Germany Advertising Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

Germany Advertising Market Summary:

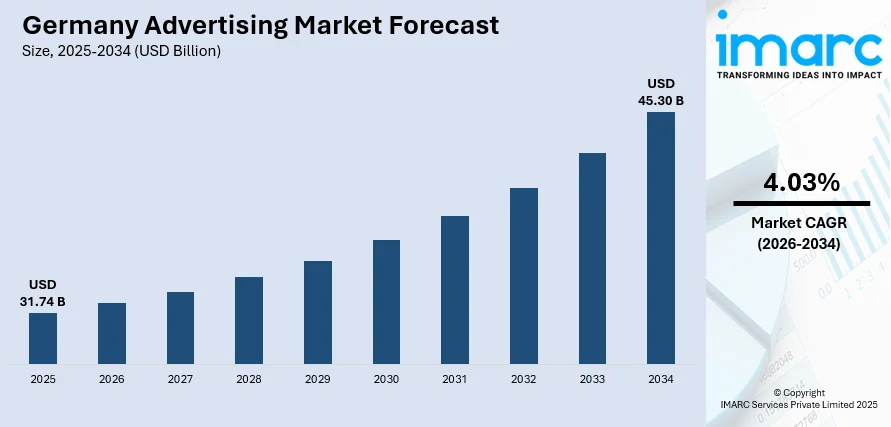

The Germany advertising market size was valued at USD 31.74 Billion in 2025 and is projected to reach USD 45.30 Billion by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

The market is expanding steadily, supported by strong digital adoption, rising brand competition, and increasing investment in data-driven marketing strategies. Growth is driven by higher spending on online, mobile, and social media advertising as businesses target highly engaged digital audiences. Traditional channels such as TV and outdoor advertising remain relevant, especially for nationwide campaigns. Evolving consumer behavior, advanced analytics, and omnichannel marketing approaches continue to shape the market’s overall direction.

Key Takeaways and Insights:

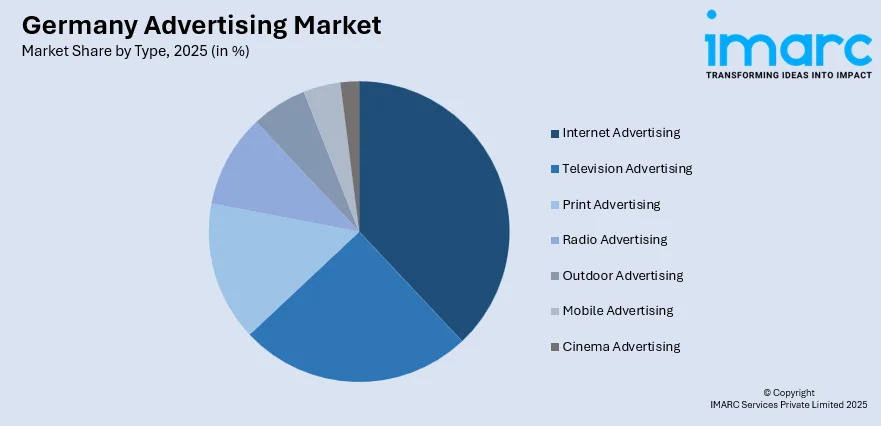

- By Type: Internet advertising dominates the market with a share of 38% in 2025, driven by accelerating digital transformation, expanding e-commerce activities, and increasing programmatic advertising adoption among German businesses seeking measurable campaign performance.

- Key Players: The Germany advertising market exhibits a competitive landscape characterized by both multinational media conglomerates and domestic broadcasting groups. Market participants are investing heavily in advertising technology infrastructure, data analytics capabilities, and cross-platform integration solutions to enhance campaign effectiveness and capture growing digital advertising expenditure across the region.

