GCC Tire Market Report by Design (Radial, Bias), End-Use (OEM Market, Replacement Market), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR)), Distribution Channel (Offline, Online), and Country 2025-2033

Report Overview:

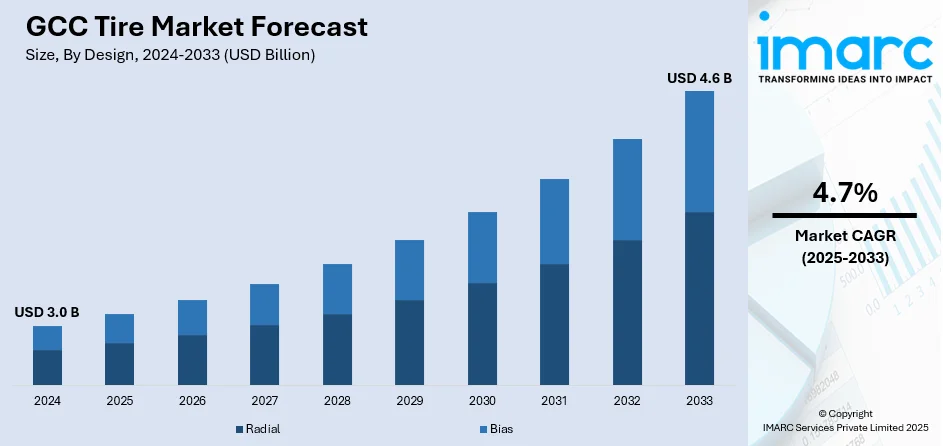

The GCC tire market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.7% during 2025-2033. The surging sales of high-end and luxury vehicles, the introduction of airless tires, rising expenditure capacities of consumers, and increasing inclination toward upgrading and customizing vehicles are some of the major factors propelling the GCC tire market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.0 Billion |

|

Market Forecast in 2033

|

USD 4.6 Billion |

| Market Growth Rate 2025-2033 | 4.7% |

A tire is a ring-shaped rubber covering that fits around the rim of a wheel. It is manufactured using natural or synthetic rubber, wire, rayon, polyester, fabric, and carbon black. It is commonly available in different sizes and shapes, depending on the vehicle and its intended use. Tires undergo a manufacturing process that involves curing, shaping, and vulcanization to achieve the desired properties and durability. They provide a cushion of air between the wheel and the road surface, enabling the vehicle to roll smoothly and grip the road effectively. They are designed to withstand the weight of the vehicle, transmit driving and braking forces, and offer grip on different road conditions. As a result, tires are widely used in passenger cars, light commercial vehicles, medium and heavy commercial, two-wheelers, three-wheelers, and off-the-road (OTR) vehicles.

The significant growth in the automotive industry and the increasing sales of passenger and commercial vehicles are positively impacting the demand for tires. Moreover, the rising need for tire replacements to ensure optimal performance and safety due to wear and tear is acting as another growth-inducing factor. Apart from this, various product innovations, such as the launch of airless non-pneumatic tires and three-dimensional (3D) printed tires produced from bio-sourced materials, are providing a considerable boost to the market growth. Furthermore, the widespread adoption of specialized tires, such as high-performance, all-terrain, and eco-friendly tires, is propelling the market growth. Other factors, including the flourishing tourism sector, rapid urbanization, and widespread product utilization in mining and construction activities, are supporting the market growth.

GCC Tire Market Trends/Drivers:

Significant growth in the automotive industry

The automotive industry is experiencing growth due to the rising sales of vehicles, which, in turn, is facilitating the demand for tires. Moreover, the increasing number of vehicles on roads to commute and transport various goods is acting as another growth-inducing factor. In line with this, growing consumer inclination towards vehicles with improved performance, safety features, and comfort is positively impacting the market for tires as they directly impact vehicle handling, traction, and ride quality. Besides this, the rising sale of cars and two-wheelers on account of inflating income levels of individuals is providing an impetus to the market growth.

The burgeoning construction industry

The rising construction projects, infrastructure development, and urbanization in the region are one of the key factors contributing to the market growth. The construction industry heavily relies on various types of heavy equipment and machinery, such as excavators, loaders, bulldozers, cranes, and dump trucks, which is propelling the market growth. Furthermore, the increasing demand for specialized tires with off-road capabilities designed to navigate challenging terrains like mud, gravel, and rough surfaces is driving the market growth. Apart from this, the widespread product utilization in fleet vehicles and commercial trucks to transport materials, equipment, and personnel to and from construction sites is augmenting the market growth.

