Germany Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

Germany Drones Market Overview:

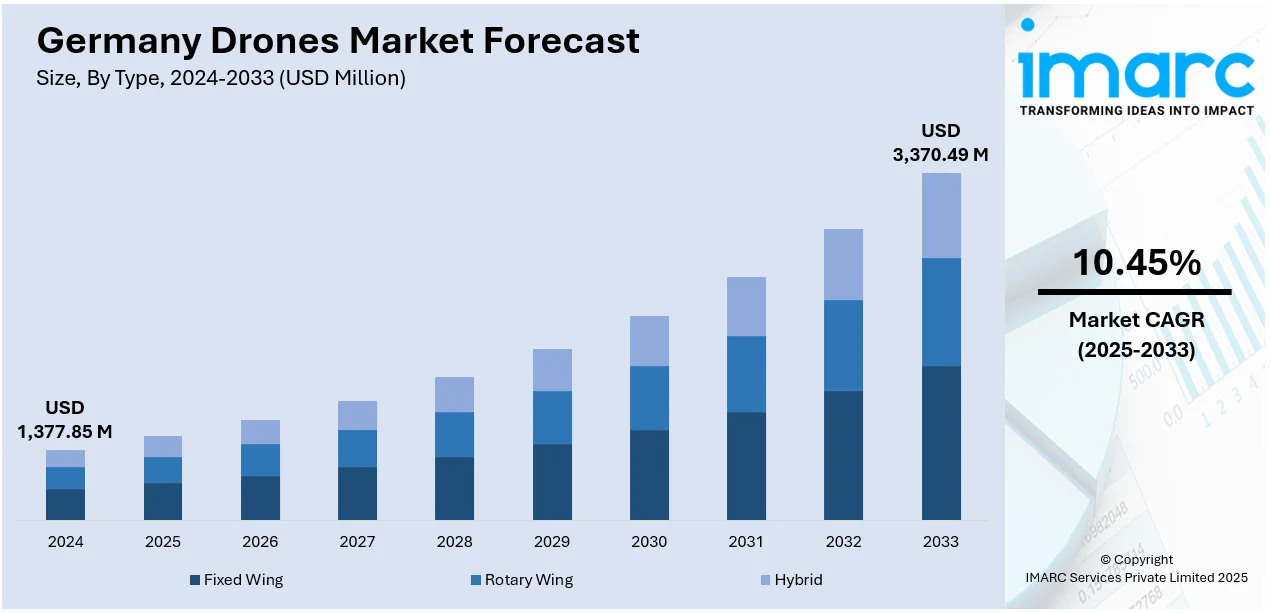

The Germany drones market size reached USD 1,377.85 Million in 2024. Looking forward, the market is projected to reach USD 3,370.49 Million by 2033, exhibiting a growth rate (CAGR) of 10.45% during 2025-2033. The market is experiencing significant growth, driven by increased adoption across sectors like agriculture, logistics, and public safety. Technological advancements, such as improved navigation and AI integration, are also enhancing drone capabilities. The demand for drones in commercial applications, such as aerial photography and infrastructure inspection, is further contributing significantly to the Germany drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,377.85 Million |

| Market Forecast in 2033 | USD 3,370.49 Million |

| Market Growth Rate 2025-2033 | 10.45% |

Germany Drones Market Trends:

Advancements in Military Drone Capabilities

Germany is making signifiicant progress in the development of military drone technology to enhance its defense capabilities and support NATO operations. The nation has ramped up investment in sophisticated drone systems for purposes such as reconnaissance, surveillance, and intelligence gathering. For instance, in July 2025, Airbus partnered with US-based Kratos Defense to deliver combat drones to the German Air Force by 2029. The XQ-58A Valkyrie, an unmanned combat aircraft, will feature Airbus' mission systems, enhancing Germany's aerial capabilities. This partnership marks a significant collaboration in the aerospace and defense sector. These military drones are intended to deliver real-time data, which improves situational awareness and operational effectiveness. Initiatives related to Germany’s military drones also emphasize the incorporation of advanced technologies like AI, autonomous flight systems, and increased payload capacities. These innovations are geared not only towards refining defense strategies but also ensuring Germany stays in sync with NATO’s evolving defense frameworks. Furthermore, Germany is investigating new drone technologies for swift deployment and tactical applications in various military missions. Consequently, these advancements in military drones are fueling Germany drones market growth, positioning the nation as a pivotal player in the modernization of defense strategies throughout Europe.

