GCC Steel Market Report by Type (Flat Steel, Long Steel), Product (Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids), Application (Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances), and Country 2025-2033

Market Overview:

The GCC steel market size reached USD 3.50 Billion in 2024. The market is projected to reach USD 5.12 Billion by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. Significant growth in construction and infrastructure development, the rising adoption of advanced manufacturing technologies and processes, and the increasing concerns about environmental sustainability and carbon emissions represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.50 Billion |

|

Market Forecast in 2033

|

USD 5.12 Billion |

| Market Growth Rate 2025-2033 | 4.10% |

Steel is a widely used alloy that is primarily composed of iron and carbon, along with small amounts of other elements. It is renowned for its strength, versatility, and durability, making it one of the most essential materials in various industries and everyday applications. It can be shaped and formed into different structures, such as beams, sheets, rods, and wires, to fulfill a wide range of purposes. Steel is used extensively in construction, manufacturing, transportation, and infrastructure projects. It serves as a fundamental material in buildings, bridges, automobiles, ships, machinery, and appliances. Steel's exceptional strength-to-weight ratio makes it an ideal choice for constructing sturdy and reliable structures. Its ductility allows for flexibility without compromising its integrity, making it resistant to fractures and deformation. Additionally, it can be easily recycled, contributing to its sustainability and environmental benefits. Beyond its mechanical properties, steel can be modified and enhanced through various alloying elements.

GCC Steel Market Trends:

Financial and Government Support

Financial incentives and strong government backing are playing a crucial role in fostering the growth of the steel market in the GCC area. Various governing bodies in the region are implementing measures, such as subsidies, advantageous loan terms, and tax breaks, all designed to encourage domestic steel manufacturing and draw in foreign investments. These initiatives aim to lower operational expenses for steel producers, thus increasing their competitiveness on both national and global stages. Moreover, steel manufacturing is frequently identified as a critical sector in larger national economic diversification plans, guaranteeing that it continues to be a primary target for policy efforts and government financing. This ongoing and strategic assistance from government entities fosters a favorable environment for the steel sector’s growth, offering fiscal stability and future opportunities for companies. As a result, local companies and international corporations are motivated to invest in the GCC steel market, which speeds up industry growth and enhances the area's standing in the worldwide steel commerce.

Enhanced Supply Chain Efficiency and Export Growth

Strategic collaborations between steel manufacturers and logistics firms are vital for enhancing the transportation of steel products both locally and globally. These partnerships enhance procedures like loading, unloading, and transport, significantly minimizing delays, decreasing expenses, and boosting output. An important instance of this collaboration is the five-year contract established in July 2024 between Milaha and Qatar Steel. This contract, focused on stevedoring services at Mesaieed Industrial City, included Milaha overseeing the logistics of loading and unloading products from Qatar Steel, such as rebar and iron slabs. This collaboration aimed to boost global logistics effectiveness and increase Qatar’s steel exports by streamlining the supply chain. The combined outcome of these partnerships is enhancing competitiveness within the global steel market, aiding GCC steel manufacturers in solidifying their standing and promoting market growth.

Rising Demand from Automotive Industry

Steel is a vital substance in car manufacturing, serving a crucial function in creating significant elements like body frames, chassis, engines, and structural components. With the rise of the automotive industry, both established car makers and new electric vehicle (EV) companies are catalyzing the demand for strong, high-quality steel. This growth is further backed by the area's increasing ability to manufacture automotive parts, along with significant government incentives designed to encourage domestic production and lessen reliance on imports. These actions promote investment in the automotive production industry, resulting in a continuous rise in steel usage. As a result, the automotive sector significantly contributes to the ongoing growth and development of the GCC steel market, positioning it as a critical pillar of economic diversification.

