GCC Surgical Robots Market Size, Share, Trends and Forecast by Product, Application, End-User, and Country, 2026-2034

GCC Surgical Robots Market Size and Share:

The GCC surgical robots market size was valued at USD 136.9 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 495.7 Million by 2034, exhibiting a CAGR of 14.61% from 2026-2034. The UAE dominates the GCC surgical robots market share by 44.6%. The demand in the region is fueled by factors like advanced healthcare facilities, a growing preference for robotic-assisted surgeries, government funding in medical technologies, and a rising demand for minimally invasive (MI) procedures.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 136.9 Million |

| Market Forecast in 2034 | USD 495.7 Million |

| Market Growth Rate (2026-2034) | 14.61% |

Access the full market insights report Request Sample

The GCC surgical robots market growth is propelled by the increasing occurrence of chronic diseases, including cardiovascular ailments and cancer, which require complex surgeries. In addition, the rising demand for minimally invasive (MI) procedures, which reduce recovery time and complications, is acting as another growth-inducing factor. Moreover, significant investments in healthcare infrastructure by GCC governments, particularly in the UAE and Saudi Arabia, boost the adoption of surgical robots, which is fueling the market demand. For example, in 2023 Asensus Surgical signed a definitive merger agreement with the German-based KARL STORZ to expand its portfolio of surgical technology solutions. This partnership is anticipated to foster innovation and improve accessibility within the field of robotic surgery. Besides this, ongoing technological advancements, including artificial intelligence (AI) integration and real-time three-dimensional (3D) visualization, enhance surgical precision and efficiency, providing an impetus to the market. Also, initiatives to integrate robotics into smart hospital projects underscore the region's commitment to healthcare innovation, thus catalyzing the market growth.

Concurrently, economic diversification efforts in the region, aiming to establish global medical hubs, fuel the GCC surgical robots market demand for cutting-edge surgical technologies, supporting the market growth. For instance, Intuitive Surgical was cleared by the FDA under the 510(k) process for its new multiport robotic system, da Vinci 5. This innovation improves the accuracy and the surgical profile, allowing GCC hospitals to offer state-of-the-art minimally invasive surgeries. Aligned with this, the rising awareness of the advantages of robotic-assisted surgeries among both patients and healthcare professionals is a key factor driving market growth. Moreover, the growing partnerships between healthcare organizations and technology companies encourage innovation and enhance accessibility, further supporting the expansion of the market. Furthermore, the rising healthcare expenditure, supported by robust economic growth, enables hospitals to invest in advanced surgical robots, driving the market demand. Apart from this, the prevalence of medical tourism, especially in the UAE, drives market growth by attracting patients seeking high-quality robotic surgeries, thereby propelling the market forward.

GCC Surgical Robots Market Trends:

Government Investment in Healthcare Innovation

The increasing government investments in healthcare innovation are driving the GCC surgical robots market trends. GCC governments have greatly stepped up expenditure on healthcare technology, particularly in the use of surgical robots to improve the quality of service delivery. For example, the UAE’s Ministry of Health and Prevention invested a significant amount of money into the upgrade of robotics into the public hospitals which is expected to enhance the results of operations and the level of care. Concurrent with this, Saudi Arabia’s Vision 2030 plan emphasizes the usage of advanced technologies in the surgical robots in the healthcare industry. These tactical investments demonstrate the area’s focus on the effective and efficient use of technology to deliver high-quality health services, thus impelling the market growth.

Increase in the Adoption of Minimally Invasive Surgeries

The growing demand for minimally invasive surgeries (MIS) in the region has greatly improved the GCC surgical robots market outlook. This is primarily because patients preferred those surgeries that had shorter recovery times and fewer risks. In confluence with this, obstruction problems can be solved with the help of the preoperative screening endoscopy, the operating time reduces with the level of experience. According to a study, it showed that robotic surgery (RS) was effective in reducing readmission by 52% as compared to open surgery patients and showed a 77% reduction in deep vein thrombosis (DVT) and pulmonary emboli (PE) prevalence amongst the study population. This shows that more healthcare providers and patients are gaining confidence in robotic technology. This tendency shows the increase in the usage of more complex surgeries in the geographic area, contributing to the market expansion.

Expansion of Robotic Surgery Training Programs

The expansion of robotic surgery training programs is strengthening the GCC surgical robots market share. Local governments in the region launched campaigns to educate healthcare practitioners about robotic surgery which is a rising tendency in the region. For example, the All-Wales National Robotic-Assisted Surgery Programme achieved a new milestone with more than 500 robotic-assisted surgical operations. The UAE also formed partnerships with key medical centers for training which improved the number of certified robotic surgeons. These efforts are intended to create a competent workforce for the efficient implementation of the latest surgical solutions, thereby driving the market forward.

