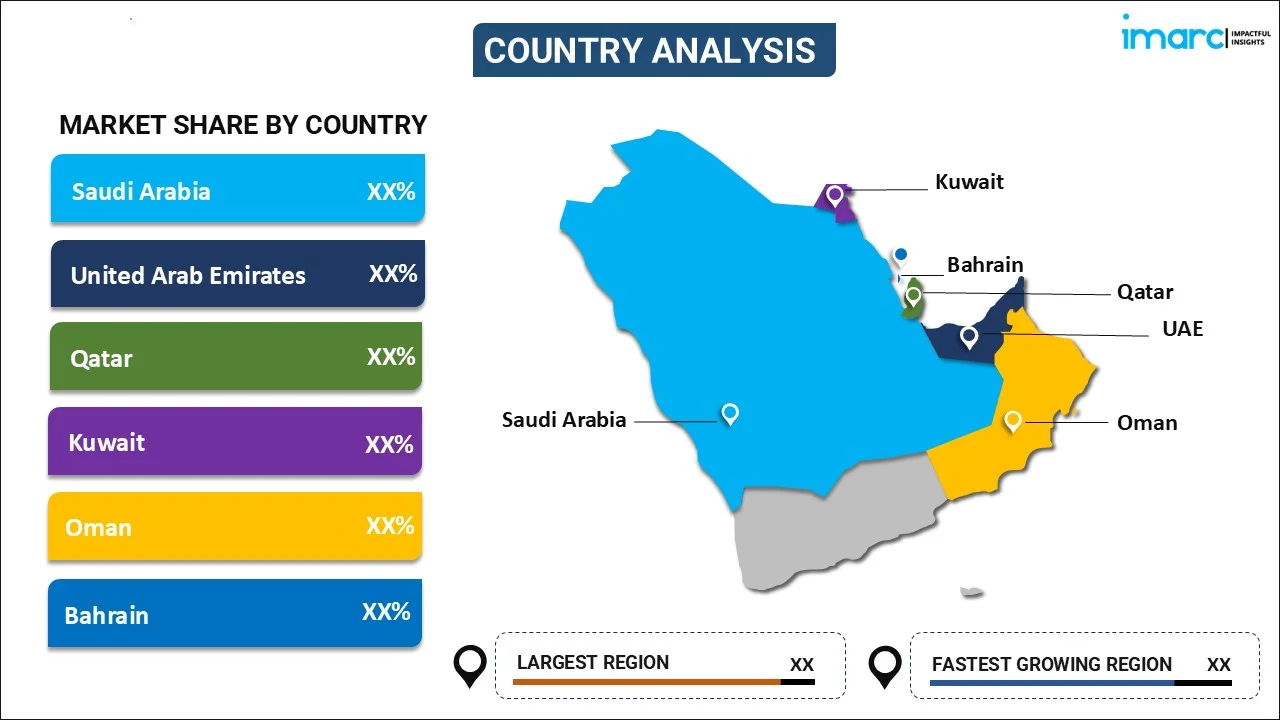

- By Country: Saudi Arabia dominates the market with a share of 30% in 2025, reflecting its substantial digital infrastructure investments, young demographic profile, and ambitious Vision 2030 sports development initiatives.

- Key Players: The GCC sports betting market exhibits moderate to high competitive intensity, with international gaming operators increasingly targeting the region due to its considerable economic prospects and technology-oriented population. Strategic local partnerships, sponsorship arrangements with prominent sports events, and customized platform offerings are shaping the competitive landscape.

The GCC sports betting market is entering a transformative phase, driven by regulatory reforms and technological advancements. The introduction of structured frameworks for commercial gaming, including sports wagering, online gaming, and lotteries, has provided a clear and regulated environment for operators, fostering market confidence. Simultaneously, rapid digital infrastructure development and widespread internet connectivity are enabling seamless access to online and mobile betting platforms. The growth of sports tourism and the hosting of major international sporting events further enhance regional interest and participation in regulated betting. Additionally, the maturation of secure digital payment systems and mobile-first solutions supports convenient, real-time wagering experiences. Together, these factors create a favorable ecosystem for market expansion, positioning the GCC as a burgeoning hub for regulated sports betting, attracting both regional consumers and international operators seeking to capitalize on the region’s evolving sports and digital entertainment landscape.

