Germany e-KYC Market Size, Share, Trends and Forecast by Product, Deployment Mode, End User, and Region, 2025-2033

Germany e-KYC Market Overview:

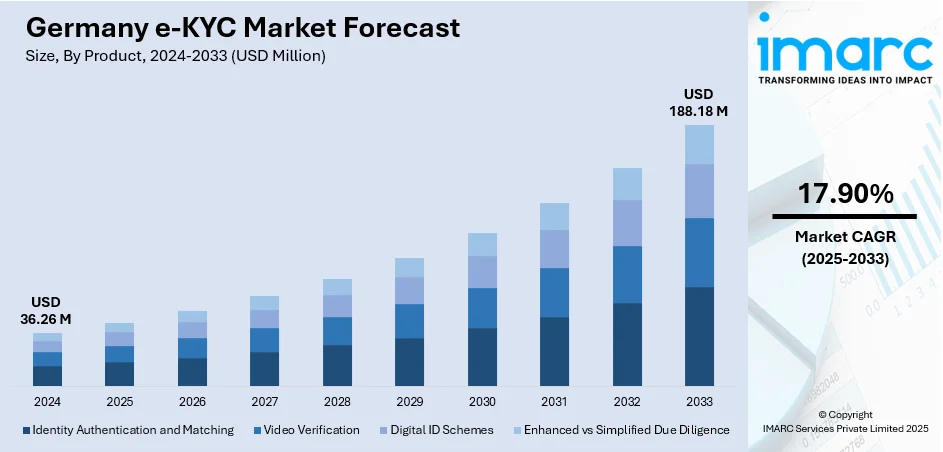

The Germany e-KYC market size reached USD 36.26 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 188.18 Million by 2033, exhibiting a growth rate (CAGR) of 17.90% during 2025-2033. The rising focus on strict regulatory needs, particularly in the banking and telecom industries, is impelling the market growth. Moreover, increased digital banking and fintech adoption in the country is positively influencing the market. Apart from this, technological innovations in biometric authentication and artificial intelligence (AI) are expanding the Germany e-KYC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 36.26 Million |

| Market Forecast in 2033 | USD 188.18 Million |

| Market Growth Rate 2025-2033 | 17.90% |

Germany e-KYC Market Trends:

Strict Compliance Regulatory Needs

The German electronic-know your customer (e-KYC) industry is witnessing robust growth on account of increasingly strict regulatory needs, particularly in the banking and telecom industries. Regulators like the Federal Financial Supervisory Authority (BaFin) are constantly imposing stricter anti-money laundering (AML) and KYC regulations to prevent fraud, terrorism financing, and identity theft. Such regulatory environment is encouraging companies to implement safer, automated, and auditable identity verification tools. With increased operations, fintech companies, financial institutions, and virtual banks are always installing e-KYC solutions to provide real-time verification and stay in line with EU policies like AMLD5 and the GDPR. The regulations' enforcement is prompting organizations to move away from conventional paper-based techniques and adopt digital methods that provide transparency, efficiency, and scalability. Moreover, the government is also investing in creating digital identity wallets for safely storing the identity and credentials of citizens, which is further driving the need for advanced e-KYC facilities. For instance, in 2024, the German Government announced its plans to create its own European Digital Identity Wallet (EUDI), enabling citizens to securely store data and various official documents on their smartphones and adopt a Qualified Electronic Signature.

To get more information on this market, Request Sample

Increased Digital Banking and Fintech Adoption

Increased digital banking and fintech adoption in Germany is positively impacting the usage of e-KYC solutions. With more customers opting for banking, payments, and investments online and on mobile, the need for frictionless and secure digital onboarding processes is growing rapidly. Fintech startups, digital banks, and neobanks are embracing e-KYC platforms to simplify account openings, lower onboarding friction, and improve customer satisfaction. The e-KYC process facilitates rapid and remote identity verification, allowing these digital-native institutions to expand rapidly without the high expense of manual verification. The trend is consistent with wider demands for convenience, speed, and personalization in financial services. As a result, the e-KYC market in Germany is experiencing steady growth, driven by the spread of mobile-first financial apps and the tech-savvy user base that places high emphasis on digital access and security. IMARC Group predicts that the Germany fintech market is projected to attain USD 35.90 Billion by 2033.