To get more information on this market, Request Sample

Technological Innovations

Continuous research and development are propelling significant technological advancements in the drone sector, especially in areas like battery performance, AI integration, and autonomous operations. Enhancements in battery technology are markedly increasing flight durations, which allows for extended missions and improved operational efficiency. Advances in energy density and more effective charging systems are boosting the reliability of drones for a range of commercial and military uses. Simultaneously, the incorporation of AI is enhancing the decision-making capabilities of drones, facilitating real-time data processing, obstacle recognition, and route optimization. As a result, drones can carry out tasks like surveying, mapping, and package delivery autonomously, without the need for human oversight. The creation of sophisticated algorithms is also improving drones’ ability to navigate intricate environments. For instance, in June 2025, Alpine Eagle launched the world’s first drone-based counter-UAS system, the Sentinel, which uses radar-equipped drones to detect and neutralize adversary drones. This innovative solution allows for enhanced aerial defense capabilities without the limitations of ground-based systems, featuring swarm formations and the ability to deploy interceptor missiles. These technological developments are broadening the possible uses of drones in sectors such as agriculture, logistics, and defense, driving both growth and innovation within the industry.

Germany Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 kilograms, 25-170 kilograms, and >170 kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

A detailed breakup and analysis of the market based on the point of sale have also been provided in the report. This includes original equipment manufacturers (OEM) and aftermarket.

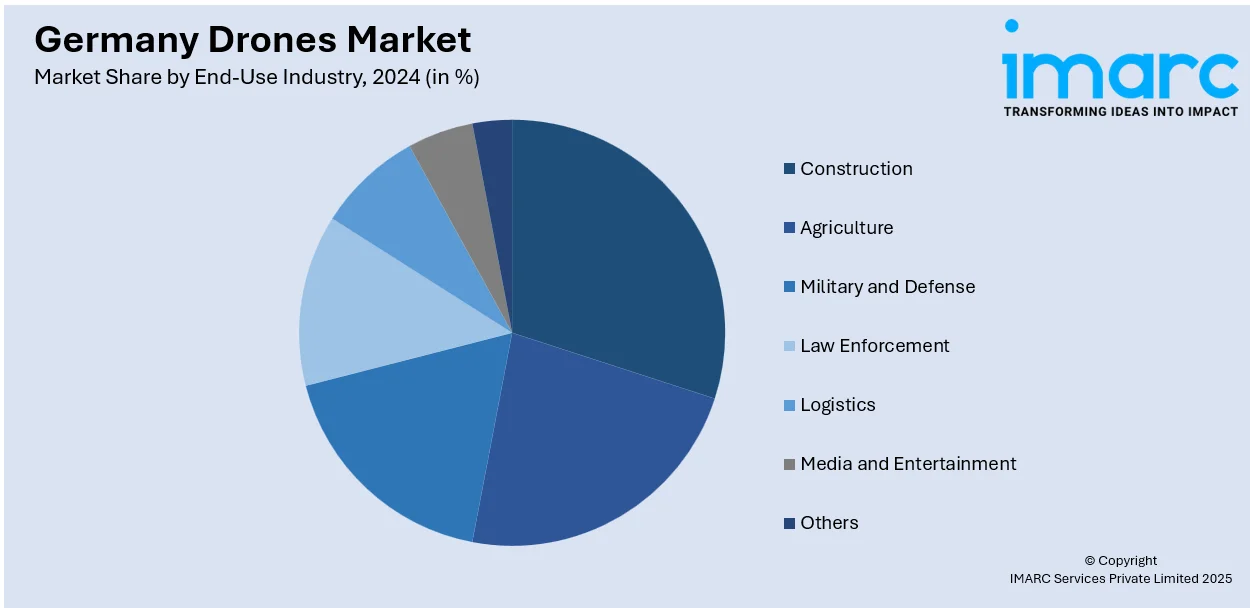

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Drones Market News:

- In July 2025, German defense company Stark announced its plans to launch a drone manufacturing plant in Swindon, UK, creating 100 local jobs. The facility will produce the OWE-V Virtus unmanned weapon system to meet growing NATO demands. The expansion strengthens defense ties between the UK and Germany, enhancing production capabilities across Europe.

- In June 2025, Anduril Industries and Rheinmetall partnered to develop Barracuda and Fury drones for European markets, enhancing military capabilities through US technology. This collaboration addresses defense needs focusing on rapid production and deployment of autonomous systems aligned with NATO's evolving requirements.

Germany Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Point of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany drones market on the basis of type?

- What is the breakup of the Germany drones market on the basis of component?

- What is the breakup of the Germany drones market on the basis of payload?

- What is the breakup of the Germany drones market on the basis of point of sale?

- What is the breakup of the Germany drones market on the basis of end-use industry?

- What is the breakup of the Germany drones market on the basis of region?

- What are the various stages in the value chain of the Germany drones market?

- What are the key driving factors and challenges in the Germany drones market?

- What is the structure of the Germany drones market and who are the key players?

- What is the degree of competition in the Germany drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)