Germany Edtech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2025-2033

Germany Edtech Market Overview:

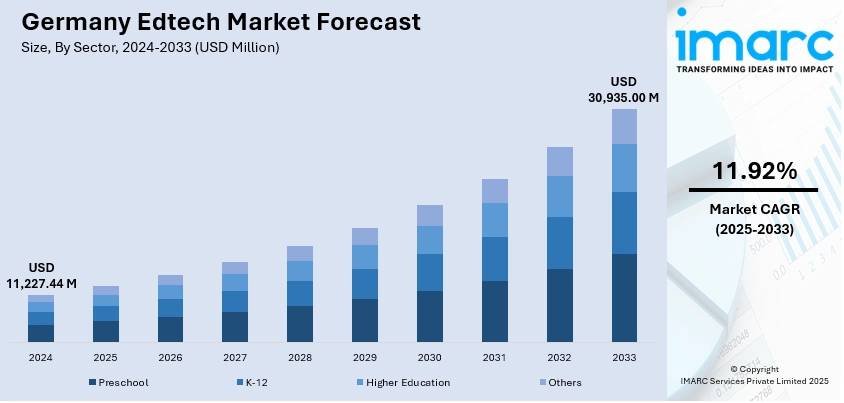

The Germany edtech market size reached USD 11,227.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 30,935.00 Million by 2033, exhibiting a growth rate (CAGR) of 11.92% during 2025-2033. The market is driven by rising demand for AI-powered personalized learning, as schools and corporations adopt adaptive platforms to enhance engagement and upskilling efficiency. Government initiatives such as DigitalPakt Schule accelerate digital infrastructure investments, while the shift to hybrid learning sustains demand for scalable EdTech solutions. Additionally, mobile-first microlearning gains traction among professionals and students, supported by 5G expansion and gamified, on-the-go education, further augmenting the Germany edtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11,227.44 Million |

| Market Forecast in 2033 | USD 30,935.00 Million |

| Market Growth Rate 2025-2033 | 11.92% |

Germany Edtech Market Trends:

Increasing Demand for Personalized Learning Solutions

The market is witnessing an increase in demand for customized learning solutions, propelled by the necessity for personalized educational experiences. With the progress in AI and machine learning, platforms currently provide adaptive learning technologies that modify content according to each student's performance. This trend is particularly strong in K-12 and higher education, where differentiated instruction improves engagement and outcomes. Additionally, corporate training programs are adopting personalized edtech tools to upskill employees efficiently. The shift toward digital and hybrid learning models post-pandemic has further accelerated this trend, as educators and businesses seek scalable, data-driven solutions. Government initiatives, such as the DigitalPakt Schule, are also fueling growth by funding digital infrastructure in schools. Germany's education system is experiencing rapid development in artificial intelligence, supported by a USD 6 Billion "DigitalPakt Schule" fund and a USD 3.3 Billion National AI Strategy. Currently, 29% of schools are utilizing AI for both administrative and learning activities. This industry aligns with the USD 5.4 Billion worldwide market, which has a compound annual growth rate (CAGR) of 47.2% and complies with GDPR, as well as the forthcoming 2024 EU AI Act. US companies are seeking partnerships with renowned German institutions, including TUM and DFKI, in the development of AI tools, training, and the enhancement of cloud infrastructure, driven by the increasing demand for AI expertise and ethical educational technology. Some of the notable trade shows for 2024–2025 are OEB Berlin in November, didacta Stuttgart in February, Learntec Karlsruhe in May, and the European AI & Cloud Summit in Düsseldorf in May. As a result, EdTech startups focusing on AI-powered tutoring, competency-based learning, and analytics are gaining traction, positioning personalized learning as a key driver of market expansion in Germany.

To get more information on this market, Request Sample

Growth of Microlearning and Mobile-First Education

Microlearning and mobile-first education are propelling the Germany edtech market growth, catering to the increasing preference for bite-sized, on-the-go learning. Professionals and students are turning to mobile apps and short-form content for quick skill acquisition, driven by busy lifestyles and the need for continuous learning. Platforms offering micro-courses, flashcards, and gamified learning experiences are gaining popularity, particularly in language learning, coding, and professional development. The rise of 5G and improved mobile connectivity further supports this trend, enabling seamless access to educational content anytime, anywhere. By April 2024, 5G standalone (SA) coverage reached 90% of Germany, up from 0% in 2021, supporting the broader 92% 5G network, according to the Bundesnetzagentur's latest mobile map. This expansion, driven by private networks such as Deutsche Telekom, Vodafone, Telefónica, and 1&1, enables high-speed, low-latency technology for AI-based e-learning and IoT-enabled smart campuses. Germany's enhanced 5G SA rollout directly supports sophisticated EdTech, AR/VR learning and a future-proof digital education system. Companies are also leveraging microlearning for employee training, as it enhances knowledge retention and reduces time constraints. With Germany’s strong mobile penetration and tech-savvy population, EdTech providers are investing in mobile-optimized solutions, making microlearning a dominant trend in the changing education landscape. This shift reflects a broader move toward flexible, user-centric learning models in the digital age.

Germany Edtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

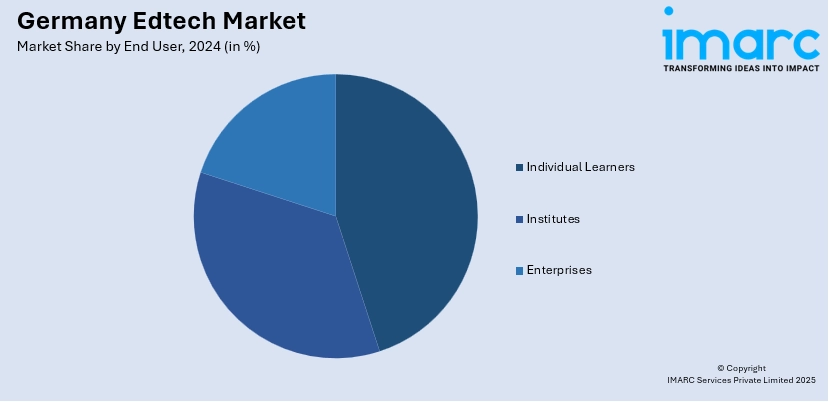

End User Insights:

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Edtech Market News:

- January 23, 2025: ApplyBoard, a student mobility platform serving over 1 million students from more than 150 countries, entered the German market as its initial market outside the English-speaking world by partnering with more than 10 universities to support the 400,000 international students it projects will be in Germany by 2025. With 72% of recruiters considering Germany as the most cost-effective choice from ApplyBoard's six locations, this entry further expands access to high-quality, affordable education in Europe. This growth aligns with ApplyBoard's goal to establish a presence in 20 destinations worldwide by 2030, addressing the interests of more than 50% of German students, as indicated in its 2024 Pulse Survey.

Germany Edtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany edtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany edtech market on the basis of sector?

- What is the breakup of the Germany edtech market on the basis of type?

- What is the breakup of the Germany edtech market on the basis of deployment mode?

- What is the breakup of the Germany edtech market on the basis of end user?

- What is the breakup of the Germany edtech market on the basis of region?

- What are the various stages in the value chain of the Germany edtech market?

- What are the key driving factors and challenges in the Germany edtech market?

- What is the structure of the Germany edtech market and who are the key players?

- What is the degree of competition in the Germany edtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany edtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany edtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany edtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)