Genotyping Market Size, Share, Trends and Forecast by Product and Service, Technology, Application, End User, and Region, 2025-2033

Genotyping Market Size and Share:

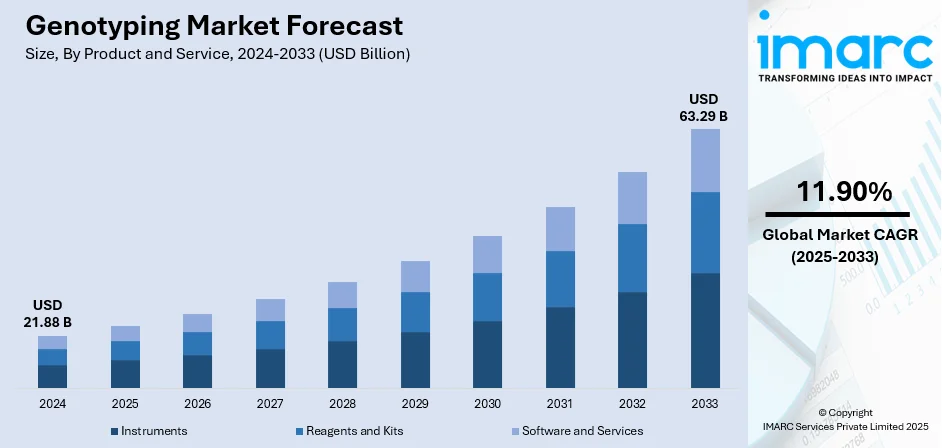

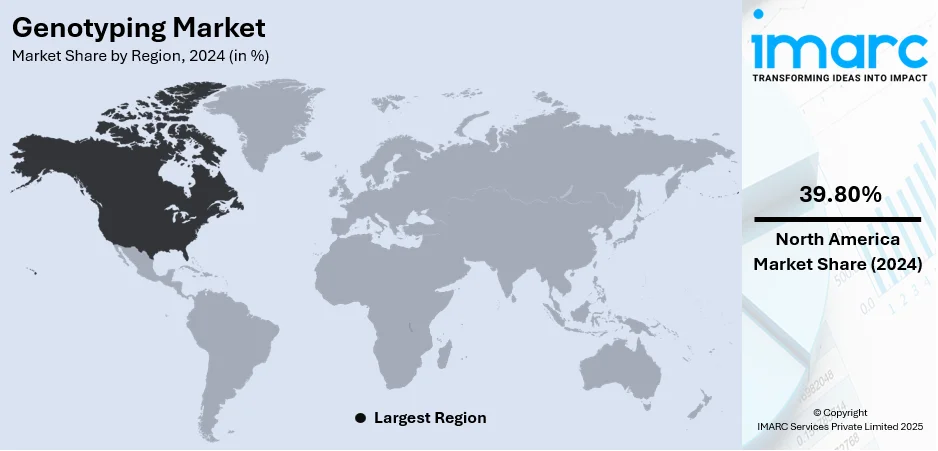

The global genotyping market size was valued at USD 21.88 Billion in 2024. Looking forward, the market is projected to reach USD 63.29 Billion by 2033, exhibiting a CAGR of 11.90% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39.80% in 2024. The market is driven by the increasing use of genotyping in precision medicine, the expanding applications in agriculture and livestock improvement, and the rising demand for direct-to-consumer testing services. With growing investments in research and technological innovations, along with expanding consumer adoption of genetic health insights, these factors are further augmenting the genotyping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.88 Billion |

| Market Forecast in 2033 | USD 63.29 Billion |

| Market Growth Rate (2025-2033) | 11.90% |

The global market is primarily driven by the rising adoption of precision medicine and personalized therapies. In line with this, the growing integration of next-generation sequencing and advanced molecular diagnostics is also providing an impetus to the market. In September 2025, Illumina launched Illumina Protein Prep, an NGS-based proteomics assay capable of measuring 9,500 unique human protein targets, the highest content available with an NGS readout. Early access studies processed 30,000 samples with the 6K assay and 6,000 with the 9.5K assay, with Genomics England reporting a 7.5% increase in diagnostic yield for rare disease cases using the platform. Moreover, the increasing investments by pharmaceutical and biotechnology companies in targeted drug discovery are also acting as a significant growth-inducing factor for the market. In addition to this, the expanding use of genotyping in agricultural biotechnology and livestock management is resulting in a wider range of applications. Besides this, the rising popularity of direct-to-consumer genetic testing kits due to increasing health consciousness is creating lucrative opportunities in the market.