GCC Sports Betting Market Trends:

Regulatory Framework Evolution and Market Formalization

The GCC region is witnessing unprecedented regulatory developments that are reshaping the sports betting landscape. The UAE's establishment of the GCGRA has introduced comprehensive frameworks for licensing, responsible gaming, and consumer protection. For instance, in July 2024, the GCGRA issued regulations for various gaming activities including sports wagering, establishing clear operational guidelines for licensed operators. This regulatory clarity is attracting international betting companies seeking entry into the region's emerging regulated market while ensuring player protection and social responsibility standards.

Integration of Artificial Intelligence and Data Analytics

Advanced technologies are revolutionizing sports betting operations across the GCC, with operators deploying AI-powered algorithms for precise odds calculation and personalized betting recommendations. Real-time data analytics enable dynamic odds adjustment and enhanced risk management capabilities. Machine learning tools analyze betting patterns to detect suspicious activities and support responsible gaming initiatives. For instance, in December 2025, Atos and N3XT Sports announced a partnership to accelerate sports digital transformation in Saudi Arabia, encompassing data-driven fan engagement and smart venue technologies.

Growth of Mobile-First Betting Platforms

Mobile commerce has become the primary channel shaping the GCC sports betting landscape, supported by strong smartphone usage and growing acceptance of digital payment methods. Betting operators are prioritizing mobile-first strategies by developing advanced applications that offer live streaming, real-time in-play wagering, and smooth, integrated payment experiences. These platforms are designed to match regional consumer preferences for convenience, speed, and interactivity. The shift toward mobile engagement reflects broader digital behavior trends across the GCC, where users increasingly favor on-the-go access to entertainment and interactive sports-related experiences.

Market Outlook 2026-2034:

The GCC sports betting market is expected to experience steady growth through 2033, driven by supportive demographic dynamics, expanding digital infrastructure, and gradual regulatory advancements. A young, tech-savvy population combined with increasing disposable incomes is fueling interest in interactive and online entertainment formats. Additionally, large-scale international sporting events, most notably the 2034 FIFA World Cup in Saudi Arabia, are anticipated to boost wagering activity, enhance global visibility, and accelerate broader market development across the region. The market generated a revenue of USD 3.07 Billion in 2025 and is projected to reach a revenue of USD 7.16 Billion by 2034, growing at a compound annual growth rate of 9.89% from 2026-2034.

GCC Sports Betting Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Platform |

Online |

63% |

|

Betting Type |

Fixed Odds Wagering |

35% |

|

Sports Type |

Football |

46% |

|

Country |

Saudi Arabia |

30% |

Platform Insights:

- Offline

- Online

Online dominates with a market share of 63% of the total GCC sports betting market in 2025.

Online betting platforms are driving market expansion through superior accessibility, convenience, and enhanced user experiences. The widespread adoption of smartphones, combined with near-universal internet penetration exceeding ninety-eight percent across the GCC region, has created optimal conditions for digital betting platform growth. Users can access diverse betting options from anywhere, at any time, utilizing secure mobile applications and web-based interfaces that offer real-time odds, live streaming, and instant payment processing.

The integration of advanced technologies including AI-driven personalization, live in-play betting features, and cryptocurrency payment options is further enhancing the appeal of online platforms. For instance, in December 2024, MyFatoorah partnered with Mastercard to launch a digital payment gateway serving over seventy-five thousand merchants across the GCC, facilitating secure e-commerce and online gaming transactions. The digital shift is particularly pronounced among younger demographics who demonstrate strong preference for mobile-first experiences and real-time engagement capabilities.

Betting Type Insights:

- Fixed Odds Wagering

- Exchange Betting

- Live/In-Play Betting

- Pari-Mutuel

- eSports Betting

- Others

Fixed odds wagering leads with a share of 35% of the total GCC sports betting market in 2025.

Fixed odds wagering leads the GCC sports betting market primarily due to its simplicity, transparency, and ease of understanding for new and conservative bettors. Unlike variable or pool-based formats, fixed odds allow users to know their potential returns at the time of placing a bet, reducing uncertainty and perceived risk. This clarity aligns well with cautious consumer behavior in the region. Additionally, fixed odds models are easier for regulators to monitor and control, making them more compatible with emerging, tightly governed regulatory frameworks across GCC countries.