Extensive research and development (R&D) activities

Several companies and manufacturers are focusing on improving tire performance, enhancing safety features, addressing environmental concerns, and catering to specialized tire segments. Additionally, the introduction of all-weather tires that provide reliable performance in all weather conditions, including dry, wet, and light winter conditions, is propelling the market growth. Moreover, manufacturers are developing specialty performance tires for sports cars, off-road tires for SUVs and trucks, racing tires for motorsports, and agricultural tires for farm equipment, which, in turn, is positively influencing the market growth. Besides this, key players are adopting innovative designs and technology to increase the efficiency, durability, and affordability of tires, which is further supporting the market growth.

GCC Tire Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the GCC tire market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on design, end-use, vehicle type, and distribution channel.

Breakup by Design:

- Radial

- Bias

Radial tires dominate the tire market in GCC

The report has provided a detailed breakup and analysis of the GCC tire market based on the design. This includes radial and bias. According to the report, radial represented the largest market segment.

Radial tires are widely used in cars, trucks, and motorcycles as they offer a more comfortable ride due to their flexible sidewalls. They absorb road imperfections and shocks, providing a smoother and less jarring driving experience. Moreover, these tires provide better steering response, allowing for more precise control and handling of the vehicle, which, in turn, is strengthening the market growth. Additionally, the widespread product utilization on heavy roads as they dissipate heat more efficiently due to their construction, reducing the risk of tire failure or blowouts, is contributing to the market growth.

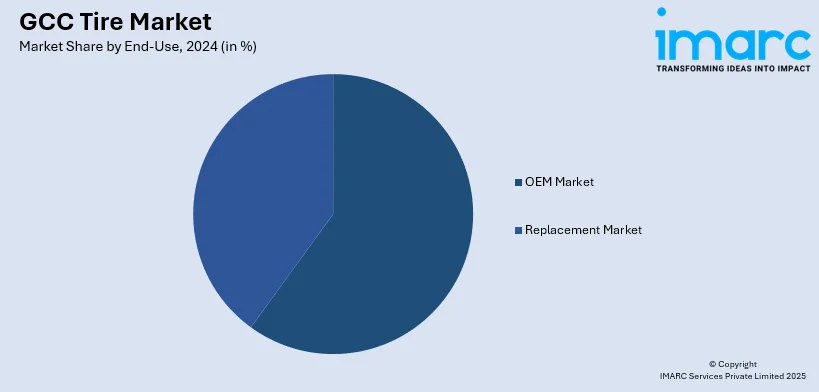

Breakup by End-Use:

- OEM Market

- Replacement Market

Replacement market represents the leading end-use segment

The report has provided a detailed breakup and analysis of the GCC tire market based on the end-use. This includes the OEM and replacement market. According to the report, replacement market represented the largest market segment.

The replacement market refers to the demand for tires that arise when existing tires on vehicles wear out, are damaged, and need to be replaced. The increasing demand for replacement and new tires is favoring the market growth. Tires have a limited lifespan and wear out over time due to factors, such as mileage, road conditions, and driving habits, which, in turn, is acting as a growth-inducing factor. Apart from this, the widespread utilization of tires in a wide range of vehicles, including passenger cars, SUVs, trucks, motorcycles, and commercial vehicles, is propelling the market growth. Besides this, the growing demand for tire replacement due to the increasing vehicle adoption and rising expenditure capacities of consumers is providing a thrust to the market growth.

Breakup by Vehicle Type:

- Passenger Cars

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Price Ranges by Rim Size

- Light Commercial Vehicles

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Price Ranges by Rim Size

- Medium and Heavy Commercial Vehicles

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Price Ranges by Rim Size

- Two Wheelers

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Price Ranges by Rim Size

- Three Wheelers

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Price Ranges by Rim Size

- Off-The-Road (OTR)

- Market Breakup by Rim Size

- Market Breakup by Tire Size

- Price Ranges by Rim Size

Passenger cars represent the leading vehicle segment

The report has provided a detailed breakup and analysis of the GCC tire market based on the vehicle type. This includes passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two-wheelers, three-wheelers, and off-the-road (OTR). According to the report, passenger cars represented the largest market segment.

The growing volume of passenger cars creates a significant demand for tires in the market. These cars require periodic replacement due to wear and tear, which, in turn, is propelling the market growth. In line with this, tires play a crucial role in maintaining traction, stability, and control between the passenger car and the road surface, thus favoring the market growth. Moreover, the increasing demand for well-maintained and properly inflated tires in passenger cars to offer precise steering response, better cornering stability, and enhanced braking capabilities is providing an impetus to the market growth. Besides this, tires provide numerous benefits to passenger cars, including improved safety, handling, performance, comfort, durability, and fuel efficiency, which is supporting the market growth.

Breakup by Distribution Channel:

- Offline

- Online

Offline sales dominate the market, holding the leading market share

The report has provided a detailed breakup and analysis of the GCC tire market based on the distribution channel. This includes offline and online. According to the report, offline represented the largest market segment.