To get more information on this market, Request Sample

The United States stands out as a key regional market, which is primarily driven by the growing prevalence of genetic disorders and the strong focus on early detection strategies. In line with this, significant investments in biotechnology infrastructure and advanced laboratory facilities are also providing an impetus to the market. In January 2025, Complete Genomics announced it had opened a 10,115 sq. ft. manufacturing facility in San Jose and a Customer Experience Center in Framingham in 2024, establishing its first U.S. NGS supply chain. The San Jose site began producing DNBSEQ-G99RS sequencers with a 12-hour run time and earned NRTL certification, while collaborations with NVIDIA, Eurofins, AdvancedDx, and seqWell expanded its U.S. genomic network. Moreover, the rising consumer demand for ancestry testing and personalized wellness programs is also acting as a significant growth-inducing factor for the market. In addition to this, the presence of leading pharmaceutical companies and their focus on pharmacogenomics is resulting in a strong commercial pipeline.

Genotyping Market Trends:

Rising Healthcare Costs and the Push for Preventive Genomics

The financial weight of chronic diseases continues to shape global healthcare strategies, creating new opportunities for genotyping solutions. According to reports, the estimated cost of chronic disease is expected to reach USD 47 Trillion worldwide by 2030, a figure that underscores the urgency for earlier and more effective prevention. Genotyping allows for predictive risk profiling, enabling individuals to understand their predispositions before illnesses progress to costly, late-stage treatments. As governments, insurers, and healthcare providers search for ways to offset unsustainable expenditures, genotyping technologies are being integrated into precision medicine programs and wellness initiatives. This shift not only reduces future healthcare spending but also strengthens the role of genetic testing companies in shaping population health strategies.

Multiple Chronic Conditions Driving Personalized Care Demand

In the United States, the prevalence of overlapping health conditions has created a fertile environment for the adoption of personalized genomic services. Data indicates that 42% of Americans manage two or more chronic conditions, and 12% live with at least five, pointing to a growing need for tailored interventions. Traditional treatment protocols often fail to account for the genetic differences influencing drug efficacy and disease progression. Genotyping offers clarity by identifying variations that can impact responses to medications or risks of complications across multiple conditions. Healthcare providers are beginning to use this information to fine-tune therapies for patients with complex health profiles. As this trend accelerates, demand for cost-effective and accessible genotyping platforms is expected to rise, particularly in primary care and specialty clinics.

Government Investments in Healthcare Fueling Genomics Expansion

National health policies are increasingly prioritizing genomics as part of larger investments in modernizing healthcare systems. According to India Brand Equity Foundation, the government has allocated Rs. 99,858 crore (USD 11.50 Billion) to the healthcare sector in the Union Budget 2025-26, signaling a clear intent to strengthen infrastructure and research capacity. Genotyping services stand to benefit directly from these public investments, particularly through initiatives focused on digital health, preventive care, and biotechnology development. By fostering collaborations between public institutions, biotech firms, and diagnostic providers, such funding helps lower the barriers to widespread adoption. India’s commitment is part of a larger global pattern, where governments are channeling resources into precision medicine to manage both rising chronic disease burdens and the growing demand for preventive health solutions.

Genotyping Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global genotyping market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and service, technology, application, and end user.

Analysis by Product and Service:

- Instruments

- Reagents and Kits

- Software and Services

Reagents and kits stand as the largest component in 2024, holding around 48.9% of the market. Their dominance is largely due to recurring demand, as laboratories and testing facilities must continually procure reagents for each test conducted. This makes them a consistent revenue stream compared to one-time purchases of instruments. Furthermore, the growing number of diagnostic centers, rising adoption of direct-to-consumer genetic testing, and increased research activity in pharmacogenomics and agricultural genetics are fueling higher consumption of kits. The availability of standardized, user-friendly, and automation-compatible reagent systems has further simplified genotyping, expanding accessibility across both advanced labs and smaller testing setups. By enabling high-throughput testing and supporting cost efficiency, reagents and kits not only streamline laboratory processes but also directly contribute to scaling up global genotyping applications and accelerating market growth.

