Germany Biometrics Market Size, Share, Trends and Forecast by Technology, Functionality, Component, Authentication, End User, and Region, 2026-2034

Germany Biometrics Market Summary:

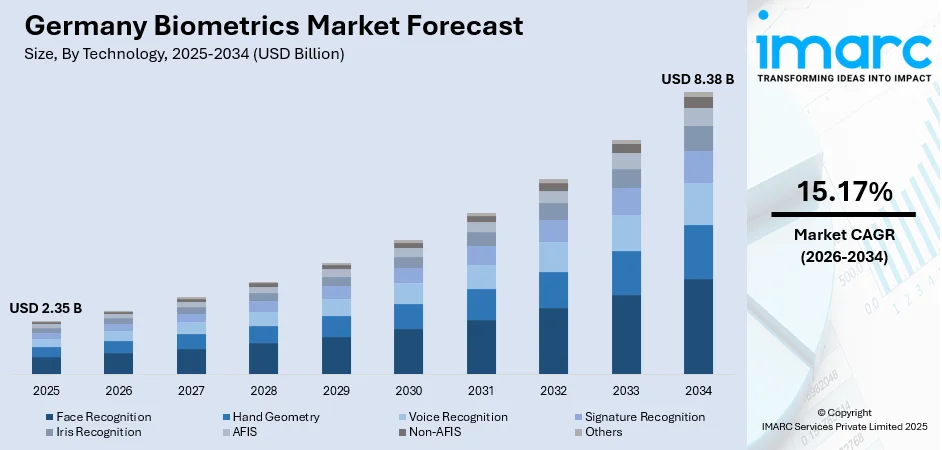

The Germany biometrics market size was valued at USD 2.35 Billion in 2025 and is projected to reach USD 8.38 Billion by 2034, growing at a compound annual growth rate of 15.17% from 2026-2034.

The market expansion is driven by Germany's accelerating digital transformation initiatives, stringent data protection regulations under GDPR, and increasing government investments in secure identity verification systems. Rising cybersecurity threats across banking, healthcare, and public administration sectors are compelling organizations to adopt advanced biometric solutions. The country's position as Europe's largest economy and its leadership in implementing the European Union Digital Identity (EUDI) Wallet framework further strengthen the Germany biometrics market share.

Key Takeaways and Insights:

- By Technology: Face Recognition dominates the market with a share of 40% in 2025, driven by widespread deployment in airport border control systems and law enforcement applications.

- By Functionality: Non-Contact leads the market with a share of 55% in 2025, fueled by heightened demand for touchless authentication solutions across public and private sectors.

- By Component: Hardware represents the largest segment with a market share of 60% in 2025, supported by extensive deployment of biometric sensors and scanners in government facilities.

- By Authentication: Single-Factor Authentication dominates with a share of 60% in 2025, owing to its widespread adoption in consumer electronics and access control systems.

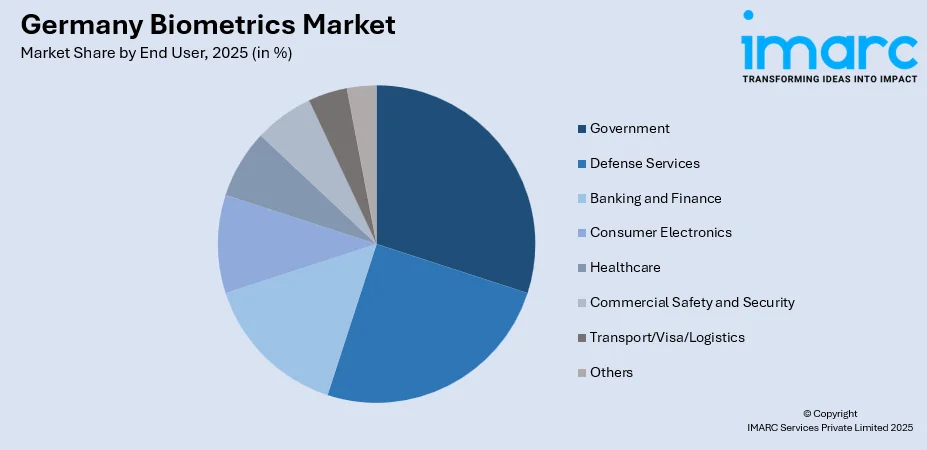

- By End User: Government holds the largest share of 25% in 2025, driven by national digital identity initiatives and border security programs.