GCC Steel Market Growth Drivers:

Growth of the Real Estate Sector

The rapid growth of the real estate sector in the GCC region is a key factor catalyzing the demand for steel in the region. As urban populations increases, there is a rise in the need for residential, commercial, and mixed-use developments, with construction projects becoming major users of steel. In addition to the demand from high-rise buildings and residential towers, large-scale infrastructure projects, such as airports, sports complexes, and shopping malls, further contribute to steel usage. For example, in 2025, the GCC Railway Project was highlighted as a major regional initiative connecting six Gulf countries with a 2,117 km rail network, aiming for completion by 2030. The project will enable seamless train travel between Kuwait, Saudi Arabia, Bahrain, Qatar, the UAE, and Oman, enhancing regional connectivity. The UAE plans to launch its national passenger train service in 2026 as part of this larger network. Real estate developers in the region continue to favor steel-intensive designs because of the material’s durability, strength, and aesthetic appeal.

Technological Advancements

Technological progress in steel production is vital for the growth of the steel market in the GCC as it greatly improves manufacturing efficiency. The use of more sustainable and economical production methods, like the introduction of electric arc furnaces and innovative recycling processes, allows steel manufacturers to satisfy rising demand while lowering production expenses and lessening their environmental footprint. Furthermore, incorporating automation and digital technology into the steel production process are resulting in enhancements in productivity and product uniformity. These advancements guarantee that steel is manufactured at a lower cost and with superior quality, enhancing its availability to industries requiring dependable materials. Moreover, these technological innovations enhance the competitiveness of domestic steel manufacturing globally while also guaranteeing that the GCC steel industry can adjust to evolving industrial standards. This establishes the area as a more appealing center for both steel manufacturing and usage.

Environmental Regulations and Sustainability Efforts

Tighter environmental regulations are encouraging GCC steel manufacturers to implement more sustainable methods in their operations. Regional governing bodies are implementing stringent environmental regulations, mandating businesses to lower carbon emissions, enhance waste management, and adopt sustainable technologies. In line with the larger regional commitment to sustainability, the steel sector is moving towards lower-carbon manufacturing techniques, including the use of hydrogen in steel production and adopting innovative recycling strategies. These initiatives not only guarantee adherence to regulations but also cater to the increasing demand for environment-friendly products. This change is improving the competitiveness of the GCC steel industry on both local and global levels. A prominent instance of this trend is the collaboration between Modon, a key developer in the UAE, and EMSTEEL, which generated green steel via a hydrogen-based method alongside Masdar. This partnership, revealed in 2024, backs the UAE’s Net-Zero 2050 plan and aimed to reduce carbon emissions in the construction sector by implementing eco-friendly building materials.

GCC Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC steel market report, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

To get more information on this market, Request Sample

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the GCC steel market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the GCC steel market based on the product has also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the GCC steel market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