Analysis by Technology:

- Polymerase Chain Reaction (PCR)

- Capillary Electrophoresis

- Microarray

- Sequencing

- Mass Spectrometry

- Others

Polymerase Chain Reaction (PCR) leads the market with around 34.8% of market share in 2024, due to its long-established reliability, cost-effectiveness, and widespread adoption. PCR enables rapid amplification of DNA, allowing even small genetic variations to be detected with high accuracy. Its dominance is further strengthened by its compatibility with various downstream applications, including disease diagnostics, forensic testing, and agricultural research. The method remains a preferred choice in clinical laboratories and research institutions as it requires relatively simple instrumentation while delivering highly reproducible results. Additionally, PCR has seen continuous technological refinement, such as the introduction of real-time and digital PCR, which provide greater sensitivity and quantification capabilities. Its cost-effectiveness makes it especially attractive in emerging economies, while its adaptability to both small-scale studies and large-scale population screening ensures broad usage.

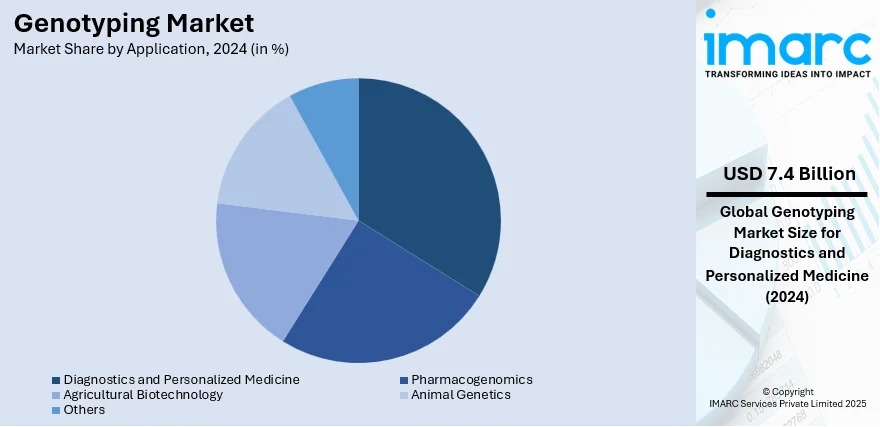

Analysis by Application:

- Pharmacogenomics

- Diagnostics and Personalized Medicine

- Agricultural Biotechnology

- Animal Genetics

- Others

Diagnostics and personalized medicine lead the market with around 33.8% of market share in 2024, driven by the growing need for targeted treatments and individualized patient care. The ability to identify genetic variations that influence disease susceptibility, treatment response, and drug metabolism has transformed medical practice. This application area is gaining dominance because it directly addresses the global rise in chronic and complex diseases, where traditional one-size-fits-all treatments are often ineffective. Healthcare systems are increasingly investing in genomic testing to enable earlier diagnosis, better therapeutic alignment, and improved patient outcomes. Moreover, pharmaceutical companies are leveraging genotyping in clinical trials to stratify patients and develop precision therapies, further embedding it into the medical pipeline. Consumer demand for personalized health insights, including ancestry and wellness testing, also feeds into this trend.

Analysis by End User:

- Pharmaceutical and Biopharmaceutical Companies

- Diagnostics and Research Laboratories

- Academic Institutes

- Others

Pharmaceutical and biopharmaceutical companies represent a major end-user segment, as they utilize genotyping to identify genetic markers linked to drug response and disease susceptibility. This enables them to design precision therapies and accelerate clinical trial efficiency. The integration of genotyping into early-stage drug development helps reduce costs and improve approval rates, making it a vital tool for commercial success. With rising investment in personalized medicine and biologics, these companies are expanding demand for advanced genotyping platforms to strengthen their research pipelines.

Diagnostics and research laboratories form a crucial segment, as they directly translate genotyping innovations into routine healthcare and specialized investigations. These facilities rely on genotyping for early disease detection, pathogen identification, and risk profiling, enabling better patient outcomes. Their role extends to high throughput testing in clinical diagnostics, cancer screening, and infectious disease monitoring. Continuous technological upgrades in laboratory settings further strengthen adoption, ensuring reliable and cost-effective results. By bridging innovation with practical medical application, diagnostics and research laboratories are key drivers of widespread genotyping market growth worldwide.