GCC Surgical Robots Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC surgical robots market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, application, and end-user.

Analysis by Product:

To get detailed segment analysis of this market Request Sample

- Robotic Systems

- Instruments and Accessories

- Services

Robotic systems represent a core segment of the GCC surgical robots market, driven by high demand for cutting-edge technology enhancing precision and reducing surgical risks. Additionally, government investments in advanced healthcare infrastructure, especially in the UAE and Saudi Arabia, propel the adoption of robotic systems across hospitals and specialized clinics, fostering the market growth.

Instruments and accessories contribute significantly to market growth due to their essential role in enhancing the functionality of robotic systems. Replacement requirements and innovations in the quality of articulation and the materials used in the construction of pacifiers drive the frequency of sales. There is also the factor of higher throughput surgery across the region which is fueling the market demand for these vital parts.

The services segment, encompassing maintenance, training, and software updates, are playing a pivotal role in ensuring the seamless operation of robotic systems. Higher installation rates across the GCC along with service contracts for the long term also comprise this segment’s growth. Moreover, the continued demand is caused by training for surgeons and technical staff, which is propelling the market forward.

Analysis by Application:

- Gynecological Surgery

- Urological Surgery

- Neurosurgery

- Orthopedic Surgery

- Others

Robotic systems are increasingly used in gynecological surgeries across the GCC, offering precision in procedures like hysterectomies and myomectomies. The demand is further fueled by increasing awareness of minimally invasive (MI) options and the rising incidence of reproductive health conditions, thereby boosting market growth.

The demand for robotic systems in urological surgery is fueled by high cases of prostate and kidney disorders. Robotic-assisted procedures are associated with greater precision, lower risks, and better results, which make them the preferred option in the GCC region’s sophisticated hospitals, boosting the market demand.

Neurosurgery applications of robotics are expanding due to the need for high precision in complex procedures like tumor resections. Advanced robotic systems enable enhanced visualization and steady operation, meeting the increasing demand for sophisticated neurological care in the region, and contributing to the market expansion.

Orthopedic procedures, such as joint replacements and spinal surgeries, are experiencing rapid growth with the incorporation of robotic technology. Improved accuracy and reduced recovery times make robotic-assisted procedures popular among patients and healthcare providers, particularly in the UAE and Saudi Arabia, thereby strengthening the market share.

Analysis by End-User:

- Hospitals

- Ambulatory Surgical Centers

- Others

The GCC surgical robots market is dominated by the hospitals segment due to their investments in hi-tech healthcare facilities and technology. In addition, promoting the usage of robotic systems is a priority of governments, especially in the UAE and Saudi Arabia to enhance surgical results. Moreover, hospitals are well-positioned for the increased demand for minimally invasive surgeries because these procedures have shorter recovery times and are less expensive for the healthcare consumer. For example, the CORI Surgical System has a unique feature of image-agnostic registration, providing users with both image-free and MRI-driven registration. This versatility in imaging solutions enables hospitals to cater to diverse surgical needs with greater precision and flexibility. Besides this, they have observed that the surge in the rate of diseases that necessitate multifaceted surgical procedures, including oncology and cardiovascular ailments, promoted the use of robotics. Furthermore, several hospitals in the region are developing affiliations with technology suppliers to increase their reach in training courses for surgeons for efficient utilization of these systems. These factors place hospitals in the largest and most rapidly developing consumer category, which is significantly contributing to the market expansion.