- Key Players: The Germany biometrics market exhibits a moderately consolidated competitive landscape, with domestic technology leaders like secunet Security Networks AG and Cognitec Systems competing alongside global players across various biometric modalities and application segments.

To get more information on this market, Request Sample

Germany stands at the forefront of Europe's biometric technology adoption, driven by its robust regulatory framework and advanced digital infrastructure. The nation's commitment to secure digital identity is evidenced by initiatives such as the electronic identity card (eID) system, which continues to evolve under the EUDI Wallet framework. In May 2025, Germany launched biometric PointID terminals across government offices for digital ID issuance, enabling citizens to capture photographs, fingerprints, and signatures electronically. Major German airports, including Frankfurt and Munich, operate the EasyPASS automated border control system, processing passengers through biometric eGates in under eighteen seconds, demonstrating the country's integration of biometrics into critical infrastructure.

Germany Biometrics Market Trends:

Accelerated Adoption of Contactless Biometric Authentication

German enterprises and government institutions are increasingly prioritizing touchless biometric modalities, particularly facial recognition and iris scanning, to address hygiene concerns and improve user experience. The deployment of non-contact solutions has accelerated across banking, healthcare, and public transportation sectors. In September 2025, the German Federal Ministry announced the phased introduction of the European Entry/Exit System (EES) at major airports, requiring biometric facial images and fingerprints from third-country nationals. This shift toward frictionless authentication is reshaping infrastructure investments and compelling organizations to upgrade legacy systems.

Integration of Artificial Intelligence in Biometric Systems

Artificial intelligence and machine learning technologies are transforming the accuracy and efficiency of biometric verification systems deployed across Germany. AI-driven algorithms now enable near-perfect recognition rates even in challenging conditions, supporting applications ranging from law enforcement to financial services. The Federal Criminal Police Office deployed a renewed AI-based facial recognition system, which authorities describe as one of the most powerful investigative tools available. German fintech companies are implementing behavioral biometrics powered by AI to detect fraud patterns and ensure secure digital banking transactions.

Expansion of Digital Identity Wallet Initiatives

Germany is actively developing its national digital identity wallet as part of the European Union Digital Identity (EUDI) framework, creating new opportunities for biometric integration. The government has outlined plans for the state digital wallet to become operational by 2027, enabling citizens to securely store credentials and authenticate across public and private services. The Federal Agency for Disruptive Innovation (SPRIND) launched a prototype competition for designing the German EUDI wallet, attracting innovative biometric solution providers. DocuSign partnered with IDnow in September 2025 to integrate eID-based biometric verification for German customers in finance and insurance sectors.

Market Outlook 2026-2034:

The Germany biometrics market demonstrates strong growth potential throughout the forecast period, underpinned by mandatory implementation of EU-wide biometric systems and sustained private sector investment in identity verification solutions. Regulatory frameworks including GDPR and the AI Act are shaping development priorities toward privacy-preserving and compliant biometric technologies. The market generated a revenue of USD 2.35 Billion in 2025 and is projected to reach a revenue of USD 8.38 Billion by 2034, growing at a compound annual growth rate of 15.17% from 2026-2034. The convergence of government digitalization mandates, financial sector security requirements, and consumer electronics integration positions Germany as a leading European market for biometric innovation.

Germany Biometrics Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Face Recognition | 40% |

| Functionality | Non-contact | 55% |

| Component | Hardware | 60% |

| Authentication | Single-factor Authentication | 60% |

| End User | Government | 25% |

Technology Insights:

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature Recognition

- Iris Recognition

- AFIS

- Non-AFIS

- Others

The face recognition segment dominates with a market share of 40% of the total Germany biometrics market in 2025.