Offline distribution channel offers customers the ability to physically inspect and compare tires, receive personalized advice from knowledgeable staff, and benefit from immediate availability and installation services. Moreover, these offline channels help customers to physically examine the tires before making a purchase decision, allowing them to assess the quality, tread pattern, size, and other features. This, in turn, provides a more tactile and sensory experience compared to online shopping, which is favoring the market growth. Additionally, customers’ inclination toward offline channels due to the immediate product availability in urgent situations, such as a tire blowout, is acting as a growth-inducing factor.

Breakup by Country:

- Saudi Arabia

- UAE

- Others

- Kuwait

- Qatar

- Bahrain

- Oman

Saudi Arabia exhibits a clear dominance in the market, accounting for the largest GCC tire market share

The report has also provided a comprehensive analysis of all the major countries, which include Saudi Arabia, UAE, and others (Kuwait, Qatar, Bahrain, and Oman). According to the report, Saudi Arabia represented the largest market for GCC tire.

Rapidly expanding automotive sector in Saudi Arabia is one of the key factors propelling the market growth. In line with this, the increasing population, rising expenditure capacities of consumers, and growing infrastructure developments are facilitating the market growth. In line with this, Saudi Arabia has been investing heavily in construction and infrastructure projects, including road networks, airports, and urban development, which, in turn, is positively influencing the market growth. Apart from this, the Saudi Arabian government is implementing various initiatives and regulations to support the automotive industry and promote road safety by including mandatory tire inspections, regulations on tire quality and safety standards, and awareness campaigns, which is providing an impetus to the market growth.

Competitive Landscape:

Several key market players are significantly investing in research and development (R&D) projects to cater to diverse customer needs and improve safety, convenience, performance, fuel efficiency, and environmental sustainability. Moreover, manufacturers are focusing on exploring new rubber compounds, reinforcing materials, and chemical additives to achieve desired properties and performance characteristics, which is favoring the market growth. Furthermore, key players are reducing rolling resistance, which results in lower energy consumption and better fuel economy, owing to the increasing environmental concerns among the masses. Apart from this, tire manufacturers invest in R&D to enhance production efficiency, reduce waste, and ensure consistent quality across their product lines.

The report has provided a comprehensive analysis of the competitive landscape in the GCC tire market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Bridgestone Corporation

- Groupe Michelin

- Continental AG

- Goodyear Tyre & Rubber Co.

- Yokohama Rubber Company

- Hankook Tire & Technology Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- PIRELLI TYRE SPA

Recent Developments:

- Bridgestone has developed a proprietary technology called ‘NanoPro-Tech’, which uses nanoparticles to improve the performance and durability of tires. In 2023 the company plans to work with automakers on joint testing and market development.

- On March 22, 2023, Continental AG won “Environmental Achievement of the Year – Manufacturing” and "Tire of the Year" at the prestigious Tire Technology International (TTI) Awards for Innovation and Excellence. The company has been working on developing new tire technologies that focus on safety, sustainability, and performance. One of their recent innovations is the ‘ContiSense’, a tire technology that uses sensors to monitor tire pressure and temperature in real-time.

- Pirelli has been focusing on the development of tires for electric and hybrid vehicles. In 2019, it introduced the "Elect" range of tires specifically designed to meet the requirements of electric and hybrid cars. These tires aim to deliver low rolling resistance, reduced noise, and enhanced grip to maximize the performance and efficiency of electric and hybrid vehicles.

GCC tire Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Units |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Designs Covered | Radial, Bias |

| End-Uses Covered | OEM Market, Replacement Market |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR) |

| Distribution Channels Covered | Offline, Online |

| Countries Covered | Saudi Arabia, UAE, Others (Kuwait, Qatar, Bahrain, Oman) |

| Companies Covered | Bridgestone Corporation, Groupe Michelin, Continental AG, Goodyear Tyre & Rubber Co., Yokohama Rubber Company, Hankook Tire & Technology Co., Ltd., Sumitomo Rubber Industries, Ltd., PIRELLI TYRE SPA |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC tire market was valued at USD 3.0 Billion in 2024.

We expect the GCC tire market to exhibit a CAGR of 4.7% during 2025-2033.

The growing number of regional tire manufacturing facilities, coupled with the expanding automobile fleet, is primarily driving the GCC tire market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations of the GCC, resulting in the temporary closure of numerous manufacturing units for tires.

Based on the design, the GCC tire market can be segmented into radial and bias. Currently, radial design holds the majority of the total market share.

Based on the end-use, the GCC tire market has been divided into OEM market and replacement market, where replacement market exhibits a clear dominance in the market.

Based on the vehicle type, the GCC tire market can be categorized into passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two wheelers, three wheelers, and off-the-road (OTR) Among these, passenger cars account for the majority of the total market share.

Based on the distribution channel, the GCC tire market has been segregated into offline and online. Currently, offline channel holds the largest market share.

On a regional level, the market has been classified into Saudi Arabia, UAE, and Others, where Saudi Arabia currently dominates the GCC tire market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)