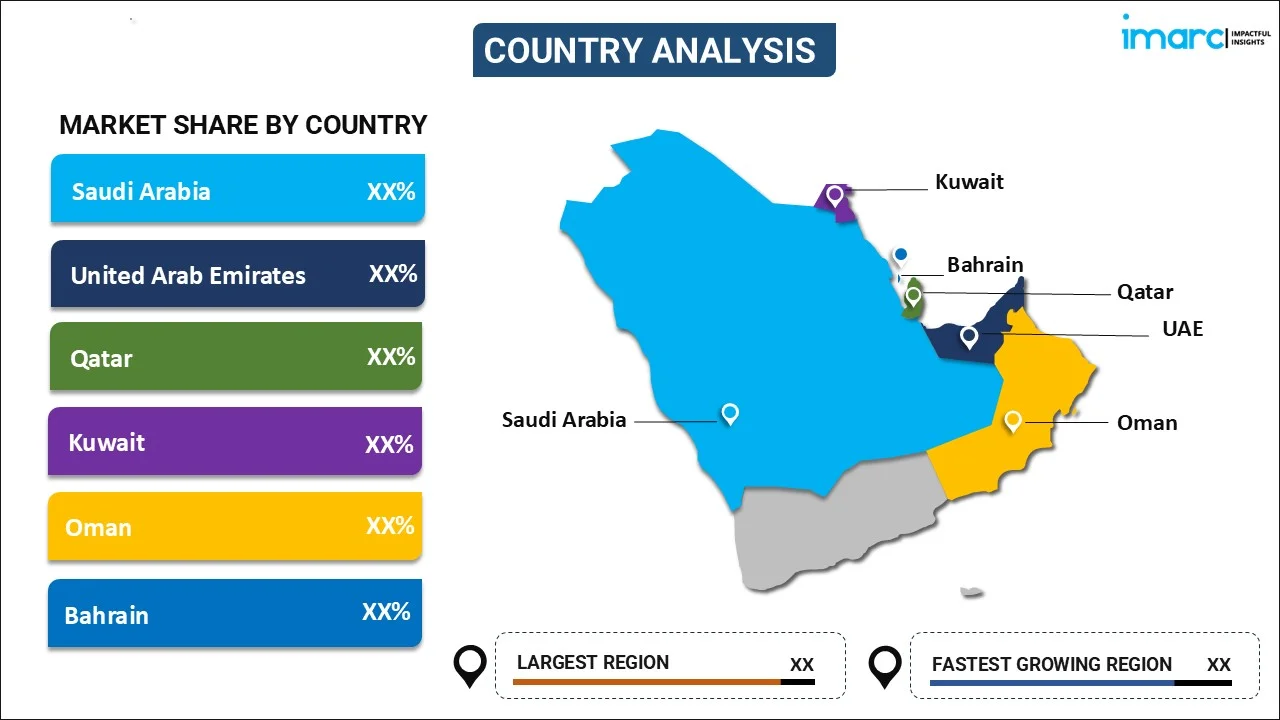

Country Analysis:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

In 2025, the UAE maintained its leadership in the GCC surgical robots market, holding a 44.6% share. This leading position is attributed to significant government investments in healthcare innovation, particularly the incorporation of advanced robotic systems in public hospitals. For instance, the Ministry of Health and Prevention (MoHAP) has been at the forefront of employing the latest surgical robot technology to perform sensitive surgeries, enhancing the country's medical capabilities. Additionally, the UAE's commitment to becoming a leading international destination for smart healthcare is evident through its Innovation Health Strategy, which emphasizes the adoption of advanced technologies like robotic surgery and telemedicine. These strategic initiatives have solidified the UAE's position as a regional leader in the adoption and utilization of surgical robots, thereby impelling the market growth.

Competitive Landscape:

The GCC surgical robots market is characterized by a mix of global industry leaders and regional players vying to increase their market presence. Key companies dominate with advanced technologies and established market shares. Moreover, strategic partnerships between these firms and regional healthcare providers enhance accessibility to robotic systems. Besides this, the local government's emphasis on technology adoption attracts international investments, fostering competition. Furthermore, emerging players are introducing cost-effective solutions tailored to regional needs. Apart from this, innovation in training programs and maintenance services intensifies the competitive landscape, driving the market growth and improving healthcare outcomes in the GCC.

The report provides a comprehensive analysis of the competitive landscape in the GCC surgical robots market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Smith+Nephew collaborated with JointVue™ to make use of ultrasound-based preoperative planning in robotic-assisted knee procedures. This partnership aims at increasing the level of individualization of processes and enhancing the productivity of the operating room.

- In August 2024, Zimmer Biomet entered into a definitive agreement to acquire OrthoGrid Systems, Inc., an enterprise in surgical guidance systems in total hip replacement that employs artificial intelligence. This acquisition is expected to help Zimmer Biomet to expand its hip portfolio with better technology.

GCC Surgical Robots Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Robotic Systems, Instruments and Accessories, Services |

| Applications Covered | Gynecological Surgery, Urological Surgery, Neurosurgery, Orthopedic Surgery, Others |

| End-Users Covered | Gynecological Surgery, Urological Surgery, Neurosurgery, Orthopedic Surgery, Others |

| Countries Covered | Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC surgical robots market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the GCC surgical robots market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC surgical robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The GCC surgical robots market was valued at USD 136.9 Million in 2025.

Key factors driving the growth of the GCC surgical robots market include rising demand for minimally invasive surgeries, advancements in robotic technology, substantial government investments in healthcare, increasing prevalence of chronic diseases, growing medical tourism, and the adoption of robotics in smart hospital initiatives for improved surgical precision.

IMARC estimates the GCC surgical robots market to reach USD 495.7 Million, exhibiting a CAGR of 14.61% during 2026-2034.

Hospitals lead the market share by end-user, driven by the extensive adoption of advanced robotic systems, government funding for healthcare modernization, and the high volume of complex surgeries requiring precision and efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)