Germany Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

Germany Cryptocurrency Market Overview:

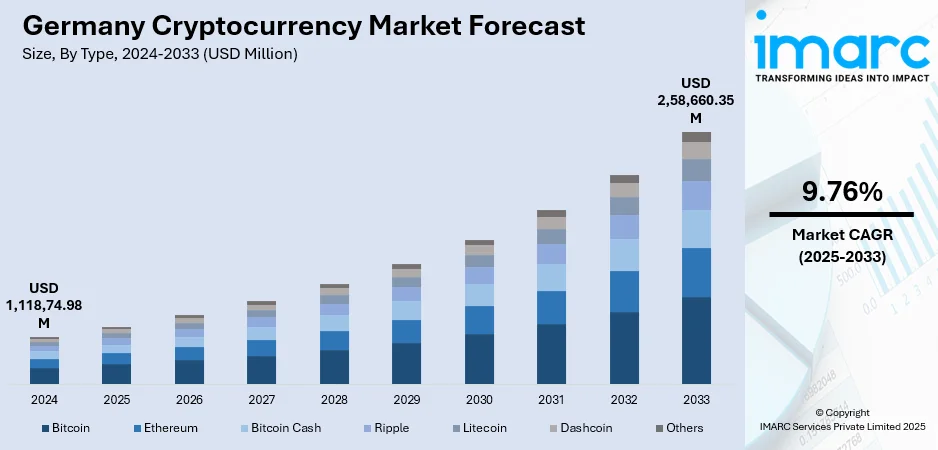

The Germany cryptocurrency market size reached USD 1,118,74.98 Million in 2024. The market is projected to reach USD 2,58,660.35 Million by 2033, exhibiting a growth rate (CAGR) of 9.76% during 2025-2033. Retail investors, especially younger generations, are drawn to crypto for its accessibility, tax incentives, and inflation-hedging potential, while the growing acceptance in e-commerce is boosting everyday use. Besides this, fintech companies are integrating crypto into user-friendly apps, wallets, and hybrid financial products. Moreover, partnerships between fintech firms and traditional banks are enhancing trust and functionality, thereby fueling the Germany cryptocurrency market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,118,74.98 Million |

| Market Forecast in 2033 | USD 2,58,660.35 Million |

| Market Growth Rate 2025-2033 | 9.76% |

Germany Cryptocurrency Market Trends:

Increasing retail participation

Rising retail participation is fueling the market growth in Germany. As more people are gaining access to digital financial tools, including user-friendly crypto trading apps and wallets, the barriers to entry are rapidly diminishing. Younger generations, particularly millennials and Gen Z, are viewing cryptocurrencies as an alternative investment and a hedge against inflation and low interest rates in traditional savings products. This generational shift, coupled with increased financial literacy and awareness about digital assets, is driving sustained demand in the retail segment. Additionally, the tax incentives in Germany are encouraging long-term holding among retail investors, contributing to the market growth. Retailers and e-commerce platforms are also beginning to accept cryptocurrencies as payment, further integrating crypto into everyday economic activity. This rising usability is not only promoting the utilization of cryptocurrency but also fostering a perception of legitimacy and trust. Social media, influencers, and education platforms are playing an important role in familiarizing the public with crypto, motivating individuals to actively participate in the market. Overall, retail and e-commerce expansion are fueling liquidity, innovation, and mainstream acceptance, making it a crucial pillar in Germany’s evolving crypto ecosystem. As per the IMARC Group, the Germany e-commerce market size is set to attain USD 6,107 Billion by 2033, showing a growth rate (CAGR) of 19.8% during 2025-2033.

To get more information on this market, Request Sample

Thriving fintech sector

The expansion of the fintech industry is impelling the Germany cryptocurrency market growth. German fintech startups are developing crypto-friendly platforms, such as digital wallets, trading apps, and decentralized finance (DeFi) services, making it easier for users and businesses to engage with cryptocurrencies. These innovations reduce friction in buying, selling, and storing digital assets, helping to normalize crypto utilization. Moreover, collaborations between fintech firms and traditional financial institutions are leading to hybrid services like crypto-backed loans and investment products, which appeal to mainstream investors. Fintech’s emphasis on user experience and compliance also enhances trust, a critical factor in crypto adoption. Besides this, Germany's supportive regulatory environment is encouraging fintech firms to explore blockchain applications and tokenization. As fintech companies continue to digitize financial services owing to rising internet penetration, they are embedding cryptocurrencies into broader financial ecosystems, thereby accelerating employment across numerous segments. According to industry reports, at the beginning of 2024, Germany had 77.70 Million internet users, with internet penetration at 93.3%. This convergence is positioning Germany as a competitive hub in Europe’s digital finance and crypto economy.

Germany Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

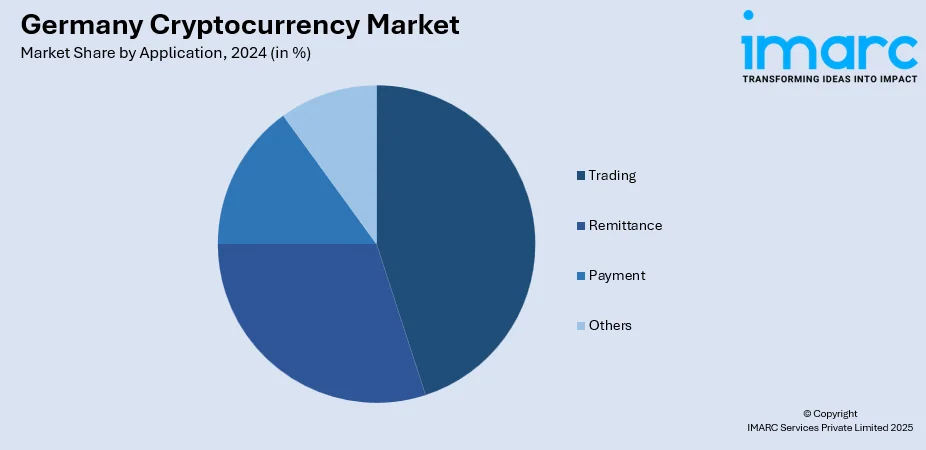

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Cryptocurrency Market News:

- In July 2025, Germany’s Sparkassen group lifted its three-year ban on cryptocurrency, revealing intentions to provide Bitcoin and crypto trading via DekaBank by summer 2026. The service would be incorporated directly into the Sparkasse app within a regulated framework, marking a significant strategic change for Germany's largest savings bank network. With around 50 Million clients, Sparkassen's venture into crypto might act as a significant driver for cryptocurrency adoption throughout Germany.

- In July 2025, Deutsche Bank, Germany’s largest bank, revealed plans to enable its clients to hold cryptocurrencies, such as Bitcoin. Deutsche Bank intended to introduce a digital assets custody service in 2026 in partnership with the technology division of Bitpanda.

Germany Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany cryptocurrency market on the basis of type?

- What is the breakup of the Germany cryptocurrency market on the basis of component?

- What is the breakup of the Germany cryptocurrency market on the basis of process?

- What is the breakup of the Germany cryptocurrency market on the basis of application?

- What is the breakup of the Germany cryptocurrency market on the basis of region?

- What are the various stages in the value chain of the Germany cryptocurrency market?

- What are the key driving factors and challenges in the Germany cryptocurrency market?

- What is the structure of the Germany cryptocurrency market and who are the key players?

- What is the degree of competition in the Germany cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)