To get more information on this market Request Sample

The Germany advertising market is experiencing consistent growth as businesses increasingly prioritize digital engagement and data-driven marketing strategies. Rising internet penetration, widespread social media usage, and the expansion of e-commerce are accelerating the shift toward online, mobile, and programmatic advertising. In early 2025, Germany had 108 million mobile connections, 128% of its population, along with 78.9 million internet users, reflecting strong digital engagement. Brands are investing more in personalized and performance-based campaigns to improve customer targeting and maximize return on ad spend. While digital channels dominate, traditional media such as television, radio, print, and outdoor advertising continue to hold value for broad-reach and brand-building campaigns, particularly among established consumer segments. The market is also shaped by stricter privacy regulations, encouraging advertisers to adopt transparent, consent-based approaches and strengthen first-party data capabilities. With growing competition, omni-channel marketing, creative innovation, and analytics-led decision-making remain at the forefront of Germany’s evolving advertising landscape.

Germany Advertising Market Trends:

Rapid Shift Toward Digital Advertising

Germany is witnessing a strong move toward digital-first advertising as brands focus on social media, search engines, streaming platforms, and mobile apps to reach targeted audiences. Digital channels offer measurable performance, granular targeting, and cost efficiency, making them essential for campaign optimization. In December 2025, Ströer announced its plans to unveil "The Whale," a 342 m² mega-screen at Hamburg Central Station, targeting around 500,000 daily viewers five times the traffic of Frankfurt Airport. Ströer predicts revenues from this installation will exceed total city-level DooH revenues nationwide, reshaping digital advertising in Germany. Growing online engagement, especially among younger consumers, is accelerating this shift, prompting advertisers to increase their investment in dynamic, content-driven digital formats.

Rising Adoption of Data-Driven and Programmatic Advertising

Programmatic technologies are transforming the Germany advertising market by enabling automated, data-informed media buying. Brands use AI-powered targeting, real-time analytics, and predictive insights to tailor ads to specific audience segments. In November 2025, All Voice AI and Factory Berlin launched the world’s first monetized voice-AI advertising platform, integrating real-time promotions into live voice conversations. This innovative technology allows brands to convert voice calls into revenue channels, enhancing user engagement and providing targeted offers during interactions, supported by 57 languages. This approach boosts efficiency, enhances personalization, and improves return on ad spend. As advertisers seek more accountability and transparency, data-driven strategies are becoming central to planning, optimizing, and scaling multi-channel campaigns.

Growth of Omnichannel Marketing Strategies

German businesses are increasingly adopting omnichannel strategies that integrate digital and traditional platforms to maintain consistent brand messaging. Companies are combining social media, websites, and mobile apps with TV, print, and outdoor advertising to strengthen visibility and enhance customer engagement. This unified approach supports seamless consumer journeys, strengthens brand recall, and allows marketers to gather deeper insights. In November 2024, Mediamarkt and Saturn launched in-store advertising across nearly 400 stores in Germany, expanding to 627 locations throughout Europe. This initiative utilizes extensive customer data for targeted ads and enhances the omnichannel experience, supporting brands with detailed analytics on return on ad spend, with further expansion planned for 2025. The trend reflects rising expectations for cohesive interactions across all touchpoints.

Market Outlook 2026-2034:

The Germany advertising market is expected to maintain steady growth as brands increase investments across both digital and traditional channels. Rising adoption of programmatic buying, CTV formats, and performance-driven campaigns will continue shaping spending patterns. Traditional media will remain relevant for mass-market communication, supporting balanced multichannel strategies. Ongoing regulatory focus on privacy and transparency will push advertisers toward first-party data and consent-based engagement. Overall, the market outlook remains positive, supported by continuous innovation and diversified media consumption. The market generated a revenue of USD 31.74 Billion in 2025 and is projected to reach a revenue of USD 45.30 Billion by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

Germany Advertising Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Internet Advertising | 38% |

Type Insights:

Access the comprehensive market breakdown Request Sample

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

The internet advertising dominates with a market share of 38% of the total Germany advertising market in 2025.

