Germany Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End-Use Industry, and Region, 2025-2033

Germany Cyber Insurance Market Overview:

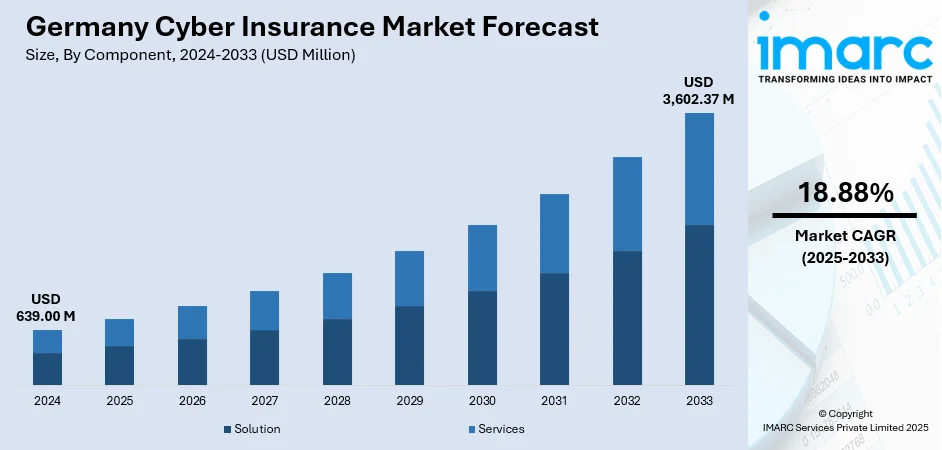

The Germany cyber insurance market size reached USD 639.00 Million in 2024. The market is projected to reach USD 3,602.37 Million by 2033, exhibiting a growth rate (CAGR) of 18.88% during 2025-2033. The market is expanding as businesses adopt digital operations and face rising cyber risks across sectors. Heightened awareness of data protection and regulatory pressure are boosting demand for tailored insurance solutions, strengthening the Germany cyber insurance market share among both SMEs and large enterprises.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 639.00 Million |

| Market Forecast in 2033 | USD 3,602.37 Million |

| Market Growth Rate 2025-2033 | 18.88% |

Germany Cyber Insurance Market Trends:

Germany Cyber Insurance Market Growth Driven by Increased Cyber Threats

The market has grown as a result of the increasing frequency and sophistication of cyberthreats that businesses must deal with. Businesses are choosing to employ cyber insurance as a crucial safeguard against monetary losses brought on by ransomware, phishing, and data breaches, which have increased in frequency. German firms of all sorts, from startups to international conglomerates, have realized in recent years how important it is to insure their digital infrastructures. The growing financial burden of cyberattacks, which can encompass recovery expenses, legal charges, fines from regulators, and loss of customer confidence, has made cyber insurance a vital component of risk management tactics. Moreover, the sheer pace of digitization across industries like healthcare, finance, and manufacturing has resulted in heightened exposure to cyber threats. This, combined with the implementation of stringent data security legislation such as the GDPR, has prompted numerous German businesses to arrange cyber insurance coverage to remain compliant and escape hefty fines. As organizations continue to expand their digital footprint and rely on interconnected networks, the need for cyber insurance has never been more urgent, pushing the Germany cyber insurance market growth forward. The increasing recognition of the importance of digital security in protecting business continuity is further propelling this demand.

To get more information on this market, Request Sample

Expanding Coverage Options and Innovation in Cyber Insurance

As the cybersecurity threat environment continues to change, the Germany cyber insurance market has witnessed an unmistakable trend toward the creation of more immersive and customized insurance products. German insurers are constantly improving their policy products to adapt to the increasing sophistication of cyber threats. Cyber insurance policies used to provide coverage for losses associated with data breaches, but now these policies have expanded to encompass a larger set of threats. They cover business interruption expenses, social engineering attacks, cyber extortion, and reputational loss after a breach. In addition, insurers are increasingly providing value-added services in conjunction with typical coverage, including cybersecurity risk assessments, breach response service, and regulatory compliance assistance. These value-added services are intended to enable organizations not just to recover from cyber breaches but also to protect themselves in advance against cyber threats. Another trend in the market is the development of policies tailored to various industry segments, with specialized coverage for segments such as healthcare, financial services, and retail, that have their own set of specific cybersecurity issues. Insurers are also giving rewards to companies showing high commitment to cybersecurity by offering premium discounts, a win-win scenario where both sides gain. This expansion and innovation in protection offerings mirror the development in knowledge of cyber risks and are anticipated to drive growth further.

Germany Cyber Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component, insurance type, organization size, and end-use industry.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Insurance Type Insights:

- Packaged

- Stand-alone

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes packaged and stand-alone.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

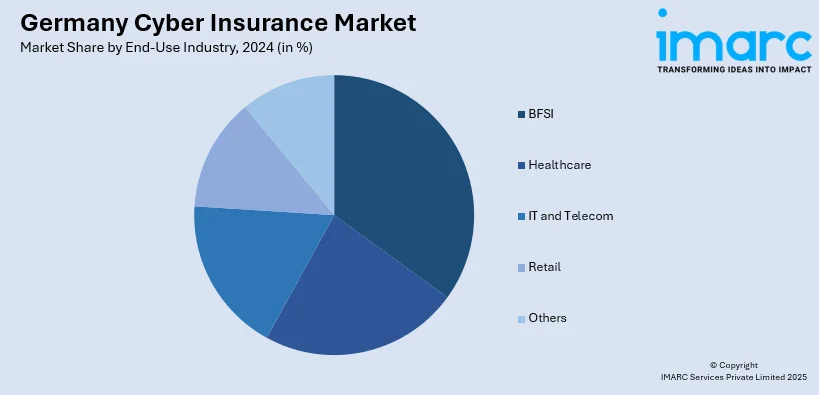

End-Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes BFSI, healthcare, IT and telecom, retail, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Cyber Insurance Market News:

- May 2025: Coalition launched Active Cyber Insurance in Denmark and Sweden, backed by Allianz. This innovative offering combined insurance coverage with cybersecurity tools, helping businesses mitigate digital risks. The move significantly impacted the Nordic cyber insurance market by enhancing risk management capabilities for companies.

- May 2024: Resilience expanded its operations to Germany and Austria, offering cyber insurance solutions with limits up to €10M. The move strengthened its presence in Europe, addressing growing cyber risks. This expansion provided businesses with enhanced risk management and loss prevention capabilities.

Germany Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End-Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany cyber insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany cyber insurance market on the basis of component?

- What is the breakup of the Germany cyber insurance market on the basis of insurance type?

- What is the breakup of the Germany cyber insurance market on the basis of organization size?

- What is the breakup of the Germany cyber insurance market on the basis of end-use industry?

- What is the breakup of the Germany cyber insurance market on the basis of region?

- What are the various stages in the value chain of the Germany cyber insurance market?

- What are the key driving factors and challenges in the Germany cyber insurance market?

- What is the structure of the Germany cyber insurance market and who are the key players?

- What is the degree of competition in the Germany cyber insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany cyber insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany cyber insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)