Germany Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

Germany Confectionery Market Overview:

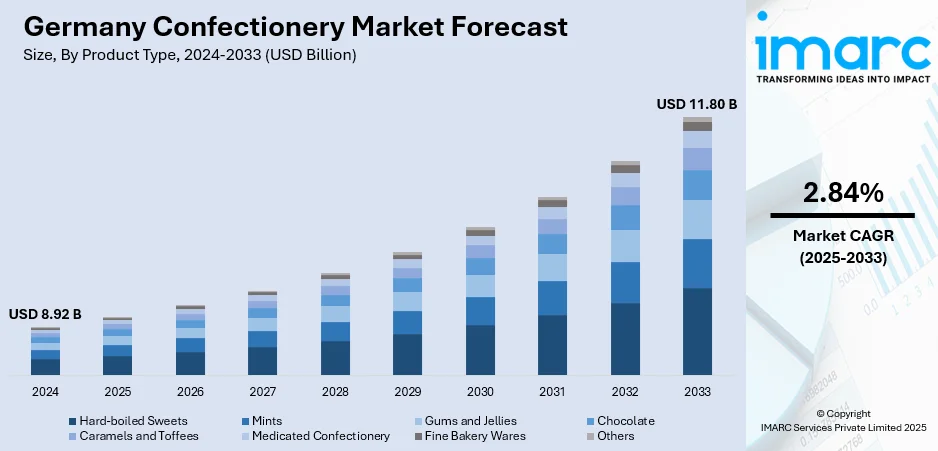

The Germany confectionery market size reached USD 8.92 Billion in 2024. The market is projected to reach USD 11.80 Billion by 2033, exhibiting a growth rate (CAGR) of 2.84% during 2025-2033. The market is fueled by premiumization, clean-label demand, and the increasing popularity of functional and plant-based products. Consumers are more and more looking for indulgent experiences that correspond with ethical values, health awareness, and ingredient visibility. Taste, texture, and nutritional value innovation is transforming product innovation and retail strategies. The market keeps on changing according to changing lifestyles and consumer needs, leading to a strong and competitive marketplace. Such trends are having a positive effect on the Germany confectionery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.92 Billion |

| Market Forecast in 2033 | USD 11.80 Billion |

| Market Growth Rate 2025-2033 | 2.84% |

Germany Confectionery Market Trends:

Premiumization and Artisanal Products Making Inroads

The confectionery industry in Germany is witnessing an increasing focus on premium and artisanal products due to increasing consumer demand for quality, authenticity, and distinctive taste experiences. Products with sustainably sourced cocoa, traditional handcrafted production processes, and local specialties are gaining traction through both retail and specialty channels. This premiumization trend rides with the desire of consumers for indulgence at value, making manufacturers emphasize provenance, craftsmanship, and limited-edition forms. For instance, in November 2024, Lindt launched 1,000 limited-edition “Dubai Chocolate” bars in Germany, blending pistachio cream and knafeh, drawing hundreds of consumers and spotlighting growing demand for Middle Eastern-inspired confections. Moreover, the market is also observing wider appeal for luxury packing and narration, making confectionery products perfect for gifting and special occasions. These trends reflect changing attitudes toward chocolate and sweets as more lifestyle-oriented than impulse purchases. Consistent with larger Germany confectionery market trends, this change is serving to reposition the category in terms of culture and identity. Consequently, market growth is more strongly spurred by higher-order experiences, underpinning both volume and value growth in both domestic and export-facing segments.

To get more information on this market, Request Sample

Clean Label and Ingredient Transparency Developing Preferences

Modern consumers in Germany are increasingly prioritizing clean-label confectionery that emphasizes natural ingredients, minimal processing, and clear sourcing practices. This has led to rising demand for products free from artificial additives, preservatives, and genetically modified ingredients. Confectionery items featuring short ingredient lists, organic certifications, and traceable raw materials are becoming more prevalent in both mass-market and premium retail channels. Transparency regarding cocoa origin, sugar level, and dietary attributes like vegan or gluten-free status is also building consumer trust and brand loyalty. In addition, this is complementing the country's overall focus on sustainability and health awareness in food consumption. In the market trends environment, clean label continues to influence innovation pipelines, marketing communication, and buying decisions. This consumer-driven trend towards purity and transparency is fueling Germany confectionery market growth as manufacturers adjust to respond to increasing demands for ethical and health-aware indulgence.