Internet advertising holds the largest share, driven by rising digital consumption, strong smartphone penetration, and the growing preference for online content. Brands are allocating larger budgets to search, display, video, and classified ads to capture highly targeted audiences. The shift toward performance-driven marketing and measurable outcomes is further strengthening the position of internet advertising as the most influential segment in the market.

The strong momentum of internet advertising is also supported by advancements in AI-powered targeting, programmatic buying, and real-time analytics, enabling advertisers to optimize campaigns with precision. In October 2024, GroupM Germany and AudienceProject launched Germany’s first comprehensive CTV measurement system. This collaboration enables better assessment of video investments, allowing advertisers to measure reach and effectiveness across multiple channels. The new system enhances cross-media measurement, providing valuable insights for optimizing campaigns in the fragmented media landscape. Video and social media platforms are attracting significant investments due to their high engagement levels and dynamic formats. As businesses adopt omnichannel strategies, online advertising continues to bridge multiple consumer touchpoints, reinforcing its role as the primary driver of visibility, brand interaction, and return on ad spend in Germany.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

Western Germany represents a significant share of the Germany advertising market, supported by its dense population, advanced digital infrastructure, and concentration of major businesses. High consumer spending and active media consumption further strengthen demand for both digital and traditional advertising formats in the region.

Southern Germany benefits from a robust industrial base, high-income households, and strong corporate presence, which drive sustained advertising investment. The region’s technologically advanced environment and rising digital adoption contribute to growing demand for online, video, and mobile advertising across diverse sectors.

Eastern Germany is witnessing steady advertising growth due to improving digital connectivity and expanding regional businesses. Increasing adoption of online platforms, combined with rising interest in cost-effective promotional channels, is gradually strengthening the region’s contribution to the overall Germany advertising market.

Northern Germany shows healthy advertising activity supported by its commercial hubs, strong logistics networks, and growing media consumption. Enhanced digital engagement and expanding service-sector industries are contributing to higher investments in internet, mobile, and outdoor advertising across key urban and semi-urban locations.

Market Dynamics:

Growth Drivers:

Why is the Germany Advertising Market Growing?

Expansion of Video and Connected TV (CTV) Advertising

The growing shift toward streaming platforms is accelerating demand for video and CTV advertising in Germany. Brands are leveraging CTV to access highly segmented audiences with measurable engagement metrics, making campaigns more precise and cost-efficient. Video formats also support stronger storytelling, higher retention, and improved brand recall. As consumers spend more time on OTT and digital streaming services, advertisers are reallocating budgets toward premium video inventory to enhance visibility, target niche groups, and optimize multi-screen advertising strategies. In June 2025, Nielsen announced the integration of Connected TV (CTV) ad spend data into its Ad Intel product, starting in Germany. This enhancement provides insights into CTV advertising across major platforms, helping marketers optimize campaigns and understand competitors' strategies in the evolving media landscape. More EMEA rollouts are planned.

Continued Relevance of Traditional Media for Brand Building

Traditional media channels such as television, radio, print, and outdoor advertising continue to play a critical role in Germany’s advertising landscape. These formats offer unmatched nationwide reach, making them invaluable for brand awareness campaigns, product launches, and message reinforcement. Large and established brands rely on traditional media to maintain visibility among diverse age groups and demographics. Despite digital expansion, mainstream audiences still engage heavily with traditional channels, ensuring they remain an essential part of balanced, multi-channel media strategies. In June 2025, Deutsche Telekom and RTL Deutschland enhanced their partnership in linear TV advertising technology. The integration of RTL's ad server with Telekom's MagentaAdSolution will enable personalized advertising on RTL’s channels. The new addressable TV offering is set to launch in 2025, marking a significant development in their collaboration.