Advancements in Artificial Intelligence (AI)-Based and Biometric Verification Technologies

Technological innovations in biometric authentication and artificial intelligence (AI) are supporting the Germany e-KYC market growth. Businesses are employing facial recognition, liveness detection, optical character recognition (OCR), and machine learning (ML) algorithms to facilitate quicker, more precise, and fraud-proof identity verification processes. These technologies facilitate real-time cross-verification of identity papers with government databases and face biometrics, which significantly improve security and minimize the threat of identity fraud. The ongoing enhancement of AI capabilities enables e-KYC providers to identify anomalies, alert suspicious behavior, and achieve regulatory compliance more efficiently. Furthermore, the incorporation of these technologies into mobile and web applications facilitates a more user-friendly experience while upholding stringent security standards. As digitalization picks up speed across sectors, the use of AI-based e-KYC systems is emerging as an essential differentiator for companies looking to provide safe and frictionless customer onboarding experiences. Moreover, in 2025, Germany's financial authority BaFin is leveraging AI to identify market misconduct and unusual trading patterns, boosting the likelihood of apprehending wrongdoers.

Germany e-KYC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, deployment mode, and end user.

Product Insights:

- Identity Authentication and Matching

- Video Verification

- Digital ID Schemes

- Enhanced vs Simplified Due Diligence

The report has provided a detailed breakup and analysis of the market based on the product. This includes identity authentication and matching, video verification, digital id schemes, and enhanced vs simplified due diligence.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

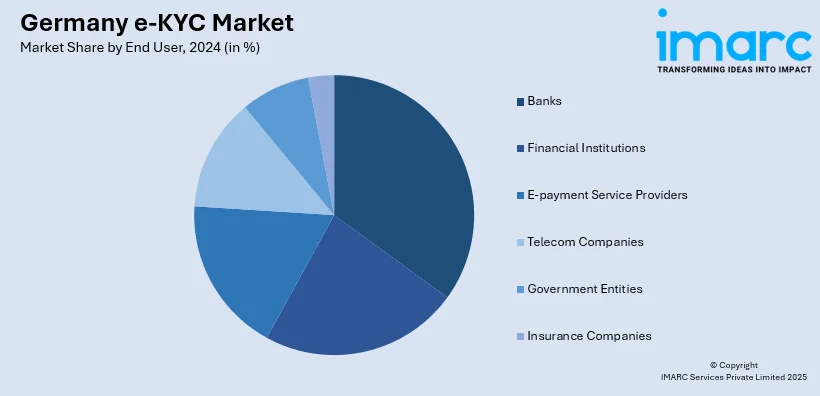

End User Insights:

- Banks

- Financial Institutions

- E-payment Service Providers

- Telecom Companies

- Government Entities

- Insurance Companies

The report has provided a detailed breakup and analysis of the market based on the end user. This includes banks, financial institutions, e-payment service providers, telecom companies, government entities, and insurance companies.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany e-KYC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Identity Authentication and Matching, Video Verification, Digital ID Schemes, Enhanced vs Simplified Due Diligence |

| Deployment Modes Covered | Cloud-based, On-Premises |

| End Users Covered | Banks, Financial Institutions, E-Payment Service Providers, Telecom Companies, Government Entities, Insurance Companies |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany e-KYC market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany e-KYC market on the basis of product?

- What is the breakup of the Germany e-KYC market on the basis of deployment mode?

- What is the breakup of the Germany e-KYC market on the basis of end user?

- What is the breakup of the Germany e-KYC market on the basis of region?

- What are the various stages in the value chain of the Germany e-KYC market?

- What are the key driving factors and challenges in the Germany e-KYC market?

- What is the structure of the Germany e-KYC market and who are the key players?

- What is the degree of competition in the Germany e-KYC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany e-KYC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany e-KYC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany e-KYC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)