Germany Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

Germany Electric Two-Wheeler Market Overview:

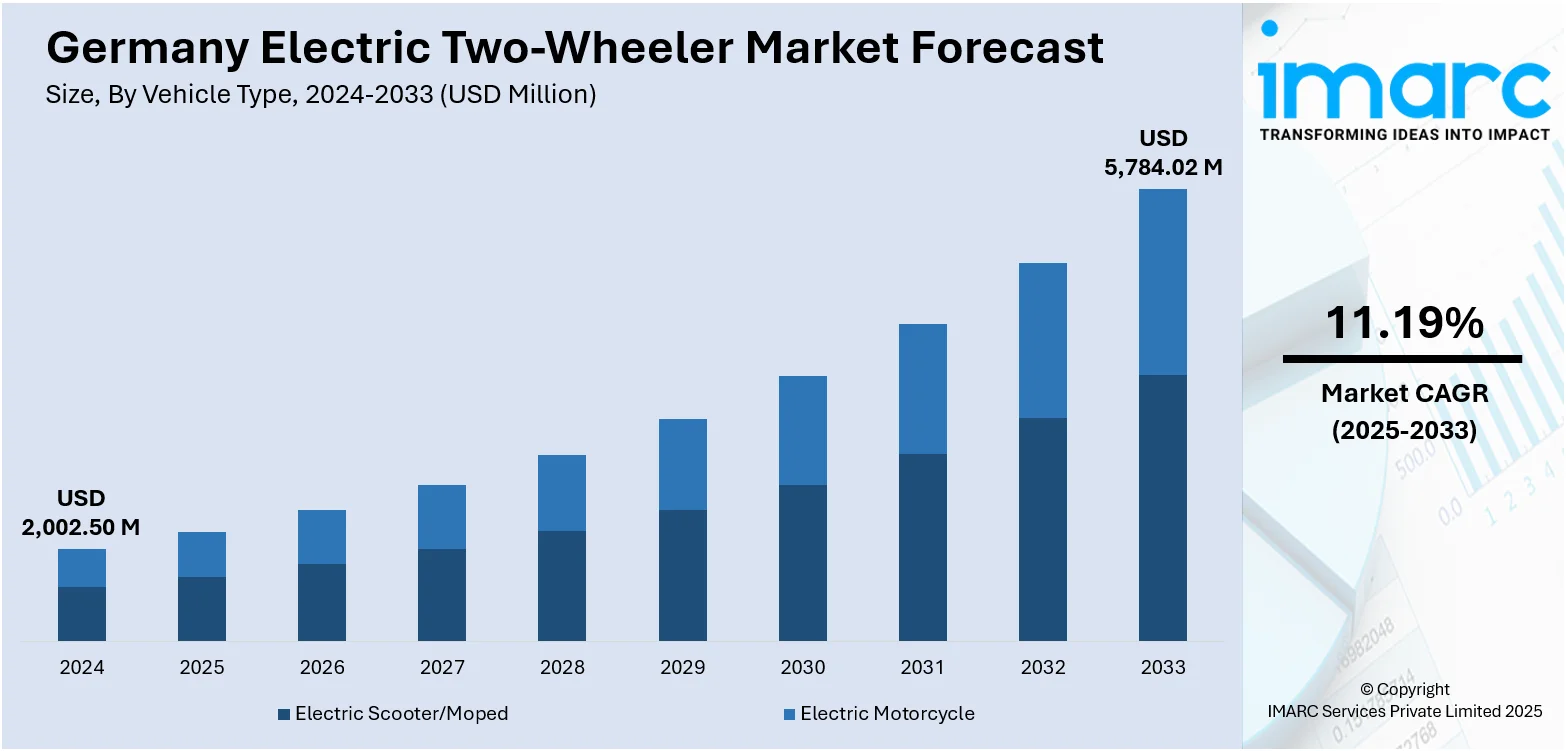

The Germany electric two-wheeler market size reached USD 2,002.50 Million in 2024. The market is projected to reach USD 5,784.02 Million by 2033, exhibiting a growth rate (CAGR) of 11.19% during 2025-2033. The market is driven by strong government backing through subsidies, tax benefits, and eco-friendly regulations that encourage sustainable mobility. Growing urbanization and traffic congestion are pushing commuters toward compact, efficient transport options. Advancements in battery technology enhance performance and convenience, while expanding charging infrastructure reduces range concerns. Increasing environmental awareness among consumers further supports the shift toward cleaner mobility solutions thus strengthening the Germany electric two-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,002.50 Million |

