Germany Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Germany Commercial Insurance Market Overview:

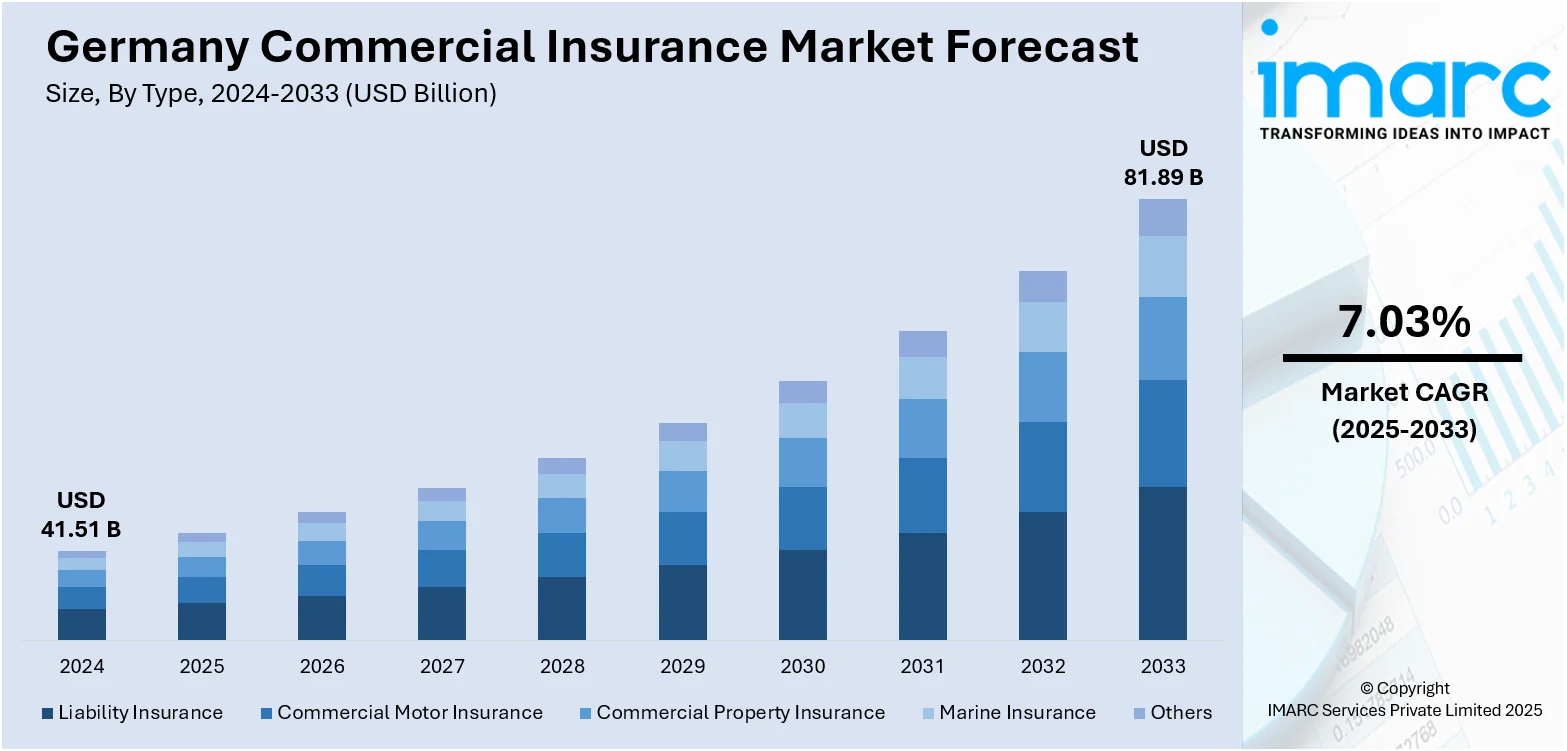

The Germany commercial insurance market size reached USD 41.51 Billion in 2024. The market is projected to reach USD 81.89 Billion by 2033, exhibiting a growth rate (CAGR) of 7.03% during 2025-2033. The market is expanding, driven by increased adoption of advanced technology and strategic acquisitions. Insurers are enhancing their offerings with tailored digital solutions, boosting operational efficiency. This trend, alongside global expansion efforts, supports Germany commercial insurance market share across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 41.51 Billion |