Functional and Plant-Based Confectioneries Growing Acceptance

Germany's confectionery market is experiencing strong momentum in developing functional and plant-based offerings that combine indulgence with well-being. As per the sources, in February 2025, German cocoa-free chocolate brand ChoViva launched Peanut Butter Mini Eggs in the UK via Aldi’s Dairyfine range, developed in partnership with WAWI-Schokolade AG for Easter retail. Furthermore, functional ingredients like collagen, probiotics, vitamins, and adaptogens are being incorporated into confectionery products to meet increasing demand for healthy treats. At the same time, trends toward plant-based diets are spurring innovations in vegan sweets, including dairy-free chocolate, gelatin-free gummies, and nut-based fillings. These are appealing to younger consumers as well as health-conscious ones who want offerings that fit personal values and dietary requirements. Placed at the nexus of pleasure and purpose, these solutions are redefining traditional confectionery's limits. The market trends illustrate this dual focus on pleasure and health, prompting brand portfolios to transform with ease. As consumers become increasingly focused on balanced indulgence and nutritional value, market growth is being supported by this dynamic movement toward encompassing and purposeful sweet foods.

Germany Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

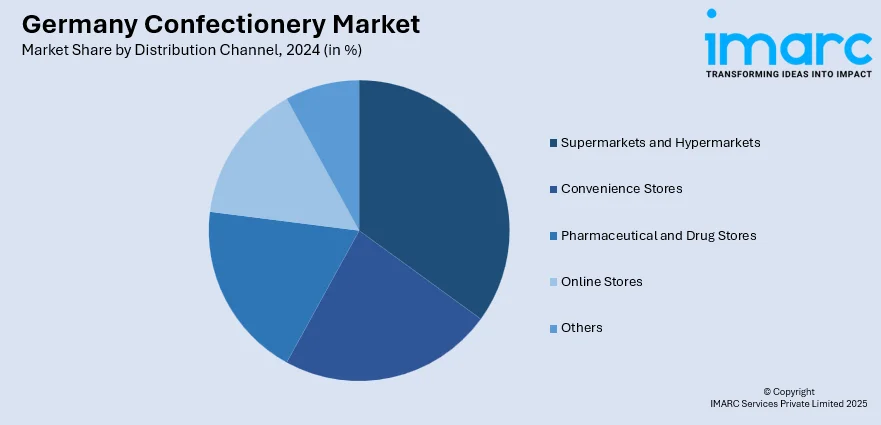

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Confectionery Market News:

- In March 2025 – Mars Wrigley has launched its new frozen snack brand trüfrü in Germany after a successful pilot in summer 2024. trüfrü is on the shelves at REWE stores across the country and consists of hyper-chilled strawberries, raspberries, and pineapple smothered in layers of chocolate. The products are gluten-free and have no artificial colors, no artificial flavors, and no artificial preservatives, providing a quality frozen treat for German shoppers.

- In August 2024, Ritter Sport launched new travel retail-exclusive chocolate flavors, Salted Caramel minis and the Vegan Double Crunch bar. They will launch at the TFWA World Exhibition in Cannes and roll out worldwide in March 2025. Natural ingredients and sustainable cocoa sourcing are the focus of the new products.

Germany Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany confectionery market on the basis of product type?

- What is the breakup of the Germany confectionery market on the basis of age group?

- What is the breakup of the Germany confectionery market on the basis of price point?

- What is the breakup of the Germany confectionery market on the basis of distribution channel?

- What is the breakup of the Germany confectionery market on the basis of region?

- What are the various stages in the value chain of the Germany confectionery market?

- What are the key driving factors and challenges in the Germany confectionery market?

- What is the structure of the Germany confectionery market and who are the key players?

- What is the degree of competition in the Germany confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)