| Market Forecast in 2033 | USD 5,784.02 Million |

| Market Growth Rate 2025-2033 | 11.19% |

Germany Electric Two-Wheeler Market Trends:

Technological innovation in batteries, connectivity & performance

Technological innovations is one of the Germany electric two-wheeler industry trends. Advanced lithium-ion batteries today offer better range, quicker charging, and extended life cycles, rendering electric scooters and motorcycles more convenient for daily commuting. More advanced power management systems further refine performance, while technologies like regenerative braking, swappable batteries, and built-in GPS tracking enhance convenience and dependability. Most models now feature smart features such as mobile app connectivity, remote diagnostic capabilities, and sophisticated safety features, appealing to both individual commuters and fleet operators. These advancements have made electric two-wheelers as competitive as traditional fuel-based solutions, diminishing worries over performance and functionality. With manufacturers making significant investments in research and development, the supply of different, feature-laden models is increasing, attracting a wide range of consumers and reinforcing the market's growth trend.

To get more information on this market, Request Sample

Urban congestion, rising fuel costs & growing environmental awareness

Urban congestion, high fuel prices, and environmental concerns are major forces accelerating electric two-wheeler adoption in Germany. In densely populated cities, heavy traffic and scarce parking make scooters and motorcycles a practical alternative to cars, offering commuters greater flexibility and time efficiency. Rising fuel costs add to their appeal, as electric two-wheelers are more economical to operate and maintain. Among German EV owners, fuel and maintenance savings, along with positive environmental impact, are key motivators for adoption, while nearly 60% of potential buyers also value driving performance and range. Growing awareness of climate change and air quality issues is pushing consumers toward cleaner mobility solutions. Electric two-wheelers, producing zero tailpipe emissions and minimal noise, align perfectly with these priorities. Collectively, these economic, environmental, and lifestyle factors are reshaping commuting habits, making electric two-wheelers a preferred, sustainable urban transport choice.

Government policies, incentives & regulatory environment

Germany’s electric two-wheeler market is strongly influenced by government support through subsidies, tax benefits, and regulatory measures aimed at promoting clean mobility. Incentive programs reduce the initial cost barrier, encouraging both individuals and fleet operators to switch to electric scooters and motorcycles. Regulations such as safety certifications and mandatory insurance ensure product reliability, boosting consumer confidence in adopting EVs. Local authorities also promote electric two-wheelers by improving road-sharing rules and facilitating their use in urban transport networks. These measures make electric two-wheelers more affordable while crrating a secure and standardized market environment, motivating manufacturers to invest in new models and technologies. As a result, the regulatory framework acts as a strong Germany electric two-wheeler market growth, aligning with Germany’s sustainability goals and encouraging widespread adoption of electric mobility solutions across urban and suburban regions.

