Germany Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

Germany Foreign Exchange Market Overview:

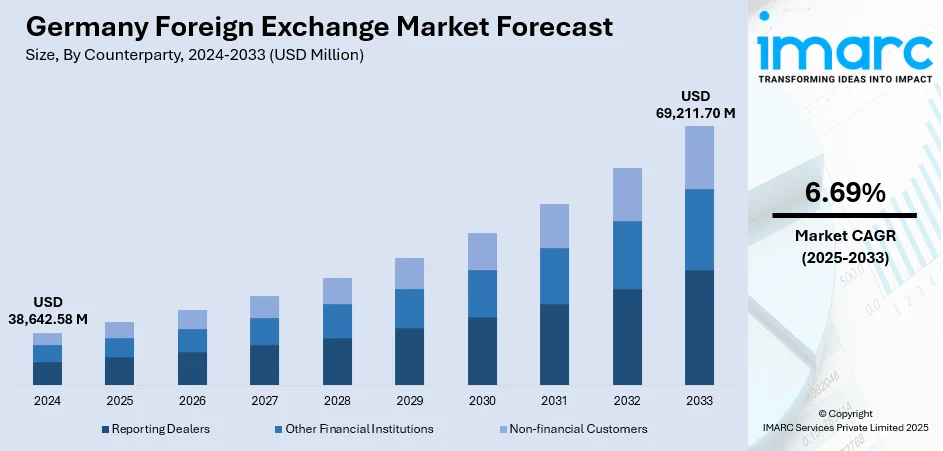

The Germany foreign exchange market size reached USD 38,642.58 Million in 2024. The market is projected to reach USD 69,211.70 Million by 2033, exhibiting a growth rate (CAGR) of 6.69% during 2025-2033. The market is propelled by the stability of the country and large trade volumes, which translate into consistent demand for foreign exchange business. In addition, the monetary policies of the European Central Bank and euro volatility significantly fuel the market development in the country. Additionally, growing investments in technology and financial services enhance electronic trading platforms and speeds up transactions, further augmenting the Germany foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38,642.58 Million |

| Market Forecast in 2033 | USD 69,211.70 Million |

| Market Growth Rate 2025-2033 | 6.69% |

Germany Foreign Exchange Market Trends:

Accelerated Adoption of Algorithmic and Electronic Trading

The market has witnessed a significant move towards electronic and algorithmic trading platforms, reflecting global trends. This follows growing demands for efficiency, transparency, and speed in executing trades. Additionally, asset managers and financial institutions are using advanced algorithms to maximize trade flows, optimize trade execution, and lower transaction costs. Additionally, the use of artificial intelligence (AI) and machine learning (ML) is furthering predictive abilities in price action and volatility modeling, enabling better decision-making in high-frequency trading scenarios. Besides this, regulatory changes, such as the European Union's Markets in Financial Instruments Directive II (MiFID II), are furthering this process by imposing higher transparency requirements and promoting electronic execution venues. Also, German trading platforms have emerged as prominent liquidity centers, with multi-asset connectivity and smooth integration with global markets. Consequently, the market is increasingly automated and data-driven, where human traders play supervisory or strategic roles rather than manually executing trades.

To get more information on this market, Request Sample

Growing Role of Sustainable Finance and ESG Integration

The broader financial sector’s shift towards sustainability and environmental, social, and governance (ESG) is positively impacting the Germany foreign exchange market growth. While traditionally outside the core purview of currency markets, ESG metrics are now shaping investment decisions and capital flows that directly affect foreign exchange demand and supply. In addition to this, the German government’s issuance of green bonds and increased ESG-aligned sovereign debt has altered portfolio allocations among international investors, impacting currency volatility and inflows into the euro. Also, sustainable finance policies implemented by the European Central Bank (ECB) and the Deutsche Bundesbank are driving FX adjustments. Central bank decisions to include green assets in quantitative easing programs indirectly affect interest rate differentials and inflation expectations, key determinants of exchange rates. Furthermore, multinational corporations headquartered in Germany are increasingly engaging in FX hedging strategies aligned with ESG benchmarks, influencing derivative demand and cross-currency swap volumes. These developments underscore the evolving interdependence between sustainable finance objectives and foreign exchange market behavior in Germany.

Increased Volatility from Geopolitical and Trade Dynamics

Geopolitical developments and shifting global trade patterns have introduced heightened volatility into the market. As Europe’s largest exporter and a core member of the eurozone, Germany is highly sensitive to external trade disruptions, sanctions, and shifts in global supply chains. Recent tensions with major trading partners such as China, alongside the effects of the Russia-Ukraine conflict, have triggered abrupt changes in currency valuations and investor sentiment. These geopolitical factors are often compounded by speculative flows and risk-aversion behavior among institutional investors, which tend to amplify movements in the euro. Also, the market responds quickly to announcements on tariffs, energy security measures, and cross-border capital controls. The uncertainty surrounding EU-level fiscal policies and Germany’s role in shaping them adds an additional layer of complexity. In such an environment, FX derivatives markets, such as options and forwards, have seen elevated demand as participants seek to hedge against macroeconomic uncertainty and currency risk tied to Germany’s global trade exposure.

Germany Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

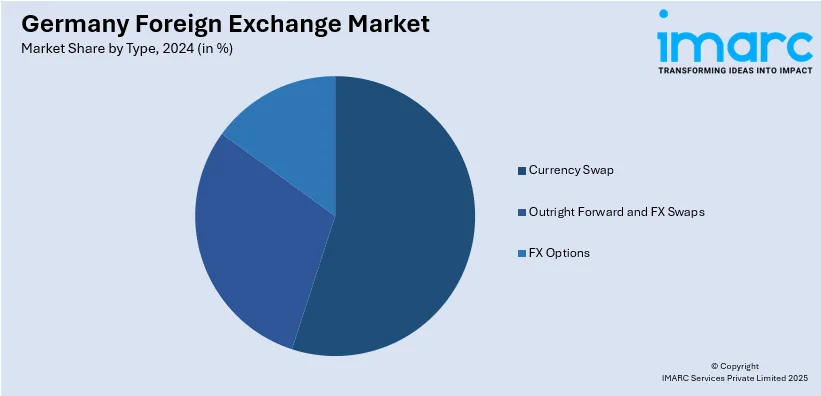

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Western Germany

- Southern Germany

- Eastern Germany

- Northern Germany

The report has also provided a comprehensive analysis of all the major regional markets, which include Western Germany, Southern Germany, Eastern Germany, and Northern Germany.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Germany Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Western Germany, Southern Germany, Eastern Germany, Northern Germany |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Germany foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the Germany foreign exchange market on the basis of counterparty?

- What is the breakup of the Germany foreign exchange market on the basis of type?

- What is the breakup of the Germany foreign exchange market on the basis of region?

- What are the various stages in the value chain of the Germany foreign exchange market?

- What are the key driving factors and challenges in the Germany foreign exchange market?

- What is the structure of the Germany foreign exchange market and who are the key players?

- What is the degree of competition in the Germany foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Germany foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Germany foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Germany foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)