Germany Alternative Data Market Size, Share, Trends and Forecast by Data Type, Industry, End User, and Region, 2025-2033

Germany Alternative Data Market Overview:

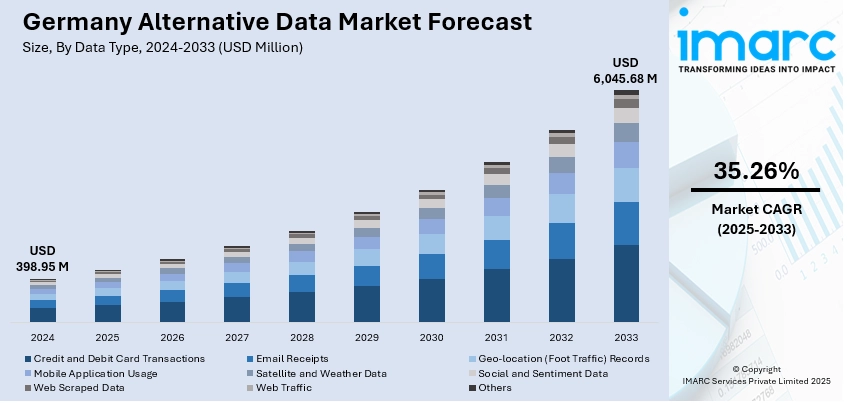

The Germany alternative data market size reached USD 398.95 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,045.68 Million by 2033, exhibiting a growth rate (CAGR) of 35.26% during 2025-2033. The market is driven by digital transformation in banking, increasing demand for real-time insights, and the growing adoption of AI-powered analytics. Regulatory openness to fintech innovation also encourages the use of unconventional data for credit scoring and investment strategies. These factors are expanding the Germany alternative data market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 398.95 Million |

| Market Forecast in 2033 | USD 6,045.68 Million |

| Market Growth Rate 2025-2033 | 35.26% |

Germany Alternative Data Market Trends:

Fintech Expansion and Open Banking Adoption

Germany’s fintech ecosystem, supported by progressive regulations like PSD2, is playing a central role in driving Germany alternative data market growth. The widespread adoption of open banking facilitates access to granular transaction-level data, enabling banks and digital lenders to generate more accurate credit profiles, especially for underbanked individuals and SMEs. German fintechs are leveraging APIs to integrate alternative data from various sources, such as e-commerce platforms, gig economy income streams, and utility payment histories, into their risk assessment models. This expansion in data scope improves loan decisioning speed and accuracy, driving innovation in consumer finance and lending. As more startups enter the market and established players integrate open banking tools, the demand for alternative data analytics continues to rise. For instance, in November 2024, Goldman Sachs began using alternative data, including satellite imagery and credit card transaction information, to improve its ability to predict retail trends. By analyzing these datasets, the firm seeks to deliver more precise forecasts of consumer behavior and spending habits, helping clients make better-informed investment decisions in the retail market.

To get more information on this market, Request Sample

Rise of AI and Machine Learning in Data Analytics

Artificial intelligence (AI) and machine learning (ML) technologies are reshaping the Germany alternative data landscape by enabling the extraction of predictive insights from vast, unstructured datasets. For instance, as per IMARC report, more than 70% of alternative data providers use AI and machine learning (ML) for data processing and analysis, allowing for quicker and more precise insights. Financial institutions and hedge funds are increasingly deploying AI to process alternative data such as social media trends, geolocation data, web traffic, and sensor outputs. These technologies enhance forecasting capabilities in asset pricing, consumer behavior, and macroeconomic trends. In Germany, strong academic research in AI, coupled with governmental support for digital innovation, fosters rapid development and adoption of machine-learning-driven data models. The use of AI improves the scalability and efficiency of alternative data processing, positioning Germany as a leader in data-driven financial intelligence and accelerating Germany alternative data market growth.

Germany Alternative Data Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on data type, industry, and end user.

Data Type Insights:

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

The report has provided a detailed breakup and analysis of the market based on the data type. This includes credit and debit card transactions, email receipts, geo-location (foot traffic) records, mobile application usage, satellite and weather data, social and sentiment data, web scraped data, web traffic, and others.

Industry Insights:

- Automotive

- BFSI

- Energy

- Industrial

- IT and Telecommunications

- Media and Entertainment

- Real Estate and Construction

- Retail

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes automotive, BFSI, energy, industrial, IT and telecommunications, media and entertainment, real estate and construction, retail, transportation and logistics, and others.

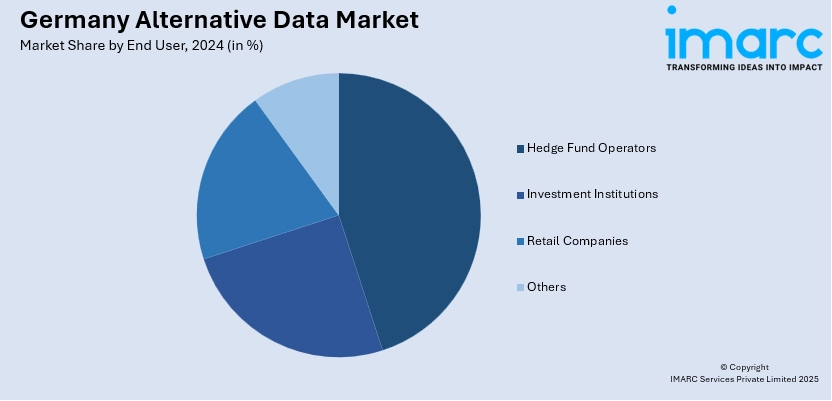

End User Insights:

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hedge fund operators, investment institutions, retail companies, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Alternative Data Market News:

- In June 2025, Bloomberg integrated Similarweb’s web traffic data into its Terminal via {ALTD<GO>}, expanding alternative data coverage to over 3,000 companies worldwide. This partnership provides investors with near real-time digital insights across sectors like SaaS, e-commerce, and healthcare, enhancing the ability to track KPIs and spot trends for better investment decisions.

Germany Alternative Data Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Credit and Debit Card Transactions, Email Receipts, Geo-location (Foot Traffic) Records, Mobile Application Usage, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, Others |

| Industries Covered | Automotive, BFSI, Energy, Industrial, IT and Telecommunications, Media and Entertainment, Real Estate and Construction, Retail, Transportation and Logistics, Others |

| End Users Covered | Hedge Fund Operators, Investment Institutions, Retail Companies, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany alternative data market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany alternative data market on the basis of data type?

- What is the breakup of the Germany alternative data market on the basis of industry?

- What is the breakup of the Germany alternative data market on the basis of end user?

- What is the breakup of the Germany alternative data market on the basis of region?

- What are the various stages in the value chain of the Germany alternative data market?

- What are the key driving factors and challenges in the Germany alternative data market?

- What is the structure of the Germany alternative data market and who are the key players?

- What is the degree of competition in the Germany alternative data market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany alternative data market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany alternative data market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany alternative data industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)