Academic institutes contribute significantly to the genotyping market by advancing basic research, validating novel methodologies, and training the next generation of scientists. They often collaborate with government agencies, biotech firms, and healthcare providers to develop innovative applications in genomics. Genotyping platforms in academic labs are widely used for studying genetic variation, evolutionary biology, and population health, fostering new discoveries that eventually transition into clinical or commercial use. By supporting innovation and building skilled expertise, academic institutes help ensure sustained progress and long-term growth within the genotyping market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.80%, supported by its advanced healthcare infrastructure, strong research ecosystem, and high healthcare spending. The United States leads within the region due to widespread adoption of personalized medicine, extensive government and private funding for genomics research, and the presence of leading biotechnology and pharmaceutical firms. Canada also contributes meaningfully with its emphasis on population-scale genetic studies and integration of genomics into public healthcare. The region’s strong regulatory frameworks, combined with robust insurance coverage for genetic testing, further promote accessibility and adoption. Additionally, North America is home to major technology developers and reagent suppliers, reinforcing its dominance in product availability and innovation. With a well-established network of diagnostic laboratories, academic institutions, and biopharma companies, the region serves as a global hub for genotyping research and commercialization, ensuring continued leadership in market growth.

Key Regional Takeaways:

United States Genotyping Market Analysis

The United States accounts for 83.80% of the North America genotyping market. United States is witnessing increased genotyping adoption due to growing chronic lifestyle diseases such as obesity, cardiovascular ailments, and diabetes. For instance, 6 out of 10 Americans have one chronic disease and four out of 10 have two or more chronic diseases that account for ninety percent of the USD 4.5 Trillion annual health care costs in the nation. Rising public awareness, increasing preventive healthcare measures, and higher inclination toward personalized medicine are further driving genotyping usage. With healthcare providers focusing on precision diagnostics, genotyping is becoming integral in disease risk assessment and treatment planning. Integration of genotyping in routine clinical workflows, supported by favourable reimbursement policies, has further accelerated its acceptance. Rising prevalence of conditions requiring early detection and targeted interventions has created a strong foundation for the adoption of genotyping technologies. Healthcare infrastructure investments and continuous physician education have also improved accessibility and patient outcomes.

Asia Pacific Genotyping Market Analysis

Asia-Pacific is experiencing strong momentum in genotyping due to the growing number of diagnostics and research laboratories across the region. For instance, India’s pharmaceutical industry ranks third globally in pharmaceutical production by volume and 14th by value, supported by a well-established domestic sector comprising approximately 3,000 drug companies and over 10,000 custom manufacturing units. As demand for accurate disease identification rises, these laboratories are increasingly deploying advanced genotyping techniques to support genomic studies, drug discovery, and molecular diagnostics. Improved funding from public and private sources has enabled laboratories to upgrade capabilities and invest in next-generation sequencing platforms. Government-supported research initiatives and medical tourism have also enhanced genotyping implementation across clinical and research settings. A surge in partnerships between academic institutions and biotechnology firms is bolstering innovation and accessibility in genotyping.

Europe Genotyping Market Analysis

Europe is showing accelerated genotyping adoption due to the growing geriatric population that is susceptible to developing numerous medical conditions, and continual technological advancements in genotyping products. According to WHO, the population aged 60 and older is rapidly growing in the WHO European Region. In 2021, there were 215 Million; by 2030, it is projected to be 247 Million, and by 2050, over 300 Million. As older adults face a higher risk of complex diseases, genotyping is increasingly used for predictive diagnostics, pharmacogenomics, and treatment planning. At the same time, technological progress in platforms such as high-throughput sequencing and microarrays has enhanced efficiency and reduced costs. Innovations in software analytics and sample preparation workflows have made genotyping more accessible to clinicians and researchers alike. The aging population is also contributing to a rise in clinical trials and biobanking initiatives, increasing the demand for accurate genotyping.

Latin America Genotyping Market Analysis

Latin America is witnessing greater genotyping expansion, driven by growing healthcare expenditure across the region. For instance, budget allocation for Brazil’s Unified Health System is expected to increase by 6.2% in 2025. As countries increase their budgets for public health services and medical infrastructure, genotyping is becoming a prioritized tool for disease prevention, genetic screening, and personalized treatment strategies. Rising investment in laboratory modernization and clinical capabilities is enabling broader access to genotyping solutions, particularly in urban healthcare settings.

Middle East and Africa Genotyping Market Analysis

Middle East and Africa are experiencing rising genotyping adoption due to growing cancer cases across the region. For instance, the Kingdom reports 27% of the GCC’s total cancer cases, with an estimated 18,000 new diagnoses annually. With healthcare systems increasingly focusing on early diagnosis and targeted oncology treatments, genotyping is becoming essential in identifying genetic mutations associated with various cancers. Enhanced access to diagnostic technologies and increased awareness among healthcare providers are contributing to this trend.

