Germany Automotive Manufacturing Market Size, Share, Trends and Forecast by Vehicle Type, Component, Manufacturing Process, Fuel Type, End User, and Region, 2025-2033

Germany Automotive Manufacturing Market Overview:

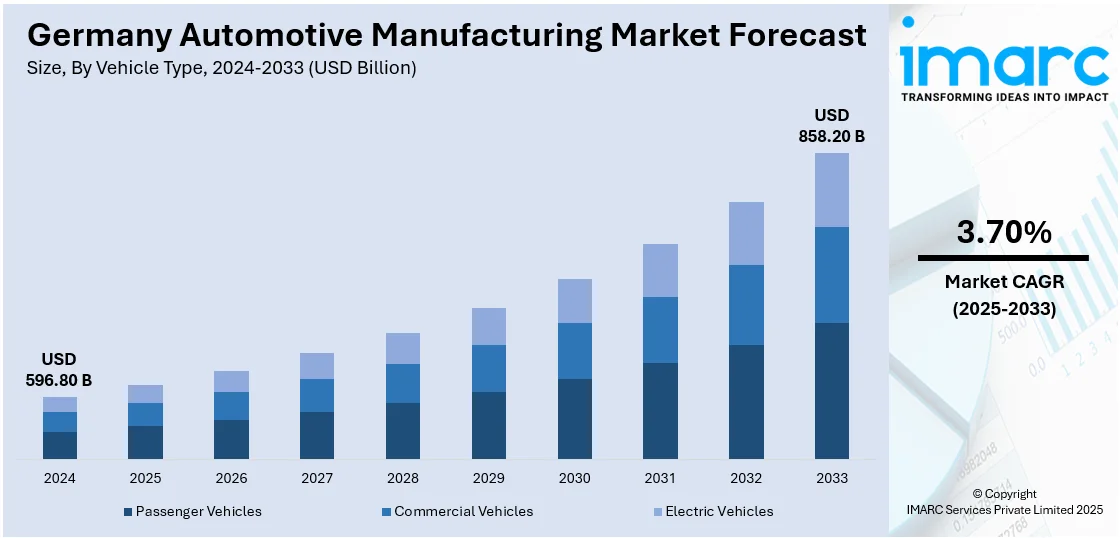

The Germany automotive manufacturing market size reached USD 596.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 858.20 Billion by 2033, exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. The market is emerging, driven by rapid technological innovation, extensive government support, increasing focus on electric vehicles (EVs) and sustainability, robust export market, and efficient supply chain.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 596.80 Billion |

| Market Forecast in 2033 | USD 858.20 Billion |

| Market Growth Rate 2025-2033 | 3.70% |

Germany Automotive Manufacturing Market Trends:

Rapid Technological Innovation

Germany's automotive industry is thriving due to rapid technological advancements, particularly in electric vehicles (EVs), autonomous driving, and advanced combustion engines. The country’s strong engineering expertise and continuous investment in research and development (R&D) drive innovation, enhancing vehicle safety, efficiency, and overall performance. In 2023, Germany produced around 995,000 purely EVs, exporting 76%, reinforcing its position as Europe’s EV leader and the world's second-largest EV producer The country is also a leader in autonomous car technology, with widespread testing and implementation activities. Cleaner transport solution-friendly government policies further fuel market growth, enabling the increased use of high-performance EVs. With producers leading the charge towards sustainability and advanced innovations, Germany is still the world's center for automotive innovation, guaranteeing ongoing industry growth and dominance in future mobility solutions.

Rising Government Support and Policies

Germany’s automotive sector benefits from government policies combining financial incentives, environmental regulations, and industrial strategies. The government allocated €3.4 billion in EV subsidies, with €2.1 billion for 2023 and €1.3 billion for 2024, stimulating consumer demand and boosting production. Germany's standing as the world leader in electric vehicles (EVs) has been strengthened by these incentives. Furthermore, the industry has been forced to switch to cleaner and more effective technology by stringent environmental restrictions, such as the European Union's CO₂ emissions regulations. German manufacturers stay ahead of the technological curve because to the government's investment on research and development (R&D) in areas like hydrogen fuel cells, autonomous vehicles, and battery technology. These policies support the nation's vehicle industry's growth and establish it as a leader in next-generation transportation technologies by encouraging sustainability and creative mobility solutions.

Increasing Focus on Sustainability and Green Technologies

Germany's focus on green technology and sustainability is propelling its automotive production industry. The increased worldwide demand for eco-friendly cars has prompted German producers to invest in clean technologies such as electric vehicles (EVs), diversifying their offerings to comply with stringent emissions regulations. The country's focus on renewable energy also lowers the carbon footprint of car manufacturing. The government is also actively promoting hydrogen fuel cells as an alternative to combustion engines, fostering innovation in future vehicle models. Under the National Innovation Programme for Hydrogen and Fuel Cell Technology, the Federal Ministry for Digital and Transport is investing €259 million in R&D and €285 million for market activation. These initiatives position Germany as a leader in sustainable mobility, reinforcing its role in advancing green automotive technologies on a global scale.

Germany Automotive Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vehicle type, component, manufacturing process, fuel type, and end user.