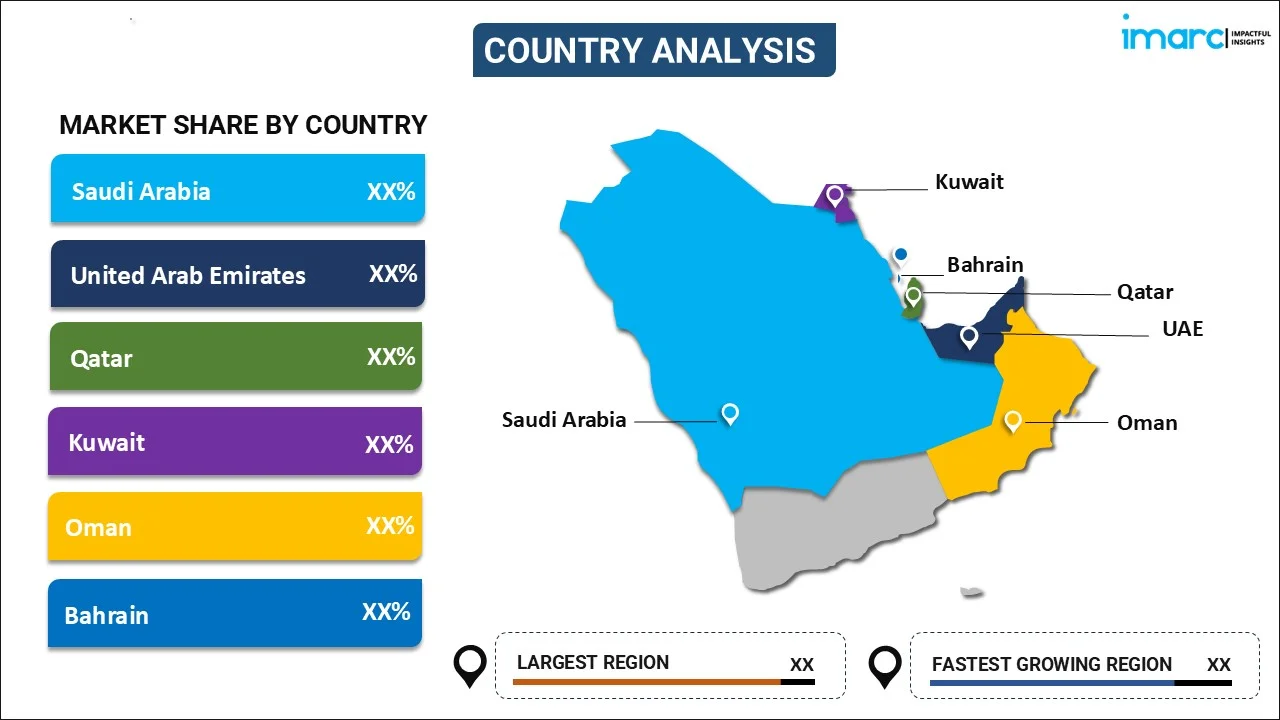

Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the GCC steel market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In July 2025, Jindal Steel Duqm announced plans to launch a $3 billion, 5 MTPA hydrogen-ready steel plant in Duqm, Oman by 2028. The facility will start with natural gas but transition to green hydrogen by 2033, aiming for 15% hydrogen use by 2035. It will serve global demand for low-emission steel, especially in Europe.

- In June 2025, Kuwait's Metal & Recycling Company (MRC) announced a new steel recycling plant set to open in the first quarter of 2025. The facility will process 60,000 tons of scrap metal annually, reducing CO₂ emissions by up to 90,000 tons. This aligns with Kuwait’s Vision 2035 and promotes sustainable industrial growth.

- In February 2025, Qatar Steel and Bahrain Steel signed a $1.27 billion deal to supply 5 million tons of steel over five years. The agreement supports industrial cooperation under the Gulf’s sustainable development initiative and aims to strengthen regional supply chains. It also boosts local production, reduces import reliance, and creates investment opportunities.

- In December 2024, Welspun Corp’s subsidiary, East Pipes Integrated Company (EPIC), secured a ₹130 crore (SAR 57 million) order in Saudi Arabia. The order involved supplying and coating steel pipes for infrastructure projects by Binyah and Al Rashid Trading.

- In October 2024, Masdar and EMSTEEL announced the successful launch of the Middle East's first pilot project using green hydrogen to produce green steel in Abu Dhabi. This marked a major step in decarbonizing the steel industry, aligning with the UAE’s Net Zero by 2050 initiative. The project supported the UAE’s ambition to become a global hub for green hydrogen and sustainable steel.

- In July 2024, Bahrain’s Ministries of Transportation and Industry signed an MoU with Maersk to establish the country’s first ship recycling initiative. The project aimed to create a green steel ecosystem by recycling ships sustainably and repurposing the steel through local industries like SULB. This aligned with Bahrain’s 2030 Economic Vision and supported global decarbonization goals.

GCC Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Countries Covered | Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC steel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The steel market in GCC was valued at USD 3.50 Billion in 2024.

The GCC steel market is projected to exhibit a CAGR of 4.10% during 2025-2033, reaching a value of USD 5.12 Billion by 2033.

The GCC steel market is driven by rapid infrastructure development, ongoing construction of residential, commercial, and industrial projects, and growing demand from the oil and gas sector. Additionally, government-led diversification initiatives and investments in transport and energy projects further strengthen the need for steel across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)