Another key driver is the strong alignment of fixed odds wagering with digital platforms and international betting standards. Most global operators entering or evaluating the GCC market already specialize in fixed odds formats, enabling faster deployment and localization. The format also integrates seamlessly with popular sports such as football, cricket, and motorsports, which dominate regional interest. Furthermore, fixed odds systems support responsible gaming measures like stake limits and clear payout structures, helping operators meet cultural expectations while building trust and long-term user engagement.

Sports Type Insights:

- Football

- Basketball

- Baseball

- Horse Racing

- Cricket

- Hockey

- Others

Football represents the largest share of 46% of the total GCC sports betting market in 2025.

Football leads the largest share of the GCC sports betting market due to its deep-rooted popularity and widespread following across the region. European leagues such as the English Premier League, UEFA Champions League, and international tournaments attract strong viewership among GCC audiences, driving consistent betting interest. The sport’s simple rules, frequent matches, and high media coverage create numerous wagering opportunities. Additionally, football fandom transcends age groups and nationalities, making it the most commercially scalable sport for regulated betting platforms targeting diverse GCC populations.

Another major factor is football’s strong alignment with digital engagement and event-led betting behavior. Major tournaments, including the FIFA World Cup, AFC competitions, and regional leagues, generate spikes in betting volumes due to match frequency and predictable schedules. The awarding of the 2034 FIFA World Cup to Saudi Arabia further strengthens football’s dominance by boosting regional interest, infrastructure investment, and global visibility. For operators, football offers stable liquidity, diverse betting markets, and lower operational complexity, reinforcing its leading position within the GCC sports betting landscape.

Country Insights:

To get detailed regional analysis of this market, Request Sample

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Saudi Arabia dominates with a market share of 30% of the total GCC sports betting market in 2025.

Saudi Arabia’s sports betting market momentum is being driven by broad economic diversification efforts under Vision 2030, which emphasize entertainment, tourism, and digital services development. Massive investments in sports infrastructure and international sporting alliances, as well as the high-profile sporting events, are making the general population more involved in professional sports. This is because a young digitally linked demographic with increased smartphone penetration is intensifying the need in on-line and cell phone-based entertainment formats. All these elements are slowly changing the behavior of consumers and developing structural conditions in which the sports betting market can evolve in the future.

Another key driver is Saudi Arabia’s growing role as a global sports hub, supported by sustained government-backed investment through the Public Investment Fund. International sporting events like Formula 1, boxing championships, football tournaments, and the forthcoming 2034 FIFA World Cup are increasing the number of viewers and consumers of sporting activities. Such happenings create a keen attraction towards match-related activity such as betting in offshore or legal ways. Besides, the development of digital payment systems and data infrastructure also facilitates the expansion of scalable sports betting platforms as the regulatory frameworks are constantly being developed.

Market Dynamics:

Growth Drivers:

Why is the GCC Sports Betting Market Growing?

Expanding Digital Infrastructure and Smartphone Penetration

The GCC region boasts among the highest internet penetration rates globally, exceeding ninety-nine percent, creating a substantial foundation for online betting platform adoption. Widespread smartphone usage and advanced telecommunications infrastructure enable seamless access to mobile betting applications. The rapid deployment of 5G networks is enhancing connectivity and supporting bandwidth-intensive services including live streaming and real-time betting. The Saudi Arabia 5G infrastructure market size reached USD 199.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 4,892.8 Million by 2034, exhibiting a growth rate (CAGR) of 42.69% during 2026-2034, reflecting substantial investment in digital capabilities. For instance, in May 2024, Zain KSA announced plans to invest approximately four hundred thirty million dollars to expand its 5G network coverage to one hundred twenty-two cities across the kingdom.

Rising Sports Tourism and Major Event Hosting

The GCC is witnessing strong growth in sports tourism, fueled by significant investments in modern sporting infrastructure and the organization of major international events. These initiatives draw global visitors who are increasingly seeking regulated and engaging sports betting experiences during their trips. By enhancing event quality, accessibility, and entertainment offerings, the region is positioning itself as a premier destination for sports enthusiasts. This expansion not only boosts visitor engagement but also strengthens the overall sports economy, creating new opportunities for operators and related service providers across the GCC. For instance, the 2024 Formula 1 Abu Dhabi Grand Prix attracted 133,000 visitors from one hundred seventy-eight countries, boosting international visitor spending by thirty-four percent. Saudi Arabia's preparation for the 2034 FIFA World Cup is driving extensive infrastructure development and positioning the kingdom as a global sports destination.