Germany Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

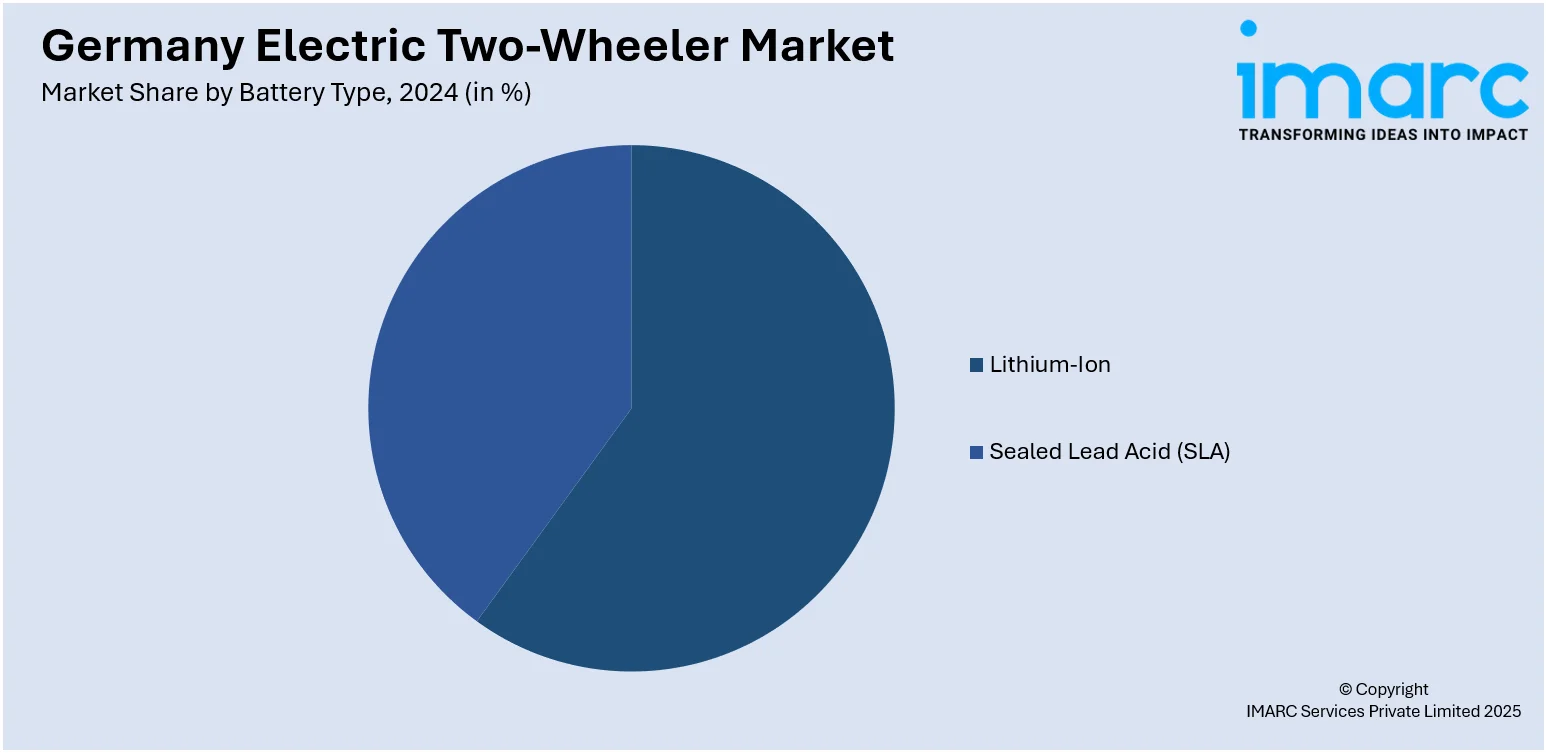

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Copetitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Electric Two-Wheeler Market News:

- In June 2025, Bengaluru-based Ultraviolette launched its F77 electric motorcycles across ten European countries, including Germany, France, the UK, and Italy. Unveiled near the Eiffel Tower, the lineup includes the performance-focused F77 MACH 2 and the comfort-oriented F77 SuperStreet. Both feature a 10.3 kWh battery, 30 kW peak power, and advanced tech like Violette A.I., Bosch ABS, and traction control. Introductory prices start at €8,990 for bookings before July 31, 2025.

Germany Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Germany electric two-wheeler market on the basis of battery type?

- What is the breakup of the Germany electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Germany electric two-wheeler market on the basis of peak power?

- What is the breakup of the Germany electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Germany electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Germany electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Germany electric two-wheeler market?

- What are the key driving factors and challenges in the Germany electric two-wheeler market?

- What is the structure of the Germany electric two-wheeler market and who are the key players?

- What is the degree of competition in the Germany electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)