Vehicle Type Insights:

- Passenger Vehicles

- Premium

- Mid-range

- Economy

- Commercial Vehicles

- Trucks

- Buses

- Vans

- Electric Vehicles

- BEVs

- PHEVs

- FCEVs

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles (premium, mid-range, and economy), commercial vehicles (trucks, buses, and vans), and electric vehicles (BEVs, PHEVs, and FCEVs).

Component Insights:

- Engine and Transmission

- Electronics and Software

- Chassis and Suspension

- Interior and Exterior Components

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes engine and transmission, electronics and software, chassis and suspension, and interior and exterior components.

Manufacturing Process Insights:

- Stamping and Forging

- Assembly and Welding

- Paint and Coating

- Engine and Transmission Manufacturing

The report has provided a detailed breakup and analysis of the market based on the manufacturing process. This includes stamping and forging, assembly and welding, paint and coating, and engine and transmission manufacturing.

Fuel Type Insights:

- Petrol and Diesel Vehicles

- Electric and Hybrid Vehicles

- Hydrogen Fuel Cell Vehicles

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes petrol and diesel vehicles, electric and hybrid vehicles, and hydrogen fuel cell vehicles.

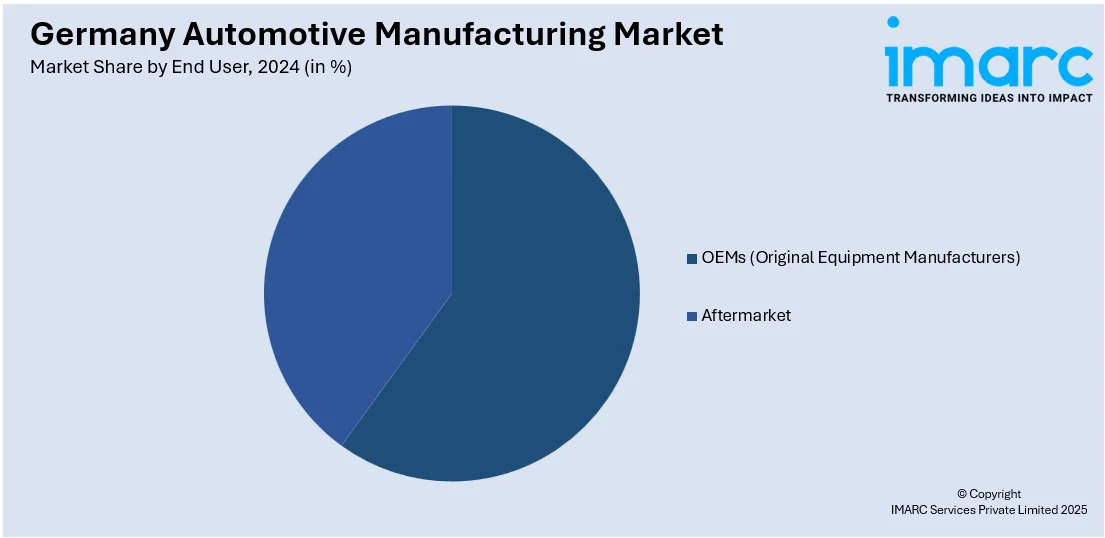

End User Insights:

- OEMs (Original Equipment Manufacturers)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the end user. This includes OEMs (original equipment manufacturers), and aftermarket.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Automotive Manufacturing Market News:

- In March 2023, Stellantis announced that the company invested over €130 Billion in the Eisenach Assembly Plant in Germany. This plant is the producer of the Opel Grandland compact SUV. The plant added production of the BEV successor vehicle that will be built on the all-new STLA Medium platform.

- In July 2024, Tesla announced that the company has received German environmental authority approval for site expansion. The company plans to double its German plant capacity to 100 GWh of battery production and 1 Billion cars per year.

Germany Automotive Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered |

|

| Components Covered | Engine and Transmission, Electronics and Software, Chassis and Suspension, Interior and Exterior Components |

| Manufacturing Processes Covered | Stamping and Forging, Assembly and Welding, Paint and Coating, Engine and Transmission Manufacturing |

| Fuel Types Covered | Petrol and Diesel Vehicles, Electric and Hybrid Vehicles, Hydrogen Fuel Cell Vehicles |

| End Users Covered | OEMs (Original Equipment Manufacturers), Aftermarket |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany automotive manufacturing market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany automotive manufacturing market on the basis of vehicle type?

- What is the breakup of the Germany automotive manufacturing market on the basis of component?

- What is the breakup of the Germany automotive manufacturing market on the basis of manufacturing process?

- What is the breakup of the Germany automotive manufacturing market on the basis of fuel type?

- What is the breakup of the Germany automotive manufacturing market on the basis of end user?

- What is the breakup of the Germany automotive manufacturing market on the basis of region?

- What are the various stages in the value chain of the Germany automotive manufacturing market?

- What are the key driving factors and challenges in the Germany automotive manufacturing market?

- What is the structure of the Germany automotive manufacturing market and who are the key players?

- What is the degree of competition in the Germany automotive manufacturing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany automotive manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany automotive manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany automotive manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)