Germany Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2025-2033

Germany Bancassurance Market Overview:

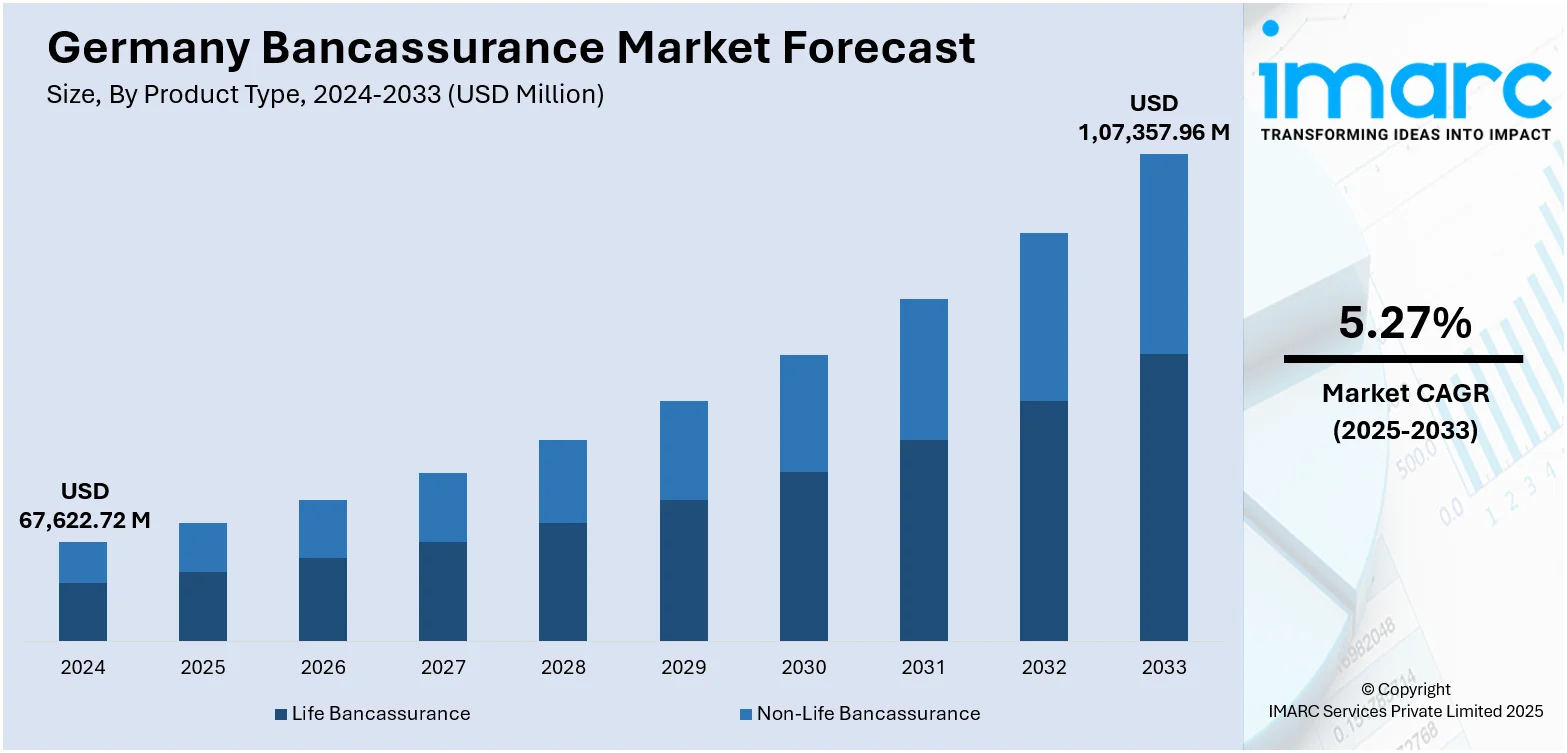

The Germany bancassurance market size reached USD 67,622.72 Million in 2024. Looking forward, the market is projected to reach USD 1,07,357.96 Million by 2033, exhibiting a growth rate (CAGR) of 5.27% during 2025-2033. The market is driven by Germany’s robust banking infrastructure, evolving pension needs, and a balanced hybrid of digital and advisory-based distribution. Pension reforms and an aging population have fueled demand for retirement-focused products, while omnichannel distribution ensures both convenience and personal guidance. Digital innovations, including API integrations and AI-assisted advice, have streamlined policy issuance and servicing, thus steadily enhancing the Germany bancassurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 67,622.72 Million |