Growing Youth Demographics and Digital Engagement

Youthful population of GCC is highly receptive to online and mobile-based platforms because of their preference of digital entertainment and interactive experiences. The use of social media, gaming, and esports creates a natural gateway to sports betting due to familiarity with this type of activity. Competitive gaming and fantasy sports are becoming popular with younger audiences and is a way to get away from casual online activity to conventional wagering. This demographic has become digitally linked, which prompts the development of mobile-first-interactive entertainment, prompting operators to create new innovative sports betting applications that are user-friendly to the tech-friendly consumers in the area.

Market Restraints:

What Challenges is the GCC Sports Betting Market Facing?

Regulatory Uncertainty and Compliance Complexity

Despite recent regulatory developments, the legal landscape for sports betting across the GCC remains fragmented and evolving. Individual emirates and countries maintain discretion over local licensing, creating compliance complexity for operators seeking regional expansion. Religious and cultural considerations continue influencing policy decisions, resulting in cautious and gradual regulatory evolution.

Social and Cultural Sensitivities

Traditional cultural norms and religious sensitivities continue to constrain market expansion. Industry participants must carefully balance growth ambitions with socially acceptable marketing approaches and platform design. Ensuring responsible gaming practices and robust consumer protection that reflect local values remains essential for building trust and achieving long-term market viability.

Competition from Unlicensed Operators

The presence of offshore unlicensed betting platforms poses challenges for regulated market development. These operators often lack consumer protection measures and responsible gaming safeguards, potentially undermining trust in the broader industry. Regulatory authorities face ongoing enforcement challenges in preventing access to unlicensed services and protecting consumers from potential harm.

Competitive Landscape:

The GCC sports betting market is characterized by emerging competitive dynamics as international operators evaluate entry strategies into the newly regulated landscape. The market structure is evolving from informal activity toward formalized, licensed operations under regulatory oversight. International gaming companies are establishing strategic partnerships with local entities, pursuing licensing applications, and customizing platform offerings to align with regional preferences and cultural considerations. Competition centers on technology differentiation, responsible gaming capabilities, payment integration, and localized content delivery. Operators are investing in mobile-first platforms, advanced analytics, and customer engagement tools to capture market share. The regulatory framework favors established operators with proven compliance track records and substantial financial resources to meet licensing requirements.

Recent Developments:

- December 2025: The United Arab Emirates marked a significant milestone in regulated digital gaming by introducing its first officially licensed online platform for internet gaming and sports wagering. Operating under the name Play971, the website has received formal approval from the General Commercial Gaming Regulatory Authority (GCGRA), the federal regulator tasked with overseeing and governing all commercial gaming activities nationwide.

- June 2025: Momentum, the operator of the UAE's National Lottery, announced plans to expand into online casino and sports betting markets. The company posted job openings for key roles, signaling its intention to launch a regulated online gaming platform following the UAE's 2024 introduction of gaming regulations under the GCGRA.

GCC Sports Betting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Platforms Covered | Offline, Online |

| Betting Types Covered | Fixed Odds Wagering, Exchange Betting, Live/In-Play Betting, Pari-Mutuel, Esports Betting, Others |

| Sports Types Covered | Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC sports betting market size was valued at USD 3.07 Billion in 2025.

The GCC sports betting market is expected to grow at a compound annual growth rate of 9.89% from 2026-2034 to reach USD 7.16 Billion by 2034.

Online dominated with a 63% share in 2025, driven by widespread smartphone penetration, advanced internet infrastructure, and growing consumer preference for convenient, mobile-first betting experiences offering real-time engagement and secure payment processing.

Key factors driving the GCC sports betting market include expanding digital infrastructure with near-universal internet penetration, rising sports tourism and major international event hosting, evolving regulatory frameworks creating licensed market opportunities, and a young, tech-savvy population with strong affinity for digital entertainment.

Major challenges include regulatory uncertainty and compliance complexity across different jurisdictions, social and cultural sensitivities influencing policy decisions, competition from unlicensed offshore operators, and the need to balance market development with responsible gaming requirements and consumer protection measures.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)