Facial recognition technology has emerged as the leading biometric modality in Germany, driven by extensive government deployment in border security and law enforcement applications. The EasyPASS automated border control system, operational at major German airports including Frankfurt, Munich, Düsseldorf, and Berlin/Brandenburg, utilizes advanced facial recognition to verify passenger identities against electronic passport photographs. German Federal Police piloted the secunet easykiosk system incorporating facial recognition cameras alongside fingerprint and iris scanners at Frankfurt Airport in 2024. The Federal Criminal Police Office maintains a database exceeding seven million facial images, with AI-powered matching systems achieving error rates below one percent. Commercial adoption is expanding across banking and retail sectors, where facial authentication provides frictionless customer experiences while meeting stringent security requirements.

Functionality Insights:

- Contact

- Non-contact

- Combined

The non-contact segment leads the market with a share of 55% of the total Germany biometrics market in 2025.

Non-contact biometric solutions have gained substantial momentum in the German market, reflecting heightened awareness of hygiene considerations and user convenience requirements. Touchless authentication methods, including facial recognition and iris scanning, are increasingly deployed across public transportation, healthcare facilities, and corporate access control systems. German airports are investing in contactless eGate infrastructure that enables travelers to complete identity verification without physical interaction with shared surfaces. Banking institutions are implementing voice biometrics for telephone customer service authentication, reducing reliance on traditional contact-based fingerprint systems.

Component Insights:

- Hardware

- Software

The hardware segment holds the largest share of 60% of the total Germany biometrics market in 2025.

Hardware components constitute the largest segment of the Germany biometrics market, driven by substantial government and enterprise investments in biometric capture devices, sensors, and processing equipment. Airport infrastructure programs continue to expand automated border control gate installations, with secunet easygate systems requiring sophisticated camera arrays, document readers, and fingerprint scanners. The Federal Printing House (Bundesdruckerei) maintains responsibility for terminal maintenance and technical compliance with federal guidelines. Enterprise security deployments are driving demand for access control hardware including fingerprint readers, facial recognition cameras, and multimodal authentication devices.

Authentication Insights:

- Single-factor Authentication

- Multi-factor Authentication

The Single-factor Authentication segment dominates the market with a share of 60% of the total Germany biometrics market in 2025.

Single-factor biometric authentication maintains market leadership in Germany, reflecting widespread adoption in consumer electronics, time and attendance systems, and basic access control applications. Smartphone fingerprint sensors and facial recognition unlock mechanisms represent the largest deployment base, with nearly all leading mobile device manufacturers incorporating single-factor biometric authentication. The EasyPASS border control system employs single-factor facial verification, matching passenger images against electronic passport photographs to authorize passage. However, multi-factor authentication is experiencing accelerated growth, particularly within enterprise security, financial services, and healthcare contexts where regulatory compliance demands enhanced protection. The Payment Services Directive 2 (PSD2) requirements for Strong Customer Authentication (SCA) are driving German banks to implement combinations of biometric factors with device-based tokens.

End User Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Government

- Defense Services

- Banking and Finance

- Consumer Electronics

- Healthcare

- Commercial Safety and Security

- Transport/Visa/Logistics

- Others

The Government sector accounts for the largest share of 25% of the total Germany biometrics market in 2025.

Government institutions represent the dominant end-user segment, reflecting Germany's substantial public sector investments in secure identity verification and border security infrastructure. The Federal Ministry of the Interior oversees nationwide biometric programs including the electronic identity card system, Entry/Exit System implementation, and law enforcement facial recognition databases. All German government and immigration offices are required to accept digital biometric photographs through PointID terminals, standardizing biometric capture across public administration. The Federal Police operates automated border control systems at eight major airports, processing millions of passengers annually through biometric verification. National security applications, including the Federal Criminal Police Office's facial recognition infrastructure, represent significant ongoing investment in advanced biometric technologies.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

Western Germany dominates the biometrics market, anchored by North Rhine-Westphalia's industrial base and Hesse's financial hub centered in Frankfurt. The region hosts major banking institutions deploying biometric authentication solutions and houses critical technology infrastructure. Cologne and Düsseldorf airports operate automated border control systems, while Frankfurt Airport serves as Germany's busiest international gateway with extensive biometric eGate installations processing millions of travelers annually.