| Market Forecast in 2033 | USD 1,07,357.96 Million |

| Market Growth Rate 2025-2033 | 5.27% |

Germany Bancassurance Market Trends:

Established Financial Infrastructure Driving Market Synergy

Germany’s bancassurance sector benefits from one of the most mature and stable banking systems in Europe, supported by universal banks, savings banks (Sparkassen), and cooperative banks (Volksbanken). This dense, well-trusted network ensures insurance providers can access a wide demographic, from urban professionals to rural communities. Decades-long partnerships between insurers and banks, such as those between Allianz and Commerzbank, have fostered operational efficiency and cross-selling expertise. Germany’s strong consumer trust in financial institutions, combined with stringent regulatory oversight under BaFin, encourages uptake of bundled insurance products. In July 2025, Crédit Mutuel Alliance Fédérale secured approval from BaFin, Germany's financial supervisory authority, for its subsidiary ACM Deutschland to market bancassurance products in Germany through the TARGOBANK network starting January 1, 2026. A pilot period will begin in July 2025, and by the end of the year, ACM Deutschland will be fully operational. This move is part of Crédit Mutuel’s broader strategic plan to expand its bancassurance model in Europe, leveraging TARGOBANK’s network and ACM's insurance expertise. The Germany bancassurance market growth is propelled by the structural integration of banking and insurance channels, where robust governance and customer confidence sustain long-term sales stability.

To get more information on this market, Request Sample

Digital Advisory and Hybrid Distribution Evolution

Germany’s bancassurance players are adapting to a market where customers value both digital convenience and human advisory. While online and mobile banking platforms offer quick product comparisons, purchase options, and policy management, many Germans still prefer in-branch consultations for complex financial decisions. This has led to a hybrid distribution model, combining AI-driven policy recommendations with face-to-face advisory services. Banks integrate insurance APIs into digital channels, enabling instant quotes and applications, while maintaining the reassurance of certified advisors. In June 2025, Deutsche Bank, the leading bank in Germany, and Mastercard announced a partnership to enhance merchant solutions in Europe through open banking and account-to-account (A2A) payments. The collaboration will enable Deutsche Bank’s Merchant Solutions to integrate Mastercard’s open banking technology, offering merchants faster settlement, real-time processing, and greater payment transparency. This strategic partnership positions R2P as a key alternative to card payments, enhancing payment efficiency and security for merchants and consumers alike across Europe. The model is especially effective in addressing diverse consumer preferences, from digitally native millennials to tradition-oriented older clients.

Germany Bancassurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and model type.

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life bancassurance and non-life bancassurance.

