Germany Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2025-2033

Germany Air Freight Market Overview:

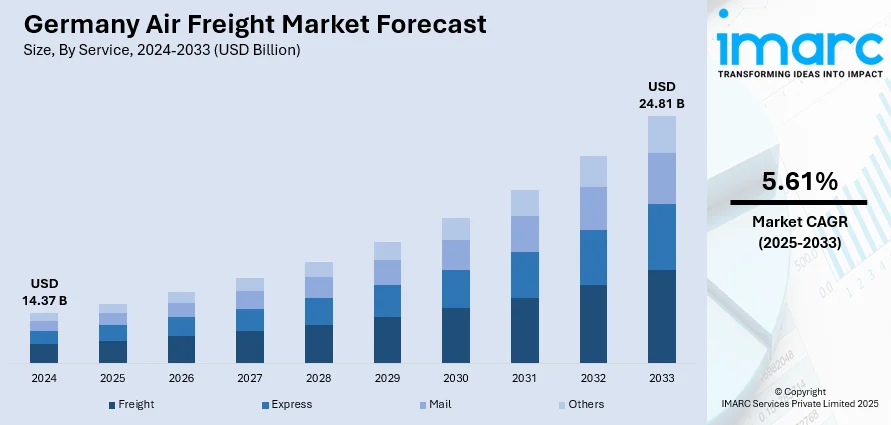

The Germany air freight market size reached USD 14.37 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 24.81 Billion by 2033, exhibiting a growth rate (CAGR) of 5.61% during 2025-2033. The market is driven by Germany’s role as a global trade leader, with high-value exports in automotive, electronics, and pharmaceuticals requiring reliable air logistics. Sector-specific cold chain solutions and precision engineering shipments are expanding cargo volumes. Concurrently, infrastructure modernization, sustainability initiatives, and digital logistics optimization are strengthening operational efficiency, further augmenting the Germany air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.37 Billion |

| Market Forecast in 2033 | USD 24.81 Billion |

| Market Growth Rate 2025-2033 | 5.61% |

Germany Air Freight Market Trends:

Robust Export-Oriented Economy and Global Trade Networks

Germany’s position as Europe’s largest economy and one of the world’s leading exporters has made air freight a crucial component of its trade infrastructure. High-value, time-sensitive exports—such as automotive parts, machinery, electronics, and pharmaceuticals—demand efficient air cargo services for international distribution. Major German airports like Frankfurt, Leipzig/Halle, and Munich serve as global logistics hubs, supported by sophisticated infrastructure and integrated customs clearance processes. These hubs facilitate fast transshipment of cargo to markets in Asia, North America, and the Middle East. Additionally, Germany’s dense manufacturing base relies on air freight for just-in-time supply chains, particularly in industries requiring rapid replenishment of components or delivery of finished goods. Freight forwarders, integrators, and dedicated cargo airlines are increasingly collaborating to develop multimodal logistics solutions tailored for exporters. In 2023, the aviation sector in Germany contributed USD 7.2 billion and 63,000 jobs from airlines, USD 29.7 billion and 323,900 jobs from airports, ANSPs, and civil manufacturing, and USD 16.9 billion and 213,900 jobs from tourism supported by aviation. Air cargo handled 4.7 million tons through German airports in the same year. These sectors combined contributed significantly to Germany's economic output and employment. With Germany playing a central role in the European Union’s external trade, the strategic significance of air freight continues to rise. This alignment between industrial demand and international logistics capabilities is a central driver of Germany air freight market growth, enabling sustained leadership in global trade.

To get more information on this market, Request Sample

Strengthening Pharmaceutical, Automotive, and Electronics Logistics

Germany’s leadership in pharmaceutical manufacturing and advanced engineering is fostering increased demand for specialized air freight services. Temperature-sensitive pharmaceutical shipments, including biotech products and vaccines, require precise cold chain logistics that air cargo operations provide efficiently. Dedicated pharmaceutical handling centers at key German airports are equipped with temperature-controlled storage and rapid customs clearance to meet stringent quality standards. In parallel, Germany’s automotive and electronics sectors—both significant contributors to GDP—are leveraging air freight for the movement of critical components, prototypes, and high-value consumer goods. In 2024, Frankfurt Airport handled nearly 2 million metric tons of cargo, a slight increase from 1.93 million metric tons in 2023. The airport's cargo volume peaked at 2.32 million metric tons in 2021 due to COVID-19-related disruptions. This reflects Frankfurt's significant role in global air freight, maintaining strong traffic despite fluctuations in demand. The increasing complexity of global supply chains and rising demand for German engineering in international markets necessitate time-sensitive transportation solutions. Additionally, German logistics providers are expanding specialized cargo offerings, including secure shipments for sensitive electronics and customized supply chain management services for automotive OEMs. Strategic alliances between manufacturers, freight operators, and logistics hubs ensure seamless connectivity from factory floors to global destinations. These sectoral demands are reinforcing Germany’s status as a critical node in international high-value logistics networks.

Germany Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

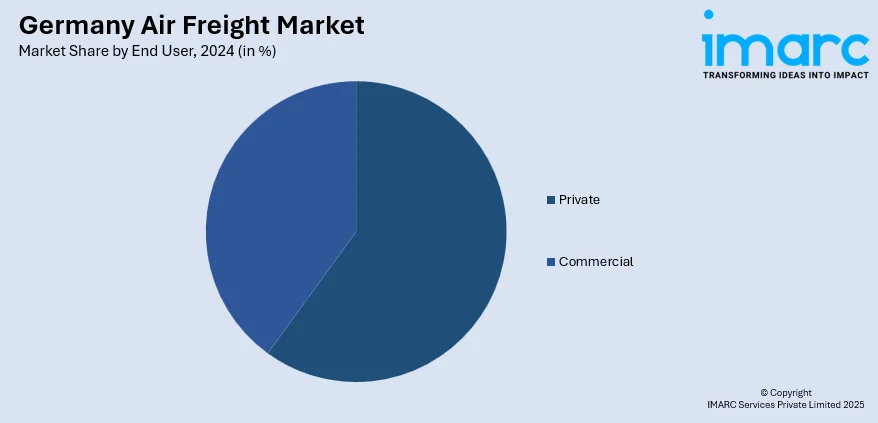

End User Insights:

- Private

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes private and commercial.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all major regional markets. This includes Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End Users Covered | Private, Commercial |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany air freight market on the basis of service?

- What is the breakup of the Germany air freight market on the basis of destination?

- What is the breakup of the Germany air freight market on the basis of end user?

- What is the breakup of the Germany air freight market on the basis of region?

- What are the various stages in the value chain of the Germany air freight market?

- What are the key driving factors and challenges in the Germany air freight market?

- What is the structure of the Germany air freight market and who are the key players?

- What is the degree of competition in the Germany air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)