Stricter Data Privacy and Transparency Requirements

Increasingly stringent data privacy regulations are reshaping how advertisers operate in Germany. Evolving compliance expectations are prompting companies to adopt ethical data practices, reduce dependence on third-party tracking, and strengthen first-party data collection. Transparency in consent, data usage, and targeting methods has become crucial to maintaining consumer trust. Advertisers are investing in privacy-centric technologies, secure data management systems, and compliant measurement tools, ensuring that campaigns remain effective while aligning with regulatory standards and consumer expectations. In August 2025, Ad Agentur GmbH launched a new Google Ads strategy aimed at improving ROI for businesses in the DACH region. The transparency-focused approach combines data-driven campaign structures and advanced tracking, addressing trust issues in online advertising. The agency emphasizes measurable results, aiming for increased conversions and business growth.

Market Restraints:

What Challenges the Germany Advertising Market is Facing?

High Compliance Burden Due to Data Privacy Rules

Strict data protection regulations are increasing operational complexity for advertisers, requiring constant adjustments to evolving compliance standards. This elevates administrative costs, slows campaign deployment, and limits data driven targeting. Both small and large advertisers face constraints in personalisation, making campaign optimisation more resource intensive. As rules tighten further, advertisers must invest continuously in compliance frameworks to avoid penalties.

Rising Competition and Media Cost Inflation

Growing competition for premium ad spaces is driving significant cost inflation across digital and traditional channels. Higher media prices are reducing overall return on investment, forcing brands to stretch budgets to maintain visibility. As bidding intensity rises, advertisers face pressure to optimise spending while ensuring campaign reach and relevance. Rising content demand also amplifies budget strain, increasing the need for efficient media planning.

Ad Fatigue and Consumer Resistance

Consumers are increasingly overwhelmed by frequent and repetitive advertising, leading to declining engagement and higher usage of ad blockers. This resistance reduces campaign impact, pushing advertisers to invest in more creative formats, personalised messaging, and meaningful content. As attention spans shrink, sustaining consumer interest becomes a greater challenge. Advertisers now must balance frequency and relevance to maintain audience trust.

Competitive Landscape:

The competitive landscape of the market is characterized by a mix of established players and emerging innovators competing to strengthen their advertising capabilities through diversified offerings and advanced technologies. Companies are investing in AI-enabled targeting, automation, and omnichannel solutions to enhance campaign performance and attract a broader client base. Competition is also intensifying as firms focus on integrated platforms that combine analytics, creative tools, and measurement systems to deliver end-to-end support. Market participants increasingly prioritize strategic partnerships, content collaborations, and continuous product upgrades to differentiate themselves and capture expanding advertising budgets.

Recent Developments:

- In November 2025, Advertima and MEKmedia announced their plans to launch Germany's largest AI retail media network in partnership with beauty alliance, aiming for over 200 locations by 2026. The initiative leverages advanced 3D computer vision technology for real-time audience insights, enhancing brick-and-mortar retail's advertising effectiveness while ensuring data protection and compliance.

- In October 2025, HBO Max announced its plans to debut in Germany in January 2026, managed by Ad Alliance for advertising sales. This partnership aims to blend HBO Max's content with Ad Alliance’s marketing expertise, competing against established services like Amazon Prime Video and Netflix in the growing German streaming market.

Germany Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Germany advertising market size was valued at USD 31.74 Billion in 2025.

The Germany advertising market is expected to grow at a compound annual growth rate of 4.03% from 2026-2034 to reach USD 45.30 Billion by 2034.

Internet advertising held the largest share of the market, driven by rising digital media consumption, expanding social and video platforms, and increasing advertiser preference for targeted, measurable, and cost-efficient promotional strategies aligned with evolving consumer behavior.

Key factors driving the Germany advertising market include rapid digital adoption, rising use of programmatic and data-driven campaigns, strong demand for video and mobile formats, and growing omnichannel strategies that enhance brand visibility and improve audience engagement across platforms.

Major challenges include evolving data privacy rules, increasing restrictions on tracking, rising competition across digital formats, and growing cost pressures that require advertisers to refine targeting, enhance transparency, and invest in compliant, privacy-focused technologies to maintain campaign effectiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)