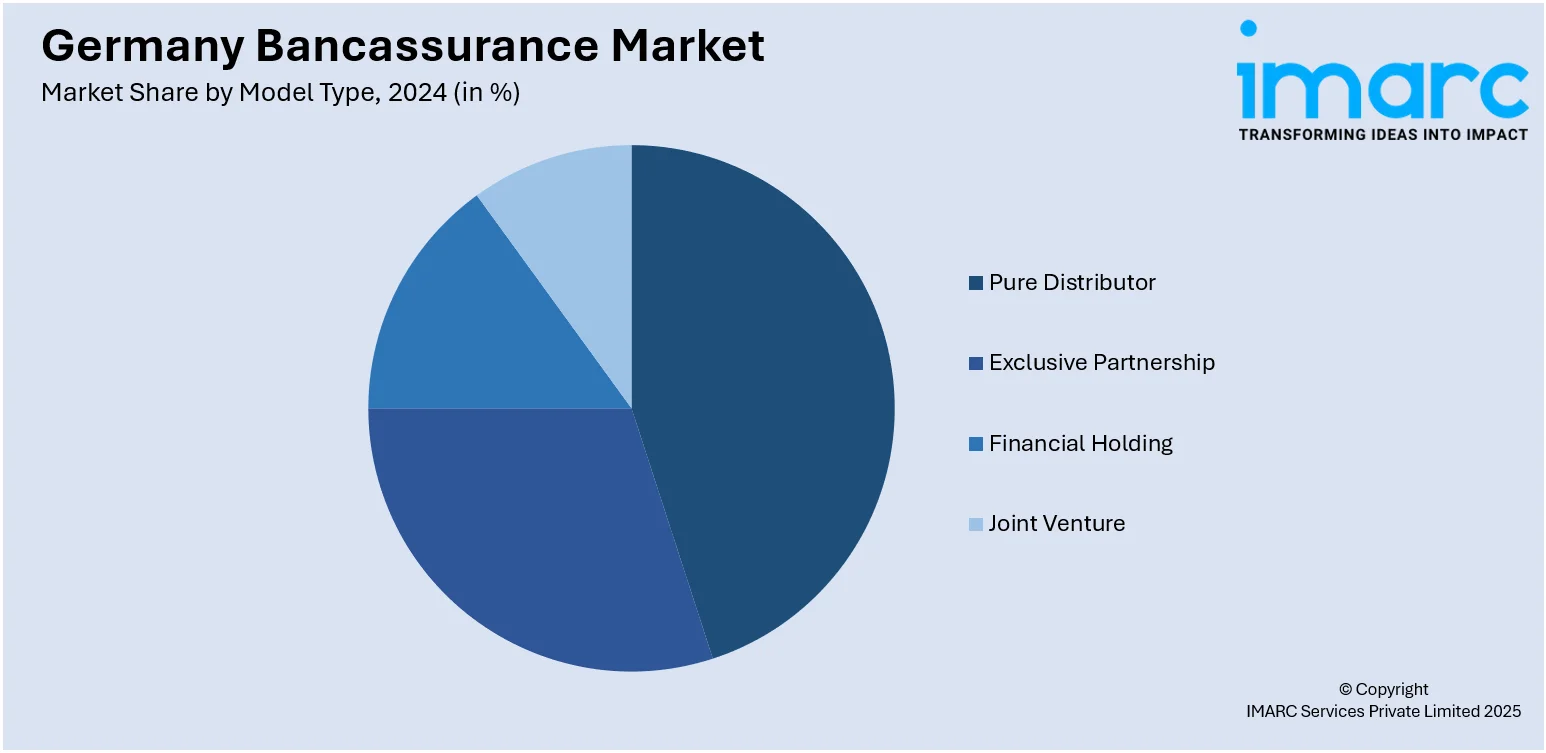

Model Type Insights:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

The report has provided a detailed breakup and analysis of the market based on the model type. This includes pure distributor, exclusive partnership, financial holding, and joint venture.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all major regional markets. This includes Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Bancassurance Market News:

- In July 2025, Round2 Capital invested a EUR 7-figure amount in Friendsurance, a Berlin-based InsurTech company, to support the growth of its digital bancassurance platform. The platform connects banks, insurers, and customers, enabling seamless digital sales of insurance products and providing new revenue streams for banks. Friendsurance, a leader in the DACH region, aims to expand its partnerships with key financial institutions and continue driving the digital transformation of bancassurance services.

Germany Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany bancassurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany bancassurance market on the basis of product type?

- What is the breakup of the Germany bancassurance market on the basis of model type?

- What is the breakup of the Germany bancassurance market on the basis of region?

- What are the various stages in the value chain of the Germany bancassurance market?

- What are the key driving factors and challenges in the Germany bancassurance market?

- What is the structure of the Germany bancassurance market and who are the key players?

- What is the degree of competition in the Germany bancassurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany bancassurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany bancassurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)