Germany CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

Germany CCTV Camera Market Overview:

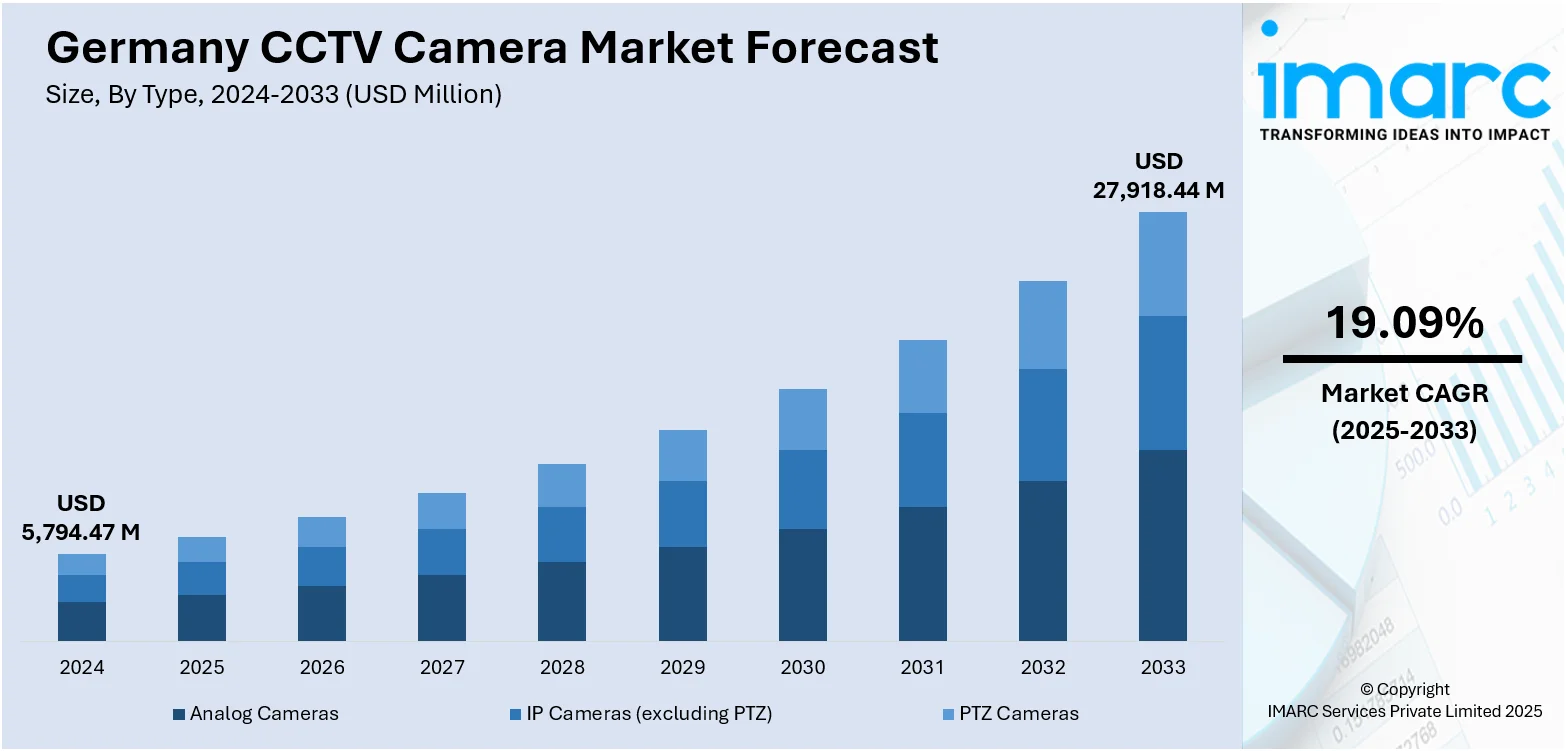

The Germany CCTV camera market size reached USD 5,794.47 Million in 2024. Looking forward, the market is projected to reach USD 27,918.44 Million by 2033, exhibiting a growth rate (CAGR) of 19.09% during 2025-2033. The market is witnessing steady growth due to rising concerns over public safety, increased adoption in commercial and residential sectors, and advancements in video surveillance technology. Demand for IP-based and AI-enabled systems is expanding, particularly in urban infrastructure and transportation. Integration with smart city projects and crime prevention initiatives continues to drive installations, positively influencing the overall Germany CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,794.47 Million |

| Market Forecast in 2033 | USD 27,918.44 Million |

| Market Growth Rate 2025-2033 | 19.09% |

Germany CCTV Camera Market Trends:

Shift to IP-Based Surveillance

In Germany, the shift from conventional analog systems to IP-based CCTV cameras is picking up pace as users seek improved performance and scalability. IP cameras offer superior image quality, web and mobile access, and easier integration with other digital technologies. The shift is especially evident in sectors such as retail, banking, and transportation where timely surveillance and centralized control are critical. In addition, IP-based systems offer sophisticated features like motion detection, cloud connectivity, and analytics that are impossible to achieve in analog systems. Their flexibility in installation and network integration makes them attractive for both small and big surveillance projects. Therefore, this trend is playing a major role in upgrading the country's security infrastructure modernization.