Competitive Landscape:

To enhance market growth, key companies in the global genotyping market are heavily investing in technological innovation to make the process faster, more accurate, and cost-effective. A primary focus is on developing high-throughput, automated systems that can process vast numbers of samples efficiently, catering to the demands of large-scale pharmaceutical and academic research. They are also expanding the applications of genotyping beyond traditional genomics into areas like pharmacogenomics for personalized medicine, agricultural biotechnology, and direct-to-consumer genetic testing. Furthermore, strategic collaborations with research institutions and pharmaceutical companies are common, helping to co-develop new applications and expand their global reach. By making the technology more accessible and applicable, these players are driving its adoption across diverse fields.

The report provides a comprehensive analysis of the competitive landscape in the genotyping market with detailed profiles of all major companies, including:

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- Eurofins Scientific SE

- F. Hoffmann-La Roche AG

- Illumina Inc.

- Laboratory Corporation of America Holdings

- Qiagen N.V

- Standard BioTools Inc.

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- June 2025: Mission Bio unveiled a first-of-its-kind Single-Cell Genotype and Targeted Gene Expression solution through its Tapestri Platform, enabling simultaneous profiling of genotype and gene expression from over 10,000 single cells to derisk cancer drug clinical development. This genotyping advancement offered new insights into tumor heterogeneity, therapeutic resistance, and T-cell dysfunction.

- June 2025: Devyser launched its Genomic Blood Typing assay as a global NGS-based solution that simplified genotyping by enabling comprehensive analysis of RBC, HPA, and HNA systems in one test. It empowered research labs and transfusion centers with high-resolution results and streamlined workflows for molecular blood group genotyping.

- May 2025: Almac Diagnostic Services launched the PNPLA3 Genotyping Kit to support liver disease research by enabling accurate genotyping of the PNPLA3 gene, aiding studies into MASH and MASLD. The kit offered ≥99% reproducibility from blood or buccal swabs, helping researchers explore genetic risk factors and disease severity.

- May 2025: Prenatal Screening Ontario launched fetal blood group genotyping in Ontario, enabling early detection of fetal RhD status and guiding care for alloimmunized pregnancies. This genotyping advancement marked a shift from routine RhIG use to a more personalized prenatal approach by fall 2025.

- March 2025: Fujirebio Europe launched the INNO-LiPA® HCV 2.0 Genotyping assay, previously known as VERSANT HCV Genotype 2.0, as a line probe assay aiding personalized HCV therapy by identifying HCV genotypes 1 to 6 and subtypes 1a and 1b. The genotyping test was designed for in vitro diagnostics using human serum or EDTA plasma samples.

Genotyping Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product and Services Covered | Instruments, Reagents and Kits, Software and Services |

| Technologies Covered | Polymerase Chain Reaction (PCR), Capillary Electrophoresis, Microarray, Sequencing, Mass Spectrometry, and Others |

| Applications Covered | Pharmacogenomics, Diagnostics and Personalized Medicine, Agricultural Biotechnology, Animal Genetics, and Others |

| End Users Covered | harmaceutical and Biopharmaceutical Companies, Diagnostics and Research Laboratories, Academic Institutes, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Bio-Rad Laboratories Inc., Danaher Corporation, Eurofins Scientific SE, F. Hoffmann-La Roche AG, Illumina Inc., Laboratory Corporation of America Holdings, Qiagen N.V, Standard BioTools Inc. and Thermo Fisher Scientific Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the genotyping market from 2019-2033

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global genotyping market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the genotyping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global genotyping market size was valued at USD 21.88 Billion in 2024.

The genotyping market is projected to exhibit a CAGR of 11.90% during 2025-2033, reaching a value of USD 63.29 Billion by 2033.

The market is primarily driven by the rising adoption of precision medicine and personalized therapies, the integration of next-generation sequencing and advanced diagnostics, and the growing use of genotyping in agricultural biotechnology. Additionally, the rising popularity of direct-to-consumer genetic testing, supportive regulatory frameworks, and increasing collaborations between research institutions and private enterprises are contributing to market expansion.

North America currently dominates the genotyping market, accounting for 39.80% of the market share, supported by advanced healthcare infrastructure, strong research funding, widespread adoption of personalized medicine, and the presence of leading biotechnology and pharmaceutical firms in the region.

Some of the major players in the genotyping market include Agilent Technologies Inc., Bio-Rad Laboratories Inc., Danaher Corporation, Eurofins Scientific SE, F. Hoffmann-La Roche AG, Illumina Inc., Laboratory Corporation of America Holdings, Qiagen N.V, Standard BioTools Inc., and Thermo Fisher Scientific Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)