| Market Forecast in 2033 | USD 81.89 Billion |

| Market Growth Rate 2025-2033 | 7.03% |

Germany Commercial Insurance Market Trends:

IT Modernization for Greater Flexibility

In the German commercial insurance market, modernization of IT is increasingly becoming the core driver of efficiency and innovation. Through the pursuit of accommodating the changing demands of companies, the adoption of advanced technology plays a critical role in enhancing the operation process and product offerings. In June 2025, VPV Versicherungen started to provide its first commercial insurance products developed with the technology of Faktor Zehn, achieving an important milestone in its IT modernization process. By combining Faktor Zehn's policy management and claims handling systems, VPV launched contents, business interruption, and liability coverage intended to increase flexibility and responsiveness in its commercial insurance portfolio. This action contributed directly to Germany commercial insurance market growth, allowing VPV to provide more customized and scalable offerings while enhancing operational effectiveness. Through the use of technology, VPV is now able to handle risk more effectively, optimize processes, and deliver faster solutions to German businesses. The trend demonstrates the wider industry shift towards more technologically advanced solutions, as insurers strive to compete in an ever-changing marketplace. The application of new technology enables product flexibility, quicker claims payment, and a more individualized customer experience, all which are vital for sustaining long-term growth within the industry.

To get more information on this market, Request Sample

Expanding Market Reach Through Strategic Acquisitions

The trend of expanding market reach through strategic acquisitions is gaining momentum in the German commercial insurance sector. Insurers are increasingly looking to enhance their capabilities and broaden their geographical presence, focusing on high-growth sectors and regions with untapped potential. In July 2025, ERGO successfully completed the full acquisition of NEXT Insurance, a leading provider in the U.S. small and medium-sized business market. This acquisition enabled ERGO to strengthen its position in the global commercial insurance landscape, particularly in the digital-first SMB sector. NEXT Insurance’s technological expertise and fully automated underwriting platform will complement ERGO’s existing offerings, improving its digital capabilities and providing innovative solutions tailored to small businesses. The integration of NEXT Insurance into ERGO’s portfolio is expected to enhance its global presence, particularly in the U.S., while supporting ERGO’s overall business strategy in Germany by broadening its product offerings and increasing market share. This acquisition highlights the increasing importance of international growth strategies in the German commercial insurance market. By acquiring established players in high-growth regions, insurers like ERGO are positioning themselves to capitalize on new opportunities and expand their market share, ultimately driving both profitability and competitive advantage.

