Germany Beer Market Size, Share, Trends and Forecast by, Product Type, Packaging, Production, Alcohol Content, Flavor, Distribution Channel and Region, 2025-2033

Germany Beer Market Overview:

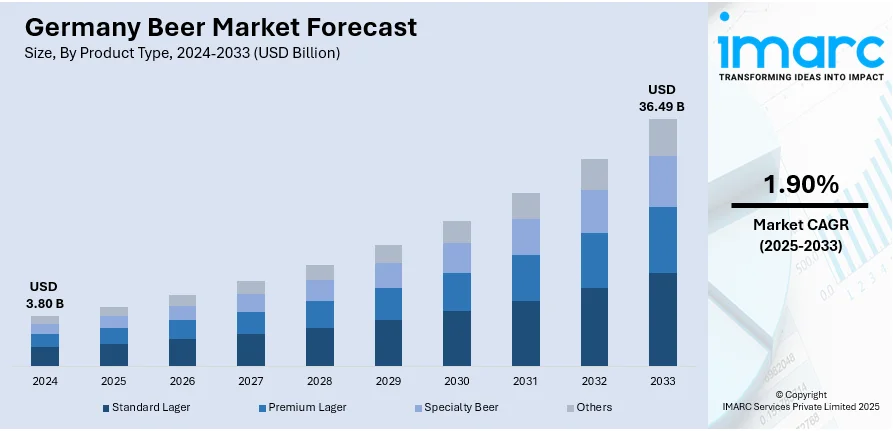

The Germany beer market size reached USD 3.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 36.49 Billion by 2033, exhibiting a growth rate (CAGR) of 1.90% during 2025-2033. A strong cultural heritage and tradition of beer consumption, increasing popularity of craft and specialty beers, rising health consciousness among consumers, growth of the beer tourism industry, expanding distribution channels, and the continued influence of the Reinheitsgebot (German Beer Purity Law), which emphasizes quality and traditional brewing methods, are some of the factors contributing to Germany beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.80 Billion |

| Market Forecast in 2033 | USD 36.49 Billion |

| Market Growth Rate 2025-2033 | 1.90% |

Germany Beer Market Trends:

Strong Cultural Heritage and Tradition

Germany boasts a strong cultural heritage tied to beer, which is an integral part of the country's society. The nation hosts many beer festivals, most prominently Oktoberfest in Munich, drawing millions of tourists annually. This deep-rooted cultural attachment encourages indigenous breweries and strengthens community bonds through beer consumption. Classic beer styles like Pilsner, Weizenbier, and Dunkel remain widely popular, sustaining steady consumer demand. According to Gitnux, Pilsner alone accounts for around 50–60% of all beer sales in the beer market in Germany. The historic Reinheitsgebot, or German Beer Purity Law, enacted in 1516, mandates the use of only water, hops, and barley in beer production, preserving traditional standards that consumers still value. This cultural and regulatory consistency ensures that beer remains a key element of German daily life, driving consumer loyalty and contributing significantly to the growth of the Germany beer and cider market, which includes both mainstream lagers and more diverse offerings.

To get more information on this market, Request Sample

Growing Popularity of Craft and Specialty Beers

In recent years, the Germany craft beer market has seen a strong upward trajectory, driven by consumers seeking variety, uniqueness, and local craftsmanship. Across the country, a wave of small, independent breweries is redefining the brewing landscape by experimenting with new techniques, ingredients, and hybrid styles. Younger drinkers in particular are drawn to the authenticity and creativity that these craft producers offer, moving away from standardized mass-market brands. As a result, bars, bottle shops, and online retailers are expanding their selections to accommodate this demand. Sustainability practices and hyperlocal sourcing further appeal to environmentally conscious consumers. Beyond just being a trend, this shift is establishing a long-term consumer base that values innovation and story-driven branding. According to insights from a recent beer report Germany, craft beer sales are gaining traction not only in major cities but also in smaller towns, where local pride in regional specialties is reviving traditional brewing communities.

Rising Health Consciousness among Consumers

Changing lifestyles and wellness awareness are reshaping the beer market Germany. As more consumers adopt health-conscious habits, demand for low-alcohol and non-alcoholic beers is surging. Non-alcoholic variants now make up about 7% of total beer sales in Germany, driven by a desire for moderation without sacrificing flavor. This shift is especially notable at social events, where lighter and alcohol-free options are becoming increasingly normalized. Large brewers and smaller craft producers alike are responding by launching dedicated product lines that cater to this segment. In parallel, consumers are scrutinizing labels more closely, opting for beers with fewer calories, organic ingredients, or sustainable packaging. The wellness-driven growth is expanding opportunities across multiple subcategories, including flavored low-alcohol beers and wellness-themed lagers. This evolving preference is creating space for functional beverages to coexist with traditional offerings within the broader beer market in Germany, reinforcing the trend toward more diverse and health-aligned choices.

