Germany Condom Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2025-2033

Germany Condom Market Overview:

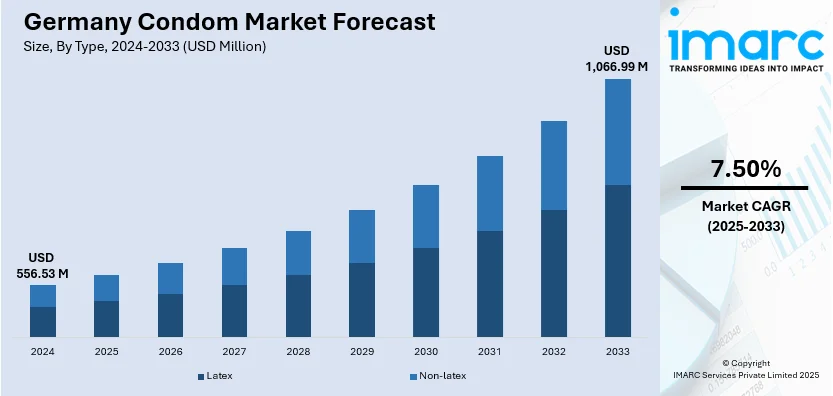

The Germany condom market size reached USD 556.53 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,066.99 Million by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. The market is primarily driven by the growing number of human immunodeficiency viruses (HIV), increasing population, rising awareness about sexual health and contraceptives, and supportive government-funded family planning programs promoting safe sex practices and accessibility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 556.53 Million |

| Market Forecast in 2033 | USD 1,066.99 Million |

| Market Growth Rate 2025-2033 | 7.50% |

Germany Condom Market Trends:

Increasing Prevalence of HIV

Germany's condom industry is spurred by the rising number of human immunodeficiency viruses (HIV) and increased travel activities. Public health programs have stepped up measures to encourage the use of condoms, particularly among traveling populations whose regions may have limited knowledge on contraception. Germany had an estimated 1,900 new HIV infections in 2022, including among Germans who got infected abroad, the Robert Koch Institute reported. This figure is estimated to rise to approximately 2,200 in 2023, bringing new infections to near pre-pandemic levels in 2019. The percentage of people receiving a first diagnosis at an advanced stage of infection or with AIDS has been relatively consistent in recent years. Since HIV is no longer usually fatal, the number of individuals with HIV in Germany rose to around 96,700 by the end of 2023, with an estimated 8,200 undiagnosed cases. In addition, health campaigns stress the need for safe sex and avoiding sexually transmitted diseases (STIs), such as HIV. This boost is credited to a synergistic effect between public health education campaigns and a focus on preventing STIs in high-risk populations, further propelling the market for condoms in Germany.

Increasing Population and Condom Usage

As reported by the Federal Statistical Office (Statistisches Bundesamt), the population of Germany grew by 1.3% in 2022, with 1,122,000 additional people, after a modest growth of 0.1% (+82,000) the year before. At the end of 2022, the population reached about 84.4 million. This is primarily due to a strong rise in net immigration, standing at 1,455,000 individuals, mainly caused by the inflow of refugees from Ukraine. Furthermore, there has been a considerable rise in the use of condoms, which has been responsible for the growth in the market. The amplification is mainly attributed to heightened awareness regarding sexual health and contraception, as well as changes in attitudes towards safe sex in society. Furthermore, the demand is also accelerating with younger generations placing more emphasis on preventing sexually transmitted infections (STIs), due to school-based educational programs and public health initiatives. As this critical demographic continues to adopt condom use as part of their sexual health regimen, the market is likely to expand, mirroring larger trends in health awareness and population shifts.

Government Support for Family Planning Programs:

Government funding of family planning initiatives is having a huge influence on the development of the condom market in Germany. Germany, under its Federal Ministry of Economic Cooperation and Development (BMZ), spent around 200 million Euros of its bilateral budget on rights-based family planning and reproductive health programs in 2022 and 2023. Every year, approximately 25% of this amount, or around 50 million Euros, is dedicated exclusively to family planning programs subject to the needs of partner countries. This investment in finance supports numerous programs, such as payments to UNFPA Supplies, the UNFPA Maternal Health Thematic Fund (MHTF), and the annual core contributions to the International Planned Parenthood Federation (IPPF), among other Financial Instrument Transfer (FiT) payments. Additionally, with a heavy budget, the federal government of Germany is making sure that contraceptives, specifically condoms, are available, particularly to poor communities. Apart from this, the government is also encouraging safe sex and STD awareness by spending millions of euros annually on these activities. This supportive strategy is primarily geared towards avoiding unwanted pregnancies and secondarily towards inhibiting the transmission of STDs, thus stimulating a public health culture conducive to condom use.

Germany Condom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, end user, and distribution channel

Type Insights:

- Latex

- Non-latex

The report has provided a detailed breakup and analysis of the market based on the type. This includes latex and non-latex.

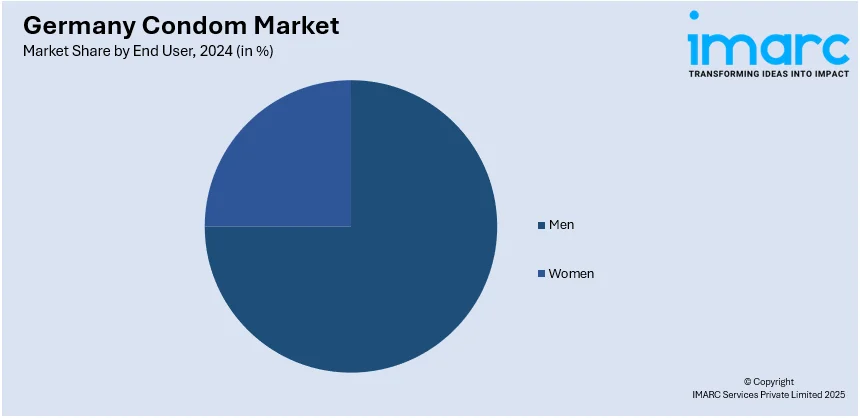

End User Insights:

- Men

- Women

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men and women.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies and Drug Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, pharmacies and drug stores, online stores, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western, Southern, Eastern, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany condom Market News:

- In October 2024, Billy Boy, a German brand, launched the Camdom app, which will prevent unwanted recording during intimate occasions. Based on Bluetooth technology, the app will shut down cameras and microphones on phones, warning users about possible privacy invasion. It has been created with the help of Innocean Berlin and has the goal to protect digital intimacy.

Germany condom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Latex, Non-Latex |

| End Users Covered | Men, Women |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies and Drug Stores, Online Stores, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany condom market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany condom market on the basis of type?

- What is the breakup of the Germany condom market on the basis of end user?

- What is the breakup of the Germany condom market on the basis of distribution channel?

- What is the breakup of the Germany condom market on the basis of region?

- What are the various stages in the value chain of the Germany condom market?

- What are the key driving factors and challenges in the Germany condom?

- What is the structure of the Germany condom market and who are the key players?

- What is the degree of competition in the Germany condom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany condom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany condom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany condom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)