To get more information on this market, Request Sample

Cloud-Based Storage Adoption

The increasing dependence on cloud storage solutions is playing a vital role in the Germany CCTV camera market growth. Cloud systems present scalable, secure, and cost-effective alternatives to traditional DVR/NVR configurations, allowing users to store, access, and manage surveillance videos remotely. Both businesses and municipalities benefit from decreased hardware upkeep and the ability to view real-time videos from various locations via the internet. The flexibility to enhance storage capacity on demand, along with the incorporation of cloud analytics tools, further boosts operational efficiency. Additionally, cloud services provide data redundancy, ensuring that video records remain secure even in the event of device malfunction or tampering. As digital transformation continues across various sectors, the adoption of cloud technology in video surveillance is increasingly becoming the preferred option for progressive organizations.

Emphasis on Data Privacy and Compliance

In Germany, where data privacy is a significant public concern, adherence to GDPR (General Data Protection Regulation) has emerged as a crucial factor in the CCTV camera market. Manufacturers and service providers are reengineering surveillance systems to integrate features such as encrypted data transmission, access controls, and the masking or blurring of personally identifiable information. Businesses are required to guarantee that recorded footage is stored and processed in compliance with stringent data protection laws, leading to an uptick in demand for secure, privacy-focused surveillance solutions. This compliance-driven trend impacts purchasing choices in both the public and private sectors. As a result, vendors that emphasize secure storage, user consent protocols, and transparent data handling practices are more likely to capture market share in Germany's highly regulated security landscape.

Germany CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

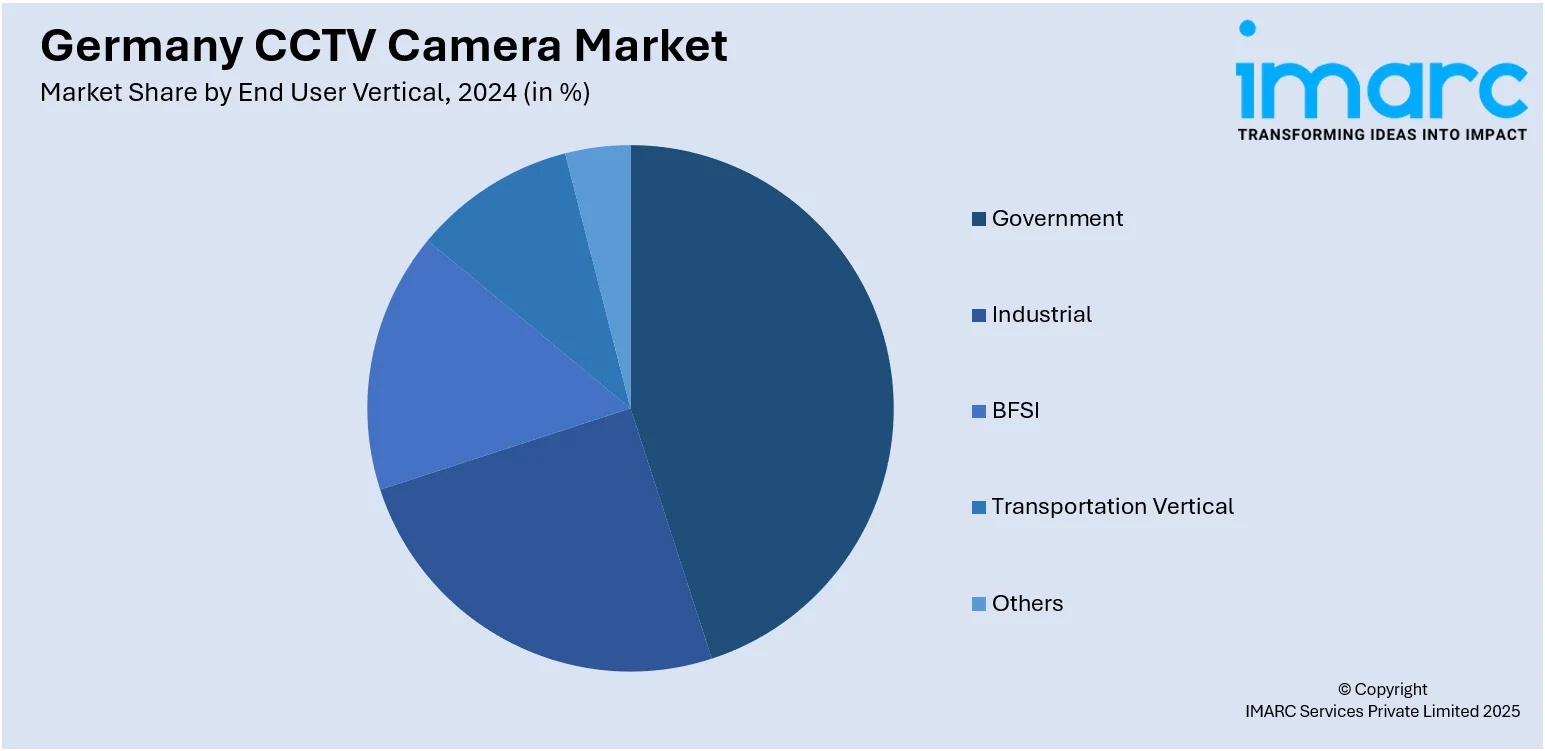

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany CCTV Camera Market News:

- In June 2024, Verkada expanded its operations into Germany, Austria, and Switzerland. The company, known for its cloud-based security solutions, now offers its Command platform and services in German. With over 24,000 customers worldwide, Verkada aims to enhance safety through integrated solutions, including video security cameras.

Germany CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany CCTV camera market on the basis of type?

- What is the breakup of the Germany CCTV camera market on the basis of end user vertical?

- What is the breakup of the Germany CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Germany CCTV camera market?

- What are the key driving factors and challenges in the Germany CCTV camera market?

- What is the structure of the Germany CCTV camera market and who are the key players?

- What is the degree of competition in the Germany CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)