Southern Germany represents a leading biometrics innovation hub, driven by Bavaria's high-tech ecosystem and Baden-Württemberg's advanced manufacturing sector. Munich serves as a primary center for ICT development and houses major technology companies investing in biometric solutions. Bavaria maintains Germany's lowest unemployment rate and highest labor productivity, supporting substantial enterprise security investments. Munich Airport operates comprehensive EasyPASS biometric border control infrastructure alongside Stuttgart's expanding facilities.

Eastern Germany is experiencing steady growth in biometrics adoption as the region continues its digital infrastructure modernization. Berlin, the federal capital, demonstrates the highest eID activation rate at fifty-four percent, reflecting government digitalization initiatives. The capital hosts numerous technology startups and serves as headquarters for national identity programs. Brandenburg's Berlin/Brandenburg Airport operates modern biometric border control systems, while Dresden and Leipzig emerge as secondary technology centers attracting biometric solution providers.

Northern Germany shows growing biometrics market activity, led by Hamburg's logistics and maritime industries requiring secure identity verification. The region's port facilities implement biometric access control for critical infrastructure protection. Hamburg Airport operates automated border control gates with facial recognition technology, while Bremen-based companies like Opto Precision develop specialized surveillance and identification systems. Lower Saxony's automotive sector drives demand for workforce biometric authentication solutions.

Market Dynamics:

Growth Drivers:

Why is the Germany Biometrics Market Growing?

Government Digital Identity Initiatives and EU Regulatory Mandates

Germany's biometrics market expansion is fundamentally driven by extensive government digitalization programs and mandatory European Union regulatory requirements for secure identity verification. This regulatory requirement is compelling substantial infrastructure investments across airports, seaports, and land border crossings. Germany became the first EU member state to complete eID notification under the eIDAS Regulation in 2017, achieving the highest possible trust level certification. The Federal Ministry of the Interior's rollout of PointID biometric terminals across all government offices demonstrates sustained commitment to standardizing biometric identity verification in public administration.

Rising Cybersecurity Threats and Financial Sector Demand

Escalating cybersecurity incidents and sophisticated fraud attempts are compelling German organizations to implement advanced biometric authentication solutions as primary security measures. Germany experienced record cybercrime losses exceeding two hundred sixty-seven billion euros in 2024, with phishing attacks representing the predominant threat vector. Financial institutions are increasingly deploying biometric verification to protect customer accounts and comply with Payment Services Directive requirements for Strong Customer Authentication. The biometric payment adoption rate in Europe increased by forty-five percent, with Germany and the United Kingdom leading regional implementation. German neobanks including N26 and Trade Republic have integrated fingerprint and facial recognition as standard authentication methods. Behavioral biometrics platforms are achieving significant reductions in false positive rates, enabling more accurate fraud detection while improving customer experience during digital banking transactions.

Advancement of AI-Powered Biometric Technologies

Technological innovation in artificial intelligence and machine learning is dramatically enhancing the accuracy, speed, and reliability of biometric systems deployed across German markets. AI-driven facial recognition algorithms now achieve near-perfect accuracy rates, enabling confident deployment in security-critical applications including law enforcement and border control. The Federal Criminal Police Office introduced a renewed AI-based facial recognition system in September 2024, with officials describing it as one of the most powerful investigative tools available. Deep learning technologies enable effective recognition even under challenging conditions including varied lighting, angles, and aging effects. German technology companies are developing behavioral biometrics solutions that analyze keystroke patterns, gait, and user interaction behaviors for continuous authentication. The integration of AI capabilities is also improving liveness detection to counter spoofing attempts, strengthening overall security while reducing friction in verification processes.