Germany Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

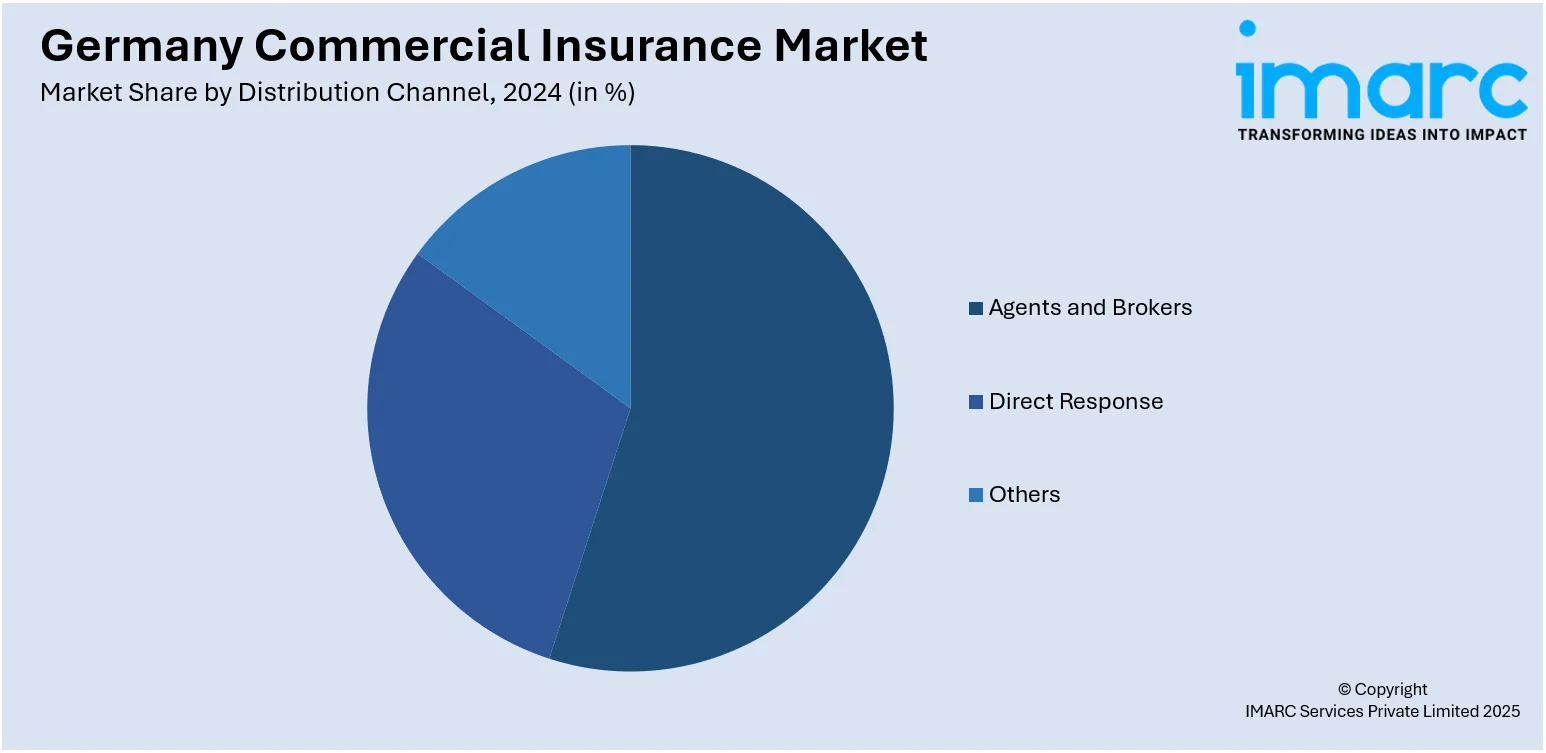

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Commercial Insurance Market News:

- June 2025: Feather launched a digital-first business insurance product targeting companies with expat employees across Europe. The service, covering health, life, pension, and liability insurance, aimed to address inefficiencies in commercial insurance for international staff, enhancing the market by offering tailored coverage for cross-border workforces.

- May 2025: Coalition launched its Active Cyber Insurance in Denmark, with Sweden to follow in June. This innovative offering, backed by Allianz, combines insurance with cybersecurity tools to help businesses manage and mitigate cyber risks, enhancing the commercial insurance market by providing proactive, comprehensive solutions.

Germany Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany commercial insurance market on the basis of type?

- What is the breakup of the Germany commercial insurance market on the basis of enterprise size?

- What is the breakup of the Germany commercial insurance market on the basis of distribution channel?

- What is the breakup of the Germany commercial insurance market on the basis of industry vertical?

- What is the breakup of the Germany commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Germany commercial insurance market?

- What are the key driving factors and challenges in the Germany commercial insurance market?

- What is the structure of the Germany commercial insurance market and who are the key players?

- What is the degree of competition in the Germany commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)