GCC Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Country, 2025-2033

GCC Vegan Cosmetics Market Overview:

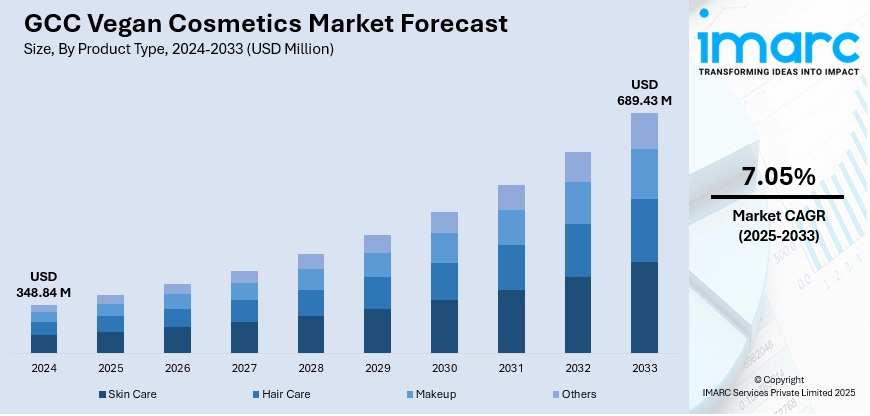

The GCC vegan cosmetics market size reached USD 348.84 Million in 2024. Looking forward, the market is expected to reach USD 689.43 Million by 2033, exhibiting a growth rate (CAGR) of 7.05% during 2025-2033. The market is driven by robust ethical and wellness-driven buying behavior, especially among young, value-conscious consumers within Saudi Arabia and the UAE. Both halal and vegan credentials add to the appeal of the product, satisfying both religious and ethical expectations. Rising number of working women are fueling demand for functional, toxin-free skincare and cosmetics. Social media and e-commerce also increase brand visibility and market reach, further increasing the GCC vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 348.84 Million |

| Market Forecast in 2033 | USD 689.43 Million |

| Market Growth Rate 2025-2033 | 7.05% |

GCC Vegan Cosmetics Market Trends:

Ethical Consumption and Cultural Values

In the GCC region, vegan cosmetics are experiencing increasing traction as ethical consumerism converges with cultural and religious sensibilities. Consumers in nations such as the UAE, Saudi Arabia, Bahrain, Kuwait, Qatar, and Oman are requesting products that are plant-based and cruelty-free while being Halal-compliant, which is a required convergence with Islamic dietary and ethical legislation. Manufacturers are meeting this need by reformulating skincare and color cosmetics to qualify for both vegan and Halal certifications, building trust with discerning GCC purchasers. The area's increasing number of educated cosmopolitan millennials and Gen Z females are especially attracted to products that align with their value of compassion, purity, and eco-friendliness. This double‑credential focus makes the GCC different from other markets and is influencing brand strategy and consumer expectations. The trend indicates that GCC ethics-based beauty needs to function at the convergence point of religious conformity and international vegan norms, which further contributes to the GCC vegan cosmetics market growth.

To get more information on this market, Request Sample

Region-Specific Innovations & Regional Sourcing

Vegan beauty companies in the GCC are formulating to address the region's extreme, desert climate, extreme sun exposure, and salt-laden air. Humectant-rich serums containing plant-based humectants such as Moroccan argan oil, date palm derivative, and aloe vera are becoming increasingly popular. Brands lead with cooling vegan face mists and balm-like lipids that shield from dehydrating and oxidative stress prevalent in desert environments. Local research facilities and floral ingredient traders, such as date farms, desert botanist associations, or Middle Eastern herb cooperatives, are all joining forces with beauty brands to tap into indigenous regional flora. This emphasis on local botanicals in the form of frankincense resin, saffron, and cactus extracts does lend authenticity while bolstering regional identity. Merging traditional regional solutions with contemporary vegan products appeals to GCC consumers who want a product that is both effective and deeply grounded in their own environmental and cultural context.

Omni‑Channel Growth & Digital Lifestyle Engagement

The highly networked, digitally literate consumer base of the GCC is driving growth of online-first vegan beauty companies. Social media influencers in cities such as Dubai and Riyadh play a key role in creating awareness, showing product rituals, and informing consumers of vegan ethics in English and Arabic. E-commerce sites and borderless marketplaces provide convenient shopping experiences, with speeded delivery throughout GCC countries. Meanwhile, high-end malls and wellness-focused boutiques are launching vegan beauty pop-ups and experience spaces where consumers can try clean, sensory products. Retailers are adding in-store digital signage that emphasizes ingredient transparency and ethical sourcing narratives. Event marketing such as vegan beauty festivals or sustainability exhibitions hosted in Dubai or Jeddah, is also propelling interest. Multi-channel approaches guarantee that vegan beauty appeals to both online lifestyle consumers and luxury-conscious in-store consumers, solidifying the positioning of vegan beauty as a mass-market lifestyle choice in the GCC.

GCC Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

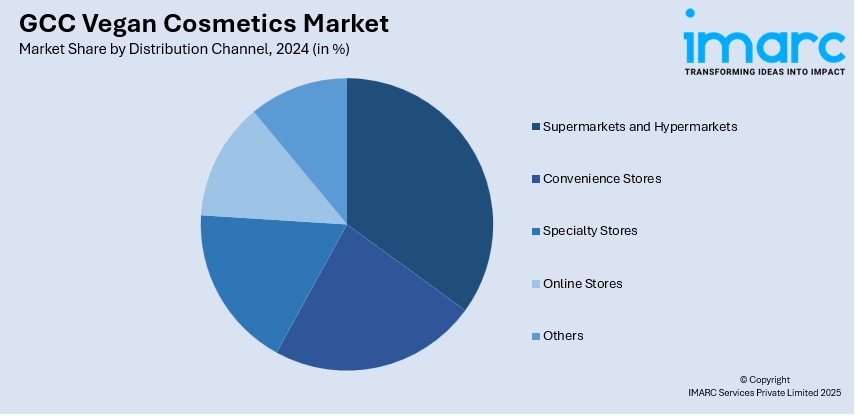

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Kuwait

- Qatar

- Bahrain

- Oman

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Bahrain, and Oman.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

GCC Vegan Cosmetics Market News:

- In June 2025, Hourglass Cosmetics launched its vegan, purpose-focused line in Saudi Arabia. Established by beauty entrepreneur Carisa Janes in 2004, Hourglass emerged to redefine the conventional notion of luxury beauty. With Saudi consumers progressively pursuing brands that resonate with their beliefs, Hourglass’s cruelty-free, vegan ethos appears particularly relevant. Hourglass has experienced robust growth throughout Europe, the Middle East, and Africa, and the move into Saudi Arabia aligns seamlessly with their worldwide strategy.

GCC Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Countries Covered | Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Bahrain, Oman |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the GCC vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the GCC vegan cosmetics market on the basis of product type?

- What is the breakup of the GCC vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the GCC vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the GCC vegan cosmetics market?

- What are the key driving factors and challenges in the GCC vegan cosmetics market?

- What is the structure of the GCC vegan cosmetics market and who are the key players?

- What is the degree of competition in the GCC vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the GCC vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the GCC vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the GCC vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)