Market Restraints:

What Challenges the Germany Biometrics Market is Facing?

Stringent Privacy Regulations and Public Concerns

Germany's rigorous data protection framework under GDPR creates significant compliance requirements that can constrain biometric technology deployment and increase implementation costs. Public sensitivity regarding surveillance and data collection has historically limited acceptance of biometric systems, with political opposition challenging proposals for expanded police facial recognition capabilities. Only thirty-five percent of adult Germans have activated their electronic identity function, indicating persistent adoption barriers despite government promotion efforts.

Technical Complexity and Integration Challenges

The integration of biometric systems with existing legacy infrastructure presents substantial technical challenges and costs that can delay deployment timelines. Organizations must navigate complex interoperability requirements when connecting biometric solutions to enterprise identity management systems and government databases. The phased European Entry/Exit System launch reflects ongoing technical difficulties in establishing stable connections with the central EU database, highlighting infrastructure complexity challenges that affect market growth.

Algorithmic Bias and Accuracy Concerns

Documented performance disparities in facial recognition systems across demographic groups raise concerns about discriminatory outcomes that complicate deployment decisions. Regulatory scrutiny of algorithmic fairness is intensifying as EU AI Act provisions take effect, requiring organizations to demonstrate unbiased system performance. These accuracy and equity considerations are particularly significant for high-stakes applications in law enforcement and border security contexts.

Competitive Landscape:

The Germany biometrics market exhibits a moderately consolidated competitive structure characterized by the presence of established domestic technology providers alongside global biometric solution leaders. German companies including secunet Security Networks AG and Cognitec Systems GmbH have developed specialized expertise in government identity and border control applications through long-term partnerships with federal authorities. International players such as IDEMIA, Thales, and NEC Corporation maintain significant market positions through comprehensive product portfolios spanning multiple biometric modalities. Competitive dynamics are increasingly shaped by technological differentiation in AI-powered recognition accuracy, compliance with evolving EU regulations, and the ability to support large-scale government implementations. Strategic partnerships between technology providers and system integrators are common, exemplified by the secunet-Bundesdruckerei consortium delivering the EasyPASS border control infrastructure. Recent market activity includes IDnow's acquisition by Corsair Capital for approximately two hundred seventy-three million euros, highlighting continued investor interest in German identity verification capabilities.

Recent Developments:

- In November 2025, Zurich Airport implemented the European Entry/Exit System biometric border control platform with support from secunet, deploying automated eGates, self-service kiosks, and facial image capture towers that connect to the EU central database for third-country traveler registration.

Germany Biometrics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Face Recognition, Hand Geometry, Voice Recognition, Signature Recognition, Iris Recognition, AFIS, Non-AFIS, Others |

| Functionalities Covered | Contact, Non-contact, Combined |

| Components Covered | Hardware, Software |

| Authentications Covered | Single-Factor Authentication, Multifactor Authentication |

| End Users Covered | Government, Defense Services, Banking and Finance, Consumer Electronics, Healthcare, Commercial Safety and Security, Transport/Visa/Logistics, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Germany biometrics market size was valued at USD 2.35 Billion in 2025.

The Germany biometrics market is expected to grow at a compound annual growth rate of 15.17% from 2026-2034 to reach USD 8.38 Billion by 2034.

The face recognition segment dominated the Germany biometrics market with a share of 40% in 2025, driven by extensive deployment in airport border control systems and law enforcement applications utilizing AI-powered matching algorithms.

Key factors driving the Germany biometrics market include government digital identity initiatives under the EUDI framework, mandatory EU Entry/Exit System implementation, rising cybersecurity threats requiring advanced authentication, and technological advancements in AI-powered biometric verification.

Major challenges include stringent GDPR privacy regulations increasing compliance costs, public concerns regarding surveillance and data collection limiting adoption, technical integration complexity with legacy systems, and algorithmic bias concerns requiring demonstration of unbiased system performance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)