Germany Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, packaging, production, alcohol content, flavor and distribution channel.

Product Type Insights:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes standard lager, premium lager, specialty beer, and others.

Packaging Insights:

- Glass

- PET Bottle

- Metal Can

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes glass, PET bottle, metal can, others.

Production Insights:

- Macro-Brewery

- Micro-Brewery

- Others

The report has provided a detailed breakup and analysis of the market based on the production. This includes macro-brewery, micro-brewery, others.

Alcohol Content Insights:

- High

- Low

- Alcohol Free

A detailed breakup and analysis of the market based on the alcohol content have also been provided in the report. This includes high, low, and alcohol free.

Flavor Insights:

- Flavored

- Unflavored

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes flavored, and unflavored.

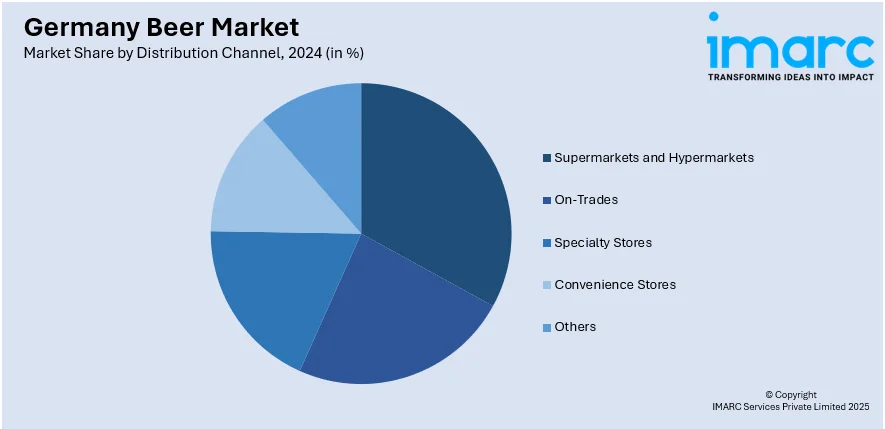

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, on-trades, specialty stores, convenience stores, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western, Southern, Eastern, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Beer Market News:

- August 2024: In anticipation of Oktoberfest 2024, Heads of Noosa Brewing Co launched a limited-edition Helles German Lager, brewed under Germany’s 1516 beer purity law, Reinheitsgebot. The lager uses only water, barley malt, hops, and yeast, ingredients still legally enforced in Germany. With 5% ABV and a clean, malty profile, this release showcases traditional German brewing values that continue to influence beer production and consumer expectations in the German market.

- March 2024: Krombacher Brewery rolled out Starnberger Hell, a Bavarian lager brewed under Germany’s Purity Law, across France, Italy, the UK, and Southeast Europe. With 4.8% ABV, it features Bavarian malt, Hallertau hops, and Lake Starnberg water. Starnberger Hell has surged in popularity. Krombacher now owns 40% of the Starnberg-based brewery, boosting investment and distribution beyond Bavaria.

- February 2024: Augustiner Bräu Wagner KG, Munich's oldest privately owned brewery, has entered into a trade agreement with James Clay & Sons, a specialist UK beer. Through this agreement, James Clay & Sons will have an exclusive right to import and distribute Augustiner products in the UK.

- September 2023: German brewer Bitburger signed a sponsorship deal with UEFA EURO 2024 as the official national partner of the championship. Under the partnership agreement, Bitburger brands will exclusively be available in all stadiums and official events in the host cities.

Germany Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Standard Lager, Premium Lager, Specialty Beer, Others |

| Packaging Covered | Glass, PET Bottle, Metal Can, Others |

| Production Covered | Macro-Brewery, Micro-Brewery, Others |

| Alcohol Content Covered | High, Low, Alcohol Free |

| Flavor Covered | Flavored, Unflavored |

| Distribution Channel Covered | Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The beer market in Germany reached USD 3.80 Billion in 2024.

The Germany beer market is projected to exhibit a CAGR of 1.90% during 2025-2033, reaching USD 36.49 Billion by 2033.

Rising demand for craft and low-alcohol beers, health-conscious consumption, heritage branding, sustainable brewing practices, and growing exports are key factors shaping the Germany beer market. Local preferences for traditional beer types, coupled with innovation in flavors and packaging, are helping breweries maintain relevance in a competitive environment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)